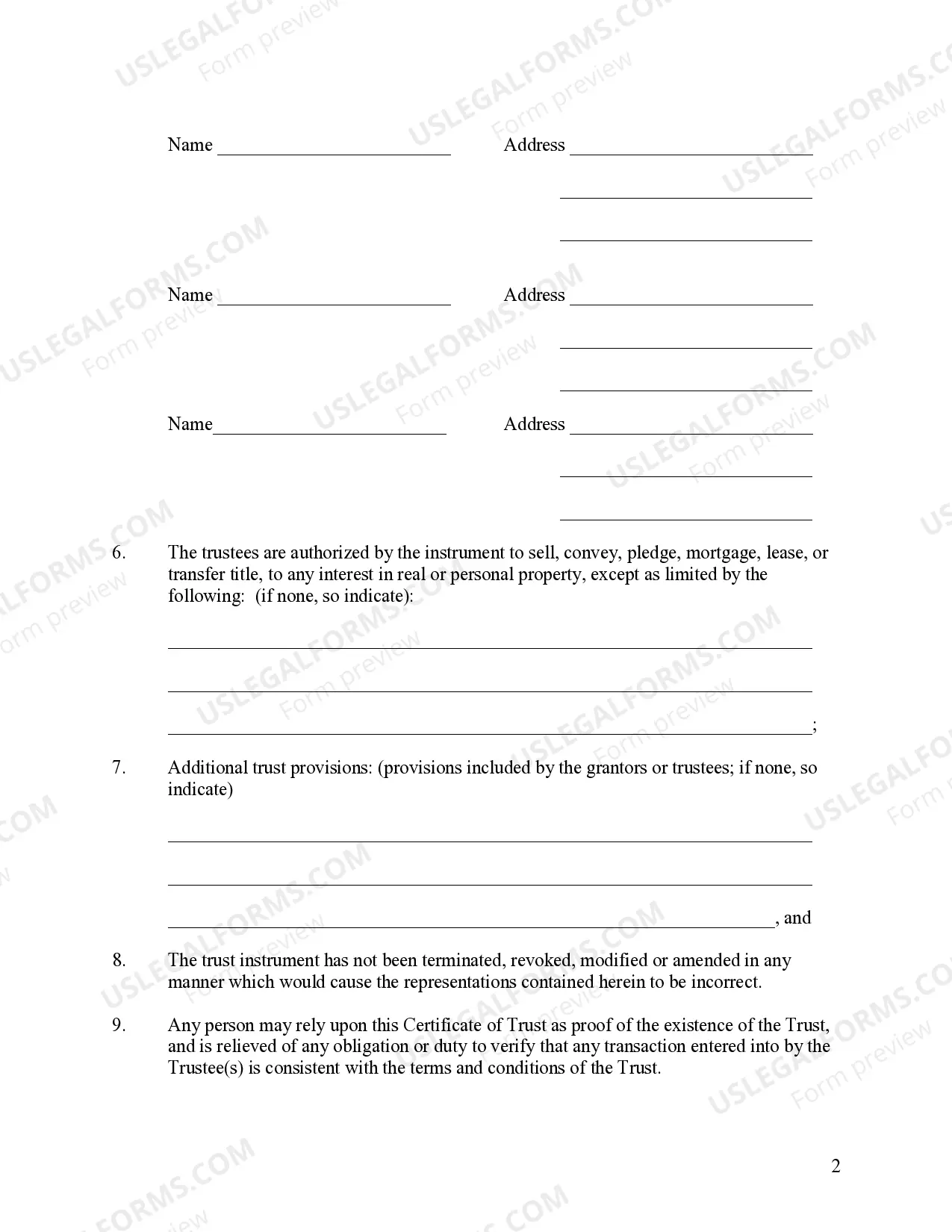

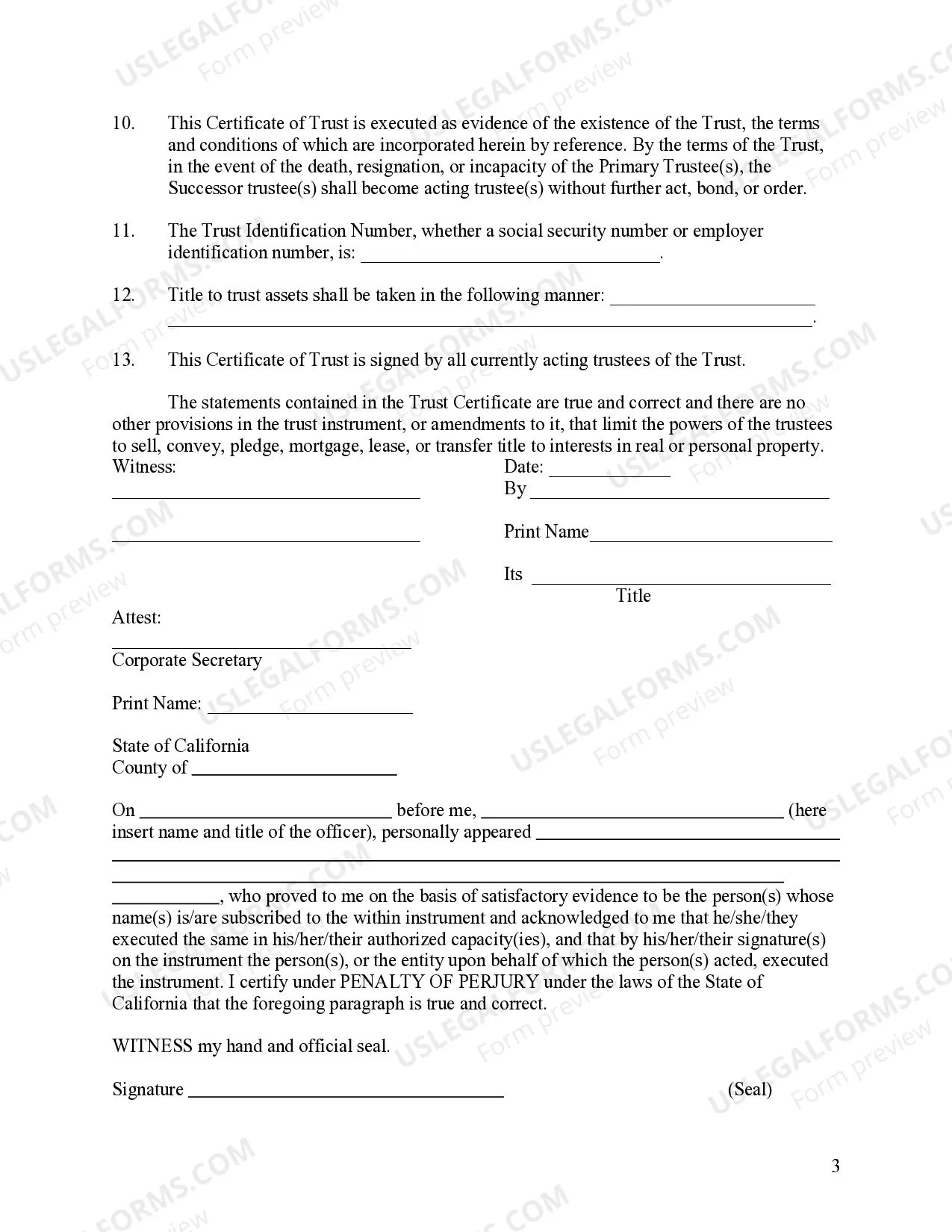

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The corporate trustee may present a certification of trust to any person in lieu of providing a copy of the trust instrument to establish the existence or terms of the trust. A certification of trust may be executed by the trustee voluntarily or at the request of the person with whom the trustee is dealing.

