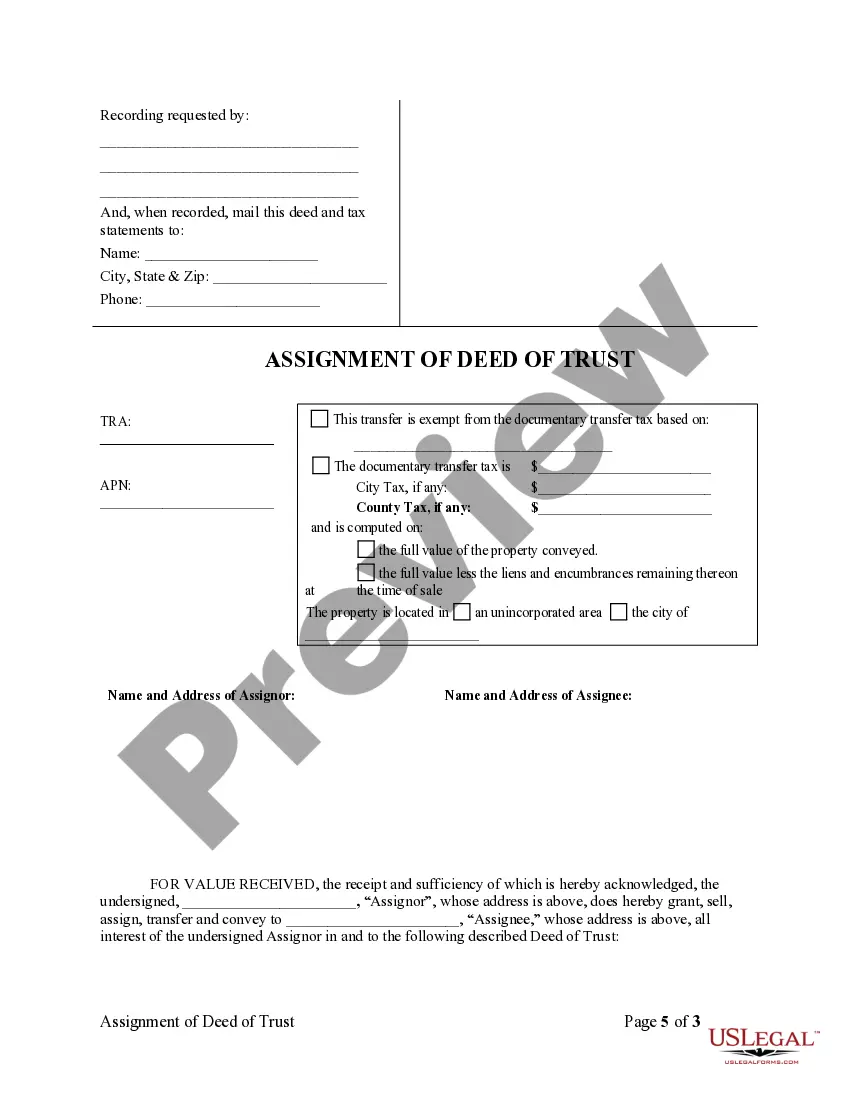

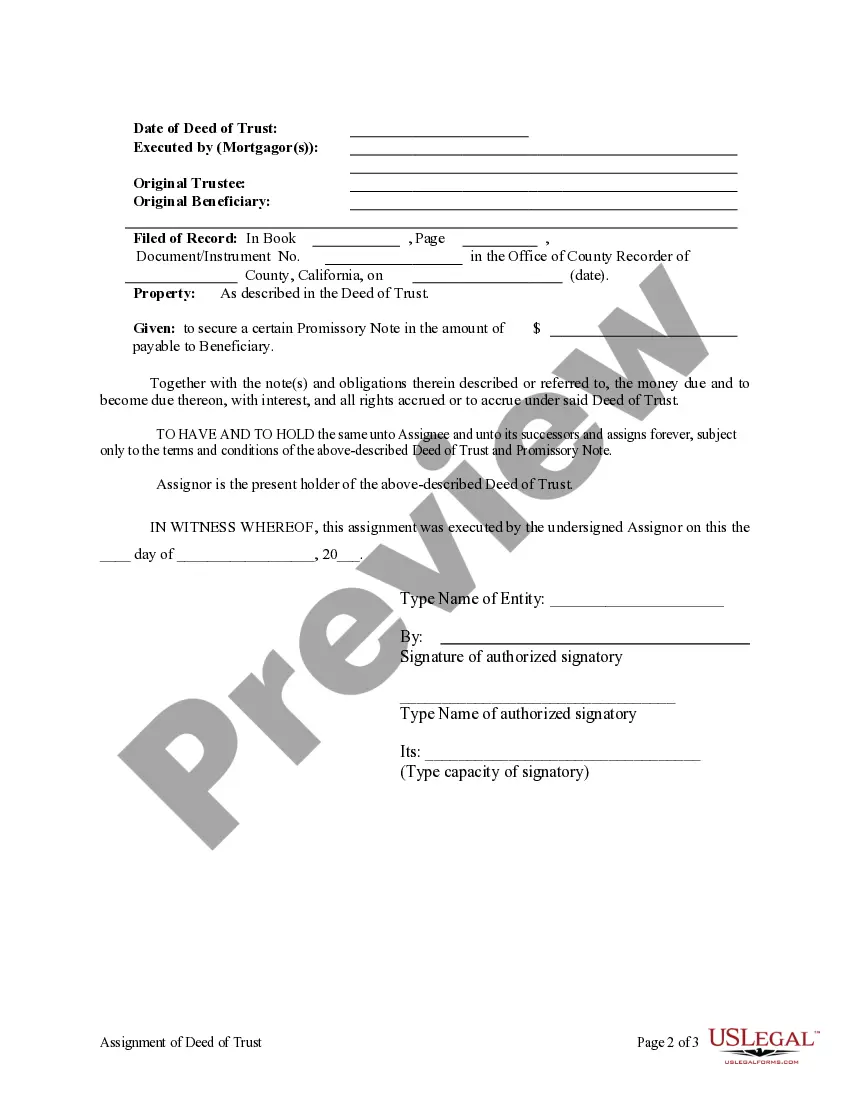

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you are looking for a suitable form template, it’s hard to select a better platform than the US Legal Forms site – likely the most extensive libraries on the internet.

With this collection, you can discover an immense quantity of form samples for business and personal uses categorized by types and areas, or keywords.

With our enhanced search feature, locating the most recent Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder is as straightforward as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the form. Specify the file format and download it onto your device.

- Furthermore, the relevance of each document is confirmed by a team of experienced attorneys who regularly evaluate the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to acquire the Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder is to Log In to your user profile and press the Download button.

- If you utilize US Legal Forms for the first time, just adhere to the instructions provided below.

- Ensure you have located the sample you require. Review its description and use the Preview option (if available) to view its contents. If it doesn’t satisfy your needs, employ the Search option at the top of the screen to find the necessary document.

- Validate your selection. Click the Buy now button. After that, choose your preferred pricing plan and provide the necessary information to set up an account.

