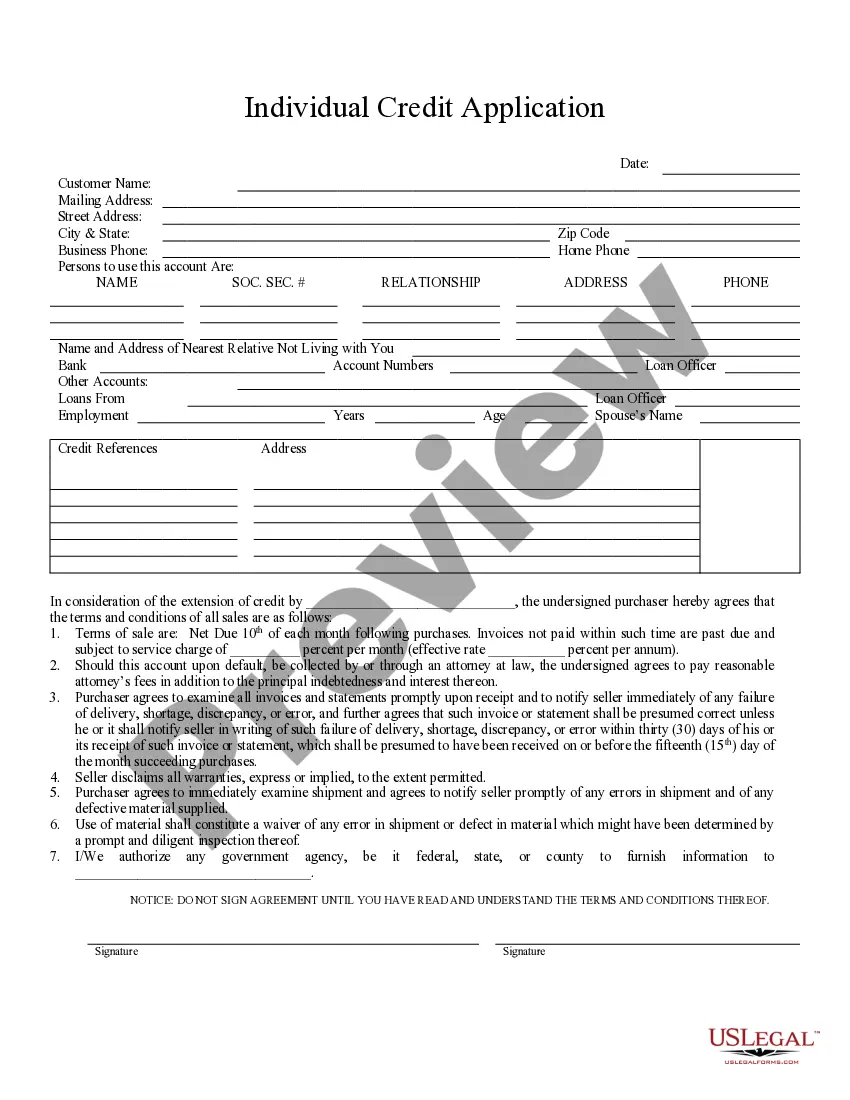

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Chico California Individual Credit Application is a comprehensive form used by individuals residing in Chico, California, to apply for credit from various financial institutions or lenders. This application allows individuals to provide detailed information about their personal and financial background to help the lenders assess their creditworthiness and determine the terms and conditions of the credit they are seeking. The Chico California Individual Credit Application typically consists of multiple sections, including personal information, employment details, income and expenses, existing debts and liabilities, banking details, and references. Each section requires precise and accurate information to ensure a thorough evaluation of the applicant's financial stability. The personal information section of the Chico California Individual Credit Application asks for the applicant's full name, address, social security number, date of birth, and contact information. This information helps verify the identity of the applicant and facilitates communication with the lender. In the employment details section, applicants are required to provide their current employment status, including the name and address of the employer, job title, length of employment, and monthly income. This section helps the lender gauge the stability of the applicant's income source and ensure their ability to repay the credit. The income and expenses section allows applicants to outline their monthly income from various sources, such as salary, investments, or rental properties. Simultaneously, they must also provide details of their regular expenses, including rent/mortgage, utilities, transportation costs, and other financial obligations. This section provides a clear picture of the applicant's income-to-debt ratio and their ability to manage their finances responsibly. Applicants must disclose their existing debts and liabilities, such as credit card balances, outstanding loans, or any other financial obligations in the corresponding section. Lenders consider this information to assess the applicant's debt load and their capacity to take on additional credit responsibly. Banking details are also required in the Chico California Individual Credit Application, including the applicant's bank name, address, account number, and the length of the banking relationship. This information aids in verifying the applicant's banking history and allows the lender to check their financial stability and transaction patterns. Lastly, the references section requires applicants to provide contact details of individuals who can vouch for their character, financial responsibility, and credibility. This enables the lender to gather additional information from trustworthy sources and verify the applicant's suitability for credit. Different types of Chico California Individual Credit Applications may exist depending on the specific financial institution or lender. For example, there could be variations for credit cards, personal loans, vehicle loans, home mortgages, or business loans. Each type may have slight variations in the application form to cater to the specific requirements of the credit being sought. In conclusion, the Chico California Individual Credit Application is a detailed document that enables individuals in Chico, California, to apply for credit from financial institutions or lenders. By supplying accurate and thorough information in the application, applicants increase their chances of