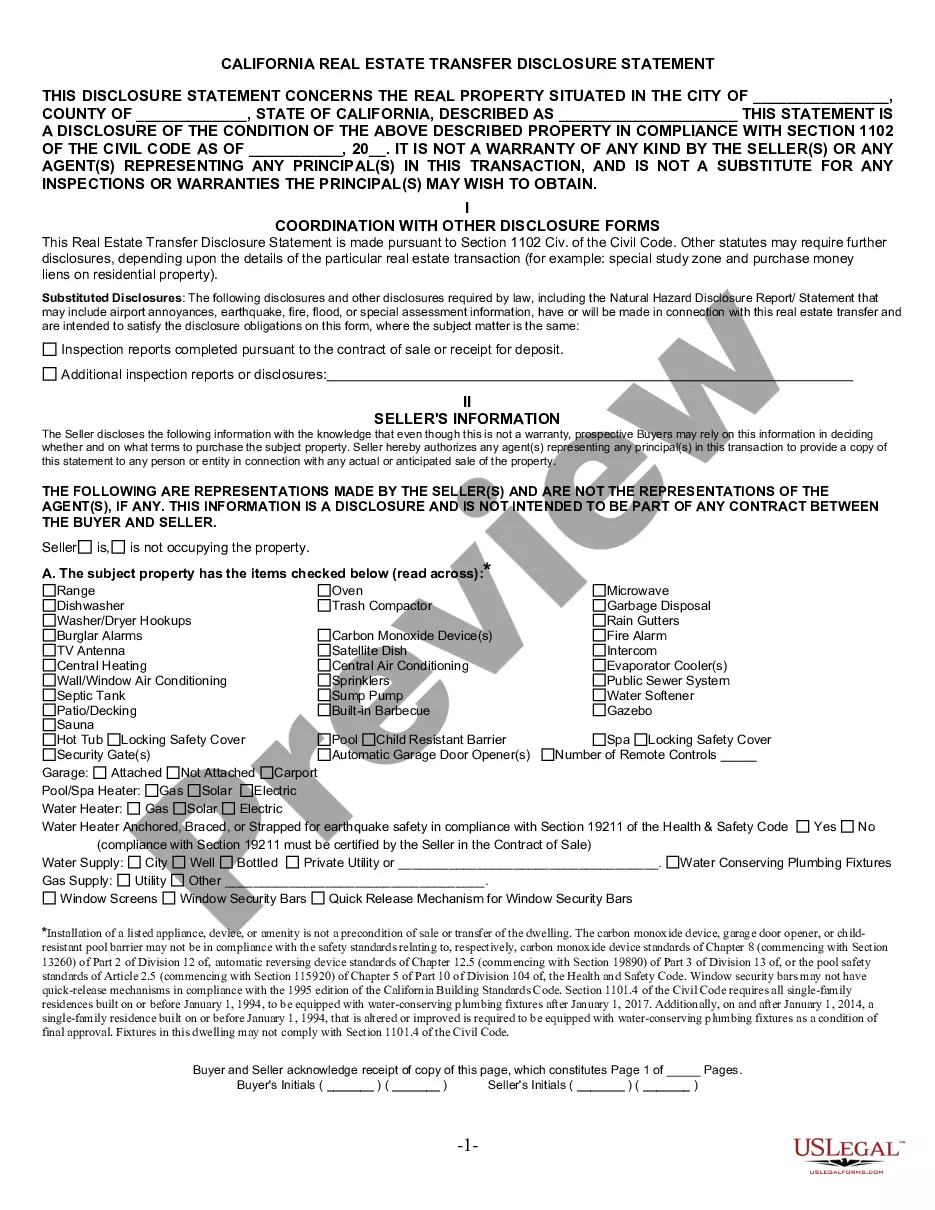

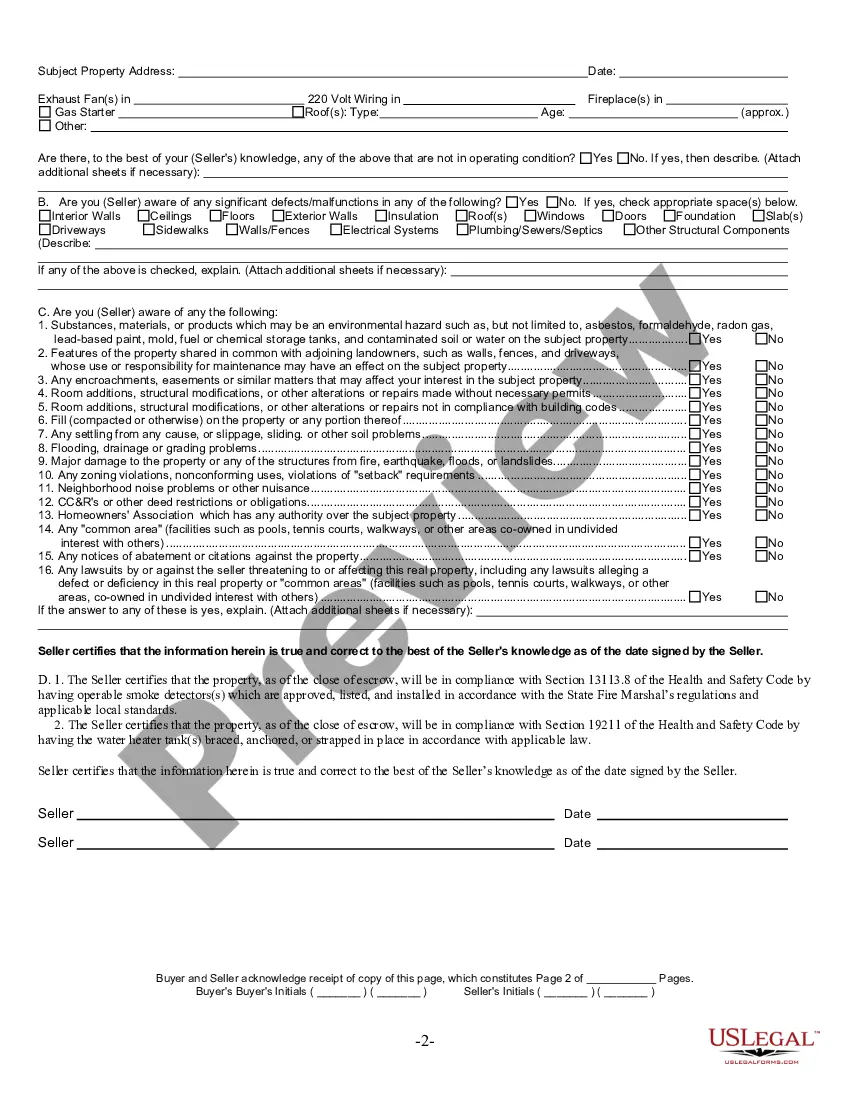

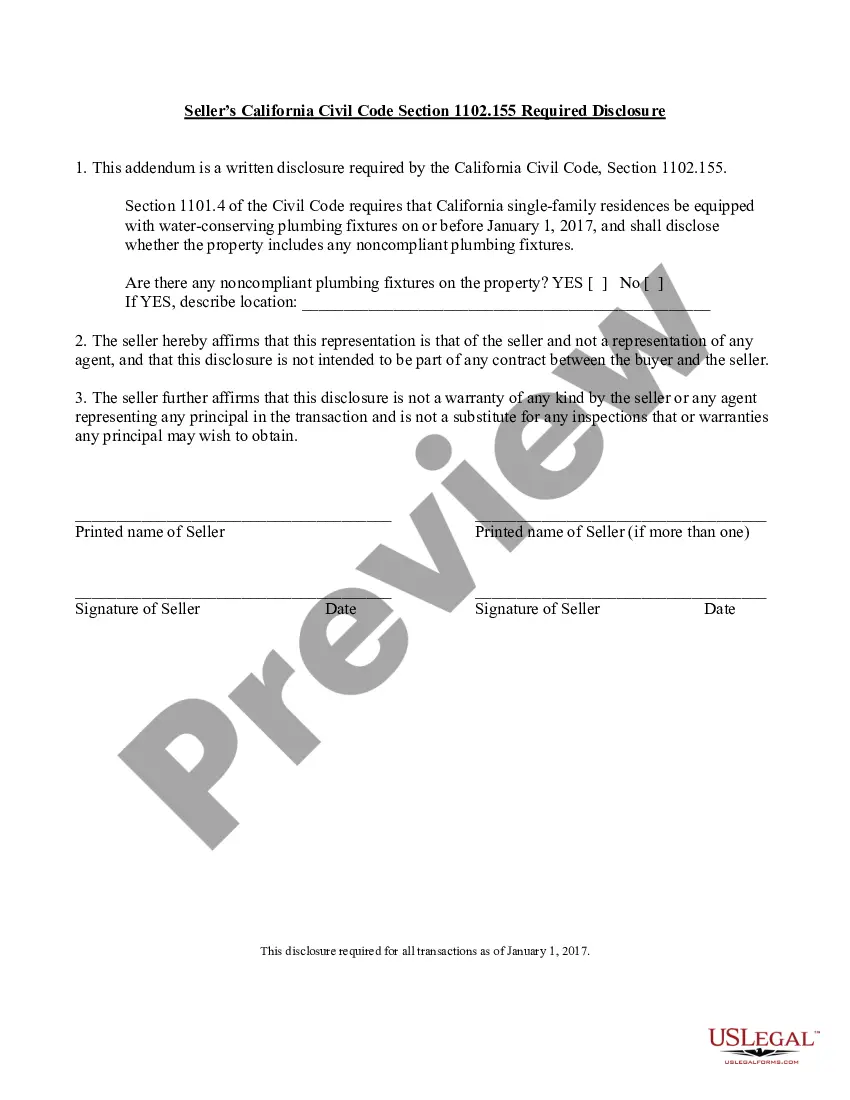

This form is a Seller's Disclosure Statement for use in a residential sales transaction in California. This disclosure statement concerns the condition of property and is completed by the Seller.

- US Legal Forms

- Localized Forms

- California

- Bakersfield

-

California Residential Real Estate Sales Disclosure Statement

Bakersfield California Residential Real Estate Sales Disclosure Statement

Description

Related Forms

Contract for Sale and Purchase of Real Estate with No Broker for Residential Home Sale Agreement

Buyer's Home Inspection Checklist

LegalLife Multistate Guide and Handbook for Selling or Buying Real Estate

Natural Hazard Disclosure Statement

Supplemental Disclosure Package for Residential Real Estate Sale

California Real Estate Home Sales Package with Contract of Sale, Disclosure Statements and more for Residential House

Lead Based Paint Disclosure for Sales Transaction

Counterproposal to Contract for the Sale and Purchase of Real Estate

Agreement to Extend or Amend Contract for the Sale and Purchase of Real Estate

View Victorville

View Victorville

View Victorville