Form popularity

FAQ

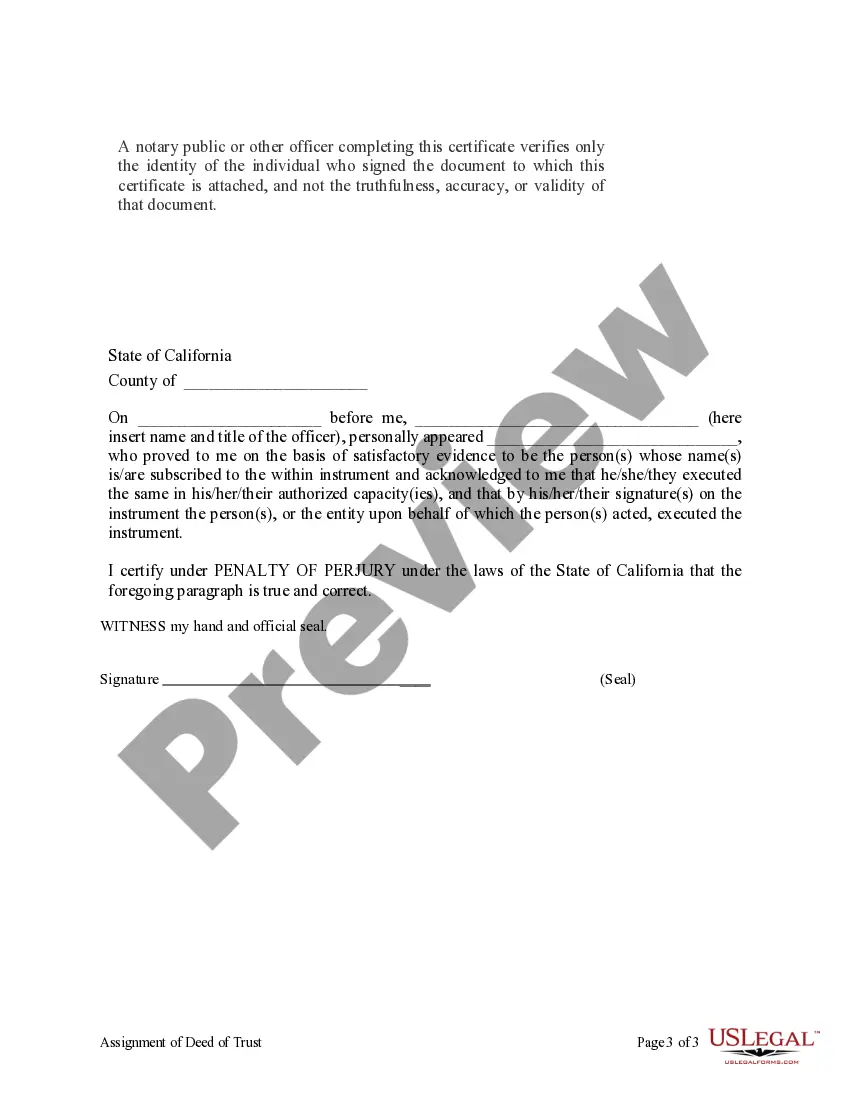

Yes, for an assignment to hold legal weight in most cases, it should be documented as a deed. This ensures that the transfer is recognized and enforceable under the law. In situations involving the Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder, formalizing the assignment through a deed can protect the interests of all parties involved.

Typically, the Assignment of a deed of trust is signed by the current holder of the deed, often a corporate entity. Additionally, the borrower may also need to acknowledge the assignment, ensuring that all parties are aware of the transfer. Understanding who signs the Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder can streamline the process and ensure legal clarity.

A corporate Assignment of deed of trust refers to the formal transfer of the rights and obligations associated with a deed of trust from one corporate entity to another. This process helps in securing loans and managing properties efficiently. With respect to Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder, it is crucial for businesses to understand how these assignments can impact their financial arrangements.

The difference between transfer and assignment of IP lies in ownership rights and control. A transfer typically involves passing on ownership completely, while assignment allows the original owner to retain certain rights. In the context of options like a Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder, understanding these differences can ensure proper management of your property interests.

Corporate Assignment of a mortgage allows one corporate entity to officially hand over the mortgage to another. This is a key aspect of the real estate process, particularly in Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder. The assignment ensures that the new entity assumes all rights and obligations, creating a seamless transition for homeowners.

Corporate Assignment of deed of trust involves a corporate entity officially transferring the rights associated with a deed of trust to another party. In Thousand Oaks, this process ensures that the responsibilities and benefits of the mortgage are properly assigned, allowing for smooth transitions in ownership and management. It is a crucial procedure in real estate transactions that maintains legal clarity.

A corporate Assignment deed of trust is a legal document that transfers the rights and obligations of a mortgage from one lender to another. In the context of Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder, this process enables corporate lenders to manage their mortgage portfolios effectively. The assignment allows for better financial organization and can facilitate quicker access to funds for homeowners.

To receive a copy of your deed of trust in California, you can request it from the county recorder's office or the lender that issued your mortgage. Many lenders also provide online requests for such documents, making the process easier. Being aware of the Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder can further clarify your rights and responsibilities regarding your property.

A corporate assignment of deed of trust is a legal mechanism where a corporate lender transfers its interest in a deed of trust to another party. This process typically involves formal documentation and helps streamline lender transactions. Understanding this concept is vital, especially if you're involved with loans in areas like Thousand Oaks, California, where the Assignment of Deed of Trust by Corporate Mortgage Holder plays a significant role.

After purchasing a house, you will typically receive your deed during closing, but it may take some time for it to be recorded. You can check with your escrow officer or closing agent for confirmation. If you need another copy, reach out to the county recorder's office. Remember, knowing the details regarding the Thousand Oaks California Assignment of Deed of Trust by Corporate Mortgage Holder can be beneficial when managing your property records.