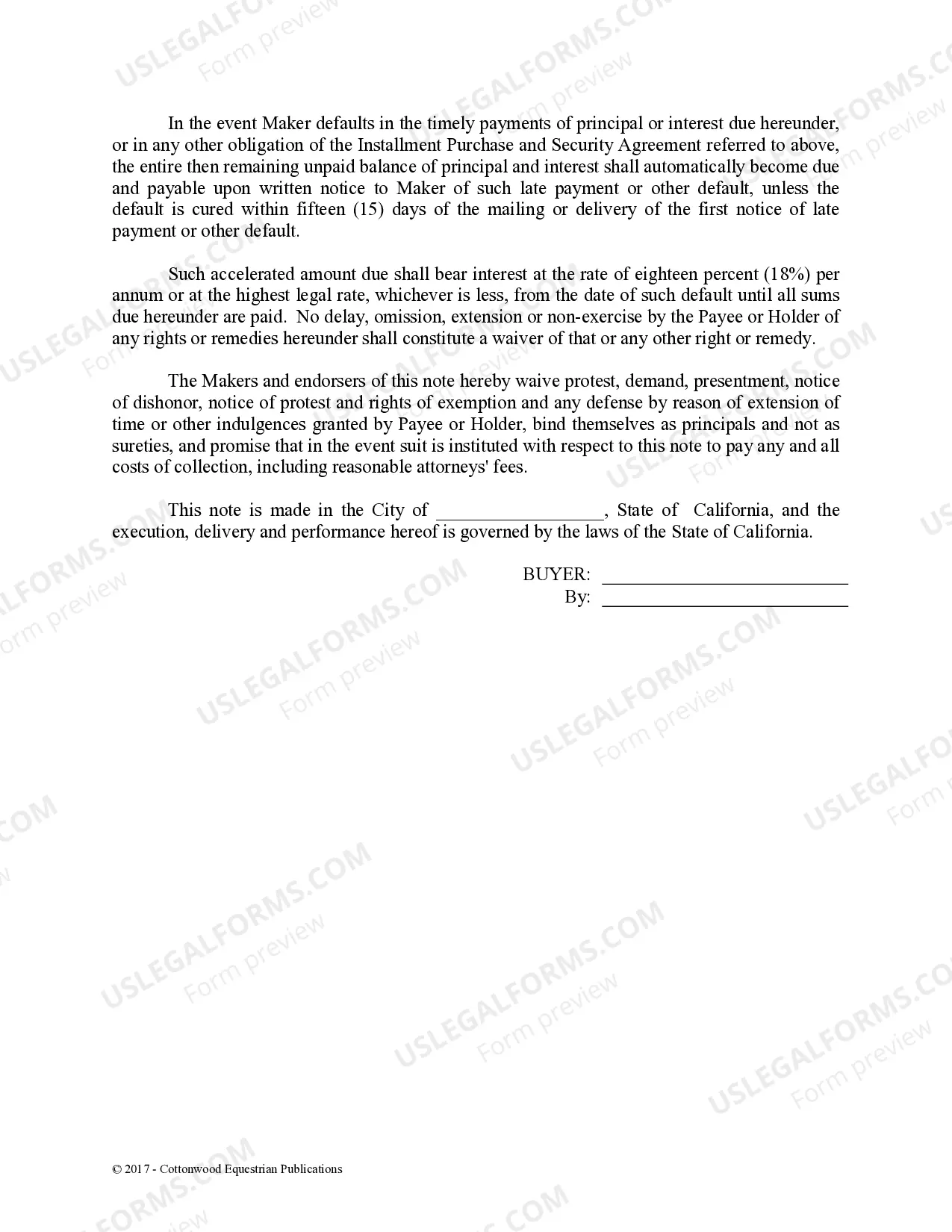

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Chico California Promissory Note — Horse Equine Forms are legal documents designed to establish a binding agreement between parties involved in horse-related transactions. These documents serve as written evidence of a loan or transaction involving horses, outlining the terms and conditions of the agreement. They are diligently drafted to protect both the borrower and the lender, ensuring transparency and clarity in the transaction process. A Chico California Promissory Note — Horse Equine Form typically includes important details such as the names and contact information of both parties involved, the amount being borrowed or transacted, the interest rate (if applicable), the repayment schedule, and any additional terms and conditions. These documents play a vital role in keeping all parties accountable and avoiding any misunderstandings or disputes that may arise. Although there are no specific types of Chico California Promissory Note — Horse Equine Forms, variations may exist to address specific requirements or circumstances. Some common variations include: 1. Simple Promissory Note: This note outlines the basic terms of the loan, such as the principal amount, interest rate, repayment schedule, and any late payment penalties, if applicable. 2. Installment Promissory Note: This type of note is used when the repayment of the loan is divided into periodic installments. It specifies the amount and frequency of each installment, making it easier for both the borrower and the lender to keep track of the repayment process. 3. Secured Promissory Note: If the borrower pledges a specific horse or other assets as collateral, this form is used to document the security interest. It outlines the details of the collateral, the consequences of defaulting, and the borrower's responsibilities to maintain and protect the collateral. 4. Demand Promissory Note: With this type of note, the lender can demand the full repayment of the loan at any time, without specifying a specific repayment schedule. This provides flexibility in case of unforeseen circumstances or when the lender requires quick repayment. While these descriptions provide an overview of Chico California Promissory Note — Horse Equine Forms and their possible variations, it is always recommended consulting with a legal professional or utilize reputable online legal service platforms to ensure the accuracy and validity of these documents based on the specific circumstances and legal requirements in Chico, California.Chico California Promissory Note — Horse Equine Forms are legal documents designed to establish a binding agreement between parties involved in horse-related transactions. These documents serve as written evidence of a loan or transaction involving horses, outlining the terms and conditions of the agreement. They are diligently drafted to protect both the borrower and the lender, ensuring transparency and clarity in the transaction process. A Chico California Promissory Note — Horse Equine Form typically includes important details such as the names and contact information of both parties involved, the amount being borrowed or transacted, the interest rate (if applicable), the repayment schedule, and any additional terms and conditions. These documents play a vital role in keeping all parties accountable and avoiding any misunderstandings or disputes that may arise. Although there are no specific types of Chico California Promissory Note — Horse Equine Forms, variations may exist to address specific requirements or circumstances. Some common variations include: 1. Simple Promissory Note: This note outlines the basic terms of the loan, such as the principal amount, interest rate, repayment schedule, and any late payment penalties, if applicable. 2. Installment Promissory Note: This type of note is used when the repayment of the loan is divided into periodic installments. It specifies the amount and frequency of each installment, making it easier for both the borrower and the lender to keep track of the repayment process. 3. Secured Promissory Note: If the borrower pledges a specific horse or other assets as collateral, this form is used to document the security interest. It outlines the details of the collateral, the consequences of defaulting, and the borrower's responsibilities to maintain and protect the collateral. 4. Demand Promissory Note: With this type of note, the lender can demand the full repayment of the loan at any time, without specifying a specific repayment schedule. This provides flexibility in case of unforeseen circumstances or when the lender requires quick repayment. While these descriptions provide an overview of Chico California Promissory Note — Horse Equine Forms and their possible variations, it is always recommended consulting with a legal professional or utilize reputable online legal service platforms to ensure the accuracy and validity of these documents based on the specific circumstances and legal requirements in Chico, California.