Related legal definitions

Viewed forms

Musical Compositions Publishing Letter Agreement

Response to Uniform Support Petition UIFSA

Gas Storage Unit Agreement (Establish Unit on Depleted Producing Property)

A10 Order Granting Continuance

Painting Contract for Contractor

Invoice Template for Therapist

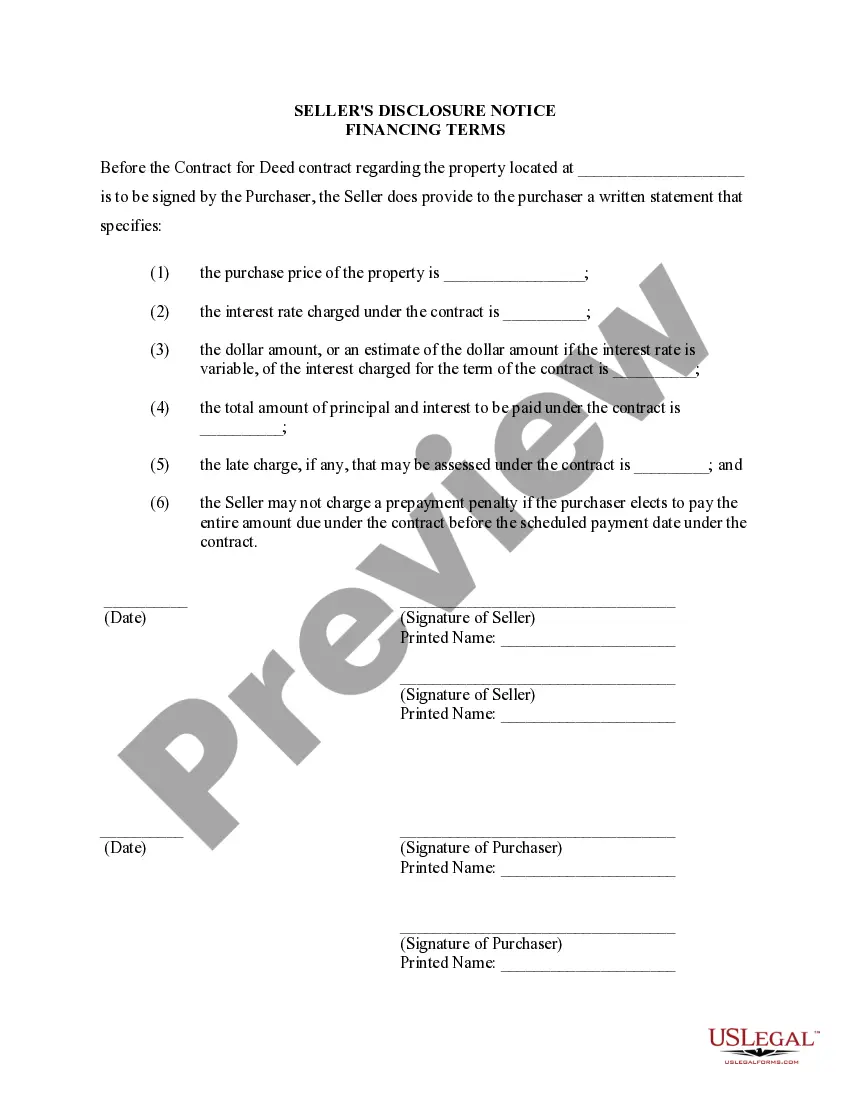

Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

How to fill out Bakersfield California Residential Real Estate Sales Disclosure Statement?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law background to draft such paperwork cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a huge library with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you need the Bakersfield California Residential Real Estate Sales Disclosure Statement or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Bakersfield California Residential Real Estate Sales Disclosure Statement quickly using our trustworthy platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Bakersfield California Residential Real Estate Sales Disclosure Statement:

- Be sure the form you have found is suitable for your location considering that the rules of one state or area do not work for another state or area.

