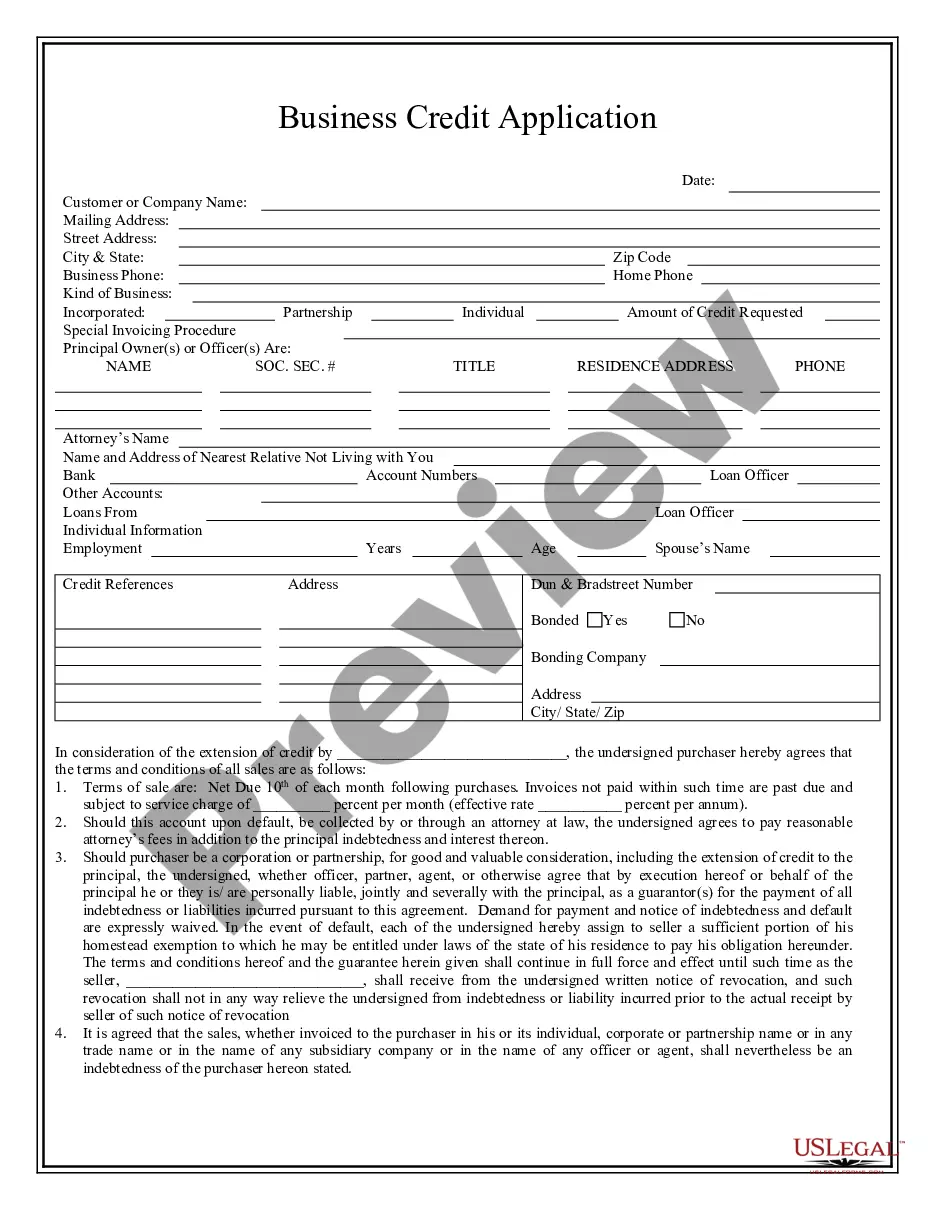

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Roseville California Business Credit Application is a comprehensive form used by businesses in Roseville, California to apply for credit from financial institutions or creditors. This form plays a vital role in the credit evaluation process and assists both the applicant and the creditor in assessing the eligibility and creditworthiness of the business. Keywords: Roseville California, Business Credit Application, credit evaluation, creditworthiness, eligibility, financial institutions, creditors. There are various types of Roseville California Business Credit Application, including: 1. Standard Business Credit Application: This is the most common type of credit application used by businesses in Roseville, California. It typically collects basic information about the business, such as its legal name, address, contact information, and ownership details. Additionally, it requires the applicant to provide financial information, such as annual revenue, current liabilities, and assets. 2. Small Business Credit Application: Specifically designed for small businesses in Roseville, California, this type of credit application takes into account the unique needs and financial situations of small enterprises. It may include sections for a business owner's personal financial information, as well as the business's financials. 3. Commercial Credit Application: This type of credit application is suitable for larger corporations and businesses dealing with commercial transactions. It typically requires more extensive financial documentation, such as audited financial statements, bank references, and trade references. 4. Vendor Credit Application: This credit application specifically targets businesses seeking credit from vendors or suppliers. It aims to establish a credit relationship between the business and the vendor, enabling the business to procure goods or services on credit terms. 5. Trade line Credit Application: Trade line credit applications are specific to businesses looking to establish credit with a particular trade line company or agency. Trade line companies often specialize in providing credit options to businesses in specific industries, such as construction, manufacturing, or retail. 6. Equipment Lease Credit Application: This type of credit application is designed for businesses seeking equipment leasing options. It gathers information about the desired equipment lease, the business's financial standing, and may include additional documentation like business plans or projections. 7. Construction Credit Application: Construction companies often require credit for various projects. This type of credit application caters specifically to their needs and considers factors such as project estimates, bonding capacity, and contractor's license information. It is important for businesses in Roseville, California to carefully review and complete the appropriate credit application that aligns with their specific requirements and industry. Providing accurate and complete information is crucial to increase the chances of credit approval and establish a successful credit