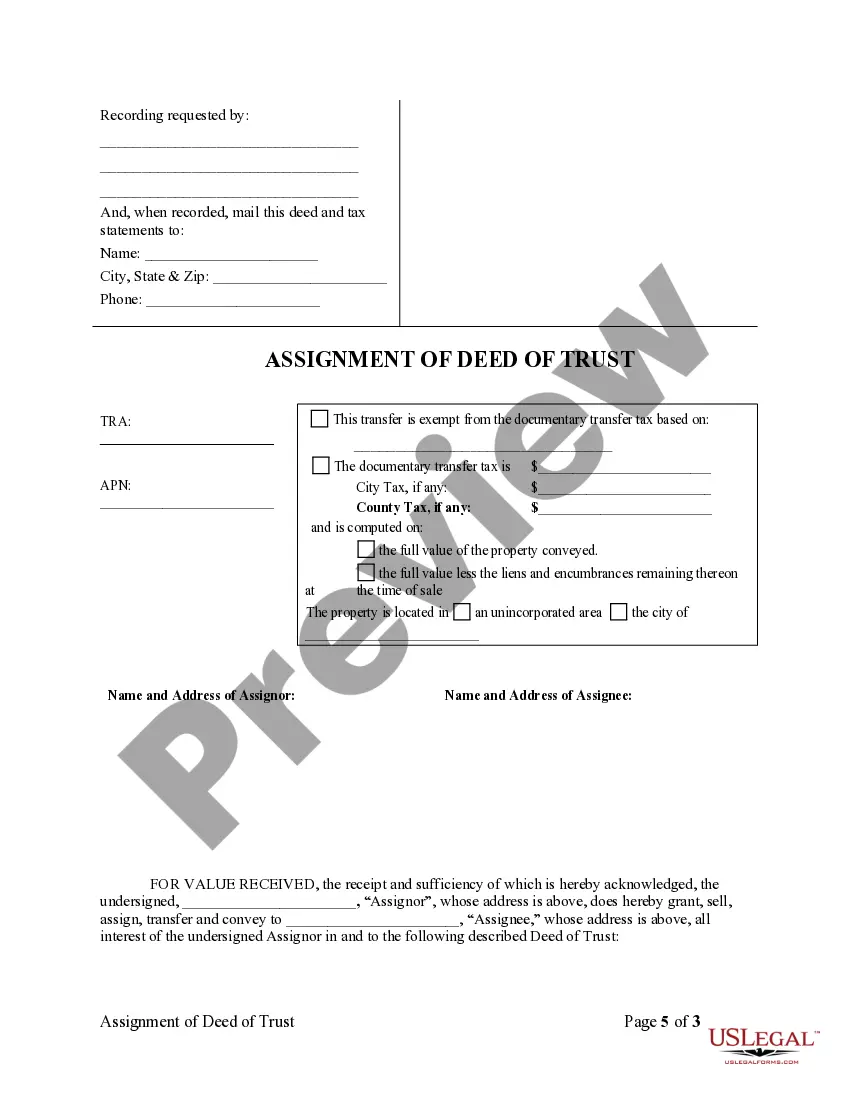

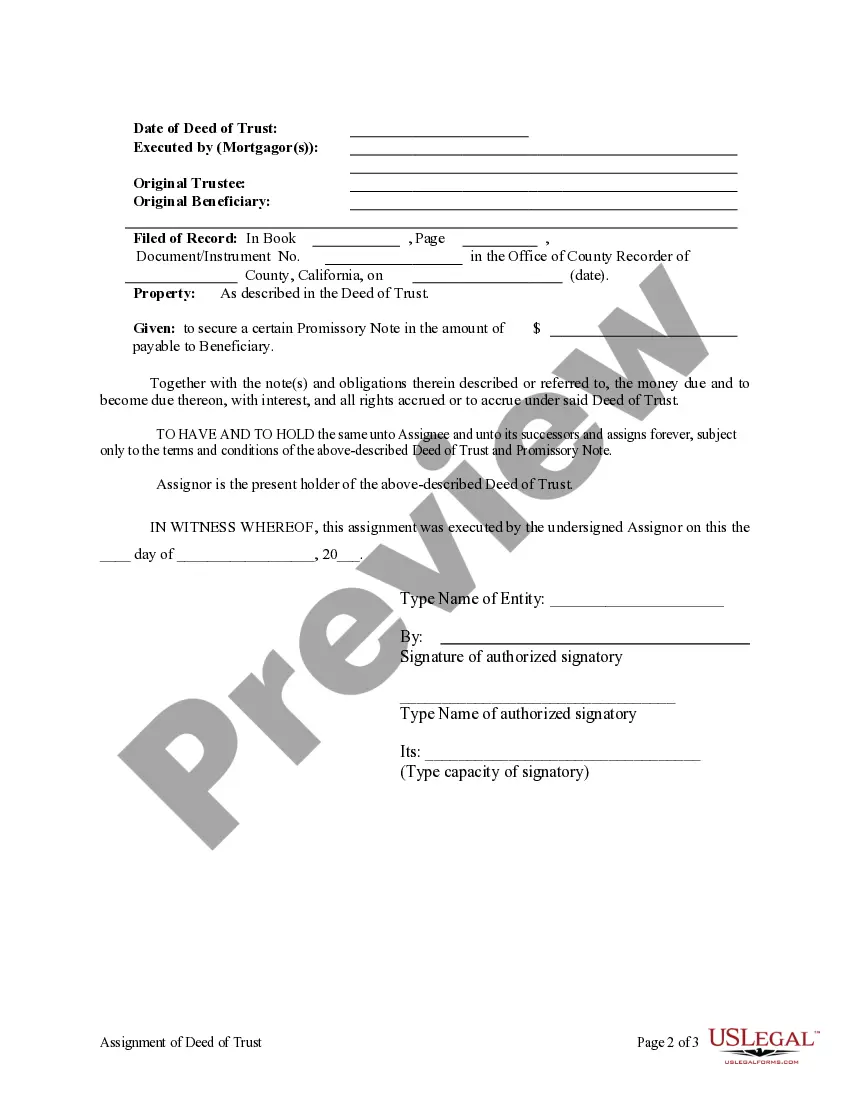

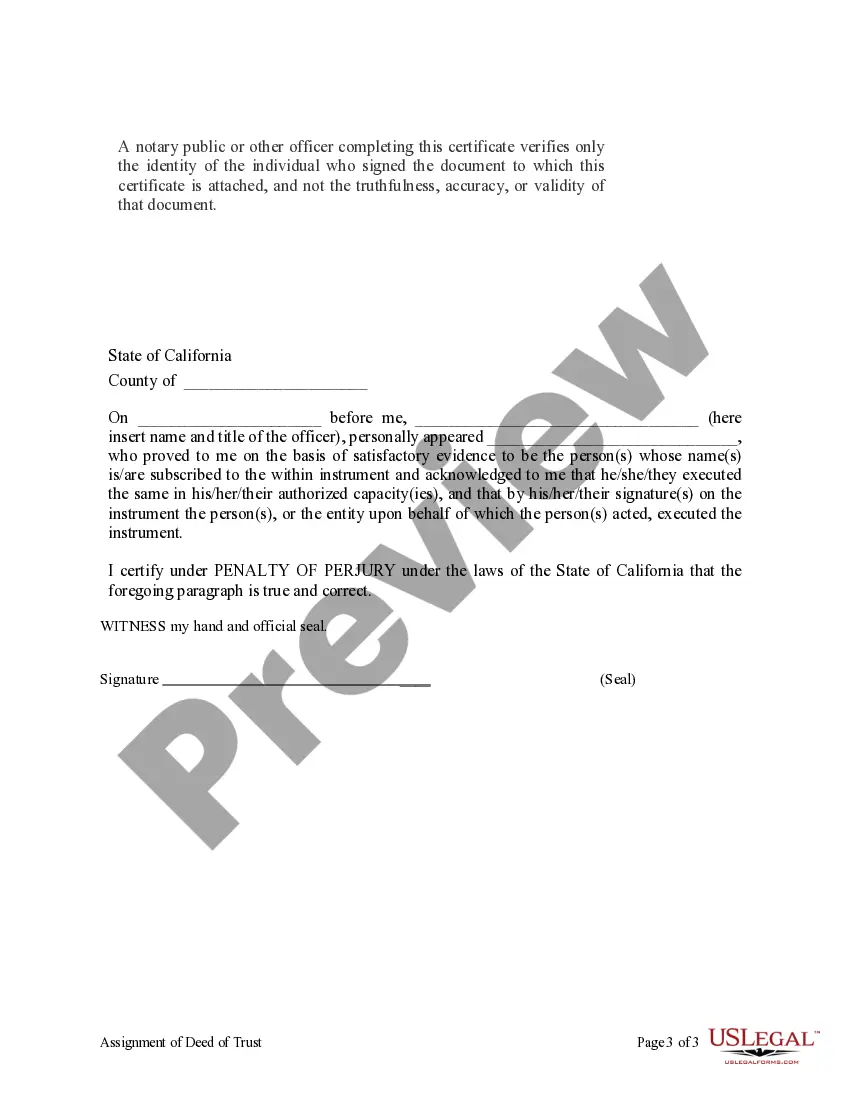

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Understanding the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Temecula, California, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process involving the transfer of rights and interests in a mortgage loan from a corporate mortgage holder to another party. This detailed description aims to shed light on this essential aspect of real estate transactions in Temecula, covering various types of assignments and relevant keywords. 1. Types of Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder: a) Partial Assignment: A partial assignment involves the transfer of a portion of the corporate mortgage holder's interests in the mortgage loan. This type of assignment is commonly seen when the mortgage holder wants to share the risk or raise funds by selling a part of the loan to another party or investor. b) Full Assignment: A full assignment, also known as absolute assignment, occurs when the corporate mortgage holder transfers all their rights, interests, and obligations related to the mortgage loan to another party. The assignee then becomes the new mortgage holder and assumes all responsibilities associated with it. c) Assignment for Security Purposes: This type of assignment is often used when the corporate mortgage holder needs to secure a debt or obligation. It involves assigning the deed of trust to a third party as collateral until the debt is repaid. Once the debt is cleared, the assignee returns the rights and interests back to the original mortgage holder. 2. Keywords: a) Assignment of Deed of Trust: This phrase denotes the legal act of transferring the rights, interests, and obligations of a mortgage loan from one party (corporate mortgage holder) to another. b) Corporate Mortgage Holder: Refers to a corporation or organization that holds the mortgage on a property in Temecula, California. c) Mortgage Loan: Indicates the financial loan obtained by a borrower for purchasing a property, which is