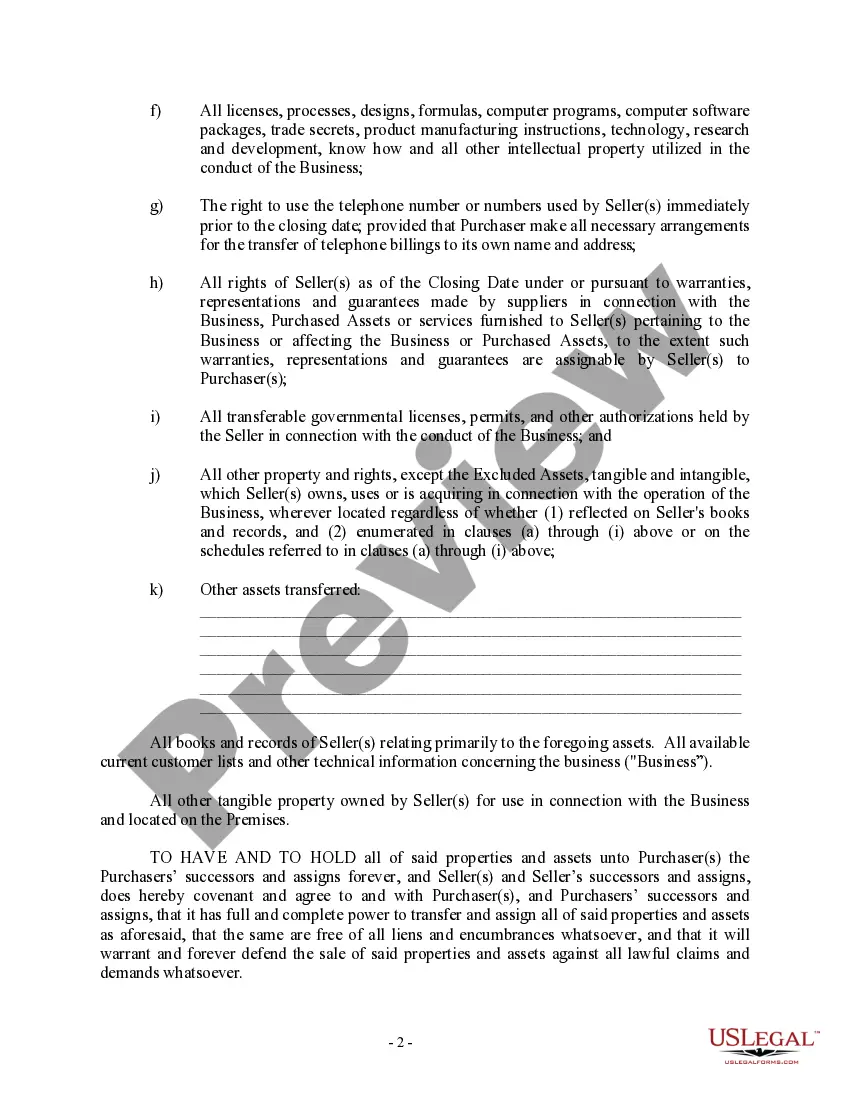

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

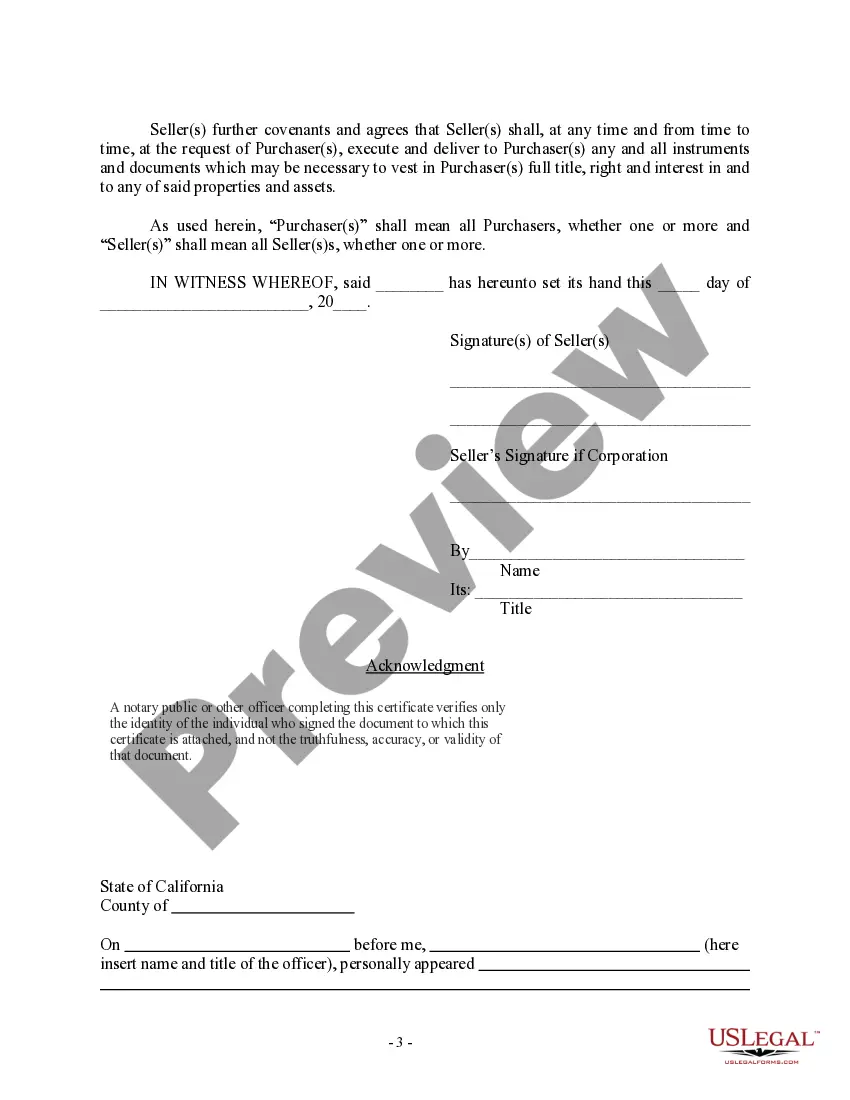

The Simi Valley California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of a business sale transaction in the city of Simi Valley, California. This document is essential for both the buyer and the seller as it provides a record of the transaction and protects their rights and interests. A Simi Valley California Bill of Sale typically includes the following information: 1. Parties Involved: The names, addresses, and contact information of both the buyer and the seller are stated in the document. 2. Business Details: The bill of sale specifies the name, location, and description of the business being sold. It may also include information about the business's assets, inventory, contracts, and any intellectual property involved. 3. Purchase Price: The agreed-upon purchase price for the business is stated explicitly in the bill of sale. It may be a lump sum amount or divided into installments, depending on the negotiation between the parties. 4. Payment Terms: The bill of sale outlines the payment terms, including any down payment, financing arrangements, or contingencies. It may also include provisions for escrow accounts or hold backs to ensure a smooth transition of ownership. 5. Representations and Warranties: The seller typically provides certain representations and warranties regarding the business being sold. These statements assure the buyer that the information provided is accurate and there are no undisclosed liabilities or issues associated with the business. 6. Closing and Transfer of Ownership: The bill of sale specifies the date of closing and the transfer of ownership. It may include a provision for a transitional period during which the seller may assist the buyer in the smooth transition of operations. Different types of Simi Valley California Bill of Sale in connection with the sale of a business by an individual or corporate seller could include: 1. Asset Sale Agreement: This type of bill of sale specifically focuses on the transfer of the business's assets, such as equipment, inventory, and intellectual property rights. 2. Stock Sale Agreement: In this scenario, the bill of sale revolves around the transfer of shares or stocks of a corporation or business entity. The buyer becomes the new owner of the business by acquiring the majority or all of the shares. 3. Membership Interest Purchase Agreement: This agreement is applicable when a limited liability company (LLC) is being sold. It involves the transfer of membership interests, indicating the buyer's ownership rights within the company. Simi Valley California Bill of Sale templates can be found online or acquired through legal service providers. It is crucial to ensure that the chosen template aligns with the specific requirements and regulations of Simi Valley, California, and should always be