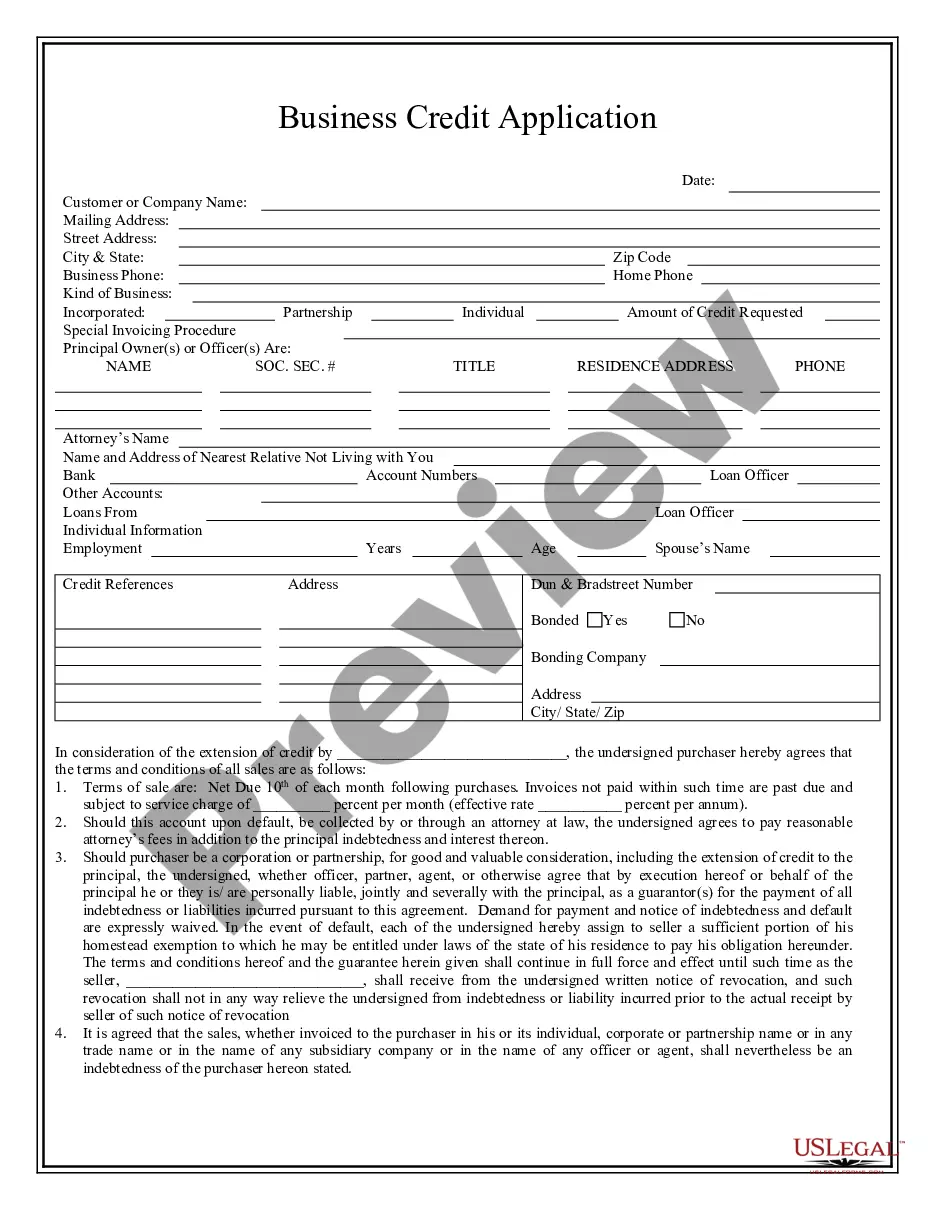

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

San Diego California Business Credit Application is a comprehensive document that enables businesses in San Diego, California, to apply for credit services offered by financial institutions or lending agencies. This application serves as a vital tool for businesses looking to acquire loans, credit lines, or other forms of financial assistance to fund their operations, investments, or expansion plans. The San Diego California Business Credit Application typically requests detailed information about the business, its owners, and its financial history. It includes sections that require the applicant to provide key details such as the business name, address, contact information, legal structure, and tax identification number. Additionally, the application usually requires the disclosure of ownership information, highlighting the names, addresses, and contact details of all owners or partners. To assess the creditworthiness and financial stability of the business, the application may also ask for financial statements, tax returns, balance sheets, profit and loss statements, cash flow projections, and other relevant financial records. These documents help the lending institution evaluate the business's ability to repay the credit. In terms of the different types of San Diego California Business Credit Applications, businesses can encounter various variations based on the specific credit products or services they are applying for. Some common types include: 1. Business Loan Application: This type of credit application is for businesses seeking a lump sum loan amount to be repaid over a predetermined period, typically with fixed installment payments. 2. Business Line of Credit Application: A line of credit application is suitable for businesses that require periodic access to funds, allowing them to withdraw and repay multiple times within a specified credit limit. 3. Business Credit Card Application: San Diego businesses can also apply for business credit cards, which provide a revolving line of credit for business expenses, often with additional perks like reward programs or expense tracking tools. 4. Equipment Financing Application: Businesses that require specific equipment or machinery for their operations can utilize this type of credit application to obtain financing solely for the purpose of acquiring those assets. It is essential to understand that the specific requirements, terms, and conditions of a San Diego California Business Credit Application can vary depending on the financial institution or lender. Therefore, it is advisable for businesses to carefully review the application form and seek professional guidance if needed to ensure accuracy and completeness before submission.San Diego California Business Credit Application is a comprehensive document that enables businesses in San Diego, California, to apply for credit services offered by financial institutions or lending agencies. This application serves as a vital tool for businesses looking to acquire loans, credit lines, or other forms of financial assistance to fund their operations, investments, or expansion plans. The San Diego California Business Credit Application typically requests detailed information about the business, its owners, and its financial history. It includes sections that require the applicant to provide key details such as the business name, address, contact information, legal structure, and tax identification number. Additionally, the application usually requires the disclosure of ownership information, highlighting the names, addresses, and contact details of all owners or partners. To assess the creditworthiness and financial stability of the business, the application may also ask for financial statements, tax returns, balance sheets, profit and loss statements, cash flow projections, and other relevant financial records. These documents help the lending institution evaluate the business's ability to repay the credit. In terms of the different types of San Diego California Business Credit Applications, businesses can encounter various variations based on the specific credit products or services they are applying for. Some common types include: 1. Business Loan Application: This type of credit application is for businesses seeking a lump sum loan amount to be repaid over a predetermined period, typically with fixed installment payments. 2. Business Line of Credit Application: A line of credit application is suitable for businesses that require periodic access to funds, allowing them to withdraw and repay multiple times within a specified credit limit. 3. Business Credit Card Application: San Diego businesses can also apply for business credit cards, which provide a revolving line of credit for business expenses, often with additional perks like reward programs or expense tracking tools. 4. Equipment Financing Application: Businesses that require specific equipment or machinery for their operations can utilize this type of credit application to obtain financing solely for the purpose of acquiring those assets. It is essential to understand that the specific requirements, terms, and conditions of a San Diego California Business Credit Application can vary depending on the financial institution or lender. Therefore, it is advisable for businesses to carefully review the application form and seek professional guidance if needed to ensure accuracy and completeness before submission.