- Review the form and read a brief outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Choose the payment method and proceed to download the Bakersfield California Residential Real Estate Sales Disclosure Statement as soon as the payment is done.

You’re all set! Now you can proceed to print the form or complete it online. If you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form Rating

Form popularity

FAQ

CALIFORNIA RESIDENTIAL PROPERTY INSURANCE DISCLOSURE It describes the principal forms of insurance coverage in California for residential dwellings. It also identifies the form of dwelling coverage you have purchased or selected.

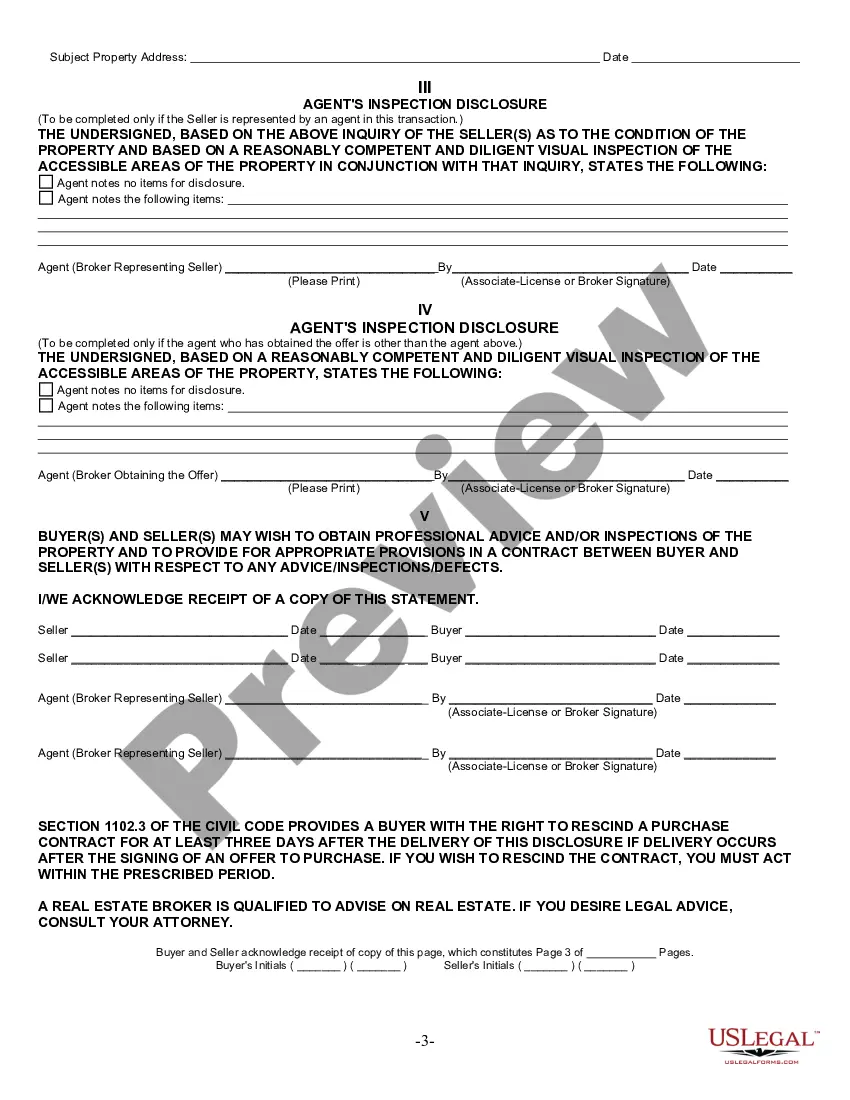

The disclosure form explains that a broker can represent a seller alone, a buyer alone, or both at the same time, known as dual agency. The form explains that dual agency is only legal in a real estate transaction if both the seller and the buyer understand and consent to the arrangement.

California, like many states, requires its residential property sellers to disclose, in writing, details about the property they have on the market.

Real Estate Transfer Disclosure Statement The seller and any broker(s)/agent(s) involved are to participate in the disclosures. If more than one broker/agent is involved, the broker/agent obtaining the offer is to deliver the disclosures to the prospective buyer unless the seller instructs otherwise.

This disclosure is required by California law (Section 10102 of the Insurance Code). It describes the principal forms of insurance coverage in California for residential dwellings. It also identifies the form of dwelling coverage you have purchased or selected.

The Transfer Disclosure Statement form can be obtained from your local California real estate agent. The TDS form covers a broad range of topics, such as structural information about your home and whether any deaths occurred on the property in the last three years.

Disclosures Upon Transfer of Residential Property Real Estate Transfer Disclosure Statement (TDS) The TDS is the most general disclosure form related to the sale of a home.Seller Property Questionnaire (SPQ)Natural Hazards Disclosure (NHD)Lead Based Paint Hazard.Other Disclosures.Termination Right.

Disclosures Upon Transfer of Residential Property Real Estate Transfer Disclosure Statement (TDS) The TDS is the most general disclosure form related to the sale of a home.Seller Property Questionnaire (SPQ)Natural Hazards Disclosure (NHD)Lead Based Paint Hazard.Other Disclosures.Termination Right.

The Transfer Disclosure Statement, also known as the TDS, is a form required by California law in most residential real estate transactions pursuant to California Civil Code 1102. This document is one of the seller's disclosures that buyers receive during their contract contingency period.

Bakersfield California Residential Real Estate Sales Disclosure Statement Related Searches

-

california real estate disclosure checklist 2021

-

seller disclosure form california

-

california real estate disclosure checklist 2020

-

california disclosure statement

-

real estate transfer disclosure statement california pdf

-

seller disclosures california

-

california real estate disclosure forms

-

california transfer disclosure statement 2020

-

seller financing disclosure should include

-

california real estate disclosure checklist 2021

Interesting Questions

A Residential Real Estate Sales Disclosure Statement is a document that provides essential information about a property being sold in Bakersfield.

The Disclosure Statement is important because it ensures that buyers have access to all relevant information about the property and helps sellers fulfill their legal obligation to disclose any known issues.

The Disclosure Statement may include details about the property's age, condition, major repairs or renovations, previous damage, presence of pests, any potential environmental hazards, and legal disputes.

It is the seller's responsibility to complete the Disclosure Statement honestly and accurately, ensuring all required information is included.

Yes, a seller can be held legally liable if they purposely or negligently fail to disclose material defects or pertinent information about the property.

While the Disclosure Statement is important, buyers should also conduct their own due diligence, such as obtaining a professional inspection and reviewing relevant property documents.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

California

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

CALIFORNIA CODES CIVIL CODE SECTION 1102-1102.18 1102. (a) Except as provided in Section 1102.2, this article applies to any transfer by sale, exchange, installment land sale contract, as defined in Section 2985, lease with an option to purchase, any other option to purchase, or ground lease coupled with improvements, of real property or residential stock cooperative, improved with or consisting of not less than one nor more than four dwelling units.

