This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

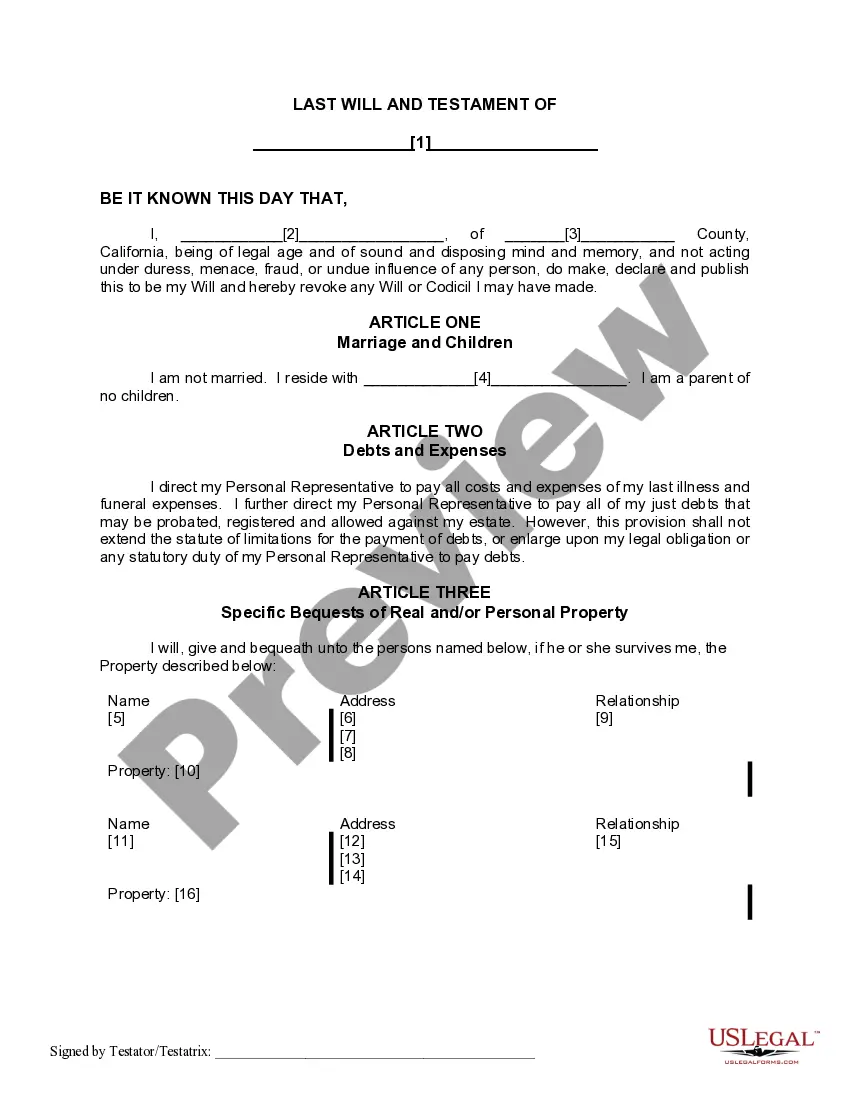

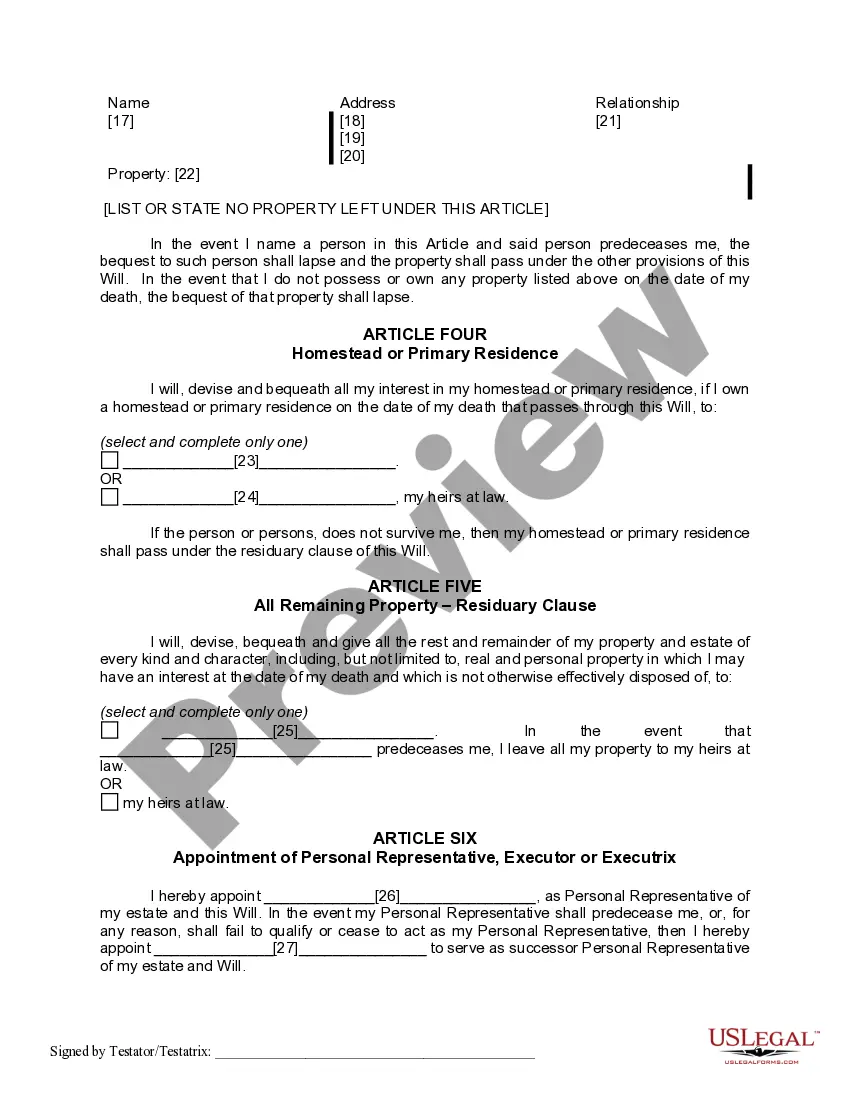

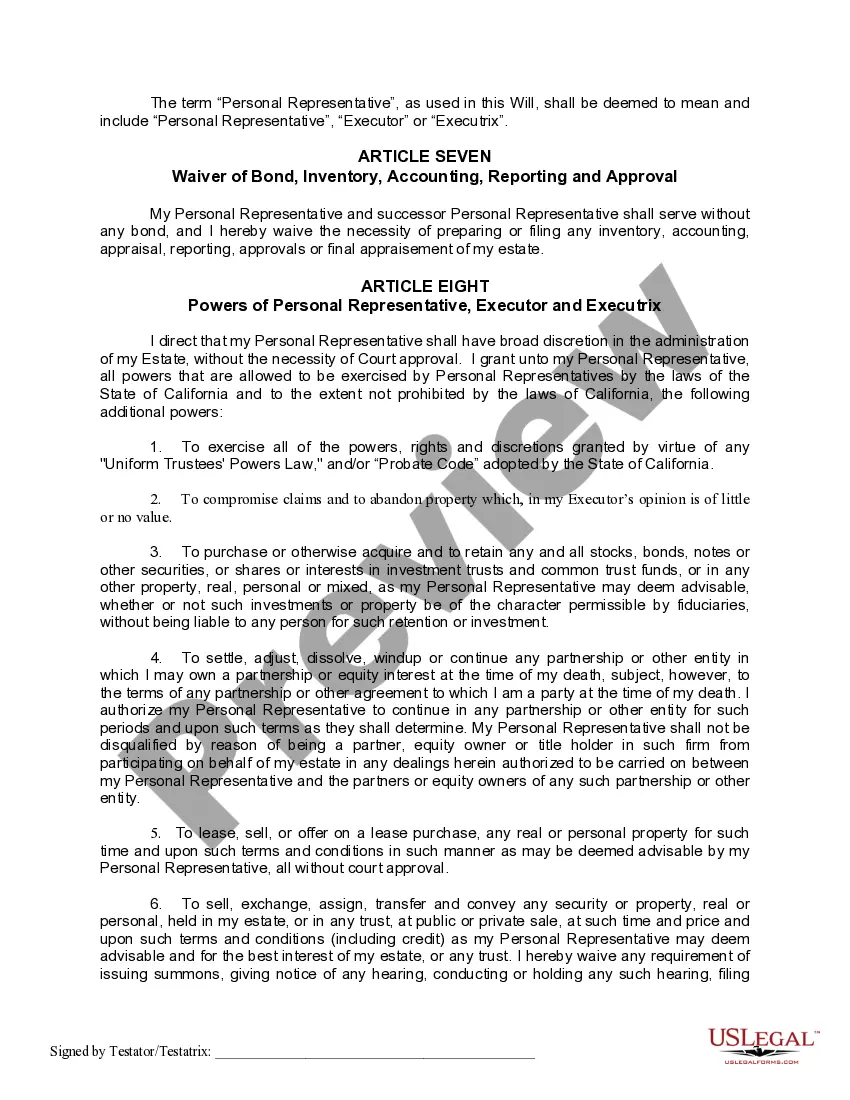

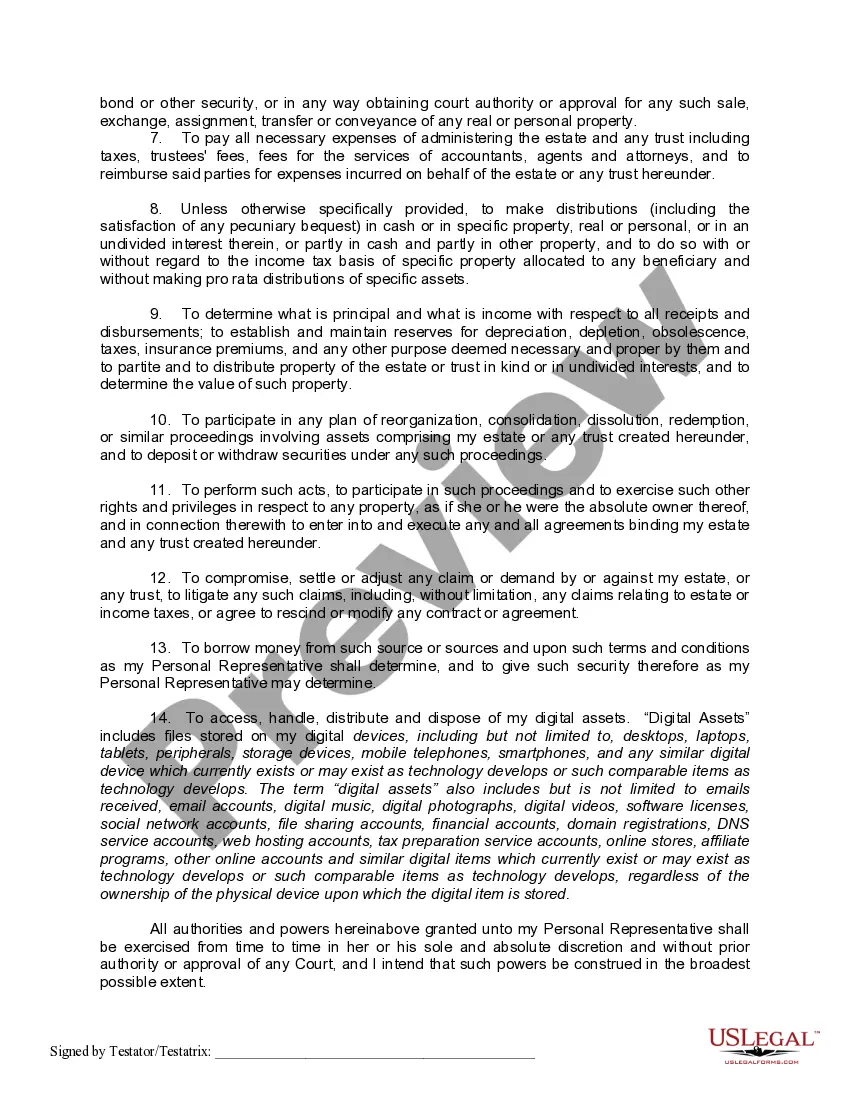

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills. Corona California Mutual Wills containing Last Will and Testaments for Unmarried Persons with No Children are legal documents designed for individuals who are unmarried and do not have any children. These wills provide a comprehensive plan for the distribution of assets, property, and personal belongings after the death of both partners. Here are some key points to consider when creating Corona California Mutual Wills for unmarried persons with no children: 1. Purpose: Corona California Mutual Wills are specifically designed for unmarried couples who wish to ensure that their assets are passed on to their chosen beneficiaries in the event of their deaths. As unmarried partners, they do not have the automatic inheritance rights that married couples enjoy. 2. Property Distribution: The Corona California Mutual Wills outline how the couple's property will be distributed upon the death of either partner. It can include real estate, vehicles, financial assets, personal possessions, and any other assets the couple owns together. 3. Beneficiaries: Couples can name their preferred beneficiaries who will receive their assets upon their deaths. These may include family members, close friends, charitable organizations, or even pets. It is essential to clearly identify the beneficiaries and their relationship to avoid any ambiguity. 