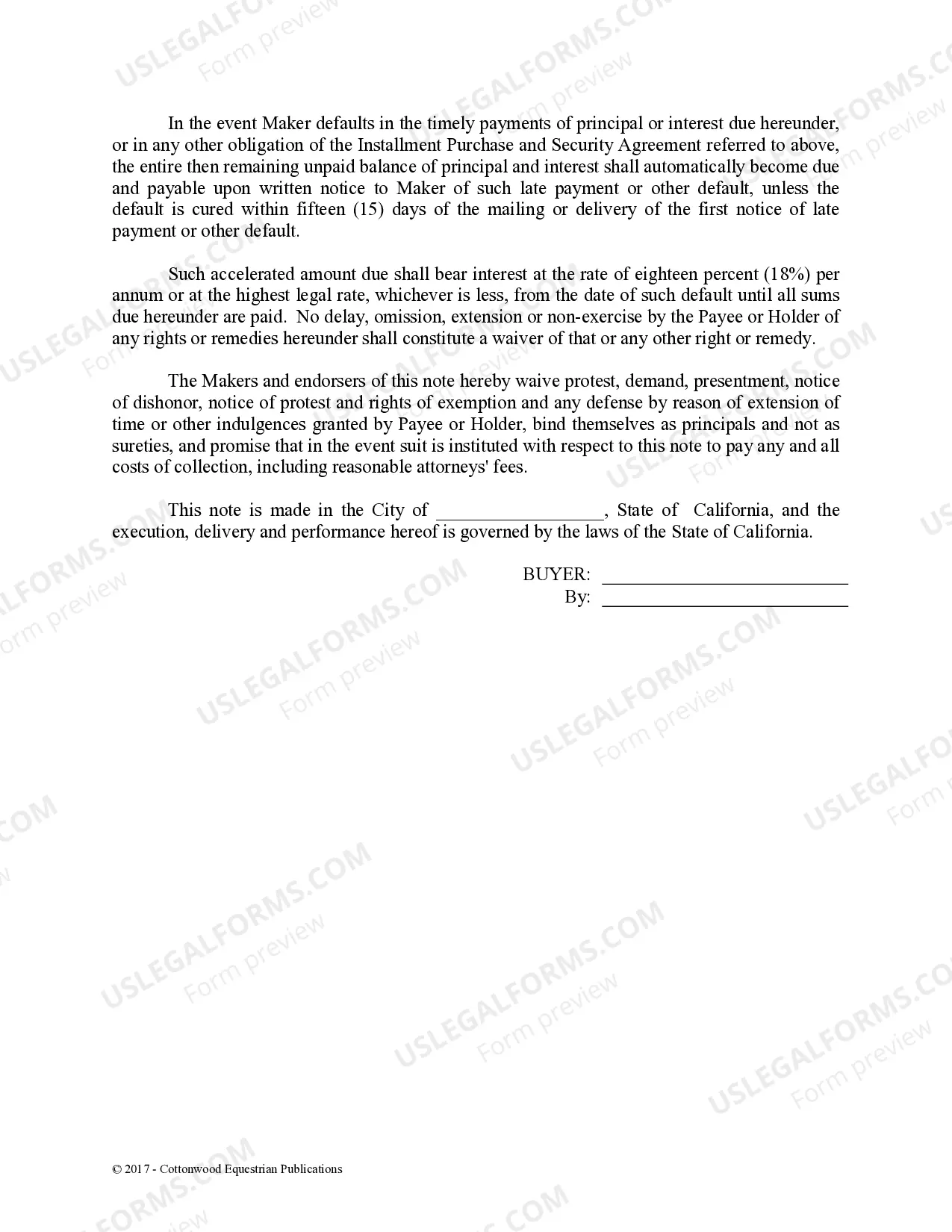

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Fullerton California Promissory Note — Horse Equine Forms are legal documents used in the state of California specifically for transactions involving horses and equine-related activities. These forms outline the terms and conditions of a promissory note, which is a written promise to repay a specified amount of money within a certain timeframe. The Fullerton California Promissory Note — Horse Equine Forms provide a comprehensive and detailed description of the loan agreement between the lender and the borrower. Some essential elements typically included in these forms are: 1. Parties involved: The full names and contact details of both the lender and borrower are recorded in the document. It ensures clear identification of the individuals or entities involved in the financial agreement. 2. Loan amount and interest: The exact amount of money being loaned is stated, along with any applicable interest rate or fees. This ensures transparency and avoids any confusion regarding the loan amount. 3. Repayment schedule: The forms include the agreed-upon repayment schedule, stating the frequency of payments (weekly, monthly, etc.) and the due dates. A specific timeframe may be outlined, including start and end dates for the repayment period. 4. Late fees and penalties: The promissory note may specify the consequences of late payments or defaulting on the loan, including additional fees or penalties. This protects the lender's interests by establishing clear consequences for non-compliance. 5. Collateral and security agreement: If applicable, the forms detail any collateral or security submitted by the borrower to secure the loan. In equine cases, this collateral could be a horse or equine-related assets. It ensures that the lender has recourse if the borrower fails to fulfill their repayment obligations. 6. Governing law: Fullerton California Promissory Note — Horse Equine Forms often include a choice-of-law provision, specifying that the laws of California govern the agreement. This ensures both parties have a clear understanding of the legal jurisdiction regarding the promissory note. Different types of Fullerton California Promissory Note — Horse Equine Forms may exist to cater to specific scenarios or preferences of the parties involved. Some variations may focus on commercial equine loans, while others might be geared towards personal or private transactions. It is crucial to choose the appropriate form that aligns with the specific nature of the transaction and the desired level of legal protection. In conclusion, Fullerton California Promissory Note — Horse Equine Forms play a vital role in facilitating loan agreements related to horses and equine activities. These forms outline the terms, conditions, and obligations of the parties involved, ensuring clarity