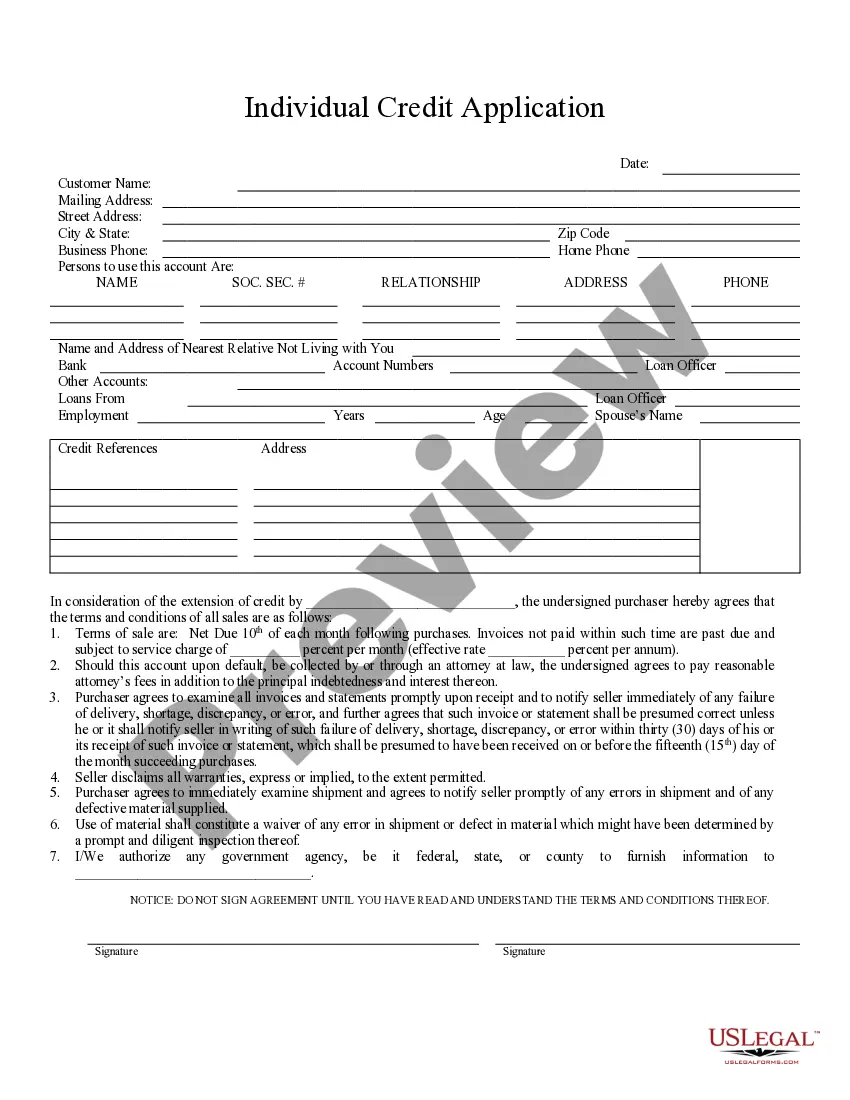

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Anaheim California Individual Credit Application is a comprehensive form used by individuals residing in Anaheim, California, to apply for various forms of credit offered by financial institutions, such as banks, credit unions, or lending agencies. This application allows individuals to provide their personal and financial information, which is essential for the evaluation and approval process. The Anaheim California Individual Credit Application typically consists of several sections that require the applicant to provide detailed information. These sections may include: 1. Personal Information: This section requires the applicant's name, contact details (address, phone number, email), social security number, date of birth, and marital status. 2. Employment Information: Here, the applicant must provide their current employment details, including the name of the employer, job title, duration of employment, and monthly income. Some applications may also ask for previous employment history. 3. Financial Information: This section collects information about the applicant's financial status. It may include details on their current bank accounts, investments, assets, and liabilities, such as loans, mortgages, or credit card debts. Applicants may also need to disclose their monthly expenses and any additional sources of income. 4. Credit History: In this part, applicants are required to provide their credit history, including any outstanding debts, late payments, bankruptcies, or previous credit applications. They may also have to consent to a credit check performed by the financial institution. 5. Purpose of Credit and Loan Preferences: Here, applicants can indicate the purpose for which they are applying for credit (e.g., home purchase, education, car loan) as well as specify the desired loan amount, repayment term, and preferred interest rate. It is important to note that while the overall structure of the Anaheim California Individual Credit Application remains consistent, different financial institutions may have their own variations tailored to their specific lending policies or products. For instance, there might be separate credit applications for mortgage loans, auto loans, personal loans, or credit cards, each catering to the unique requirements of those types of credit. Overall, the Anaheim California Individual Credit Application serves as a fundamental tool for individuals seeking credit opportunities in Anaheim, California. The comprehensive information provided in this application assists financial institutions in evaluating an applicant's creditworthiness and determining their eligibility for various credit products.