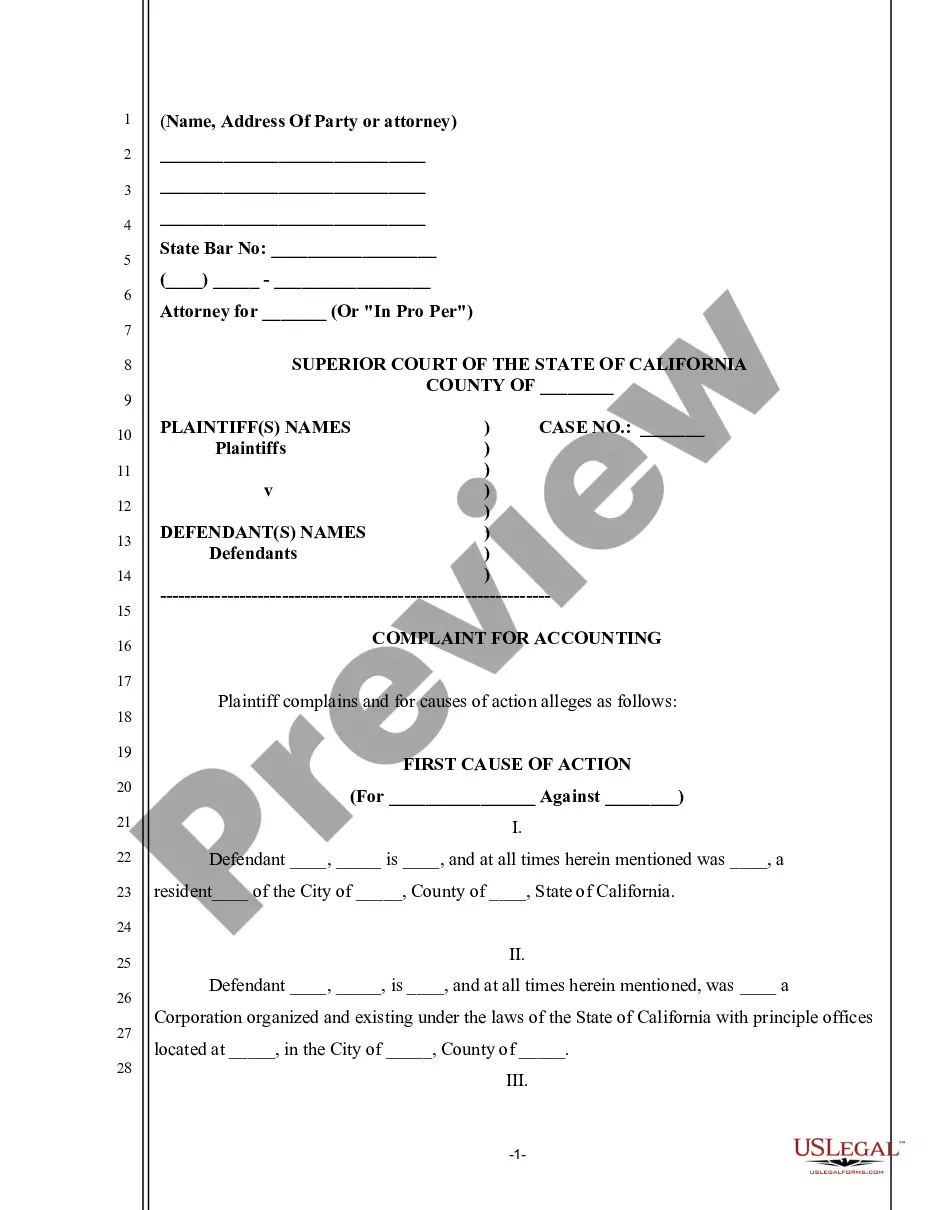

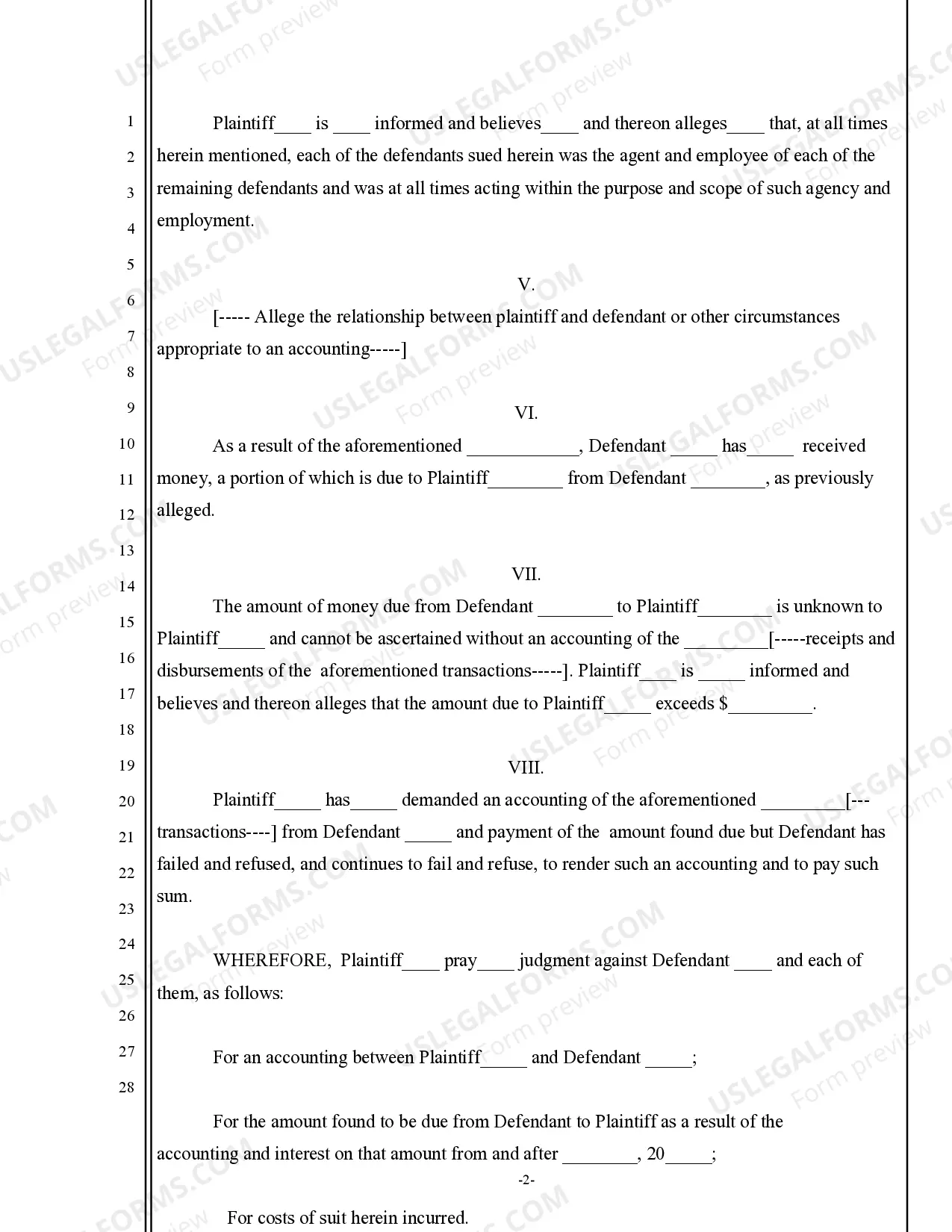

This form is a Complaint for Accounting. The plaintiff has demanded an accounting of funds from the defendant. However, the defendant has failed to render the accounting and to pay the sum owed to the plaintiff. Therefore, the plaintiff seeks to have the court enter judgment against the defendant for the amount due, plus interest.