A San Bernardino California Certificate of Trust by Corporation is a legal instrument used by corporations to establish a trust for various purposes in the San Bernardino County area. This certificate acts as evidence of the existence of a trust, providing relevant details and key provisions governing the trust's operation. In the context of trust administration, there are several types of San Bernardino California Certificates of Trust by Corporation. These types may vary based on the specific purpose of the trust, its beneficiaries, or the assets involved. Some common types include: 1. Revocable Living Trust Certificate: This type of trust allows the settler (the person creating the trust) to retain control over the assets during their lifetime. It provides flexibility for managing and distributing assets while avoiding probate upon the settler's death. 2. Irrevocable Trust Certificate: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked by the settler once it is established. These trusts are typically used for more specific purposes, such as asset protection, charitable giving, or estate tax planning. 3. Special Needs Trust Certificate: This type of trust is designed to provide financial support and protect the assets of individuals with disabilities. The trust can supplement government benefits without disqualifying the beneficiary from receiving them. 4. Testamentary Trust Certificate: Created through a person's will, a testamentary trust becomes effective upon the individual's death. It allows for the distribution of assets according to specific instructions outlined in the will. 5. Charitable Remainder Trust Certificate: This trust allows individuals to donate assets to a charitable organization while retaining the right to receive income from the trust during their lifetime. Upon the donor's death, the remaining assets are then transferred to the charity. A San Bernardino California Certificate of Trust by Corporation typically includes key provisions such as the name of the trust, the names of the trustees and beneficiaries, a description of the trust assets, the distribution rules, and any limitations or conditions imposed on the trustees. This document serves as a condensed version of the trust agreement and is often used to provide proof of the trust's existence to financial institutions, real estate agents, or other parties involved in trust-related transactions. When seeking information regarding a San Bernardino California Certificate of Trust by Corporation, it is essential to consult with a qualified attorney specializing in trust law. They can provide advice tailored to individual circumstances and ensure that all legal requirements are met in the creation and administration of the trust.A San Bernardino California Certificate of Trust by Corporation is a legal instrument used by corporations to establish a trust for various purposes in the San Bernardino County area. This certificate acts as evidence of the existence of a trust, providing relevant details and key provisions governing the trust's operation. In the context of trust administration, there are several types of San Bernardino California Certificates of Trust by Corporation. These types may vary based on the specific purpose of the trust, its beneficiaries, or the assets involved. Some common types include: 1. Revocable Living Trust Certificate: This type of trust allows the settler (the person creating the trust) to retain control over the assets during their lifetime. It provides flexibility for managing and distributing assets while avoiding probate upon the settler's death. 2. Irrevocable Trust Certificate: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked by the settler once it is established. These trusts are typically used for more specific purposes, such as asset protection, charitable giving, or estate tax planning. 3. Special Needs Trust Certificate: This type of trust is designed to provide financial support and protect the assets of individuals with disabilities. The trust can supplement government benefits without disqualifying the beneficiary from receiving them. 4. Testamentary Trust Certificate: Created through a person's will, a testamentary trust becomes effective upon the individual's death. It allows for the distribution of assets according to specific instructions outlined in the will. 5. Charitable Remainder Trust Certificate: This trust allows individuals to donate assets to a charitable organization while retaining the right to receive income from the trust during their lifetime. Upon the donor's death, the remaining assets are then transferred to the charity. A San Bernardino California Certificate of Trust by Corporation typically includes key provisions such as the name of the trust, the names of the trustees and beneficiaries, a description of the trust assets, the distribution rules, and any limitations or conditions imposed on the trustees. This document serves as a condensed version of the trust agreement and is often used to provide proof of the trust's existence to financial institutions, real estate agents, or other parties involved in trust-related transactions. When seeking information regarding a San Bernardino California Certificate of Trust by Corporation, it is essential to consult with a qualified attorney specializing in trust law. They can provide advice tailored to individual circumstances and ensure that all legal requirements are met in the creation and administration of the trust.