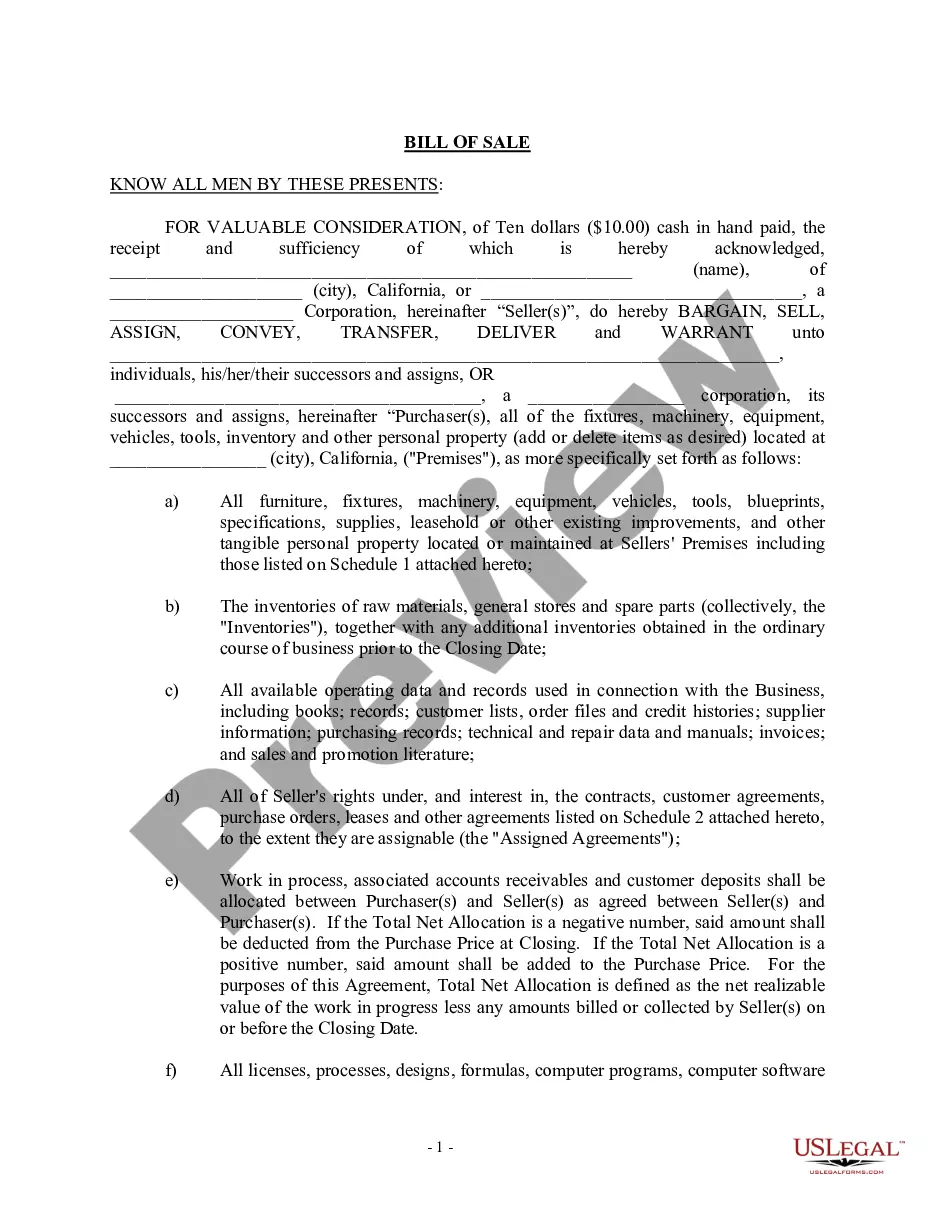

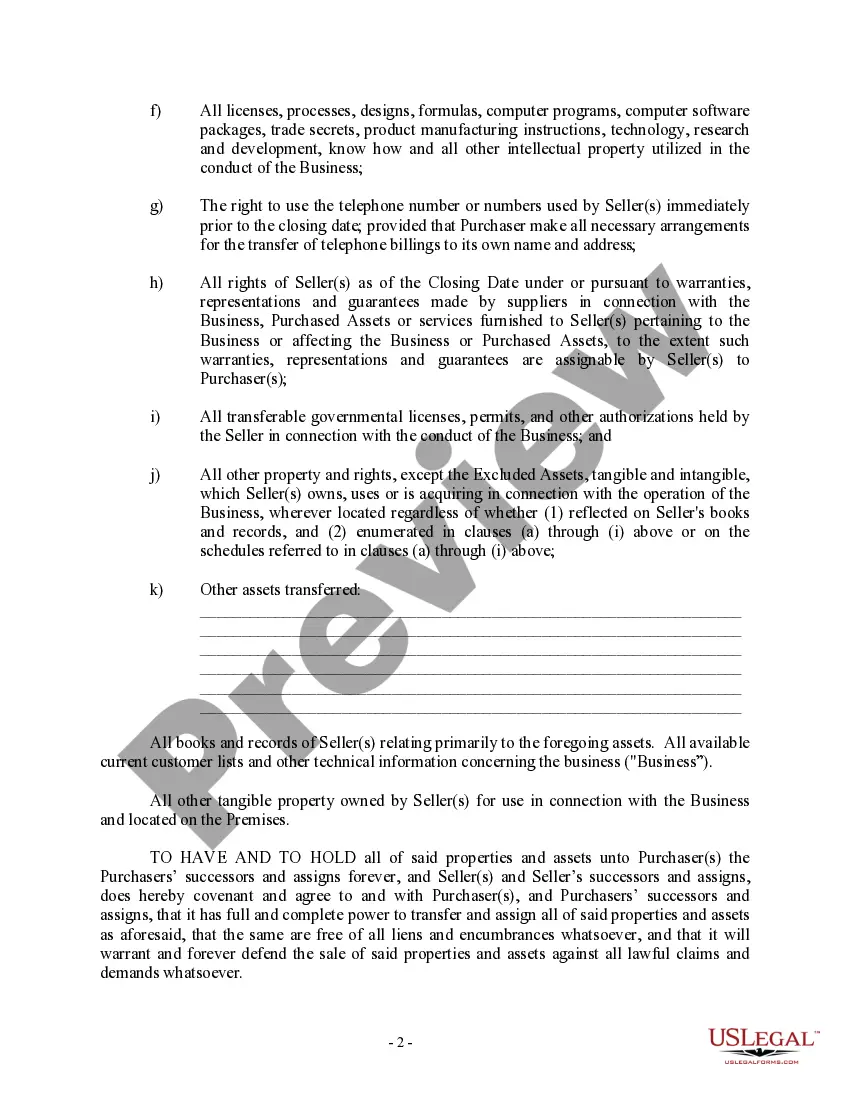

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

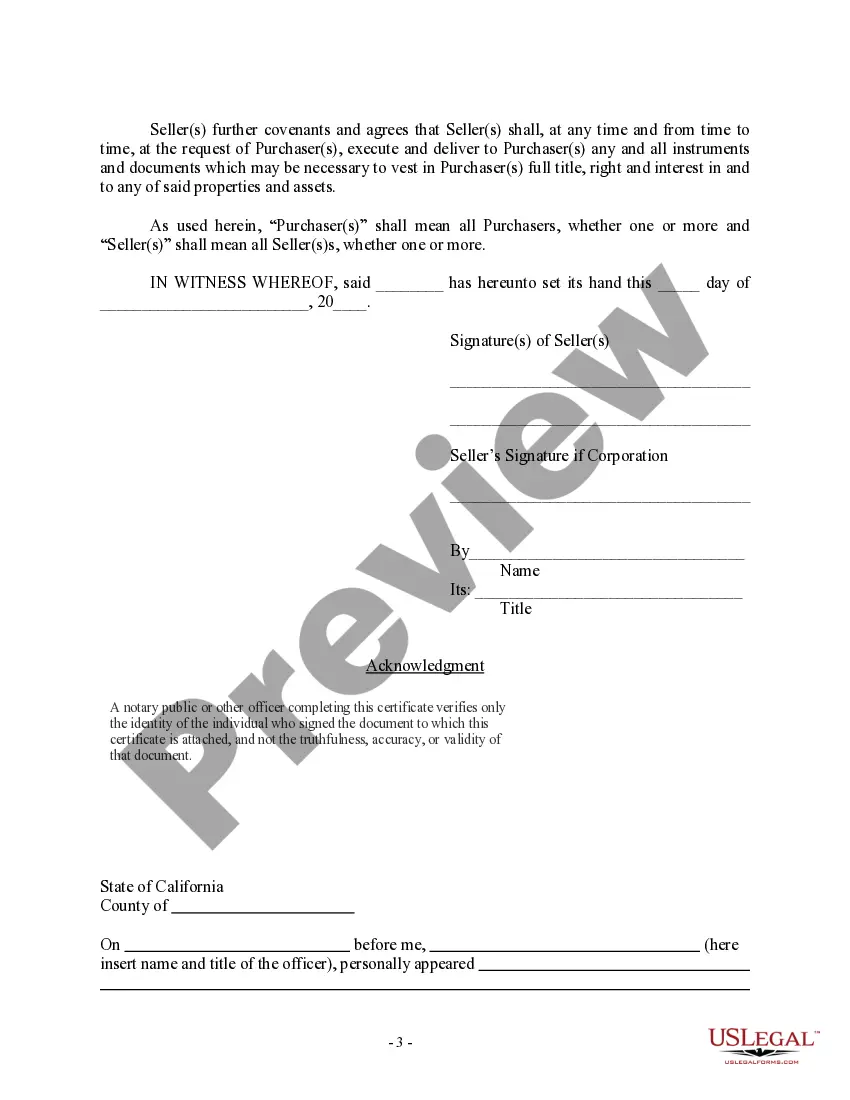

The Santa Maria California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of transferring ownership of a business from the seller to the buyer. This document serves as proof of the transaction and provides protection for both parties involved. When drafting a Santa Maria California Bill of Sale for the sale of a business, there are different types depending on the nature of the transaction. These include: 1. Asset Purchase Agreement: This type of bill of sale is used when the buyer is only acquiring certain assets of the business, such as equipment, inventory, and intellectual property. It specifies the assets being transferred, their condition, and the agreed-upon purchase price. 2. Stock Purchase Agreement: Here, the buyer acquires the business by purchasing all or a majority of the seller's ownership interests, typically the stocks or shares of the corporation. This agreement includes the number of shares being sold, the price per share, and any conditions or restrictions associated with the purchase. 3. Merger or Acquisition Agreement: In a merger or acquisition, two businesses combine to form a new entity or one business acquires another. This type of agreement includes details about the structure of the transaction, the treatment of current employees, and the division of assets and liabilities. 4. Partnership Agreement: If the sale involves the transfer of a partnership interest, a partnership agreement is used to outline the terms of the sale, including the rights and obligations of the buyer and the remaining partners. Regardless of the type of Santa Maria California Bill of Sale, it should typically include the following key elements: 1. Identification of the parties: The document starts by identifying the seller(s) and buyer(s) involved in the sale and their contact information. 2. Description of the business: A detailed description of the business being sold, including its name, address, legal structure, and any relevant permits or licenses. 3. Purchase price and payment terms: The agreed-upon purchase price for the business or its assets, along with any payment terms, such as a lump sum payment or installments. 4. Asset or stock transfer: This section details the assets, stocks, or shares being transferred, including any warranties or representations provided by the seller regarding their ownership and condition. 