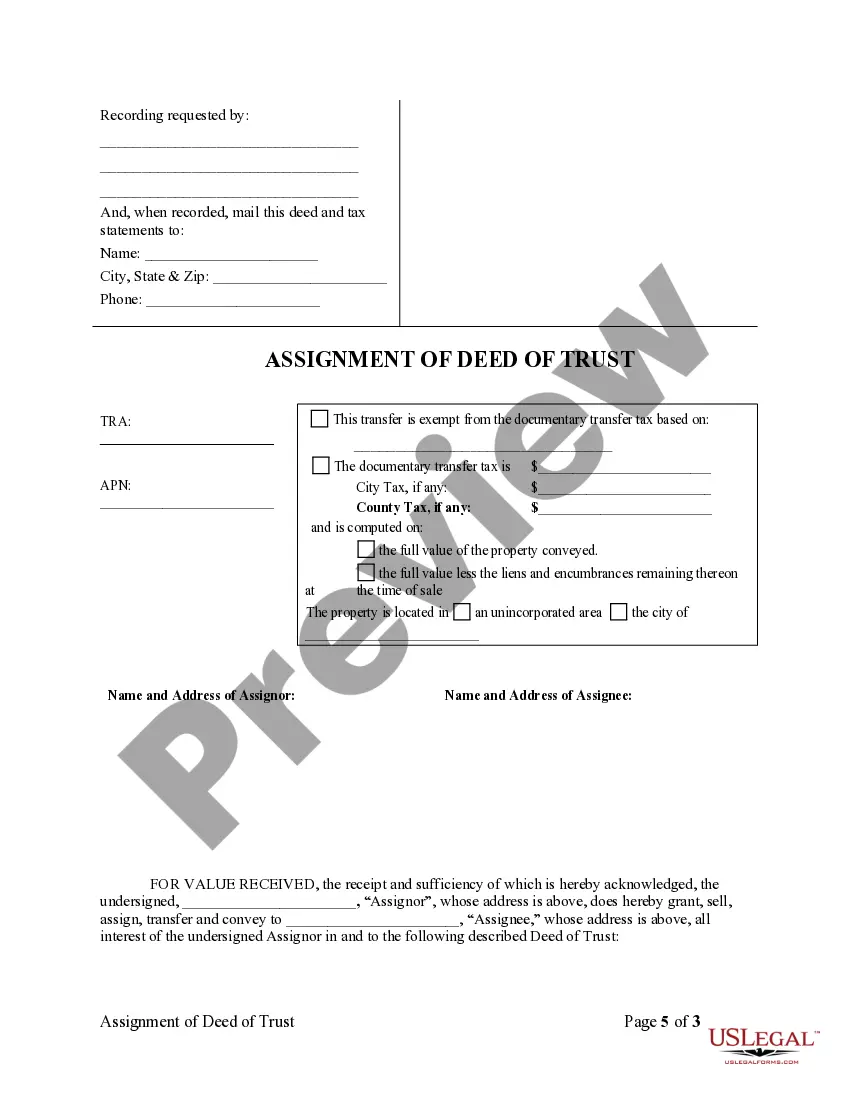

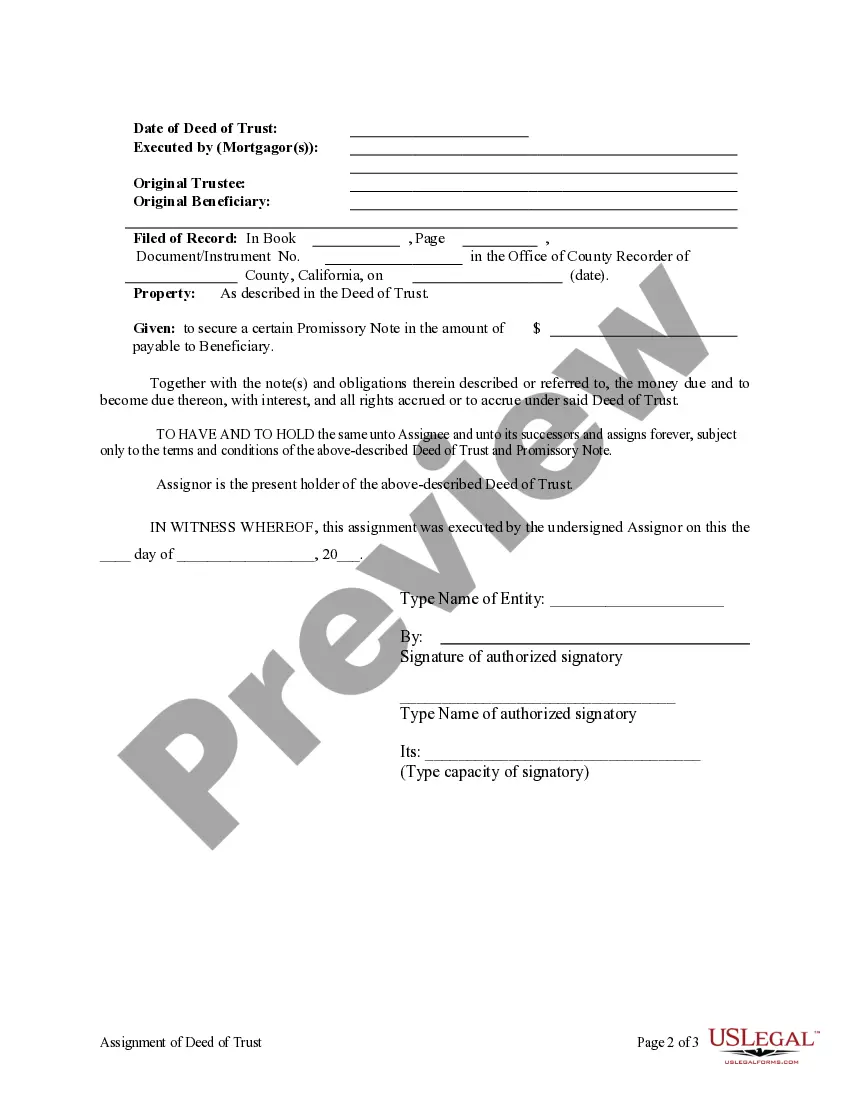

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Vista California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