and legal compliance throughout the loan process.Fullerton California Promissory Note — Horse Equine Forms are legal documents used in the state of California specifically for transactions involving horses and equine-related activities. These forms outline the terms and conditions of a promissory note, which is a written promise to repay a specified amount of money within a certain timeframe. The Fullerton California Promissory Note — Horse Equine Forms provide a comprehensive and detailed description of the loan agreement between the lender and the borrower. Some essential elements typically included in these forms are: 1. Parties involved: The full names and contact details of both the lender and borrower are recorded in the document. It ensures clear identification of the individuals or entities involved in the financial agreement. 2. Loan amount and interest: The exact amount of money being loaned is stated, along with any applicable interest rate or fees. This ensures transparency and avoids any confusion regarding the loan amount. 3. Repayment schedule: The forms include the agreed-upon repayment schedule, stating the frequency of payments (weekly, monthly, etc.) and the due dates. A specific timeframe may be outlined, including start and end dates for the repayment period. 4. Late fees and penalties: The promissory note may specify the consequences of late payments or defaulting on the loan, including additional fees or penalties. This protects the lender's interests by establishing clear consequences for non-compliance. 5. Collateral and security agreement: If applicable, the forms detail any collateral or security submitted by the borrower to secure the loan. In equine cases, this collateral could be a horse or equine-related assets. It ensures that the lender has recourse if the borrower fails to fulfill their repayment obligations. 6. Governing law: Fullerton California Promissory Note — Horse Equine Forms often include a choice-of-law provision, specifying that the laws of California govern the agreement. This ensures both parties have a clear understanding of the legal jurisdiction regarding the promissory note. Different types of Fullerton California Promissory Note — Horse Equine Forms may exist to cater to specific scenarios or preferences of the parties involved. Some variations may focus on commercial equine loans, while others might be geared towards personal or private transactions. It is crucial to choose the appropriate form that aligns with the specific nature of the transaction and the desired level of legal protection. In conclusion, Fullerton California Promissory Note — Horse Equine Forms play a vital role in facilitating loan agreements related to horses and equine activities. These forms outline the terms, conditions, and obligations of the parties involved, ensuring clarity and legal compliance throughout the loan process.