(b) Except as provided in Section 1102.2, this article shall apply to a resale transaction entered into on or after January 1, 2000, for a manufactured home, as defined in Section 18007 of the Health and Safety Code, or a mobilehome, as defined in Section 18008 of the Health and Safety Code, which manufactured home or mobilehome is classified as personal property and intended for use as a residence.

(c) Any waiver of the requirements of this article is void as against public policy. 1102.1. (a) In enacting Chapter 817 of the Statutes of 1994, it was the intent of the Legislature to clarify and facilitate the use of the real estate disclosure statement, as specified in Section 1102.6.

The Legislature intended the statement to be used by transferors making disclosures required under this article and by agents making disclosures required by Section 2079 on the agent's portion of the real estate disclosure statement, in transfers subject to this article. In transfers not subject to this article, agents may make required disclosures in a separate writing. The Legislature did not intend to affect the existing obligations of the parties to a real estate contract, or their agents, to disclose any fact materially affecting the value and desirability of the property, including, but not limited to, the physical conditions of the property and previously received reports of physical inspections noted on the disclosure form set forth in Section 1102.6 or 1102.6a, and that nothing in this article shall be construed to change the duty of a real estate broker or salesperson pursuant to Section 2079.

It is also the intent of the Legislature that the delivery of a real estate transfer disclosure statement may not be waived in an "as is" sale, as held in Loughrin v. Superior Court (1993) 15 Cal. App. 4th 1188.

(b) In enacting Chapter 677 of the Statutes of 1996, it was the intent of the Legislature to clarify and facilitate the use of the manufactured home and mobilehome transfer disclosure statement applicable to the resale of a manufactured home or mobilehome pursuant to subdivision (b) of Section 1102. The Legislature intended the statements to be used by transferors making disclosures required under this article and by agents making disclosures required by Section 2079 on the agent's portion of the disclosure statement and as required by Section 18046 of the Health and Safety Code on the dealer's portion of the manufactured home and mobilehome transfer disclosure statement, in transfers subject to this article. In transfers not subject to this article, agents may make required disclosures in a separate writing. The Legislature did not intend to affect the existing obligations of the parties to a real estate contract, or their agents, to disclose any fact materially affecting the value and desirability of the property, including, but not limited to, the physical conditions of the property and previously received reports of physical inspections noted on the disclosure form set forth in Section 1102.6 or 1102.6a or to affect the existing obligations of the parties to a manufactured home or mobilehome purchase contract, and nothing in this article shall be construed to change the duty of a real estate broker or salesperson pursuant to Section 2079 or the duty of a manufactured home or mobilehome dealer or salesperson pursuant to Section 18046 of the Health and Safety Code.

It is also the intent of the Legislature that the delivery of a mobilehome transfer disclosure statement may not be waived in an "as is" sale.

(c) It is the intent of the Legislature that manufactured home and mobilehome dealers and salespersons and real estate brokers and salespersons use the form provided pursuant to Section 1102.6d. It is also the intent of the Legislature for sellers of manufactured homes or mobilehomes who are neither manufactured home dealers or salespersons nor real estate brokers or salespersons to use the Manufactured Home/Mobilehome Transfer Disclosure Statement contained in Section 1102.6d. 1102.2. This article does not apply to the following:

(a) Transfers which are required to be preceded by the furnishing to a prospective transferee of a copy of a public report pursuant to Section 11018.1 of the Business and Professions Code and transfers which can be made without a public report pursuant to Section 11010.4 of the Business and Professions Code.

(b) Transfers pursuant to court order, including, but not limited to, transfers ordered by a probate court in the administration of an estate, transfers pursuant to a writ of execution, transfers by any foreclosure sale, transfers by a trustee in bankruptcy, transfers by eminent domain, and transfers resulting from a decree for specific performance.

(c) Transfers to a mortgagee by a mortgagor or successor in interest who is in default, transfers to a beneficiary of a deed of trust by a trustor or successor in interest who is in default, transfers by any foreclosure sale after default, transfers by any foreclosure sale after default in an obligation secured by a mortgage, transfers by a sale under a power of sale or any foreclosure sale under a decree of foreclosure after default in an obligation secured by a deed of trust or secured by any other instrument containing a power of sale, transfers by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a mortgage or deed of trust or a sale pursuant to a decree of foreclosure or has acquired the real property by a deed in lieu of foreclosure, transfers to the legal owner or lienholder of a manufactured home or mobilehome by a registered owner or successor in interest who is in default, or transfers by reason of any foreclosure of a security interest in a manufactured home or mobilehome.

(d) Transfers by a fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or trust. This exemption shall not apply to a transfer if the trustee is a natural person who is sole trustee of a revocable trust and he or she is a former owner of the property or an occupant in possession of the property within the preceding year.

(e) Transfers from one coowner to one or more other coowners.

(f) Transfers made to a spouse, or to a person or persons in the lineal line of consanguinity of one or more of the transferors.

(g) Transfers between spouses resulting from a judgment of dissolution of marriage or of legal separation or from a property settlement agreement incidental to that judgment.

(h) Transfers by the Controller in the course of administering Chapter 7 (commencing with Section 1500) of Title 10 of Part 3 of the Code of Civil Procedure.

(i) Transfers under Chapter 7 (commencing with Section 3691) or Chapter 8 (commencing with Section 3771) of Part 6 of Division 1 of the Revenue and Taxation Code.

(j) Transfers or exchanges to or from any governmental entity. 1102.3. The transferor of any real property subject to this article shall deliver to the prospective transferee the written statement required by this article, as follows:

(a) In the case of a sale, as soon as practicable before transfer of title.

(b) In the case of transfer by a real property sales contract, as defined in Section 2985, or by a lease together with an option to purchase, or a ground lease coupled with improvements, as soon as practicable before execution of the contract. For the purpose of this subdivision, "execution" means the making or acceptance of an offer.   With respect to any transfer subject to subdivision (a) or (b), the transferor shall indicate compliance with this article either on the receipt for deposit, the real property sales contract, the lease, or any addendum attached thereto or on a separate document.   If any disclosure, or any material amendment of any disclosure, required to be made by this article, is delivered after the execution of an offer to purchase, the transferee shall have three days after delivery in person or five days after delivery by deposit in the mail, to terminate his or her offer by delivery of a written notice of termination to the transferor or the transferor's agent. 1102.3a. (a) The transferor of any manufactured home or mobilehome subject to this article shall deliver to the prospective transferee the written statement required by this article, as follows:

(1) In the case of a sale, or a lease with an option to purchase, of a manufactured home or mobilehome, involving an agent, as defined in Section 18046 of the Health and Safety Code, as soon as practicable, but no later than the close of escrow for the purchase of the manufactured home or mobilehome.

(2) In the case of a sale, or lease with an option to purchase, of a manufactured home or mobilehome, not involving an agent, as defined in Section 18046 of the Health and Safety Code, at the time of execution of any document by the prospective transferee with the transferor for the purchase of the manufactured home or mobilehome.