5. Closing and transfer of ownership: The document should specify the date of closing, when the ownership of the business or assets will be transferred from the seller to the buyer, and any conditions or obligations that need to be fulfilled before the transfer. 6. Representations and warranties: Both parties may include representations and warranties to protect their respective interests, such as assurances from the seller about the accuracy of financial statements or the absence of undisclosed liabilities. 7. Indemnification: This section outlines the responsibilities of the parties for any losses or damages that may arise as a result of the sale. 8. Governing law and dispute resolution: The document should specify that it is governed by the laws of Santa Maria, California and any mechanisms for resolving disputes, such as mediation or arbitration. It is crucial for both the seller and the buyer to carefully review and understand the Santa Maria California Bill of Sale before signing to ensure that their rights and obligations are adequately protected. Consulting with a legal professional is highly recommended ensuring compliance with state laws and to draft a comprehensive and enforceable agreement.The Santa Maria California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of transferring ownership of a business from the seller to the buyer. This document serves as proof of the transaction and provides protection for both parties involved. When drafting a Santa Maria California Bill of Sale for the sale of a business, there are different types depending on the nature of the transaction. These include: 1. Asset Purchase Agreement: This type of bill of sale is used when the buyer is only acquiring certain assets of the business, such as equipment, inventory, and intellectual property. It specifies the assets being transferred, their condition, and the agreed-upon purchase price. 2. Stock Purchase Agreement: Here, the buyer acquires the business by purchasing all or a majority of the seller's ownership interests, typically the stocks or shares of the corporation. This agreement includes the number of shares being sold, the price per share, and any conditions or restrictions associated with the purchase. 