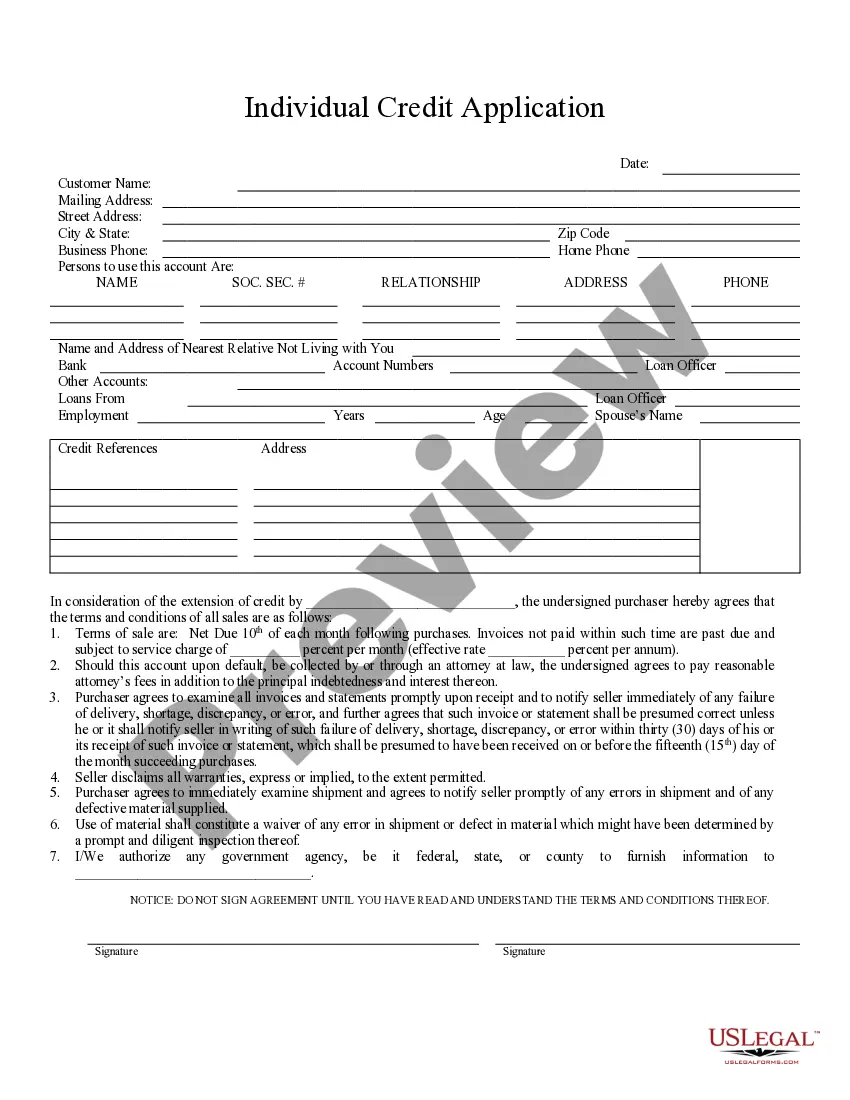

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Burbank, California Individual Credit Application: A Comprehensive Overview In Burbank, California, the Individual Credit Application refers to the documentation required by financial institutions and lenders to evaluate an individual's creditworthiness and eligibility for various financial products such as loans, credit cards, or mortgages. This application plays a crucial role in determining an individual's borrowing capacity and aids lenders in making informed decisions regarding extending credit. The Burbank, California Individual Credit Application is a detailed form that collects comprehensive information about the applicant's personal, financial, and employment background. This information is crucial as it helps lenders assess an individual's ability to repay debts and manage financial obligations responsibly. Some key factors evaluated in the application include: 1. Personal Information: This section gathers basic details about the applicant, including their full name, current address, contact information, date of birth, social security number, and marital status. 2. Employment and Income Details: Lenders require information about the applicant's employment history, employer name, job title, years of service, and monthly income. This data helps lenders determine stability and reliability as well as the ability to repay loans. 3. Residence History: This section focuses on past and present residences, including rental history, homeownership details, and length of stay. It helps lenders gauge stability and assess collateral options if necessary. 4. Financial Information: This segment requires the applicant to disclose information about their existing financial assets, liabilities, and monthly expenses. Existing debts, such as credit card balances, student loans, or car loans, help lenders determine an individual's debt-to-income ratio. 5. Credit History: The credit application requires a comprehensive credit history check, which includes assessing the applicant's credit score, payment history, outstanding debts, bankruptcies, and any prior loan defaults. 6. References: Applicants may be asked to provide personal references who can vouch for their character, trustworthiness, and financial stability. It is important to note that there may be various types of Individual Credit Applications in Burbank, California, depending on the specific financial institution, loan product, or service offered. Some examples of specialized credit applications include: 1. Mortgage Credit Application: Designed specifically for individuals seeking a home loan, this application might require additional information such as property details, down payment amount, and intended use of the property. 2. Auto Loan Credit Application: Targeting prospective car buyers, this credit application may emphasize factors like the vehicle's make, model, year, purchase price, and desired loan term. 3. Credit Card Application: Tailored for individuals interested in acquiring a credit card, this type of application may emphasize income documentation, employment history, and may also require information about card preferences, credit limit requirements, and desired rewards programs. In conclusion, the Burbank, California Individual Credit Application is a crucial document that enables lenders and financial institutions to assess the creditworthiness and eligibility of individuals seeking various types of credit. By collecting comprehensive information about an applicant's financial background, credit history, employment details, and personal information, lenders can make informed