relationship with financial institutions or creditors.Roseville California Business Credit Application is a comprehensive form used by businesses in Roseville, California to apply for credit from financial institutions or creditors. This form plays a vital role in the credit evaluation process and assists both the applicant and the creditor in assessing the eligibility and creditworthiness of the business. Keywords: Roseville California, Business Credit Application, credit evaluation, creditworthiness, eligibility, financial institutions, creditors. There are various types of Roseville California Business Credit Application, including: 1. Standard Business Credit Application: This is the most common type of credit application used by businesses in Roseville, California. It typically collects basic information about the business, such as its legal name, address, contact information, and ownership details. Additionally, it requires the applicant to provide financial information, such as annual revenue, current liabilities, and assets. 2. Small Business Credit Application: Specifically designed for small businesses in Roseville, California, this type of credit application takes into account the unique needs and financial situations of small enterprises. It may include sections for a business owner's personal financial information, as well as the business's financials. 3. Commercial Credit Application: This type of credit application is suitable for larger corporations and businesses dealing with commercial transactions. It typically requires more extensive financial documentation, such as audited financial statements, bank references, and trade references. 4. Vendor Credit Application: This credit application specifically targets businesses seeking credit from vendors or suppliers. It aims to establish a credit relationship between the business and the vendor, enabling the business to procure goods or services on credit terms. 5. Trade line Credit Application: Trade line credit applications are specific to businesses looking to establish credit with a particular trade line company or agency. Trade line companies often specialize in providing credit options to businesses in specific industries, such as construction, manufacturing, or retail. 6. Equipment Lease Credit Application: This type of credit application is designed for businesses seeking equipment leasing options. It gathers information about the desired equipment lease, the business's financial standing, and may include additional documentation like business plans or projections. 7. Construction Credit Application: Construction companies often require credit for various projects. This type of credit application caters specifically to their needs and considers factors such as project estimates, bonding capacity, and contractor's license information. It is important for businesses in Roseville, California to carefully review and complete the appropriate credit application that aligns with their specific requirements and industry. Providing accurate and complete information is crucial to increase the chances of credit approval and establish a successful credit relationship with financial institutions or creditors.