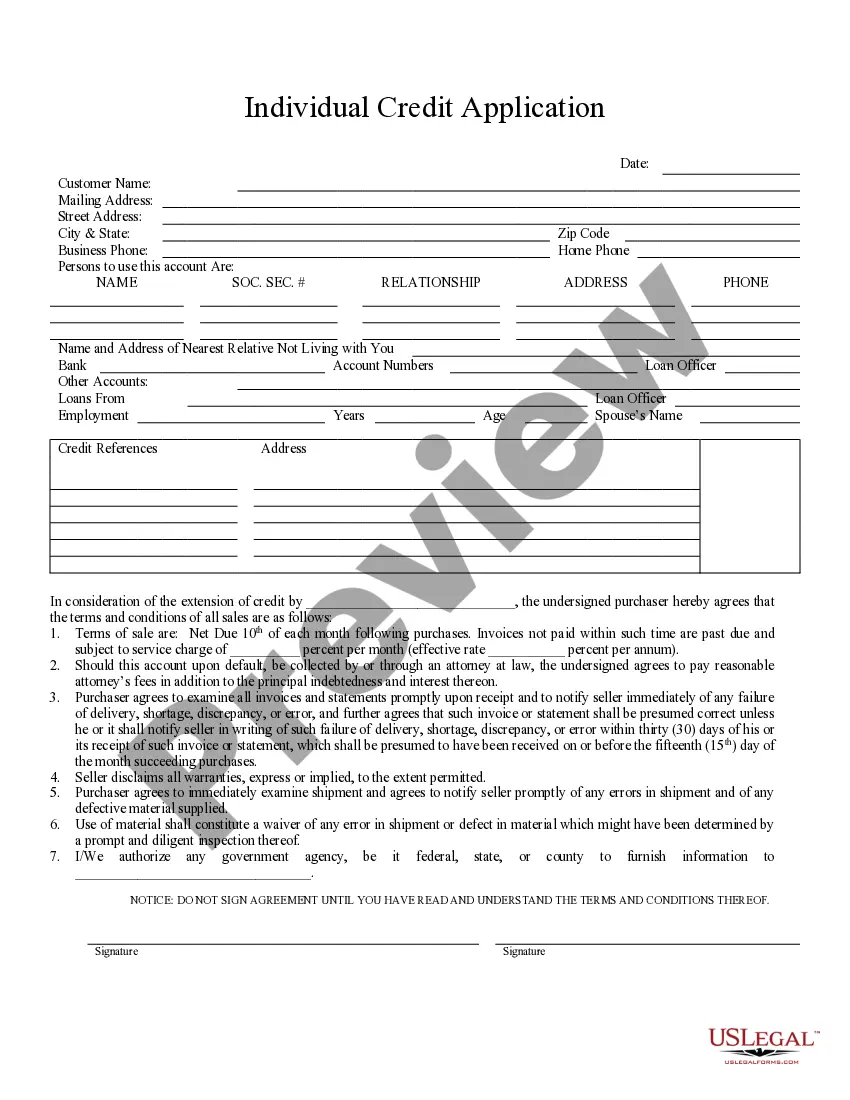

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

San Diego California Individual Credit Application is a comprehensive form that individuals residing in the city of San Diego, California, can use to apply for credit. This application allows individuals to request various types of credit, such as personal loans, credit cards, mortgages, or auto loans, from financial institutions and lenders operating in San Diego. The San Diego California Individual Credit Application consists of multiple sections designed to gather all necessary information about the applicant. It typically starts with personal details, including name, address, phone number, and social security number, ensuring proper identification and contact information for the applicant. The application then proceeds to collect employment information, which involves indicating the current employer's name, job title, duration of employment, and monthly income. This section helps lenders assess the applicant's employment stability and financial capacity to repay the credit. Furthermore, the San Diego California Individual Credit Application requests detailed financial information. This includes information about existing debts, such as outstanding loans or credit card balances, as well as monthly expenses like rent, utility bills, and other financial obligations. The applicant may also be required to disclose their assets, such as savings accounts, investments, and real estate holdings, to provide a comprehensive overview of their financial status. Additionally, the credit application may ask for references, such as personal or professional contacts who can vouch for the applicant's character and reliability. These references can be helpful for lenders when evaluating an applicant's creditworthiness. It is important to note that there are various types of San Diego California Individual Credit Applications available, each tailored to specific types of credit. For instance, there might be separate credit applications for personal loans, credit cards, mortgages, or auto loans. These forms can have slightly different sections or questions to align with the specific requirements of each credit type. In conclusion, San Diego California Individual Credit Application is a vital tool for individuals seeking credit in San Diego, California. By gathering detailed information about personal, employment, and financial aspects, lenders can assess the applicant's financial eligibility and determine the terms and conditions of credit approval.