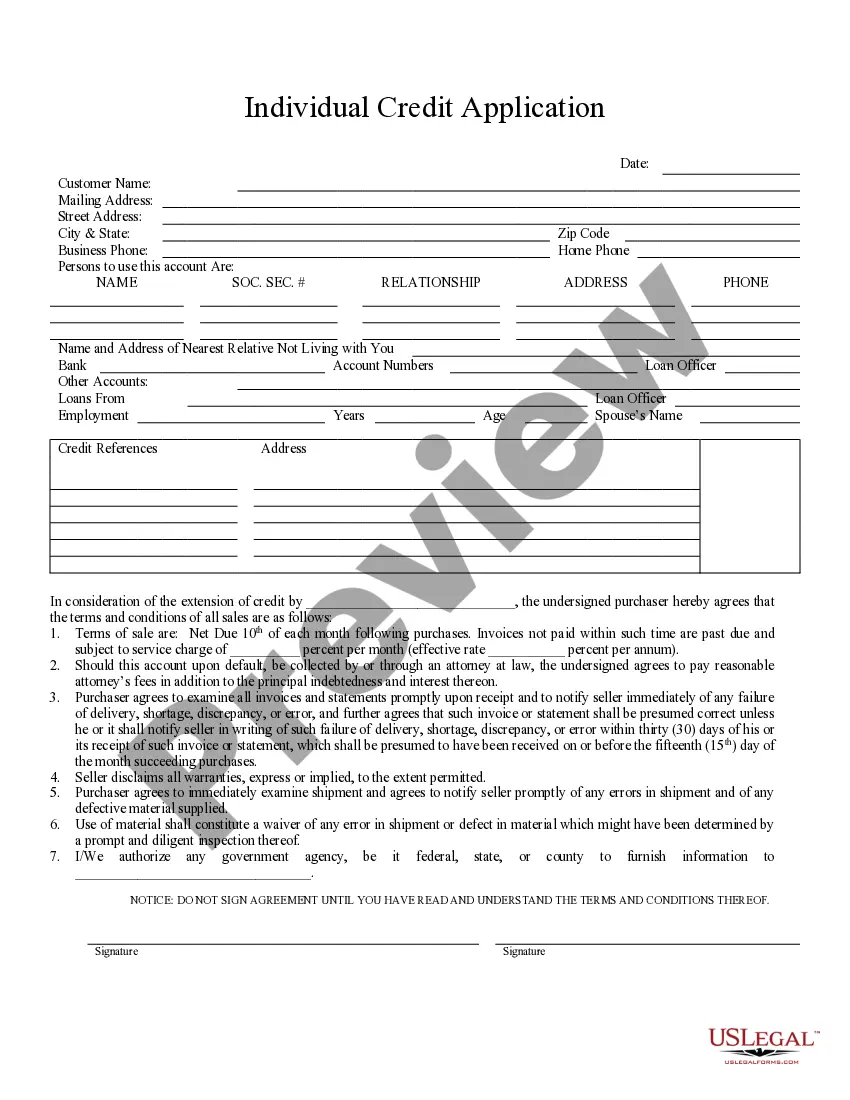

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Corona California Individual Credit Application is a comprehensive document that individuals residing in the city of Corona, California, utilize to apply for credit from a financial institution or lender. This application form is specifically designed to gather essential information about the applicant's personal, financial, and employment details, which helps lenders assess their creditworthiness and make an informed decision regarding the potential credit extension. The Corona California Individual Credit Application typically consists of various sections that require detailed information. These sections include personal details, such as the applicant's full name, social security number, address, phone number, and email address. Additionally, applicants are asked to provide their date of birth, marital status, and the number of dependents they have. In terms of financial information, the application usually asks for the applicant's employment details, including current occupation, employer's name, length of employment, and monthly income. It may also inquire about other sources of income, such as investments or rental properties. Furthermore, applicants may need to provide details about their bank accounts, including bank name, account number, and balances. Applicants may be required to provide information pertaining to their outstanding debts, such as mortgage, car loans, credit card balances, and other forms of credit. The application may ask about the borrower's existing credit limits, payment history, and any bankruptcies or foreclosures in their financial history. The Corona California Individual Credit Application may also inquire about the purpose of the requested credit, whether it is for purchasing a home, a vehicle, or for general personal use. Additionally, the application may require the applicant to disclose any collateral they are willing to pledge against the credit, which can include real estate, vehicles, or other valuable assets. Different types of Corona California Individual Credit Applications may exist based on the specific type of credit being sought. For example, there may be separate applications for mortgage loans, auto loans, personal loans, or credit cards. Each application may have slightly different sections or requirements tailored to the specific credit product. In conclusion, the Corona California Individual Credit Application is a crucial tool that enables individuals in Corona, California, to apply for credit. It gathers comprehensive information about an applicant's personal and financial background, allowing lenders to evaluate their creditworthiness accurately. By providing detailed information, applicants increase their chances of obtaining credit on favorable terms, helping them achieve their financial goals.Corona California Individual Credit Application is a comprehensive document that individuals residing in the city of Corona, California, utilize to apply for credit from a financial institution or lender. This application form is specifically designed to gather essential information about the applicant's personal, financial, and employment details, which helps lenders assess their creditworthiness and make an informed decision regarding the potential credit extension. The Corona California Individual Credit Application typically consists of various sections that require detailed information. These sections include personal details, such as the applicant's full name, social security number, address, phone number, and email address. Additionally, applicants are asked to provide their date of birth, marital status, and the number of dependents they have. In terms of financial information, the application usually asks for the applicant's employment details, including current occupation, employer's name, length of employment, and monthly income. It may also inquire about other sources of income, such as investments or rental properties. Furthermore, applicants may need to provide details about their bank accounts, including bank name, account number, and balances. Applicants may be required to provide information pertaining to their outstanding debts, such as mortgage, car loans, credit card balances, and other forms of credit. The application may ask about the borrower's existing credit limits, payment history, and any bankruptcies or foreclosures in their financial history. The Corona California Individual Credit Application may also inquire about the purpose of the requested credit, whether it is for purchasing a home, a vehicle, or for general personal use. Additionally, the application may require the applicant to disclose any collateral they are willing to pledge against the credit, which can include real estate, vehicles, or other valuable assets. Different types of Corona California Individual Credit Applications may exist based on the specific type of credit being sought. For example, there may be separate applications for mortgage loans, auto loans, personal loans, or credit cards. Each application may have slightly different sections or requirements tailored to the specific credit product. In conclusion, the Corona California Individual Credit Application is a crucial tool that enables individuals in Corona, California, to apply for credit. It gathers comprehensive information about an applicant's personal and financial background, allowing lenders to evaluate their creditworthiness accurately. By providing detailed information, applicants increase their chances of obtaining credit on favorable terms, helping them achieve their financial goals.