secured by a deed of trust and is subject to assignment. d) Deed of Trust: A legal document that outlines the terms and conditions of a loan, acting as security for the loan and granting the lender the authority to foreclose in case of default. e) Real Estate Transactions: Covers the process of buying or selling property, including mortgage loans, transfers, assignments, and various legalities involved. f) Transfer of Rights: This phrase signifies the act of transferring legal ownership, rights, interests, or obligations from one party to another. g) Investor: An individual or organization that purchases a mortgage loan or a portion of it for investment purposes. Conclusion: Understanding the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for all parties involved in real estate transactions. Whether it's a partial or full assignment or an assignment for security purposes, this legal process plays a significant role in transferring and managing mortgage loans. By familiarizing oneself with the relevant keywords, individuals can navigate this process more effectively and make informed decisions in the Temecula real estate market.Title: Understanding the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Temecula, California, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process involving the transfer of rights and interests in a mortgage loan from a corporate mortgage holder to another party. This detailed description aims to shed light on this essential aspect of real estate transactions in Temecula, covering various types of assignments and relevant keywords. 1. Types of Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder: a) Partial Assignment: A partial assignment involves the transfer of a portion of the corporate mortgage holder's interests in the mortgage loan. This type of assignment is commonly seen when the mortgage holder wants to share the risk or raise funds by selling a part of the loan to another party or investor. b) Full Assignment: A full assignment, also known as absolute assignment, occurs when the corporate mortgage holder transfers all their rights, interests, and