3. Merger or Acquisition Agreement: In a merger or acquisition, two businesses combine to form a new entity or one business acquires another. This type of agreement includes details about the structure of the transaction, the treatment of current employees, and the division of assets and liabilities. 4. Partnership Agreement: If the sale involves the transfer of a partnership interest, a partnership agreement is used to outline the terms of the sale, including the rights and obligations of the buyer and the remaining partners. Regardless of the type of Santa Maria California Bill of Sale, it should typically include the following key elements: 1. Identification of the parties: The document starts by identifying the seller(s) and buyer(s) involved in the sale and their contact information. 2. Description of the business: A detailed description of the business being sold, including its name, address, legal structure, and any relevant permits or licenses. 3. Purchase price and payment terms: The agreed-upon purchase price for the business or its assets, along with any payment terms, such as a lump sum payment or installments. 4. Asset or stock transfer: This section details the assets, stocks, or shares being transferred, including any warranties or representations provided by the seller regarding their ownership and condition. 5. Closing and transfer of ownership: The document should specify the date of closing, when the ownership of the business or assets will be transferred from the seller to the buyer, and any conditions or obligations that need to be fulfilled before the transfer. 6. Representations and warranties: Both parties may include representations and warranties to protect their respective interests, such as assurances from the seller about the accuracy of financial statements or the absence of undisclosed liabilities. 7. Indemnification: This section outlines the responsibilities of the parties for any losses or damages that may arise as a result of the sale. 8. Governing law and dispute resolution: The document should specify that it is governed by the laws of Santa Maria, California and any mechanisms for resolving disputes, such as mediation or arbitration. It is crucial for both the seller and the buyer to carefully review and understand the Santa Maria California Bill of Sale before signing to ensure that their rights and obligations are adequately protected. Consulting with a legal professional is highly recommended ensuring compliance with state laws and to draft a comprehensive and enforceable agreement.