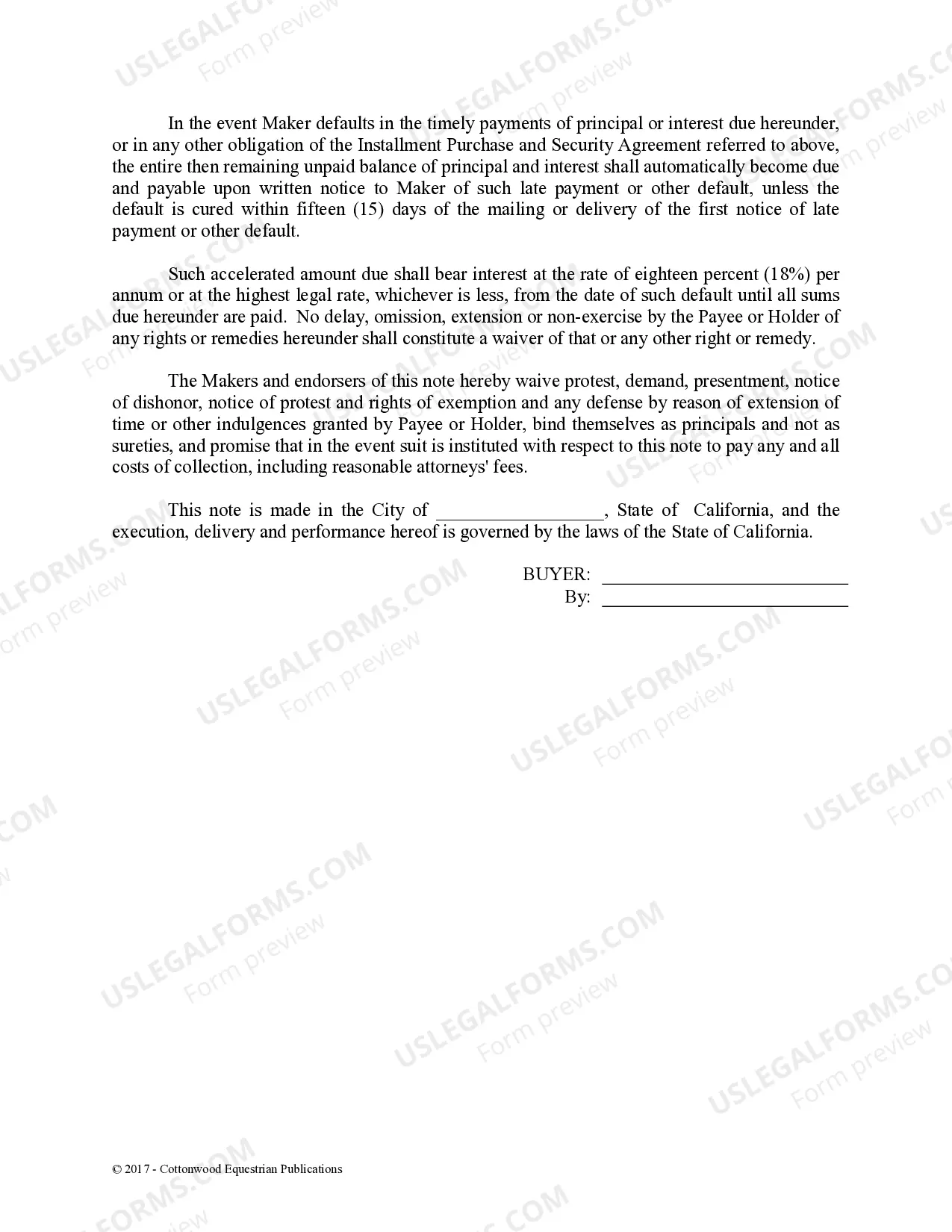

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Downey, California Promissory Note — Horse Equine Forms serve as legal agreements that outline the terms and conditions of a loan between two parties in the horse industry. These comprehensive written agreements are crucial for ensuring clear communication and a smooth financial transaction. Typically, a promissory note for horse equine forms will include the following details: 1. Parties involved: The note identifies the lender (often the seller or the horse owner) and the borrower (usually the buyer or the individual seeking financial assistance). 2. Loan amount: The note lists the specific amount of money being lent to the borrower. 3. Interest rate and payment schedule: It specifies the interest rate provided by the lender and outlines how and when the borrower will repay the loan (monthly or biweekly installments, for example). 4. Collateral: In horse equine forms, the promissory note may also include details about any collateral offered by the borrower, such as the horse, equipment, or property, which can be used to settle the debt in case of default. 5. Late fees and default terms: The note specifies the penalties or fees incurred by the borrower in case of delayed or missed payments. It also clarifies the consequences if the borrower defaults on the loan, such as repossession of the horse or legal action. 6. Governing law: The note typically states which state laws will govern the agreement, such as the laws of California. Different types of Downey, California Promissory Note — Horse Equine Forms may vary in their specific terms and details depending on the circumstances. Some additional variations of this form may include: 1. Simple Promissory Note: A basic form that outlines the loan amount, interest rate, payment schedule, and terms, but may exclude details about collateral or penalties. 2. Secured Promissory Note: This form includes provisions for collateral as security for the loan in case of default. 3. Installment Promissory Note: A specific type of note that arranges for payment in regular installments over a set period, rather than one lump-sum payment. 4. Demand Promissory Note: This form allows the lender to demand full repayment of the loan at any time, without specifying fixed repayment dates. 