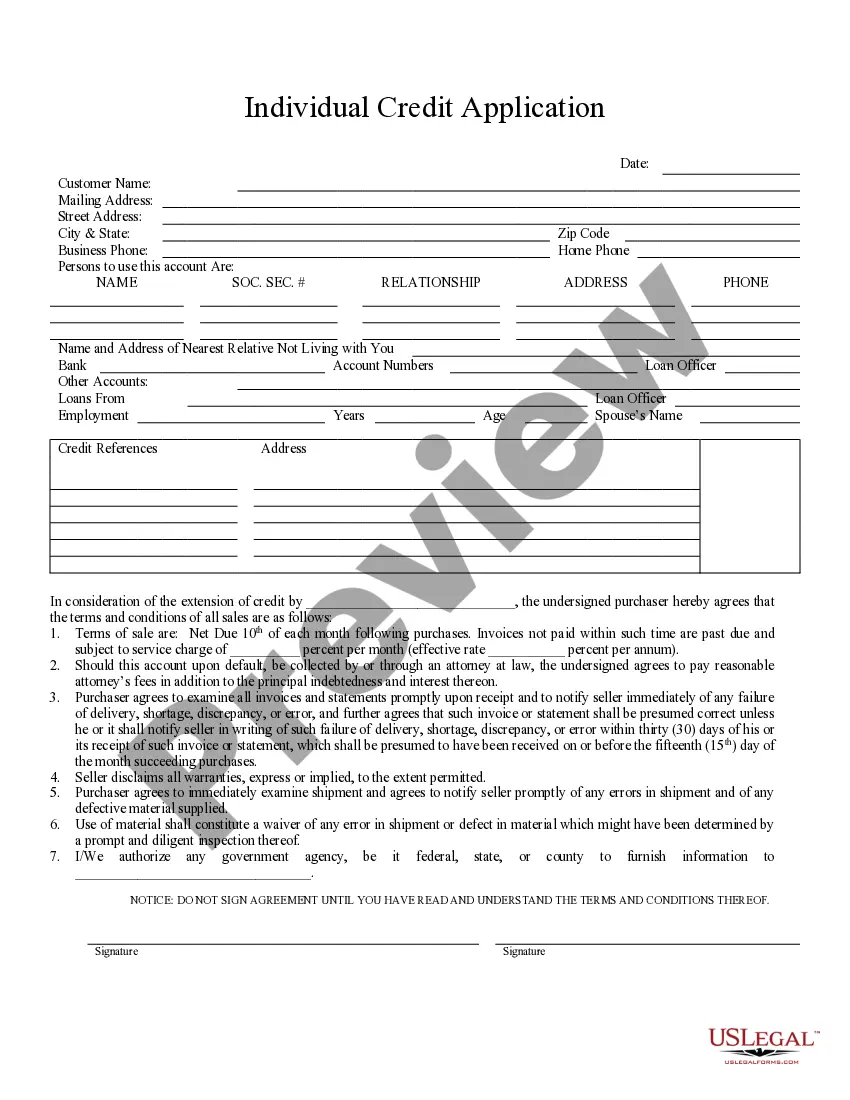

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Vacaville California Individual Credit Application is a comprehensive document used by individuals living in Vacaville, California, to apply for credit at various financial institutions, such as banks, credit unions, or lending agencies. This application plays a crucial role in accessing financial resources, whether it's for personal expenses, education, housing, or starting a business. It allows individuals to request a line of credit or a loan based on their creditworthiness and eligibility. The Vacaville California Individual Credit Application gathers vital personal and financial information from applicants, including their full name, address, contact details, Social Security number, date of birth, and employment history. These details help financial institutions assess an applicant's creditworthiness and make informed decisions regarding granting credit. Additionally, individuals may need to provide details about their income, monthly expenses, existing debts, assets, and any collateral they may offer as security against the credit they are requesting. This information assists lenders in evaluating an individual's ability to repay the borrowed funds and in determining the terms and conditions of the credit application. Different types of Vacaville California Individual Credit Applications may exist, tailored to specific financial needs or situations. Some common variations include: 1. Personal Loan Application: This type of credit application is used when individuals need funds for personal expenses like home renovations, medical treatments, or debt consolidation. 2. Auto Loan Application: Designed specifically for individuals looking to finance the purchase of a vehicle, this application gathers information about the desired vehicle, such as make, model, year, and vehicle identification number (VIN). 3. Mortgage Loan Application: With this type of credit application, individuals can apply for a loan to purchase a home or refinance an existing mortgage. It requires details on the property, including its estimated value and property identification information. 4. Student Loan Application: Geared towards students looking to fund their education, this application collects information regarding enrollment in an educational institution, program duration, and other relevant details required for educational financing. It is essential for applicants to complete the Vacaville California Individual Credit Application accurately and honestly, as any discrepancies or incorrect information can potentially lead to rejections or delays in credit approval. Additionally, applicants should review the terms and conditions provided by the financial institution before submitting the credit application to ensure full understanding of the lending agreement.The Vacaville California Individual Credit Application is a comprehensive document used by individuals living in Vacaville, California, to apply for credit at various financial institutions, such as banks, credit unions, or lending agencies. This application plays a crucial role in accessing financial resources, whether it's for personal expenses, education, housing, or starting a business. It allows individuals to request a line of credit or a loan based on their creditworthiness and eligibility. The Vacaville California Individual Credit Application gathers vital personal and financial information from applicants, including their full name, address, contact details, Social Security number, date of birth, and employment history. These details help financial institutions assess an applicant's creditworthiness and make informed decisions regarding granting credit. Additionally, individuals may need to provide details about their income, monthly expenses, existing debts, assets, and any collateral they may offer as security against the credit they are requesting. This information assists lenders in evaluating an individual's ability to repay the borrowed funds and in determining the terms and conditions of the credit application. Different types of Vacaville California Individual Credit Applications may exist, tailored to specific financial needs or situations. Some common variations include: 1. Personal Loan Application: This type of credit application is used when individuals need funds for personal expenses like home renovations, medical treatments, or debt consolidation. 2. Auto Loan Application: Designed specifically for individuals looking to finance the purchase of a vehicle, this application gathers information about the desired vehicle, such as make, model, year, and vehicle identification number (VIN). 3. Mortgage Loan Application: With this type of credit application, individuals can apply for a loan to purchase a home or refinance an existing mortgage. It requires details on the property, including its estimated value and property identification information. 4. Student Loan Application: Geared towards students looking to fund their education, this application collects information regarding enrollment in an educational institution, program duration, and other relevant details required for educational financing. It is essential for applicants to complete the Vacaville California Individual Credit Application accurately and honestly, as any discrepancies or incorrect information can potentially lead to rejections or delays in credit approval. Additionally, applicants should review the terms and conditions provided by the financial institution before submitting the credit application to ensure full understanding of the lending agreement.