(b) With respect to any transfer subject to this section, the transferor shall indicate compliance with this article either on the transfer disclosure statement, any addendum thereto, or on a separate document.

(c) If any disclosure, or any material amendment of any disclosure, required to be made pursuant to subdivision (b) of Section 1102, is delivered after the execution of an offer to purchase, the transferee shall have three days after delivery in person or five days after delivery by deposit in the mail, to terminate his or her offer by delivery of a written notice of termination to the transferor. 1102.4. (a) Neither the transferor nor any listing or selling agent shall be liable for any error, inaccuracy, or omission of any information delivered pursuant to this article if the error, inaccuracy, or omission was not within the personal knowledge of the transferor or that listing or selling agent, was based on information timely provided by public agencies or by other persons providing information as specified in subdivision (c) that is required to be disclosed pursuant to this article, and ordinary care was exercised in obtaining and transmitting it.

(b) The delivery of any information required to be disclosed by this article to a prospective transferee by a public agency or other person providing information required to be disclosed pursuant to this article shall be deemed to comply with the requirements of this article and shall relieve the transferor or any listing or selling agent of any further duty under this article with respect to that item of information.

(c) The delivery of a report or opinion prepared by a licensed engineer, land surveyor, geologist, structural pest control operator, contractor, or other expert, dealing with matters within the scope of the professional's license or expertise, shall be sufficient compliance for application of the exemption provided by subdivision (a) if the information is provided to the prospective transferee pursuant to a request therefor, whether written or oral. In responding to such a request, an expert may indicate, in writing, an understanding that the information provided will be used in fulfilling the requirements of Section 1102.6 and, if so, shall indicate the required disclosures, or parts thereof, to which the information being furnished is applicable. Where such a statement is furnished, the expert shall not be responsible for any items of information, or parts thereof, other than those expressly set forth in the statement. 1102.5. If information disclosed in accordance with this article is subsequently rendered inaccurate as a result of any act, occurrence, or agreement subsequent to the delivery of the required disclosures, the inaccuracy resulting therefrom does not constitute a violation of this article. If at the time the disclosures are required to be made, an item of information required to be disclosed is unknown or not available to the transferor, and the transferor or his or her agent has made a reasonable effort to ascertain it, the transferor may use an approximation of the information, provided the approximation is clearly identified as such, is reasonable, is based on the best information available to the transferor or his or her agent, and is not used for the purpose of circumventing or evading this article. 1102.6. The disclosures required by this article pertaining to the property proposed to be transferred are set forth in, and shall be made on a copy of, the following disclosure form: 1102.6a. (a) On and after July 1, 1990, any city or county may elect to require disclosures on the form set forth in subdivision (b) in addition to those disclosures required by Section 1102.6. However, this section does not affect or limit the authority of a city or county to require disclosures on a different disclosure form in connection with transactions subject to this article pursuant to an ordinance adopted prior to July 1, 1990. Such an ordinance adopted prior to July 1, 1990, may be amended thereafter to revise the disclosure requirements of the ordinance, in the discretion of the city council or county board of supervisors.

(b) Disclosures required pursuant to this section pertaining to the property proposed to be transferred, shall be set forth in, and shall be made on a copy of, the following disclosure form:

(c) This section does not preclude the use of addenda to the form specified in subdivision (b) to facilitate the required disclosures. This section does not preclude a city or county from using the disclosure form specified in subdivision (b) for a purpose other than that specified in this section. 1102.6b. (a) This section applies to all transfers of real property for which all of the following apply:

(1) The transfer is subject to this article.

(2) The property being transferred is subject to a continuing lien securing the levy of special taxes pursuant to the Mello-Roos Community Facilities Act (Chapter 2.5 (commencing with Section 53311) of Part 1 of Division 2 of Title 5 of the Government Code) or to a fixed lien assessment collected in installments to secure bonds issued pursuant to the Improvement Bond Act of 1915 (Division 10 (commencing with Section 8500) of the Streets and Highways Code).

(3) A notice is not required pursuant to Section 53341.5 of the Government Code.

(b) In addition to any other disclosure required pursuant to this article, the seller of any real property subject to this section shall make a good faith effort to obtain a disclosure notice concerning the special tax as provided for in Section 53340.2 of the Government Code, or a disclosure notice concerning an assessment installment as provided in Section 53754 of the Government Code, from each local agency that levies a special tax pursuant to the Mello-Roos Community Facilities Act, or that collects assessment installments to secure bonds issued pursuant to the Improvement Bond Act of 1915 (Division 10 (commencing with Section 8500) of the Streets and Highways Code), on the property being transferred, and shall deliver that notice or those notices to the prospective purchaser, as long as the notices are made available by the local agency.

(c) If a disclosure received pursuant to subdivision (b) has been delivered to the transferee, a seller or his or her agent is not required to provide additional information concerning, and information in the disclosure shall be deemed to satisfy the responsibility of the seller or his or her agent to inform the transferee regarding the special tax or assessment installments and the district. Notwithstanding subdivision (b), nothing in this section imposes a duty to discover a special tax or assessment installments or the existence of any levying district not actually known to the agents. 1102.6d. Except for manufactured homes and mobilehomes located in a common interest development governed by Title 6 (commencing with Section 1351), the disclosures applicable to the resale of a manufactured home or mobilehome pursuant to subdivision (b) of Section 1102 are set forth in, and shall be made on a copy of, the following disclosure form: 1102.7. Each disclosure required by this article and each act which may be performed in making the disclosure, shall be made in good faith. For purposes of this article, "good faith" means honesty in fact in the conduct of the transaction. 1102.8. The specification of items for disclosure in this article does not limit or abridge any obligation for disclosure created by any other provision of law or which may exist in order to avoid fraud, misrepresentation, or deceit in the transfer transaction. 1102.9. Any disclosure made pursuant to this article may be amended in writing by the transferor or his or her agent, but the amendment shall be subject to Section 1102.3 or 1102.3a. 1102.10. Delivery of disclosures required by this article shall be by personal delivery to the tranferee or by mail to the prospective transferee. For the purposes of this article, delivery to the spouse of a transferee shall be deemed delivery to the transferee, unless provided otherwise by contract. 1102.11. Any person or entity, other than a real estate licensee licensed pursuant to Part 1 (commencing with Section 10000) of Division 4 of the Business and Professions Code, acting in the capacity of an escrow agent for the transfer of real property subject to this article shall not be deemed the agent of the transferor or transferee for purposes of the disclosure requirements of this article, unless the person or entity is empowered to so act by an express written agreement to that effect. The extent of such an agency shall be governed by the written agreement. 1102.12. (a) If more than one licensed real estate broker is acting as an agent in a transaction subject to this article, the broker who has obtained the offer made by the transferee shall, except as otherwise provided in this article, deliver the disclosure required by this article to the transferee, unless the transferor has given other written instructions for delivery.   (b) If a licensed real estate broker responsible for delivering the disclosures under this section cannot obtain the disclosure document required and does not have written assurance from the transferee that the disclosure has been received, the broker shall advise the transferee in writing of his or her rights to the disclosure. A licensed real estate broker responsible for delivering disclosures under this section shall maintain a record of the action taken to effect compliance in accordance with Section 10148 of the Business and Professions Code. 1102.13. No transfer subject to this article shall be invalidated solely because of the failure of any person to comply with any provision of this article. However, any person who willfully or negligently violates or fails to perform any duty prescribed by any provision of this article shall be liable in the amount of actual damages suffered by a transferee. 1102.14. (a) As used in this article, "listing agent" means listing agent as defined in subdivision (f) of Section 1086.   (b) As used in this article, "selling agent" means selling agent as defined in subdivision (g) of Section 1086, exclusive of the requirement that the agent be a participant in a multiple listing service as defined in Section 1087. 1102.15. The seller of residential real property subject to this article who has actual knowledge of any former federal or state ordnance locations within the neighborhood area shall give written notice of that knowledge as soon as practicable before transfer of title.