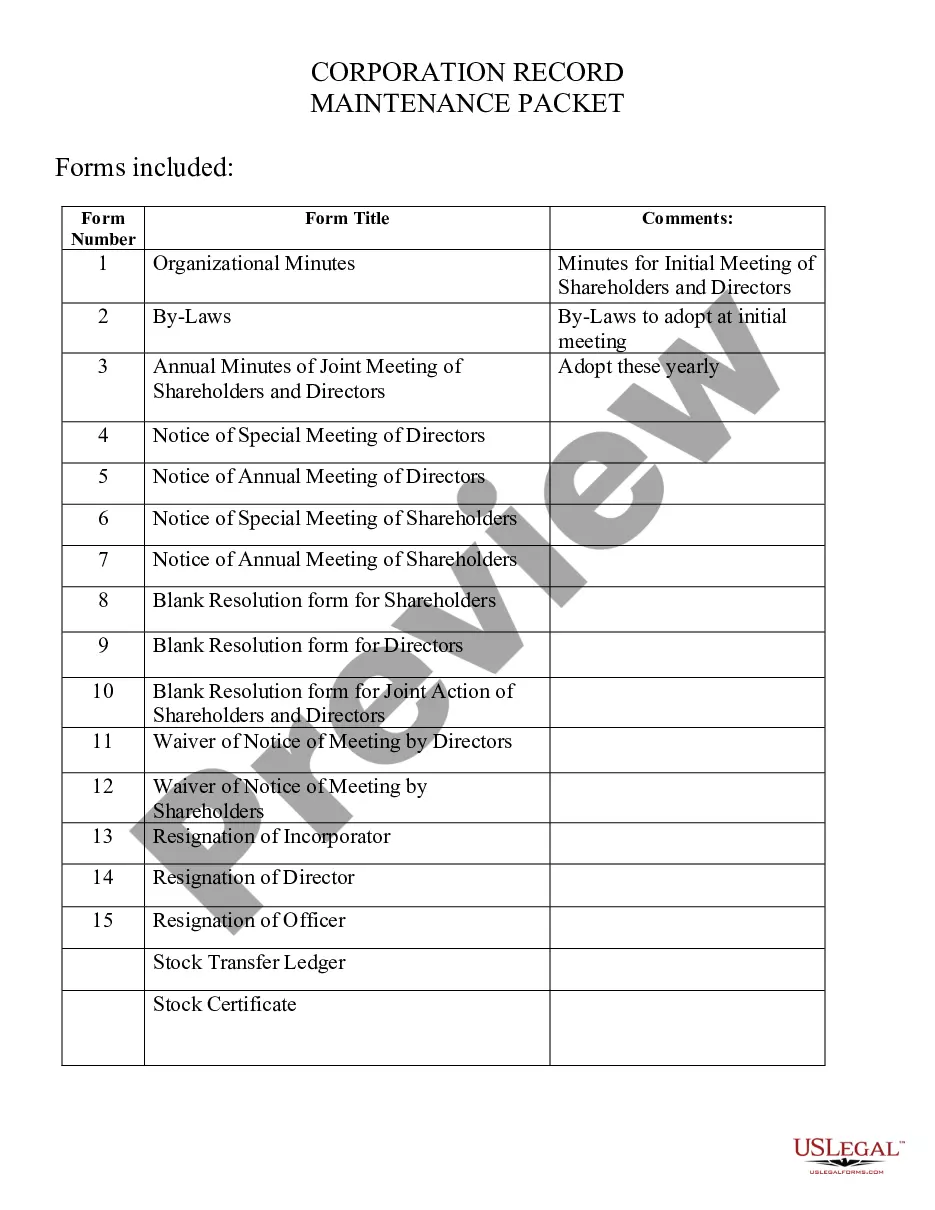

Utilize the US Legal Forms and gain immediate access to any form sample you desire.

Our user-friendly platform with a vast array of documents streamlines the process of locating and acquiring nearly any document sample you require.

You can download, fill out, and sign the Vista California Assignment of Deed of Trust by Corporate Mortgage Holder within minutes instead of spending countless hours online searching for a suitable template.

Employing our catalog is an excellent approach to enhance the security of your document submissions.

If you haven’t created an account yet, adhere to the guidelines outlined below.

Locate the form you need. Verify that it is the form you were seeking: review its title and description, and use the Preview feature when available. Alternatively, use the Search field to find the right one.

- Our skilled legal experts frequently examine all documents to ensure that the forms are applicable for a specific state and compliant with current laws and regulations.

- How can you procure the Vista California Assignment of Deed of Trust by Corporate Mortgage Holder.

- If you already have a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- Furthermore, you can access all previously stored records in the My documents section.

Form popularity

FAQ

Documents on behalf of a trust are typically signed by the trustee designated in the trust agreement. The trustee acts as the representative of the trust and is responsible for executing documents like the Vista California Assignment of Deed of Trust by Corporate Mortgage Holder. Trust documents usually specify who can sign, so it's important to confirm the trustee's authority before proceeding.

The assignment of a deed of trust must be signed by the current mortgage holder and the new mortgage holder. If the original mortgage holder is a corporation, an authorized officer should sign on their behalf. Clear documentation is vital to ensure your assignment complies with local laws in Vista, California.

A deed of transfer generally refers to the broader concept of moving ownership of a property, while a deed of assignment specifically pertains to transferring rights or interests in a contract, such as a mortgage. In the context of the Vista California Assignment of Deed of Trust by Corporate Mortgage Holder, the assigned deed reflects the transfer of the mortgage rights rather than a full ownership change. Understanding these distinctions can greatly aid in proper documentation and compliance.