4. Executors: Unmarried couples should appoint an executor who will be responsible for carrying out the instructions specified in the mutual wills. The executor ensures that the distribution of assets is done according to the terms outlined. Different types of Corona California Mutual Wills for unmarried persons with no children may include the following variations: 1. Simple Mutual Will: This type of mutual will is suitable for couples with relatively uncomplicated estates and straightforward distribution wishes. It outlines the basic provisions for asset distribution and beneficiaries. 2. Conditional Mutual Will: In this type of mutual will, couples can include specific conditions that must be met for the distribution of assets to take place. For example, assets might be distributed to the survivor partner only if they do not remarry after the death of their partner. 3. Reciprocal Mutual Wills: Reciprocal wills are created by partners to leave their estate to each other. When one partner dies, their assets pass to the surviving partner. Upon the death of the surviving partner, the remaining assets are distributed as per the agreed-upon terms. Creating Corona California Mutual Wills containing Last Will and Testaments for Unmarried Persons with No Children ensures that unmarried couples have a legally binding document that protects their assets and carries out their wishes upon their deaths. It is advisable to consult with an attorney familiar with California estate laws to ensure that the mutual wills comply with all legal requirements and accurately reflect the couple's intentions.

Corona California Mutual Wills containing Last Will and Testaments for Unmarried Persons with No Children are legal documents designed for individuals who are unmarried and do not have any children. These wills provide a comprehensive plan for the distribution of assets, property, and personal belongings after the death of both partners. Here are some key points to consider when creating Corona California Mutual Wills for unmarried persons with no children: 1. Purpose: Corona California Mutual Wills are specifically designed for unmarried couples who wish to ensure that their assets are passed on to their chosen beneficiaries in the event of their deaths. As unmarried partners, they do not have the automatic inheritance rights that married couples enjoy. 2. Property Distribution: The Corona California Mutual Wills outline how the couple's property will be distributed upon the death of either partner. It can include real estate, vehicles, financial assets, personal possessions, and any other assets the couple owns together. 3. Beneficiaries: Couples can name their preferred beneficiaries who will receive their assets upon their deaths. These may include family members, close friends, charitable organizations, or even pets. It is essential to clearly identify the beneficiaries and their relationship to avoid any ambiguity. 4. Executors: Unmarried couples should appoint an executor who will be responsible for carrying out the instructions specified in the mutual wills. The executor ensures that the distribution of assets is done according to the terms outlined. Different types of Corona California Mutual Wills for unmarried persons with no children may include the following variations: 1. Simple Mutual Will: This type of mutual will is suitable for couples with relatively uncomplicated estates and straightforward distribution wishes. It outlines the basic provisions for asset distribution and beneficiaries. 2. Conditional Mutual Will: In this type of mutual will, couples can include specific conditions that must be met for the distribution of assets to take place. For example, assets might be distributed to the survivor partner only if they do not remarry after the death of their partner. 3. Reciprocal Mutual Wills: Reciprocal wills are created by partners to leave their estate to each other. When one partner dies, their assets pass to the surviving partner. Upon the death of the surviving partner, the remaining assets are distributed as per the agreed-upon terms. Creating Corona California Mutual Wills containing Last Will and Testaments for Unmarried Persons with No Children ensures that unmarried couples have a legally binding document that protects their assets and carries out their wishes upon their deaths. It is advisable to consult with an attorney familiar with California estate laws to ensure that the mutual wills comply with all legal requirements and accurately reflect the couple's intentions.