For purposes of this section, "former federal or state ordnance locations" means an area identified by an agency or instrumentality of the federal or state government as an area once used for military training purposes which may contain potentially explosive munitions. "Neighborhood area" means within one mile of the residential real property.

The disclosure required by this section does not limit or abridge any obligation for disclosure created by any other law or that may exist in order to avoid fraud, misrepresentation, or deceit in the transfer transaction. 1102.16. The disclosure of the existence of any window security bars and any safety release mechanism on those window security bars shall be made pursuant to Section 1102.6 or 1106.6a of the Civil Code. 1102.17. The seller of residential real property subject to this article who has actual knowledge that the property is affected by or zoned to allow an industrial use described in Section 731a of the Code of Civil Procedure shall give written notice of that knowledge as soon as practicable before transfer of title. 1102.18. (a) For purposes of this section, the following definitions shall apply:

(1) "Illegal controlled substance" means a drug, substance, or immediate precursor listed in any schedule contained in Section 11054, 11055, 11056, 11057, or 11058 of the Health and Safety Code, or an emission or waste material resulting from the unlawful manufacture or attempt to manufacture an illegal controlled substance. An "illegal controlled substance" does not include, for purposes of this section, marijuana.

(2) "Release" means any spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, or disposing of an illegal controlled substance in a structure or into the environment.   (b) (1) Any owner of residential real property who knows, as provided in paragraph (2), that any release of an illegal controlled substance has come to be located on or beneath that real property shall, prior to the sale of the real property by that owner, give written notice of that condition to the buyer pursuant to Section 1102.6 by checking "yes" in question IC1 of the Real Estate Transfer Disclosure Statement contained in that section and attaching a copy of any notice received from law enforcement or any other entity, such as the Department of Toxic Substances Control, the county health department, the local environmental health officer, or a designee, advising the owner of the release on the property.   (2) For purposes of this subdivision, a seller's knowledge of the condition is established by the receipt of a notice specified in paragraph (1) or by actual knowledge of the condition from a source independent of the notice.

(3) If the seller delivers the disclosure information required by paragraph (1), delivery shall be deemed legally adequate for purposes of informing the prospective buyer of that condition, and the seller is not required to provide any additional disclosure of that information.

(4) Failure of the owner to provide written notice to the buyer when required by this subdivision shall subject the owner to actual damages and any other remedies provided by law. In addition, if the owner has actual knowledge of the presence of any release of an illegal controlled substance and knowingly and willfully fails to provide written notice to the buyer, as required by this subdivision, the owner is liable for a civil penalty not to exceed five thousand dollars ($5,000) for each separate violation, in addition to any other damages provided by law.

(c) This section shall remain in effect only until January 1, 2004, and as of that date is repealed, unless a later enacted statute, that is enacted before January 1, 2004, deletes or extends that date.

CALIFORNIA CODES CIVIL CODE SECTION 1102-1102.18 1102. (a) Except as provided in Section 1102.2, this article applies to any transfer by sale, exchange, installment land sale contract, as defined in Section 2985, lease with an option to purchase, any other option to purchase, or ground lease coupled with improvements, of real property or residential stock cooperative, improved with or consisting of not less than one nor more than four dwelling units.

(b) Except as provided in Section 1102.2, this article shall apply to a resale transaction entered into on or after January 1, 2000, for a manufactured home, as defined in Section 18007 of the Health and Safety Code, or a mobilehome, as defined in Section 18008 of the Health and Safety Code, which manufactured home or mobilehome is classified as personal property and intended for use as a residence.

(c) Any waiver of the requirements of this article is void as against public policy. 1102.1. (a) In enacting Chapter 817 of the Statutes of 1994, it was the intent of the Legislature to clarify and facilitate the use of the real estate disclosure statement, as specified in Section 1102.6.

The Legislature intended the statement to be used by transferors making disclosures required under this article and by agents making disclosures required by Section 2079 on the agent's portion of the real estate disclosure statement, in transfers subject to this article. In transfers not subject to this article, agents may make required disclosures in a separate writing. The Legislature did not intend to affect the existing obligations of the parties to a real estate contract, or their agents, to disclose any fact materially affecting the value and desirability of the property, including, but not limited to, the physical conditions of the property and previously received reports of physical inspections noted on the disclosure form set forth in Section 1102.6 or 1102.6a, and that nothing in this article shall be construed to change the duty of a real estate broker or salesperson pursuant to Section 2079.

It is also the intent of the Legislature that the delivery of a real estate transfer disclosure statement may not be waived in an "as is" sale, as held in Loughrin v. Superior Court (1993) 15 Cal. App. 4th 1188.

(b) In enacting Chapter 677 of the Statutes of 1996, it was the intent of the Legislature to clarify and facilitate the use of the manufactured home and mobilehome transfer disclosure statement applicable to the resale of a manufactured home or mobilehome pursuant to subdivision (b) of Section 1102. The Legislature intended the statements to be used by transferors making disclosures required under this article and by agents making disclosures required by Section 2079 on the agent's portion of the disclosure statement and as required by Section 18046 of the Health and Safety Code on the dealer's portion of the manufactured home and mobilehome transfer disclosure statement, in transfers subject to this article. In transfers not subject to this article, agents may make required disclosures in a separate writing. The Legislature did not intend to affect the existing obligations of the parties to a real estate contract, or their agents, to disclose any fact materially affecting the value and desirability of the property, including, but not limited to, the physical conditions of the property and previously received reports of physical inspections noted on the disclosure form set forth in Section 1102.6 or 1102.6a or to affect the existing obligations of the parties to a manufactured home or mobilehome purchase contract, and nothing in this article shall be construed to change the duty of a real estate broker or salesperson pursuant to Section 2079 or the duty of a manufactured home or mobilehome dealer or salesperson pursuant to Section 18046 of the Health and Safety Code.

It is also the intent of the Legislature that the delivery of a mobilehome transfer disclosure statement may not be waived in an "as is" sale.

(c) It is the intent of the Legislature that manufactured home and mobilehome dealers and salespersons and real estate brokers and salespersons use the form provided pursuant to Section 1102.6d. It is also the intent of the Legislature for sellers of manufactured homes or mobilehomes who are neither manufactured home dealers or salespersons nor real estate brokers or salespersons to use the Manufactured Home/Mobilehome Transfer Disclosure Statement contained in Section 1102.6d. 1102.2. This article does not apply to the following:

(a) Transfers which are required to be preceded by the furnishing to a prospective transferee of a copy of a public report pursuant to Section 11018.1 of the Business and Professions Code and transfers which can be made without a public report pursuant to Section 11010.4 of the Business and Professions Code.