5. Balloon Promissory Note: This note sets smaller regular payments, with a large final payment (balloon payment) to be made at a specified date. In conclusion, Downey, California Promissory Note — Horse Equine Forms are essential legal documents that outline the terms of a loan in the horse industry. With various types available, individuals can choose the appropriate form depending on their specific requirements and preferences.Downey, California Promissory Note — Horse Equine Forms serve as legal agreements that outline the terms and conditions of a loan between two parties in the horse industry. These comprehensive written agreements are crucial for ensuring clear communication and a smooth financial transaction. Typically, a promissory note for horse equine forms will include the following details: 1. Parties involved: The note identifies the lender (often the seller or the horse owner) and the borrower (usually the buyer or the individual seeking financial assistance). 2. Loan amount: The note lists the specific amount of money being lent to the borrower. 3. Interest rate and payment schedule: It specifies the interest rate provided by the lender and outlines how and when the borrower will repay the loan (monthly or biweekly installments, for example). 4. Collateral: In horse equine forms, the promissory note may also include details about any collateral offered by the borrower, such as the horse, equipment, or property, which can be used to settle the debt in case of default. 5. Late fees and default terms: The note specifies the penalties or fees incurred by the borrower in case of delayed or missed payments. It also clarifies the consequences if the borrower defaults on the loan, such as repossession of the horse or legal action. 6. Governing law: The note typically states which state laws will govern the agreement, such as the laws of California. Different types of Downey, California Promissory Note — Horse Equine Forms may vary in their specific terms and details depending on the circumstances. Some additional variations of this form may include: 1. Simple Promissory Note: A basic form that outlines the loan amount, interest rate, payment schedule, and terms, but may exclude details about collateral or penalties. 2. Secured Promissory Note: This form includes provisions for collateral as security for the loan in case of default. 3. Installment Promissory Note: A specific type of note that arranges for payment in regular installments over a set period, rather than one lump-sum payment. 4. Demand Promissory Note: This form allows the lender to demand full repayment of the loan at any time, without specifying fixed repayment dates. 5. Balloon Promissory Note: This note sets smaller regular payments, with a large final payment (balloon payment) to be made at a specified date. In conclusion, Downey, California Promissory Note — Horse Equine Forms are essential legal documents that outline the terms of a loan in the horse industry. With various types available, individuals can choose the appropriate form depending on their specific requirements and preferences.