obligations related to the mortgage loan to another party. The assignee then becomes the new mortgage holder and assumes all responsibilities associated with it. c) Assignment for Security Purposes: This type of assignment is often used when the corporate mortgage holder needs to secure a debt or obligation. It involves assigning the deed of trust to a third party as collateral until the debt is repaid. Once the debt is cleared, the assignee returns the rights and interests back to the original mortgage holder. 2. Keywords: a) Assignment of Deed of Trust: This phrase denotes the legal act of transferring the rights, interests, and obligations of a mortgage loan from one party (corporate mortgage holder) to another. b) Corporate Mortgage Holder: Refers to a corporation or organization that holds the mortgage on a property in Temecula, California. c) Mortgage Loan: Indicates the financial loan obtained by a borrower for purchasing a property, which is secured by a deed of trust and is subject to assignment. d) Deed of Trust: A legal document that outlines the terms and conditions of a loan, acting as security for the loan and granting the lender the authority to foreclose in case of default. e) Real Estate Transactions: Covers the process of buying or selling property, including mortgage loans, transfers, assignments, and various legalities involved. f) Transfer of Rights: This phrase signifies the act of transferring legal ownership, rights, interests, or obligations from one party to another. g) Investor: An individual or organization that purchases a mortgage loan or a portion of it for investment purposes. Conclusion: Understanding the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for all parties involved in real estate transactions. Whether it's a partial or full assignment or an assignment for security purposes, this legal process plays a significant role in transferring and managing mortgage loans. By familiarizing oneself with the relevant keywords, individuals can navigate this process more effectively and make informed decisions in the Temecula real estate market.