Title: Pomona California Complaint for Accounting — Genera— - State Basis: Understanding Types and Key Considerations Introduction: The Pomona California Complaint for Accounting — Genera— - State Basis can refer to several types of legal complaints filed within the state of California concerning accounting issues. These complaints can arise from various circumstances, such as financial misconduct, negligence, fraud, misrepresentation, or improper financial reporting. This article aims to provide a detailed description of this type of complaint, including its types, key considerations, and relevant keywords. 1. Types of Pomona California Complaint for Accounting — Genera— - State Basis: a. Accounting Malpractice Complaint: Pertains to professional negligence or misconduct on the part of an accounting firm or individual accountant. b. Fraud Complaint: Involves deliberate deception, misrepresentation, or manipulation of financial records for personal gain. c. Breach of Fiduciary Duty Complaint: Accuses an accountant or accounting firm of failing to act in the best interests of their clients or abusing their position of trust. d. Improper Financial Reporting Complaint: Focuses on inaccuracies or manipulation of financial statements, non-disclosure of vital information, or violation of generally accepted accounting principles (GAAP). e. Negligence or Misrepresentation Complaint: Alleges that an accountant or accounting firm provided inaccurate or misleading information, resulting in financial harm to the plaintiff. 2. Key Considerations for Pomona California Complaints: a. Timeliness: Complaints should be filed within the statute of limitations, which can vary depending on the specific violation and circumstances. b. Supporting Evidence: It is crucial to gather and present relevant documents, such as financial records, contracts, emails, receipts, or any communication pertaining to the accounting practices in question. c. Expert Opinion: In some cases, it may be beneficial to include an expert witness, such as a forensic accountant, to evaluate the claims and provide professional opinion. d. Legal Assistance: Seeking professional advice from a qualified attorney experienced in accounting-related complaints is highly recommended ensuring the complaint is properly prepared and filed. e. Remedies: Understanding the potential outcomes sought, such as financial restitution, punitive damages, or injunctions, is essential for building a strong complaint. Relevant Keywords: Pomona California, complaint, accounting, general, state basis, accounting malpractice, fraud, breach of fiduciary duty, improper financial reporting, negligence, misrepresentation, statute of limitations, supporting evidence, expert opinion, legal assistance, remedies. Conclusion: Pomona California Complaints for Accounting — Genera— - State Basis encompass various legal complaints involving accounting misconduct, fraud, negligence, and misrepresentation. By identifying the specific type of complaint and providing adequate supporting evidence, seeking legal assistance, and understanding relevant laws and regulations, plaintiffs can take action to address accounting-related issues effectively. Remember, consulting with an experienced attorney is crucial in navigating the complexities involved in bringing forth a strong complaint.Title: Pomona California Complaint for Accounting — Genera— - State Basis: Understanding Types and Key Considerations Introduction: The Pomona California Complaint for Accounting — Genera— - State Basis can refer to several types of legal complaints filed within the state of California concerning accounting issues. These complaints can arise from various circumstances, such as financial misconduct, negligence, fraud, misrepresentation, or improper financial reporting. This article aims to provide a detailed description of this type of complaint, including its types, key considerations, and relevant keywords. 1. Types of Pomona California Complaint for Accounting — Genera— - State Basis: a. Accounting Malpractice Complaint: Pertains to professional negligence or misconduct on the part of an accounting firm or individual accountant. b. Fraud Complaint: Involves deliberate deception, misrepresentation, or manipulation of financial records for personal gain. c. Breach of Fiduciary Duty Complaint: Accuses an accountant or accounting firm of failing to act in the best interests of their clients or abusing their position of trust. d. Improper Financial Reporting Complaint: Focuses on inaccuracies or manipulation of financial statements, non-disclosure of vital information, or violation of generally accepted accounting principles (GAAP). e. Negligence or Misrepresentation Complaint: Alleges that an accountant or accounting firm provided inaccurate or misleading information, resulting in financial harm to the plaintiff. 2. Key Considerations for Pomona California Complaints: a. Timeliness: Complaints should be filed within the statute of limitations, which can vary depending on the specific violation and circumstances. b. Supporting Evidence: It is crucial to gather and present relevant documents, such as financial records, contracts, emails, receipts, or any communication pertaining to the accounting practices in question. c. Expert Opinion: In some cases, it may be beneficial to include an expert witness, such as a forensic accountant, to evaluate the claims and provide professional opinion. d. Legal Assistance: Seeking professional advice from a qualified attorney experienced in accounting-related complaints is highly recommended ensuring the complaint is properly prepared and filed. e. Remedies: Understanding the potential outcomes sought, such as financial restitution, punitive damages, or injunctions, is essential for building a strong complaint. Relevant Keywords: Pomona California, complaint, accounting, general, state basis, accounting malpractice, fraud, breach of fiduciary duty, improper financial reporting, negligence, misrepresentation, statute of limitations, supporting evidence, expert opinion, legal assistance, remedies. Conclusion: Pomona California Complaints for Accounting — Genera— - State Basis encompass various legal complaints involving accounting misconduct, fraud, negligence, and misrepresentation. By identifying the specific type of complaint and providing adequate supporting evidence, seeking legal assistance, and understanding relevant laws and regulations, plaintiffs can take action to address accounting-related issues effectively. Remember, consulting with an experienced attorney is crucial in navigating the complexities involved in bringing forth a strong complaint.