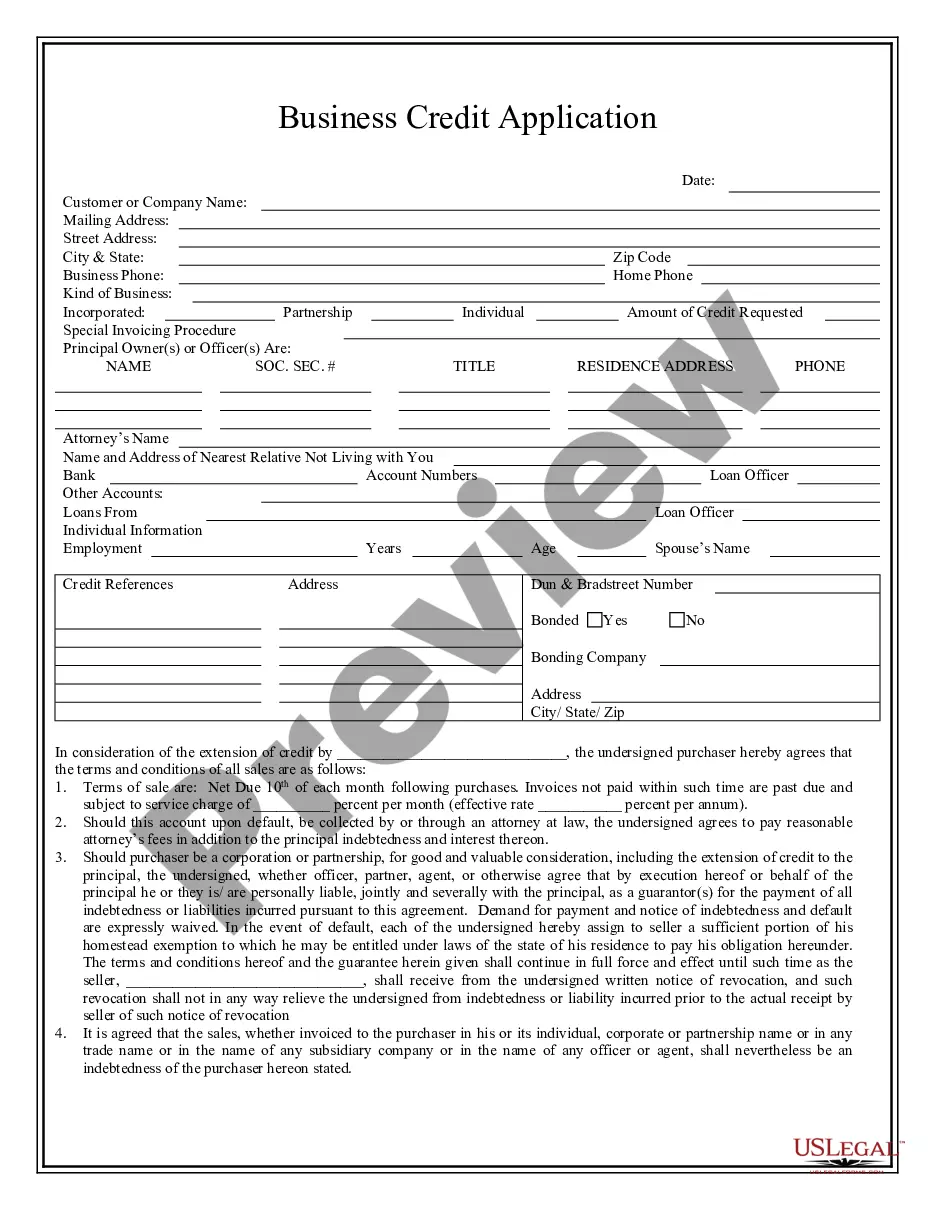

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Irvine California Business Credit Application is a formal document used by businesses in Irvine, California to request credit from financial institutions or lenders. This application acts as a means for businesses to apply for credit lines or loans to fund their operations, expansion, or other financial needs. It serves as an essential tool for businesses in Irvine to attain the necessary financial resources required for growth and success. At its core, the Irvine California Business Credit Application outlines important information about the applying business, its owners or directors, and its financial standing. The application typically includes details such as the business name, address, contact information, years in operation, legal structure (sole proprietorship, partnership, corporation, etc.), and taxpayer identification number. The application also requires the business to provide comprehensive financial information, including financial statements such as balance sheets, income statements, and cash flow statements. Additionally, it may ask for bank statements, tax returns, and other relevant financial documents to assess the business's creditworthiness. Furthermore, the Irvine California Business Credit Application usually requires businesses to specify the purpose of the requested credit and the intended loan amount. This information helps lenders determine whether the business's financial needs align with the available credit products they offer. It is worth mentioning that different types of Irvine California Business Credit Applications can exist, depending on the specific institution or lender providing the credit. Some lenders might have their own customized application forms, while others may follow more standardized applications. Examples of specific Irvine California Business Credit Application types may include: 1. Small Business Loan Application: This type of credit application is tailored for Irvine-based small businesses seeking a loan to support their day-to-day operations, working capital needs, or specific projects. 2. Commercial Line of Credit Application: This application is designed for companies looking to establish a revolving line of credit, enabling them to access funds whenever needed for various business purposes. 3. Equipment Financing Application: Businesses in Irvine requiring funding specifically for purchasing or leasing equipment can utilize this type of credit application, which focuses on providing financial support for equipment acquisition. 4. Business Credit Card Application: Lenders offering business credit cards may have a separate application process designed for Irvine businesses looking to obtain a credit card for their company's expenses. These are just a few examples of Irvine California Business Credit Applications, but it is important to note that each financial institution or lender might have specific applications tailored to their credit products and requirements. Businesses should thoroughly review the particular application provided by their