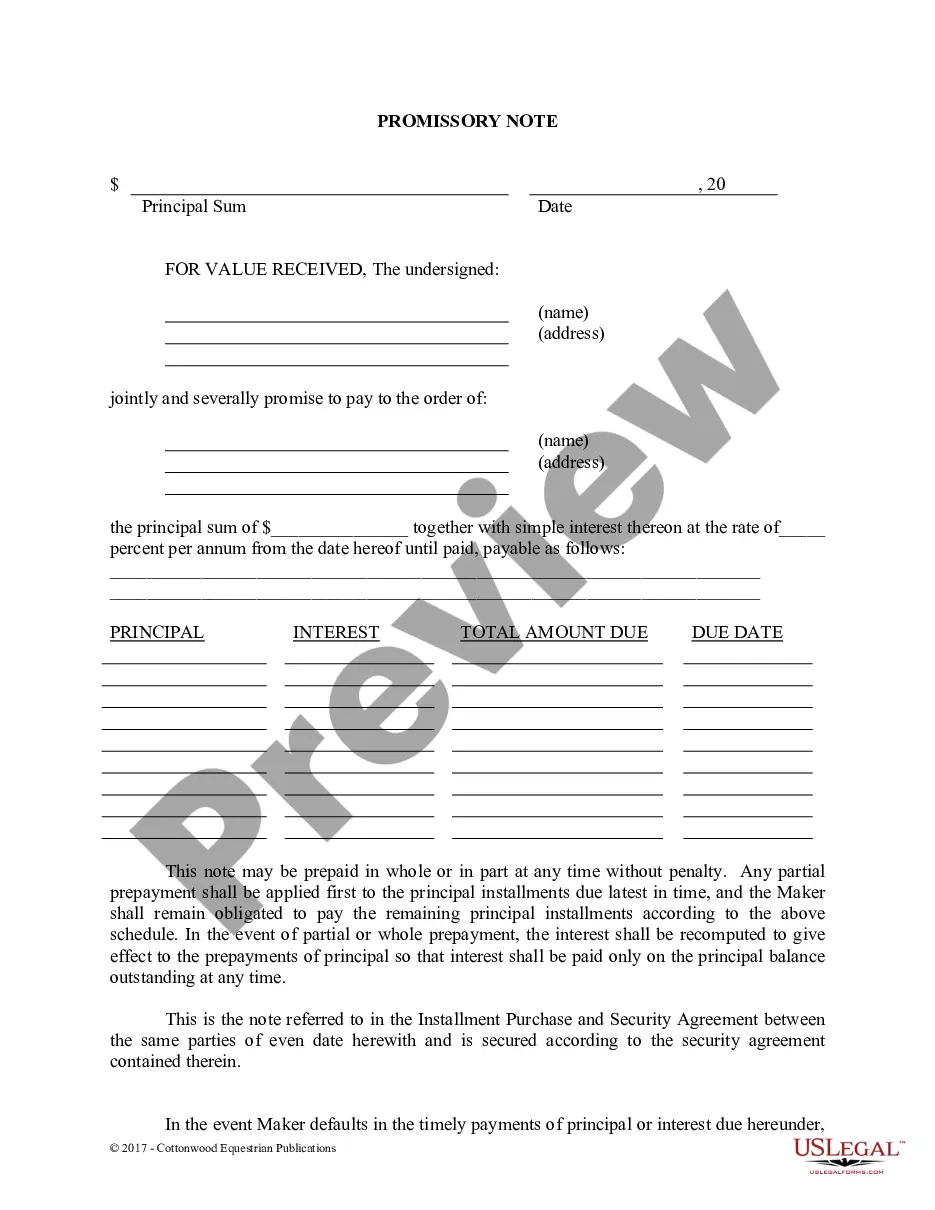

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Antioch California Promissory Note — Horse Equine Forms: A Comprehensive Guide When engaging in financial transactions related to the buying, selling, or leasing of horses or equine properties, it is essential to have legally binding agreements in place. One such crucial document is the Antioch California promissory note — horse equine forms. A promissory note is a legally enforceable written agreement between a borrower and a lender that outlines the terms and conditions of a loan. In the context of the horse and equine industry, these notes serve as a reliable means to ensure transparency and protect the interests of both parties involved. Antioch, California, being home to a thriving horse and equine community, offers specific promissory note forms tailored to suit the unique requirements of this industry. These forms are particularly relevant when individuals or businesses need to finance the purchase of horses, boarding services, equipment, or any other related expenses. The Antioch California promissory note — horse equine forms typically include the following essential details: 1. Parties Involved: The note clearly identifies the borrower (the individual or entity borrowing money) and the lender (the individual or entity providing the loan). 2. Loan Terms: This section outlines the loan amount, whether it is a lump sum or installments, the interest rate applied, any applicable fees, and the repayment schedule. 3. Collateral: Since horses and equine properties can have considerable value, the note may specify the collateral being used to secure the loan in case of default. This could include identifying details of the horse(s) involved, their registration papers, or legal descriptions of the equine property. 4. Default and Remedies: The document defines the actions that either party can take in case of payment default by the borrower. It may include penalties, legal costs, and the right to repossess the horse(s) or equine property. Different types of Antioch California promissory note — horse equine forms may cater to specific transactions related to horse and equine industry such as: 1. Horse Purchase Agreement Promissory Note: This type of form is used when a buyer requires financial assistance from a lender to acquire a horse. It outlines the loan terms, purchase price, payment schedule, and other pertinent details. 2. Equine Property Lease Promissory Note: When a lessee requires financial assistance to lease an equine property, this form helps establish the terms of the loan, lease duration, monthly payment obligations, and any additional security requirements. 3. Horse Boarding Service Promissory Note: For those seeking financial assistance to cover boarding fees for their horses, this form outlines the loan terms, boarding rates, payment schedule, and the rights and responsibilities of both parties involved. In conclusion, the Antioch California promissory note — horse equine forms play an integral role in facilitating financial transactions within the horse and equine industry. These legally binding documents ensure transparency, protect the interests of all parties, and provide a framework for resolving potential disputes. Whether it's purchasing horses, leasing equine properties, or availing boarding services, having the appropriate promissory note form is paramount in