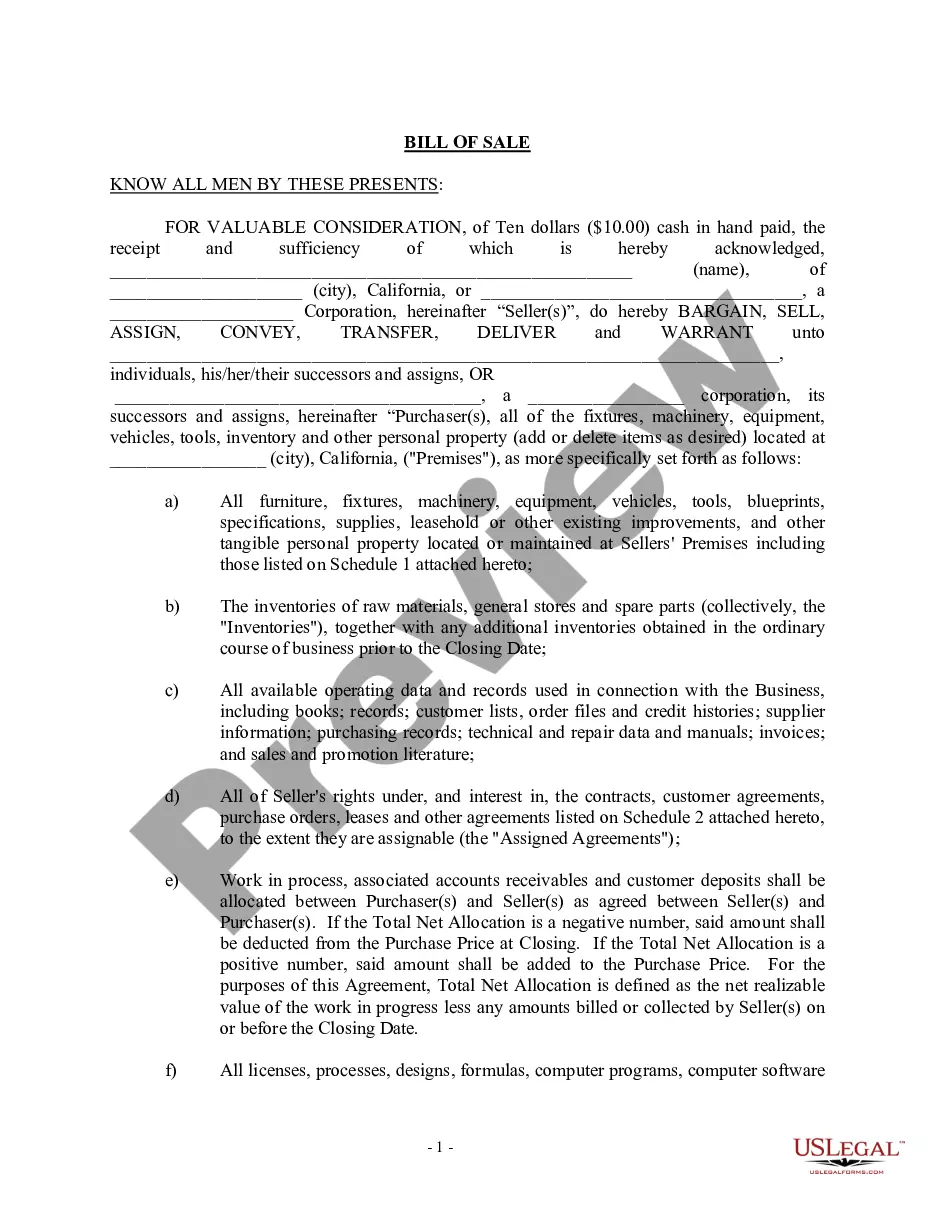

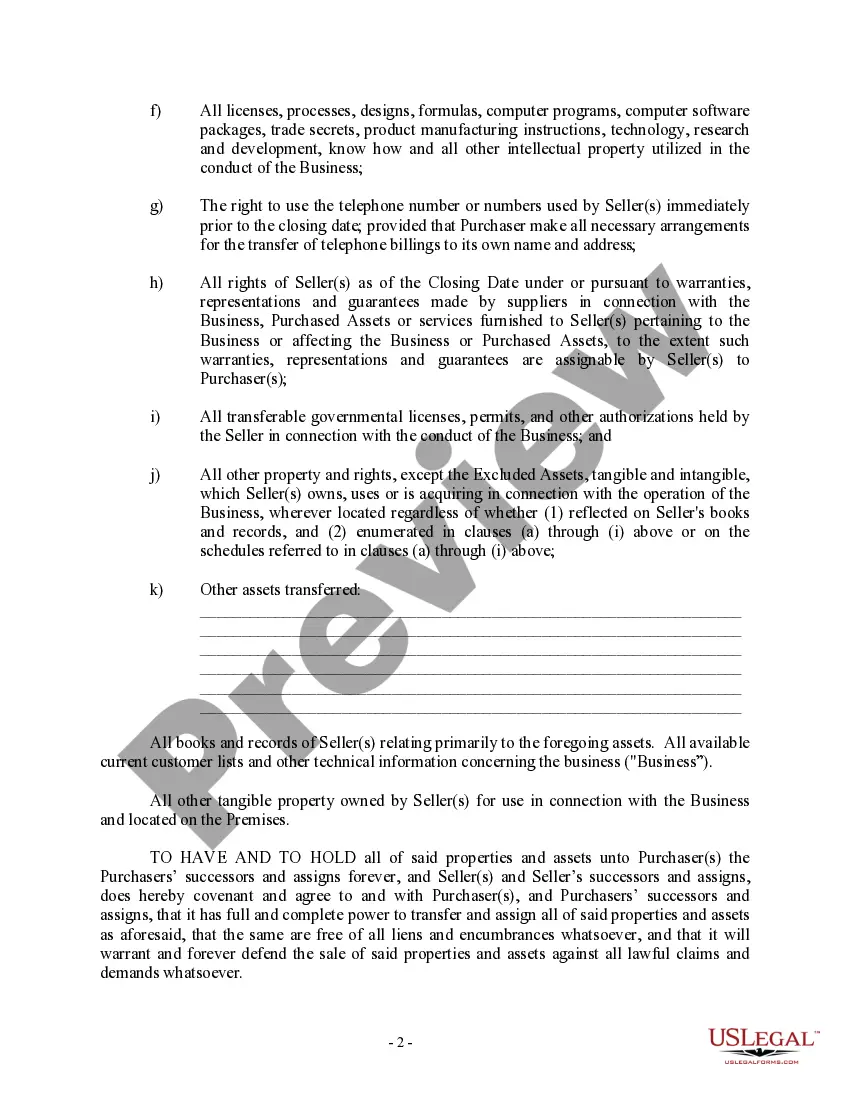

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

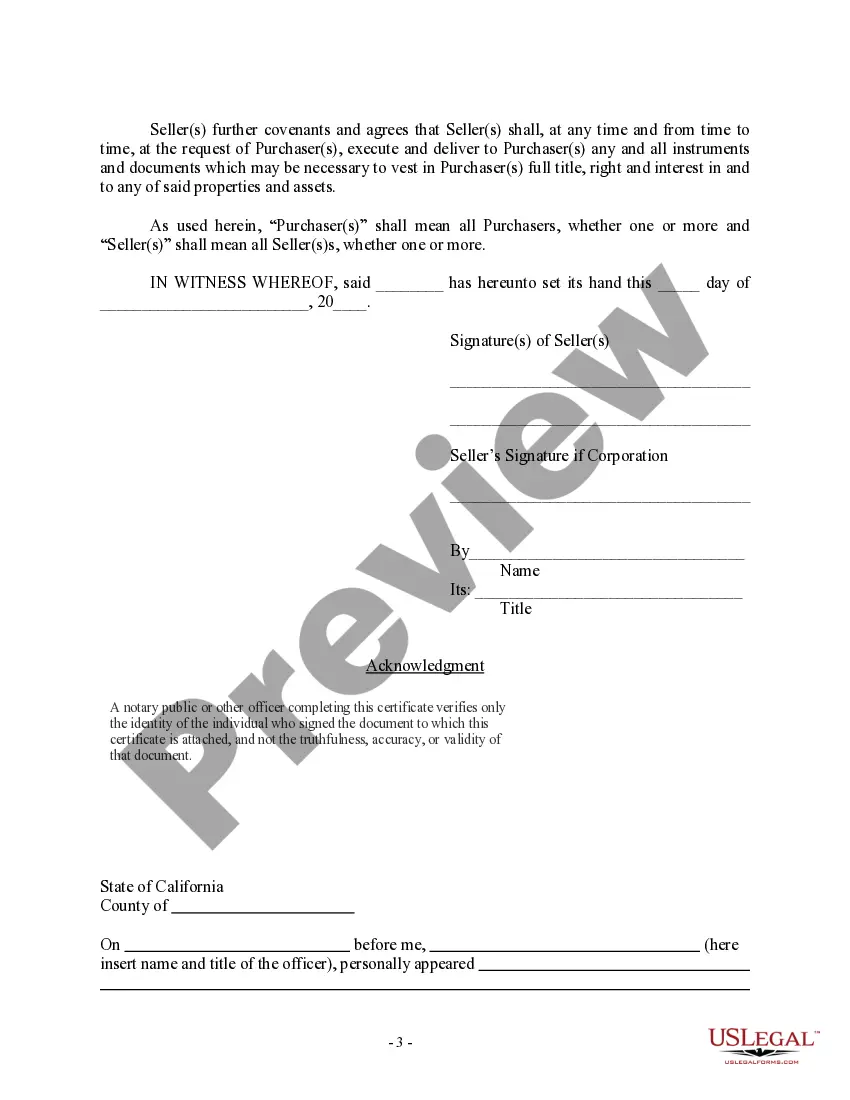

The Stockton California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of the sale. It acts as proof of ownership transfer and ensures transparency between the buyer and seller. This bill of sale typically includes vital information such as the names and contact details of both parties involved, the date of the transaction, and a detailed description of the business being sold, including assets, trademarks, and any licenses or permits associated with it. It also highlights the purchase price, payment terms, and any contingencies agreed upon, such as financing or seller financing arrangements. Different types of Stockton California Bill of Sale in connection with the sale of a business by an individual or corporate seller may include: 1. Asset Purchase Agreement: This type of bill of sale focuses on the transfer of particular assets rather than the entire business. It allows the buyer to select specific assets they wish to acquire, such as equipment, inventory, or intellectual property. 2. Stock Purchase Agreement: In this type of bill of sale, the buyer purchases shares or stocks of the business rather than its assets. It entails a transfer of ownership and control of the entire business, including its liabilities and obligations. 3. Business Purchase Agreement: This broader form of bill of sale encompasses the sale of the entire business, including its assets, stocks, liabilities, and contracts. It provides a comprehensive transfer of ownership from the seller to the buyer. 