(b) Transfers pursuant to court order, including, but not limited to, transfers ordered by a probate court in the administration of an estate, transfers pursuant to a writ of execution, transfers by any foreclosure sale, transfers by a trustee in bankruptcy, transfers by eminent domain, and transfers resulting from a decree for specific performance.

(c) Transfers to a mortgagee by a mortgagor or successor in interest who is in default, transfers to a beneficiary of a deed of trust by a trustor or successor in interest who is in default, transfers by any foreclosure sale after default, transfers by any foreclosure sale after default in an obligation secured by a mortgage, transfers by a sale under a power of sale or any foreclosure sale under a decree of foreclosure after default in an obligation secured by a deed of trust or secured by any other instrument containing a power of sale, transfers by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a mortgage or deed of trust or a sale pursuant to a decree of foreclosure or has acquired the real property by a deed in lieu of foreclosure, transfers to the legal owner or lienholder of a manufactured home or mobilehome by a registered owner or successor in interest who is in default, or transfers by reason of any foreclosure of a security interest in a manufactured home or mobilehome.

(d) Transfers by a fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or trust. This exemption shall not apply to a transfer if the trustee is a natural person who is sole trustee of a revocable trust and he or she is a former owner of the property or an occupant in possession of the property within the preceding year.

(e) Transfers from one coowner to one or more other coowners.

(f) Transfers made to a spouse, or to a person or persons in the lineal line of consanguinity of one or more of the transferors.

(g) Transfers between spouses resulting from a judgment of dissolution of marriage or of legal separation or from a property settlement agreement incidental to that judgment.

(h) Transfers by the Controller in the course of administering Chapter 7 (commencing with Section 1500) of Title 10 of Part 3 of the Code of Civil Procedure.

(i) Transfers under Chapter 7 (commencing with Section 3691) or Chapter 8 (commencing with Section 3771) of Part 6 of Division 1 of the Revenue and Taxation Code.

(j) Transfers or exchanges to or from any governmental entity. 1102.3. The transferor of any real property subject to this article shall deliver to the prospective transferee the written statement required by this article, as follows:

(a) In the case of a sale, as soon as practicable before transfer of title.

(b) In the case of transfer by a real property sales contract, as defined in Section 2985, or by a lease together with an option to purchase, or a ground lease coupled with improvements, as soon as practicable before execution of the contract. For the purpose of this subdivision, "execution" means the making or acceptance of an offer.   With respect to any transfer subject to subdivision (a) or (b), the transferor shall indicate compliance with this article either on the receipt for deposit, the real property sales contract, the lease, or any addendum attached thereto or on a separate document.   If any disclosure, or any material amendment of any disclosure, required to be made by this article, is delivered after the execution of an offer to purchase, the transferee shall have three days after delivery in person or five days after delivery by deposit in the mail, to terminate his or her offer by delivery of a written notice of termination to the transferor or the transferor's agent. 1102.3a. (a) The transferor of any manufactured home or mobilehome subject to this article shall deliver to the prospective transferee the written statement required by this article, as follows:

(1) In the case of a sale, or a lease with an option to purchase, of a manufactured home or mobilehome, involving an agent, as defined in Section 18046 of the Health and Safety Code, as soon as practicable, but no later than the close of escrow for the purchase of the manufactured home or mobilehome.

(2) In the case of a sale, or lease with an option to purchase, of a manufactured home or mobilehome, not involving an agent, as defined in Section 18046 of the Health and Safety Code, at the time of execution of any document by the prospective transferee with the transferor for the purchase of the manufactured home or mobilehome.

(b) With respect to any transfer subject to this section, the transferor shall indicate compliance with this article either on the transfer disclosure statement, any addendum thereto, or on a separate document.

(c) If any disclosure, or any material amendment of any disclosure, required to be made pursuant to subdivision (b) of Section 1102, is delivered after the execution of an offer to purchase, the transferee shall have three days after delivery in person or five days after delivery by deposit in the mail, to terminate his or her offer by delivery of a written notice of termination to the transferor. 1102.4. (a) Neither the transferor nor any listing or selling agent shall be liable for any error, inaccuracy, or omission of any information delivered pursuant to this article if the error, inaccuracy, or omission was not within the personal knowledge of the transferor or that listing or selling agent, was based on information timely provided by public agencies or by other persons providing information as specified in subdivision (c) that is required to be disclosed pursuant to this article, and ordinary care was exercised in obtaining and transmitting it.

(b) The delivery of any information required to be disclosed by this article to a prospective transferee by a public agency or other person providing information required to be disclosed pursuant to this article shall be deemed to comply with the requirements of this article and shall relieve the transferor or any listing or selling agent of any further duty under this article with respect to that item of information.

(c) The delivery of a report or opinion prepared by a licensed engineer, land surveyor, geologist, structural pest control operator, contractor, or other expert, dealing with matters within the scope of the professional's license or expertise, shall be sufficient compliance for application of the exemption provided by subdivision (a) if the information is provided to the prospective transferee pursuant to a request therefor, whether written or oral. In responding to such a request, an expert may indicate, in writing, an understanding that the information provided will be used in fulfilling the requirements of Section 1102.6 and, if so, shall indicate the required disclosures, or parts thereof, to which the information being furnished is applicable. Where such a statement is furnished, the expert shall not be responsible for any items of information, or parts thereof, other than those expressly set forth in the statement. 1102.5. If information disclosed in accordance with this article is subsequently rendered inaccurate as a result of any act, occurrence, or agreement subsequent to the delivery of the required disclosures, the inaccuracy resulting therefrom does not constitute a violation of this article. If at the time the disclosures are required to be made, an item of information required to be disclosed is unknown or not available to the transferor, and the transferor or his or her agent has made a reasonable effort to ascertain it, the transferor may use an approximation of the information, provided the approximation is clearly identified as such, is reasonable, is based on the best information available to the transferor or his or her agent, and is not used for the purpose of circumventing or evading this article. 1102.6. The disclosures required by this article pertaining to the property proposed to be transferred are set forth in, and shall be made on a copy of, the following disclosure form: 1102.6a. (a) On and after July 1, 1990, any city or county may elect to require disclosures on the form set forth in subdivision (b) in addition to those disclosures required by Section 1102.6. However, this section does not affect or limit the authority of a city or county to require disclosures on a different disclosure form in connection with transactions subject to this article pursuant to an ordinance adopted prior to July 1, 1990. Such an ordinance adopted prior to July 1, 1990, may be amended thereafter to revise the disclosure requirements of the ordinance, in the discretion of the city council or county board of supervisors.

(b) Disclosures required pursuant to this section pertaining to the property proposed to be transferred, shall be set forth in, and shall be made on a copy of, the following disclosure form:

(c) This section does not preclude the use of addenda to the form specified in subdivision (b) to facilitate the required disclosures. This section does not preclude a city or county from using the disclosure form specified in subdivision (b) for a purpose other than that specified in this section. 1102.6b. (a) This section applies to all transfers of real property for which all of the following apply:

(1) The transfer is subject to this article.