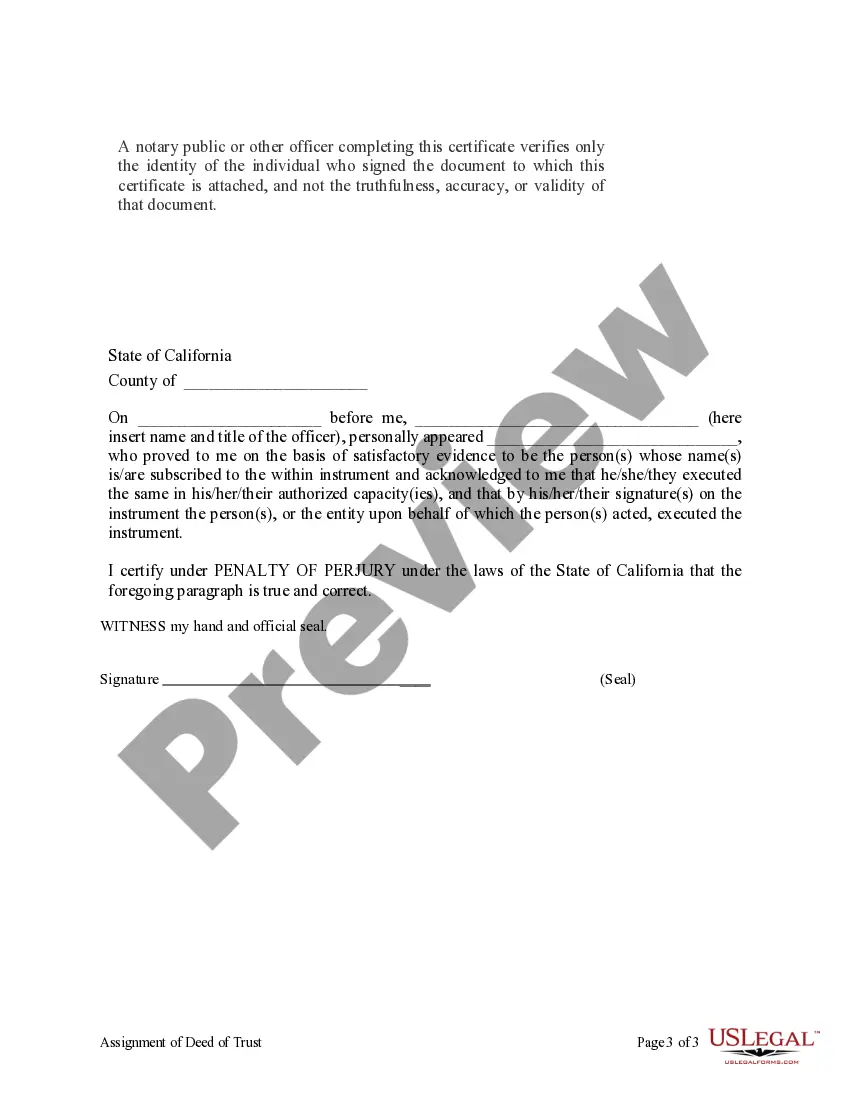

Typically, the deed of trust document title must be signed by the borrower and the trustee. If the borrower is a corporate entity, an authorized representative must sign on behalf of the entity. It's crucial to understand that all signatures must be notarized for the deed to be legally binding in Vista, California.

To complete an assignment of mortgage, begin by gathering all necessary documentation regarding the current mortgage. You will need to fill out the assignment form, which should include details such as the original lender, the new mortgage holder, and the relevant property information. Once you've completed the form, ensure all parties involved sign it, and then file the assignment with the county recorder's office in Vista, California. This process is essential to officially transfer the mortgage rights to the new holder.

The Assignment of mortgage or deed of trust is a legal mechanism that allows the current lender to transfer their rights to another party. This process is vital in real estate transactions, especially for corporate mortgage holders in Vista, California, seeking to reallocate financial assets or refinance. By understanding this concept, parties can navigate the complexities of property finance more effectively. The Vista California Assignment of Deed of Trust by Corporate Mortgage Holder simplifies this process for its users.

In California, a deed of trust must include specific elements to be considered valid, such as clear identification of the borrower, the lender, and the property involved. It must also be signed and notarized to ensure enforceability. Additionally, adhering to local laws and ensuring proper filing with the county recorder is crucial. The Vista California Assignment of Deed of Trust by Corporate Mortgage Holder meets these legal criteria, making the process smoother for corporate entities.