customized to fit the unique details of the business sale transaction.The Simi Valley California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of a business sale transaction in the city of Simi Valley, California. This document is essential for both the buyer and the seller as it provides a record of the transaction and protects their rights and interests. A Simi Valley California Bill of Sale typically includes the following information: 1. Parties Involved: The names, addresses, and contact information of both the buyer and the seller are stated in the document. 2. Business Details: The bill of sale specifies the name, location, and description of the business being sold. It may also include information about the business's assets, inventory, contracts, and any intellectual property involved. 3. Purchase Price: The agreed-upon purchase price for the business is stated explicitly in the bill of sale. It may be a lump sum amount or divided into installments, depending on the negotiation between the parties. 4. Payment Terms: The bill of sale outlines the payment terms, including any down payment, financing arrangements, or contingencies. It may also include provisions for escrow accounts or hold backs to ensure a smooth transition of ownership. 5. Representations and Warranties: The seller typically provides certain representations and warranties regarding the business being sold. These statements assure the buyer that the information provided is accurate and there are no undisclosed liabilities or issues associated with the business. 6. Closing and Transfer of Ownership: The bill of sale specifies the date of closing and the transfer of ownership. It may include a provision for a transitional period during which the seller may assist the buyer in the smooth transition of operations. Different types of Simi Valley California Bill of Sale in connection with the sale of a business by an individual or corporate seller could include: 1. Asset Sale Agreement: This type of bill of sale specifically focuses on the transfer of the business's assets, such as equipment, inventory, and intellectual property rights. 2. Stock Sale Agreement: In this scenario, the bill of sale revolves around the transfer of shares or stocks of a corporation or business entity. The buyer becomes the new owner of the business by acquiring the majority or all of the shares. 3. Membership Interest Purchase Agreement: This agreement is applicable when a limited liability company (LLC) is being sold. It involves the transfer of membership interests, indicating the buyer's ownership rights within the company. Simi Valley California Bill of Sale templates can be found online or acquired through legal service providers. It is crucial to ensure that the chosen template aligns with the specific requirements and regulations of Simi Valley, California, and should always be customized to fit the unique details of the business sale transaction.