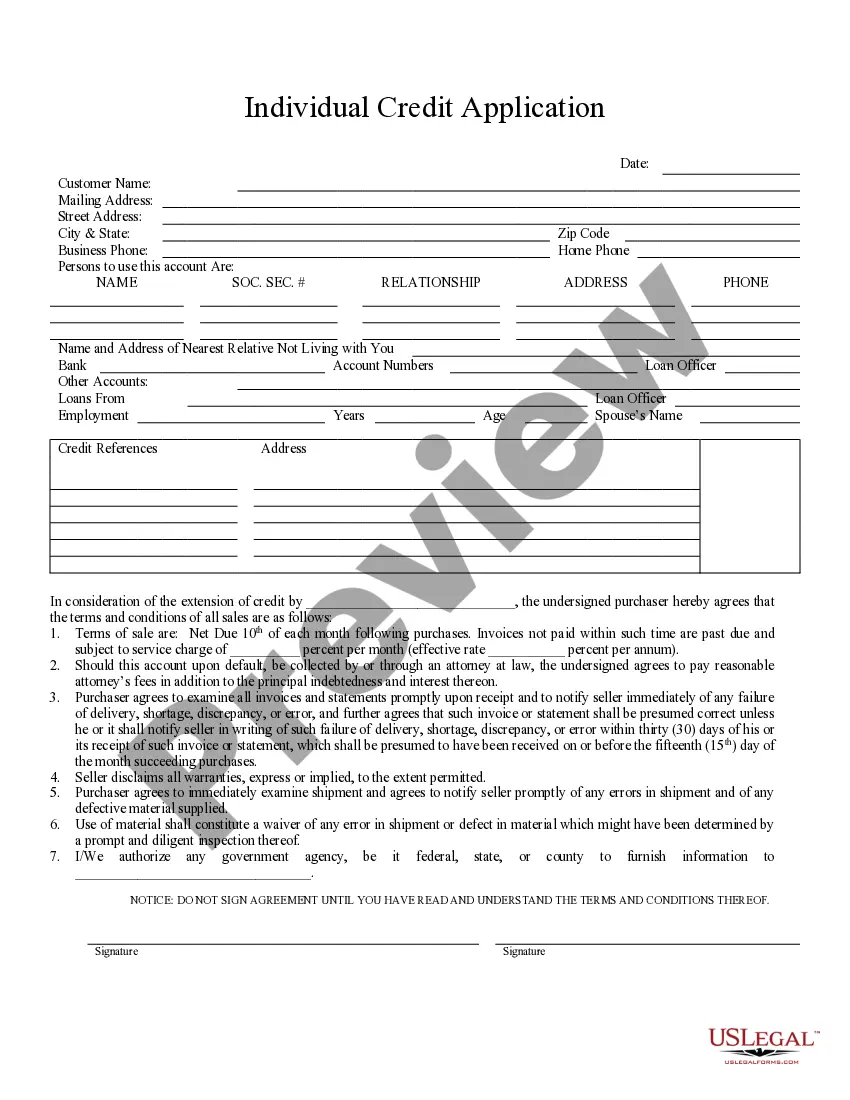

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Huntington Beach California Individual Credit Application is a comprehensive form used by individuals residing in Huntington Beach, California, to apply for credit from various financial institutions. This document enables individuals to request credit, such as personal loans, credit cards, or mortgages, by providing essential personal and financial information. Key elements of the Huntington Beach California Individual Credit Application include the following: 1. Personal Information: Applicants are required to fill in their full name, current address, phone number, email address, and Social Security number. This information helps lenders identify and communicate with applicants throughout the process. 2. Employment Details: The application asks for details about the applicant's current employment, such as their employer's name, job position, length of employment, and monthly income. This section helps lenders assess the income stability and repayment capability of applicants. 3. Financial Information: Applicants must provide a detailed overview of their financial situation, including bank account details, assets (such as property or investments), and liabilities (such as outstanding loans or credit card debt). This information assists lenders in evaluating an applicant's financial health and creditworthiness. 4. Credit History: Applicants must disclose their credit history, including any outstanding or past loans, credit card accounts, bankruptcies, foreclosures, or late payments. This section allows lenders to assess an applicant's repayment track record and creditworthiness. 5. Loan Details: Depending on the type of credit being sought, the application may include specific sections for the desired loan amount, purpose of the loan, repayment terms, and collateral information. These details help lenders understand the purpose and extent of the credit being sought. Different types of Huntington Beach California Individual Credit Applications may exist based on the specific credit product being applied for. Some examples include: 1. Personal Loan Application: This application is used when individuals in Huntington Beach seek credit to fulfill personal needs like home renovations, debt consolidation, or to cover unexpected expenses. 2. Mortgage Loan Application: Designed for individuals looking to purchase or refinance a property, this application includes additional sections related to property information, down payment, and details about the mortgage terms. 3. Auto Loan Application: This application is applicable for individuals seeking financing for purchasing a new or used vehicle. It may include sections for car details, loan amount, and desired repayment term. 4. Credit Card Application: Individuals wanting to obtain a credit card can use this type of application, which typically focuses on personal and financial details rather than specific loan amounts. By submitting a properly completed Huntington Beach California Individual Credit Application, individuals can provide lenders with the necessary information to evaluate their creditworthiness and make an informed decision regarding the approval of their desired credit product.Huntington Beach California Individual Credit Application is a comprehensive form used by individuals residing in Huntington Beach, California, to apply for credit from various financial institutions. This document enables individuals to request credit, such as personal loans, credit cards, or mortgages, by providing essential personal and financial information. Key elements of the Huntington Beach California Individual Credit Application include the following: 1. Personal Information: Applicants are required to fill in their full name, current address, phone number, email address, and Social Security number. This information helps lenders identify and communicate with applicants throughout the process. 2. Employment Details: The application asks for details about the applicant's current employment, such as their employer's name, job position, length of employment, and monthly income. This section helps lenders assess the income stability and repayment capability of applicants. 3. Financial Information: Applicants must provide a detailed overview of their financial situation, including bank account details, assets (such as property or investments), and liabilities (such as outstanding loans or credit card debt). This information assists lenders in evaluating an applicant's financial health and creditworthiness. 4. Credit History: Applicants must disclose their credit history, including any outstanding or past loans, credit card accounts, bankruptcies, foreclosures, or late payments. This section allows lenders to assess an applicant's repayment track record and creditworthiness. 5. Loan Details: Depending on the type of credit being sought, the application may include specific sections for the desired loan amount, purpose of the loan, repayment terms, and collateral information. These details help lenders understand the purpose and extent of the credit being sought. Different types of Huntington Beach California Individual Credit Applications may exist based on the specific credit product being applied for. Some examples include: 1. Personal Loan Application: This application is used when individuals in Huntington Beach seek credit to fulfill personal needs like home renovations, debt consolidation, or to cover unexpected expenses. 2. Mortgage Loan Application: Designed for individuals looking to purchase or refinance a property, this application includes additional sections related to property information, down payment, and details about the mortgage terms. 3. Auto Loan Application: This application is applicable for individuals seeking financing for purchasing a new or used vehicle. It may include sections for car details, loan amount, and desired repayment term. 4. Credit Card Application: Individuals wanting to obtain a credit card can use this type of application, which typically focuses on personal and financial details rather than specific loan amounts. By submitting a properly completed Huntington Beach California Individual Credit Application, individuals can provide lenders with the necessary information to evaluate their creditworthiness and make an informed decision regarding the approval of their desired credit product.