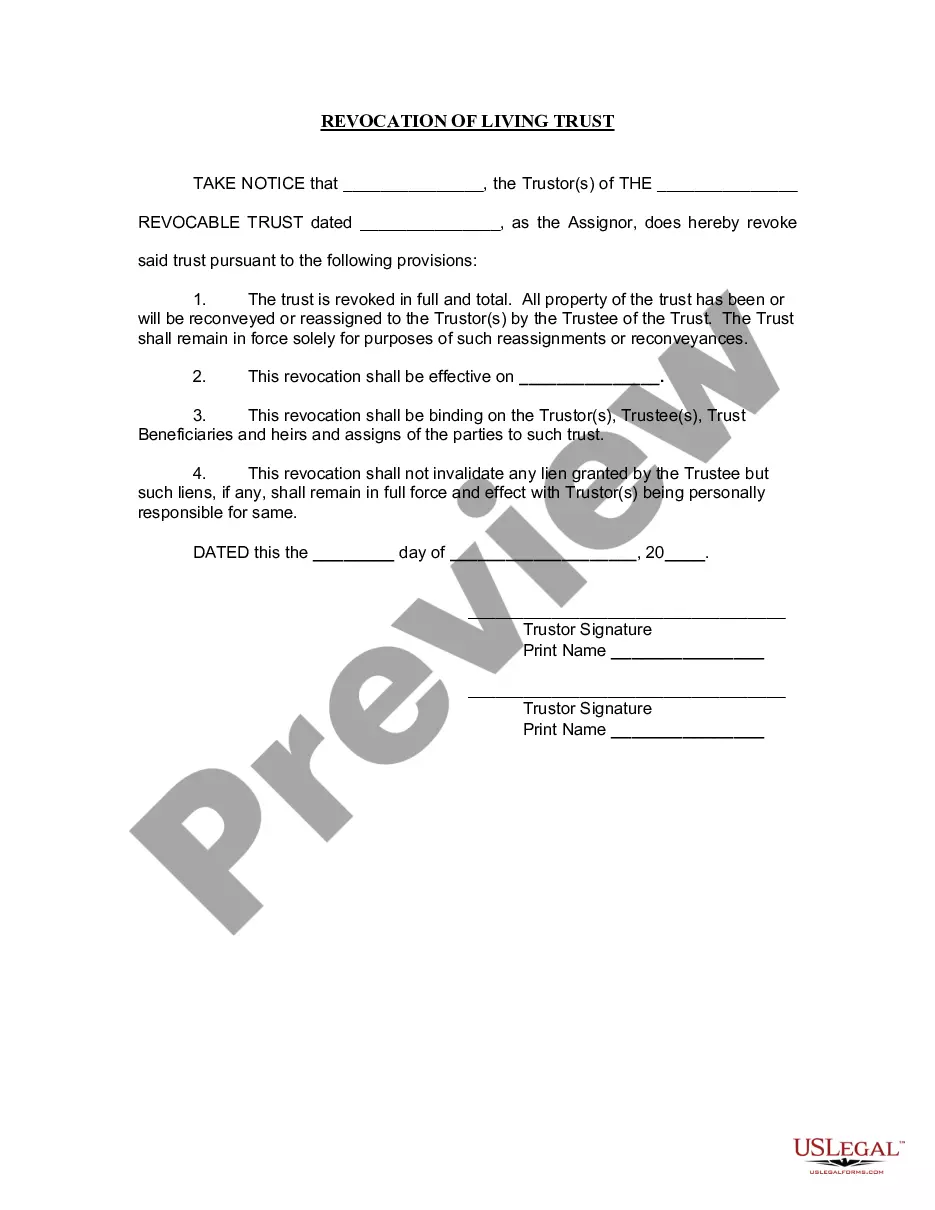

The Assignment of trust refers to the transfer of a trust's rights and responsibilities from one trustee to another or to a beneficiary. This process is essential for ensuring that the trust can continue to fulfill its intended purpose when changes occur. In the context of real estate, understanding the Assignment of trust is vital for managing properties effectively in Vista, California. The Vista California Assignment of Deed of Trust by Corporate Mortgage Holder embodies this principle in corporate real estate transactions.

A corporate Assignment of deed of trust refers to the process where a corporate mortgage holder transfers their interests in a property secured by a deed of trust. This action is common when corporations manage multiple properties and wish to streamline their financial assets. In Vista, California, this practice is critical for businesses looking to efficiently handle their real estate dealings. Utilizing the Vista California Assignment of Deed of Trust by Corporate Mortgage Holder can streamline financial operations.

A deed is a legal document that conveys ownership or an interest in property, while a deed of Assignment specifically transfers rights or interests from one party to another without altering ownership. In the context of Vista California Assignment of Deed of Trust by Corporate Mortgage Holder, the distinction is significant. The deed provides ownership documentation, whereas the deed of Assignment facilitates the transfer of financial obligation and rights related to the property.