(2) The property being transferred is subject to a continuing lien securing the levy of special taxes pursuant to the Mello-Roos Community Facilities Act (Chapter 2.5 (commencing with Section 53311) of Part 1 of Division 2 of Title 5 of the Government Code) or to a fixed lien assessment collected in installments to secure bonds issued pursuant to the Improvement Bond Act of 1915 (Division 10 (commencing with Section 8500) of the Streets and Highways Code).

(3) A notice is not required pursuant to Section 53341.5 of the Government Code.

(b) In addition to any other disclosure required pursuant to this article, the seller of any real property subject to this section shall make a good faith effort to obtain a disclosure notice concerning the special tax as provided for in Section 53340.2 of the Government Code, or a disclosure notice concerning an assessment installment as provided in Section 53754 of the Government Code, from each local agency that levies a special tax pursuant to the Mello-Roos Community Facilities Act, or that collects assessment installments to secure bonds issued pursuant to the Improvement Bond Act of 1915 (Division 10 (commencing with Section 8500) of the Streets and Highways Code), on the property being transferred, and shall deliver that notice or those notices to the prospective purchaser, as long as the notices are made available by the local agency.

(c) If a disclosure received pursuant to subdivision (b) has been delivered to the transferee, a seller or his or her agent is not required to provide additional information concerning, and information in the disclosure shall be deemed to satisfy the responsibility of the seller or his or her agent to inform the transferee regarding the special tax or assessment installments and the district. Notwithstanding subdivision (b), nothing in this section imposes a duty to discover a special tax or assessment installments or the existence of any levying district not actually known to the agents. 1102.6d. Except for manufactured homes and mobilehomes located in a common interest development governed by Title 6 (commencing with Section 1351), the disclosures applicable to the resale of a manufactured home or mobilehome pursuant to subdivision (b) of Section 1102 are set forth in, and shall be made on a copy of, the following disclosure form: 1102.7. Each disclosure required by this article and each act which may be performed in making the disclosure, shall be made in good faith. For purposes of this article, "good faith" means honesty in fact in the conduct of the transaction. 1102.8. The specification of items for disclosure in this article does not limit or abridge any obligation for disclosure created by any other provision of law or which may exist in order to avoid fraud, misrepresentation, or deceit in the transfer transaction. 1102.9. Any disclosure made pursuant to this article may be amended in writing by the transferor or his or her agent, but the amendment shall be subject to Section 1102.3 or 1102.3a. 1102.10. Delivery of disclosures required by this article shall be by personal delivery to the tranferee or by mail to the prospective transferee. For the purposes of this article, delivery to the spouse of a transferee shall be deemed delivery to the transferee, unless provided otherwise by contract. 1102.11. Any person or entity, other than a real estate licensee licensed pursuant to Part 1 (commencing with Section 10000) of Division 4 of the Business and Professions Code, acting in the capacity of an escrow agent for the transfer of real property subject to this article shall not be deemed the agent of the transferor or transferee for purposes of the disclosure requirements of this article, unless the person or entity is empowered to so act by an express written agreement to that effect. The extent of such an agency shall be governed by the written agreement. 1102.12. (a) If more than one licensed real estate broker is acting as an agent in a transaction subject to this article, the broker who has obtained the offer made by the transferee shall, except as otherwise provided in this article, deliver the disclosure required by this article to the transferee, unless the transferor has given other written instructions for delivery.   (b) If a licensed real estate broker responsible for delivering the disclosures under this section cannot obtain the disclosure document required and does not have written assurance from the transferee that the disclosure has been received, the broker shall advise the transferee in writing of his or her rights to the disclosure. A licensed real estate broker responsible for delivering disclosures under this section shall maintain a record of the action taken to effect compliance in accordance with Section 10148 of the Business and Professions Code. 1102.13. No transfer subject to this article shall be invalidated solely because of the failure of any person to comply with any provision of this article. However, any person who willfully or negligently violates or fails to perform any duty prescribed by any provision of this article shall be liable in the amount of actual damages suffered by a transferee. 1102.14. (a) As used in this article, "listing agent" means listing agent as defined in subdivision (f) of Section 1086.   (b) As used in this article, "selling agent" means selling agent as defined in subdivision (g) of Section 1086, exclusive of the requirement that the agent be a participant in a multiple listing service as defined in Section 1087. 1102.15. The seller of residential real property subject to this article who has actual knowledge of any former federal or state ordnance locations within the neighborhood area shall give written notice of that knowledge as soon as practicable before transfer of title.

For purposes of this section, "former federal or state ordnance locations" means an area identified by an agency or instrumentality of the federal or state government as an area once used for military training purposes which may contain potentially explosive munitions. "Neighborhood area" means within one mile of the residential real property.

The disclosure required by this section does not limit or abridge any obligation for disclosure created by any other law or that may exist in order to avoid fraud, misrepresentation, or deceit in the transfer transaction. 1102.16. The disclosure of the existence of any window security bars and any safety release mechanism on those window security bars shall be made pursuant to Section 1102.6 or 1106.6a of the Civil Code. 1102.17. The seller of residential real property subject to this article who has actual knowledge that the property is affected by or zoned to allow an industrial use described in Section 731a of the Code of Civil Procedure shall give written notice of that knowledge as soon as practicable before transfer of title. 1102.18. (a) For purposes of this section, the following definitions shall apply:

(1) "Illegal controlled substance" means a drug, substance, or immediate precursor listed in any schedule contained in Section 11054, 11055, 11056, 11057, or 11058 of the Health and Safety Code, or an emission or waste material resulting from the unlawful manufacture or attempt to manufacture an illegal controlled substance. An "illegal controlled substance" does not include, for purposes of this section, marijuana.

(2) "Release" means any spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, or disposing of an illegal controlled substance in a structure or into the environment.   (b) (1) Any owner of residential real property who knows, as provided in paragraph (2), that any release of an illegal controlled substance has come to be located on or beneath that real property shall, prior to the sale of the real property by that owner, give written notice of that condition to the buyer pursuant to Section 1102.6 by checking "yes" in question IC1 of the Real Estate Transfer Disclosure Statement contained in that section and attaching a copy of any notice received from law enforcement or any other entity, such as the Department of Toxic Substances Control, the county health department, the local environmental health officer, or a designee, advising the owner of the release on the property.   (2) For purposes of this subdivision, a seller's knowledge of the condition is established by the receipt of a notice specified in paragraph (1) or by actual knowledge of the condition from a source independent of the notice.

(3) If the seller delivers the disclosure information required by paragraph (1), delivery shall be deemed legally adequate for purposes of informing the prospective buyer of that condition, and the seller is not required to provide any additional disclosure of that information.

(4) Failure of the owner to provide written notice to the buyer when required by this subdivision shall subject the owner to actual damages and any other remedies provided by law. In addition, if the owner has actual knowledge of the presence of any release of an illegal controlled substance and knowingly and willfully fails to provide written notice to the buyer, as required by this subdivision, the owner is liable for a civil penalty not to exceed five thousand dollars ($5,000) for each separate violation, in addition to any other damages provided by law.

(c) This section shall remain in effect only until January 1, 2004, and as of that date is repealed, unless a later enacted statute, that is enacted before January 1, 2004, deletes or extends that date.