chosen lender to ensure compliance and accuracy.Irvine California Business Credit Application is a formal document used by businesses in Irvine, California to request credit from financial institutions or lenders. This application acts as a means for businesses to apply for credit lines or loans to fund their operations, expansion, or other financial needs. It serves as an essential tool for businesses in Irvine to attain the necessary financial resources required for growth and success. At its core, the Irvine California Business Credit Application outlines important information about the applying business, its owners or directors, and its financial standing. The application typically includes details such as the business name, address, contact information, years in operation, legal structure (sole proprietorship, partnership, corporation, etc.), and taxpayer identification number. The application also requires the business to provide comprehensive financial information, including financial statements such as balance sheets, income statements, and cash flow statements. Additionally, it may ask for bank statements, tax returns, and other relevant financial documents to assess the business's creditworthiness. Furthermore, the Irvine California Business Credit Application usually requires businesses to specify the purpose of the requested credit and the intended loan amount. This information helps lenders determine whether the business's financial needs align with the available credit products they offer. It is worth mentioning that different types of Irvine California Business Credit Applications can exist, depending on the specific institution or lender providing the credit. Some lenders might have their own customized application forms, while others may follow more standardized applications. Examples of specific Irvine California Business Credit Application types may include: 1. Small Business Loan Application: This type of credit application is tailored for Irvine-based small businesses seeking a loan to support their day-to-day operations, working capital needs, or specific projects. 2. Commercial Line of Credit Application: This application is designed for companies looking to establish a revolving line of credit, enabling them to access funds whenever needed for various business purposes. 3. Equipment Financing Application: Businesses in Irvine requiring funding specifically for purchasing or leasing equipment can utilize this type of credit application, which focuses on providing financial support for equipment acquisition. 4. Business Credit Card Application: Lenders offering business credit cards may have a separate application process designed for Irvine businesses looking to obtain a credit card for their company's expenses. These are just a few examples of Irvine California Business Credit Applications, but it is important to note that each financial institution or lender might have specific applications tailored to their credit products and requirements. Businesses should thoroughly review the particular application provided by their chosen lender to ensure compliance and accuracy.