4. Confidentiality Agreement: This type of agreement is often included alongside the bill of sale to protect sensitive and confidential information shared during the negotiation and due diligence process. It ensures that both parties maintain confidentiality and refrain from disclosing any proprietary information learned during the sale process. 5. Non-Compete Agreement: This agreement prevents the seller from engaging in similar business activities that directly compete with the one sold, within a specified timeframe and geographical area. It protects the buyer's interests and the value of the business being purchased. When drafting a Stockton California Bill of Sale in connection with the sale of a business, it is advisable to consult with legal professionals specializing in business transactions to ensure all necessary provisions are included and both parties are adequately protected.The Stockton California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legally binding document that outlines the terms and conditions of the sale. It acts as proof of ownership transfer and ensures transparency between the buyer and seller. This bill of sale typically includes vital information such as the names and contact details of both parties involved, the date of the transaction, and a detailed description of the business being sold, including assets, trademarks, and any licenses or permits associated with it. It also highlights the purchase price, payment terms, and any contingencies agreed upon, such as financing or seller financing arrangements. Different types of Stockton California Bill of Sale in connection with the sale of a business by an individual or corporate seller may include: 1. Asset Purchase Agreement: This type of bill of sale focuses on the transfer of particular assets rather than the entire business. It allows the buyer to select specific assets they wish to acquire, such as equipment, inventory, or intellectual property. 2. Stock Purchase Agreement: In this type of bill of sale, the buyer purchases shares or stocks of the business rather than its assets. It entails a transfer of ownership and control of the entire business, including its liabilities and obligations. 3. Business Purchase Agreement: This broader form of bill of sale encompasses the sale of the entire business, including its assets, stocks, liabilities, and contracts. It provides a comprehensive transfer of ownership from the seller to the buyer. 4. Confidentiality Agreement: This type of agreement is often included alongside the bill of sale to protect sensitive and confidential information shared during the negotiation and due diligence process. It ensures that both parties maintain confidentiality and refrain from disclosing any proprietary information learned during the sale process. 5. Non-Compete Agreement: This agreement prevents the seller from engaging in similar business activities that directly compete with the one sold, within a specified timeframe and geographical area. It protects the buyer's interests and the value of the business being purchased. When drafting a Stockton California Bill of Sale in connection with the sale of a business, it is advisable to consult with legal professionals specializing in business transactions to ensure all necessary provisions are included and both parties are adequately protected.