qualifying for credit and securing favorable terms.Chico California Individual Credit Application is a comprehensive form used by individuals residing in Chico, California, to apply for credit from various financial institutions or lenders. This application allows individuals to provide detailed information about their personal and financial background to help the lenders assess their creditworthiness and determine the terms and conditions of the credit they are seeking. The Chico California Individual Credit Application typically consists of multiple sections, including personal information, employment details, income and expenses, existing debts and liabilities, banking details, and references. Each section requires precise and accurate information to ensure a thorough evaluation of the applicant's financial stability. The personal information section of the Chico California Individual Credit Application asks for the applicant's full name, address, social security number, date of birth, and contact information. This information helps verify the identity of the applicant and facilitates communication with the lender. In the employment details section, applicants are required to provide their current employment status, including the name and address of the employer, job title, length of employment, and monthly income. This section helps the lender gauge the stability of the applicant's income source and ensure their ability to repay the credit. The income and expenses section allows applicants to outline their monthly income from various sources, such as salary, investments, or rental properties. Simultaneously, they must also provide details of their regular expenses, including rent/mortgage, utilities, transportation costs, and other financial obligations. This section provides a clear picture of the applicant's income-to-debt ratio and their ability to manage their finances responsibly. Applicants must disclose their existing debts and liabilities, such as credit card balances, outstanding loans, or any other financial obligations in the corresponding section. Lenders consider this information to assess the applicant's debt load and their capacity to take on additional credit responsibly. Banking details are also required in the Chico California Individual Credit Application, including the applicant's bank name, address, account number, and the length of the banking relationship. This information aids in verifying the applicant's banking history and allows the lender to check their financial stability and transaction patterns. Lastly, the references section requires applicants to provide contact details of individuals who can vouch for their character, financial responsibility, and credibility. This enables the lender to gather additional information from trustworthy sources and verify the applicant's suitability for credit. Different types of Chico California Individual Credit Applications may exist depending on the specific financial institution or lender. For example, there could be variations for credit cards, personal loans, vehicle loans, home mortgages, or business loans. Each type may have slight variations in the application form to cater to the specific requirements of the credit being sought. In conclusion, the Chico California Individual Credit Application is a detailed document that enables individuals in Chico, California, to apply for credit from financial institutions or lenders. By supplying accurate and thorough information in the application, applicants increase their chances of qualifying for credit and securing favorable terms.