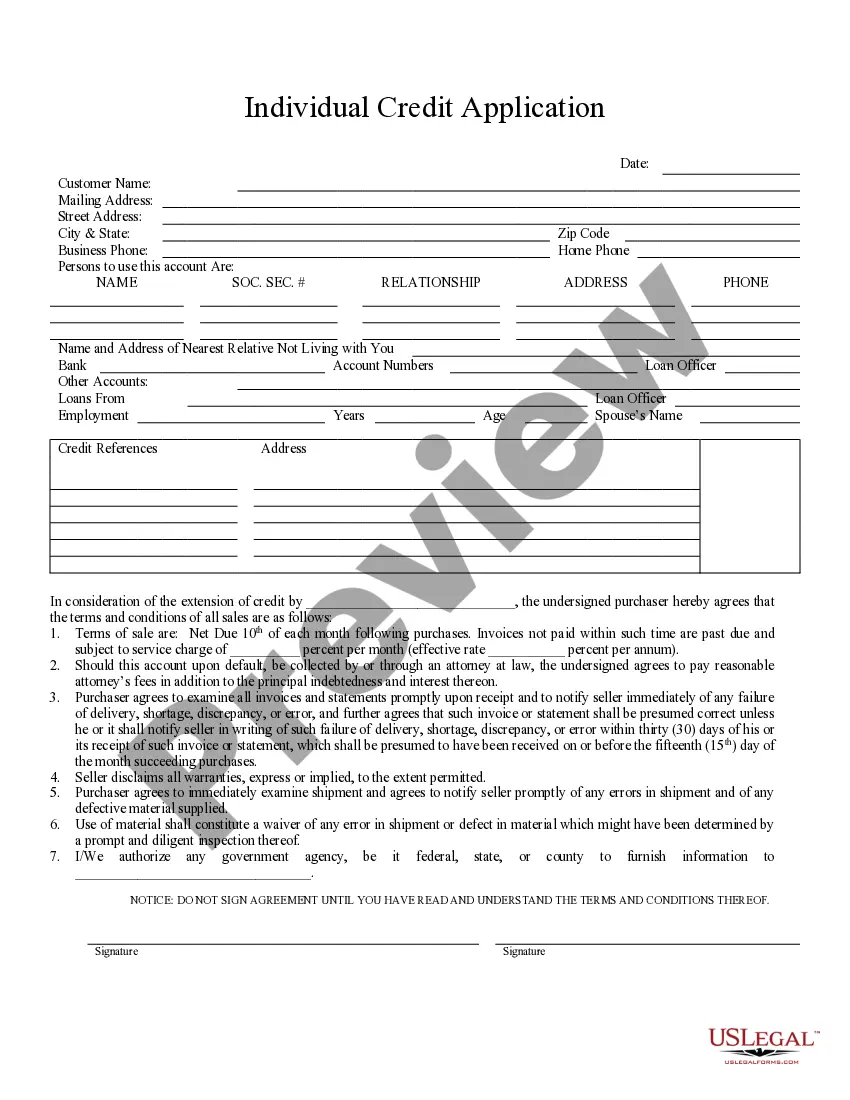

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Orange California Individual Credit Application is a document used by individuals residing in Orange, California, to apply for credit from financial institutions, lenders, or other entities. This application serves as a comprehensive and formal request for credit, allowing individuals to access funds, loans, or credit lines for various purposes. Keywords: Orange California, Individual Credit Application, credit, financial institutions, lenders, funds, loans, credit lines. There are typically different types of Orange California Individual Credit Applications available, depending on the specific credit needs and financial institution requirements. Some common types of credit applications may include: 1. Personal Credit Application: This type of application is for individuals who require credit for personal use, such as purchasing a vehicle, financing education, home improvement, or handling unexpected expenses. It requests important personal information, including name, contact details, Social Security number, employment history, income, and expenses. 2. Business Credit Application: Catering to entrepreneurs and business owners in Orange, California, this application is designed to obtain credit for business-related purposes. It seeks information about the applicant's business, including the legal entity type, address, industry, revenue, and any existing business credit history. 3. Mortgage Loan Application: Specifically tailored for individuals seeking home or property financing, this credit application focuses on details like property information, down payment amount, desired mortgage type, and personal financial information. It typically requires additional documentation, such as bank statements, tax returns, and employment proof. 4. Student Loan Application: Geared towards students pursuing higher education, this application helps in securing loans to cover tuition fees, books, and living expenses. It often requires information about the applicant's educational institution, program of study, expected graduation date, and financial aid details. 5. Credit Card Application: Sought after by individuals looking for credit card options, this application gathers personal information, employment details, income sources, and existing debt obligations. It also requests credit card preferences, such as rewards programs or low-interest rates. These variations of Orange California Individual Credit Applications ensure that individuals can apply for credit that aligns with their specific needs — ranging from personal expenses, business ventures, property purchases, educational pursuits, or general credit card usage. Each application type requires thorough and accurate completion to increase the chances of credit approval and obtain favorable terms.