decisions and provide suitable credit solutions.Burbank, California Individual Credit Application: A Comprehensive Overview In Burbank, California, the Individual Credit Application refers to the documentation required by financial institutions and lenders to evaluate an individual's creditworthiness and eligibility for various financial products such as loans, credit cards, or mortgages. This application plays a crucial role in determining an individual's borrowing capacity and aids lenders in making informed decisions regarding extending credit. The Burbank, California Individual Credit Application is a detailed form that collects comprehensive information about the applicant's personal, financial, and employment background. This information is crucial as it helps lenders assess an individual's ability to repay debts and manage financial obligations responsibly. Some key factors evaluated in the application include: 1. Personal Information: This section gathers basic details about the applicant, including their full name, current address, contact information, date of birth, social security number, and marital status. 2. Employment and Income Details: Lenders require information about the applicant's employment history, employer name, job title, years of service, and monthly income. This data helps lenders determine stability and reliability as well as the ability to repay loans. 3. Residence History: This section focuses on past and present residences, including rental history, homeownership details, and length of stay. It helps lenders gauge stability and assess collateral options if necessary. 4. Financial Information: This segment requires the applicant to disclose information about their existing financial assets, liabilities, and monthly expenses. Existing debts, such as credit card balances, student loans, or car loans, help lenders determine an individual's debt-to-income ratio. 5. Credit History: The credit application requires a comprehensive credit history check, which includes assessing the applicant's credit score, payment history, outstanding debts, bankruptcies, and any prior loan defaults. 6. References: Applicants may be asked to provide personal references who can vouch for their character, trustworthiness, and financial stability. It is important to note that there may be various types of Individual Credit Applications in Burbank, California, depending on the specific financial institution, loan product, or service offered. Some examples of specialized credit applications include: 1. Mortgage Credit Application: Designed specifically for individuals seeking a home loan, this application might require additional information such as property details, down payment amount, and intended use of the property. 2. Auto Loan Credit Application: Targeting prospective car buyers, this credit application may emphasize factors like the vehicle's make, model, year, purchase price, and desired loan term. 3. Credit Card Application: Tailored for individuals interested in acquiring a credit card, this type of application may emphasize income documentation, employment history, and may also require information about card preferences, credit limit requirements, and desired rewards programs. In conclusion, the Burbank, California Individual Credit Application is a crucial document that enables lenders and financial institutions to assess the creditworthiness and eligibility of individuals seeking various types of credit. By collecting comprehensive information about an applicant's financial background, credit history, employment details, and personal information, lenders can make informed decisions and provide suitable credit solutions.