safeguarding the financial aspects of the transaction.Antioch California Promissory Note — Horse Equine Forms: A Comprehensive Guide When engaging in financial transactions related to the buying, selling, or leasing of horses or equine properties, it is essential to have legally binding agreements in place. One such crucial document is the Antioch California promissory note — horse equine forms. A promissory note is a legally enforceable written agreement between a borrower and a lender that outlines the terms and conditions of a loan. In the context of the horse and equine industry, these notes serve as a reliable means to ensure transparency and protect the interests of both parties involved. Antioch, California, being home to a thriving horse and equine community, offers specific promissory note forms tailored to suit the unique requirements of this industry. These forms are particularly relevant when individuals or businesses need to finance the purchase of horses, boarding services, equipment, or any other related expenses. The Antioch California promissory note — horse equine forms typically include the following essential details: 1. Parties Involved: The note clearly identifies the borrower (the individual or entity borrowing money) and the lender (the individual or entity providing the loan). 2. Loan Terms: This section outlines the loan amount, whether it is a lump sum or installments, the interest rate applied, any applicable fees, and the repayment schedule. 3. Collateral: Since horses and equine properties can have considerable value, the note may specify the collateral being used to secure the loan in case of default. This could include identifying details of the horse(s) involved, their registration papers, or legal descriptions of the equine property. 4. Default and Remedies: The document defines the actions that either party can take in case of payment default by the borrower. It may include penalties, legal costs, and the right to repossess the horse(s) or equine property. Different types of Antioch California promissory note — horse equine forms may cater to specific transactions related to horse and equine industry such as: 1. Horse Purchase Agreement Promissory Note: This type of form is used when a buyer requires financial assistance from a lender to acquire a horse. It outlines the loan terms, purchase price, payment schedule, and other pertinent details. 2. Equine Property Lease Promissory Note: When a lessee requires financial assistance to lease an equine property, this form helps establish the terms of the loan, lease duration, monthly payment obligations, and any additional security requirements. 3. Horse Boarding Service Promissory Note: For those seeking financial assistance to cover boarding fees for their horses, this form outlines the loan terms, boarding rates, payment schedule, and the rights and responsibilities of both parties involved. In conclusion, the Antioch California promissory note — horse equine forms play an integral role in facilitating financial transactions within the horse and equine industry. These legally binding documents ensure transparency, protect the interests of all parties, and provide a framework for resolving potential disputes. Whether it's purchasing horses, leasing equine properties, or availing boarding services, having the appropriate promissory note form is paramount in safeguarding the financial aspects of the transaction.