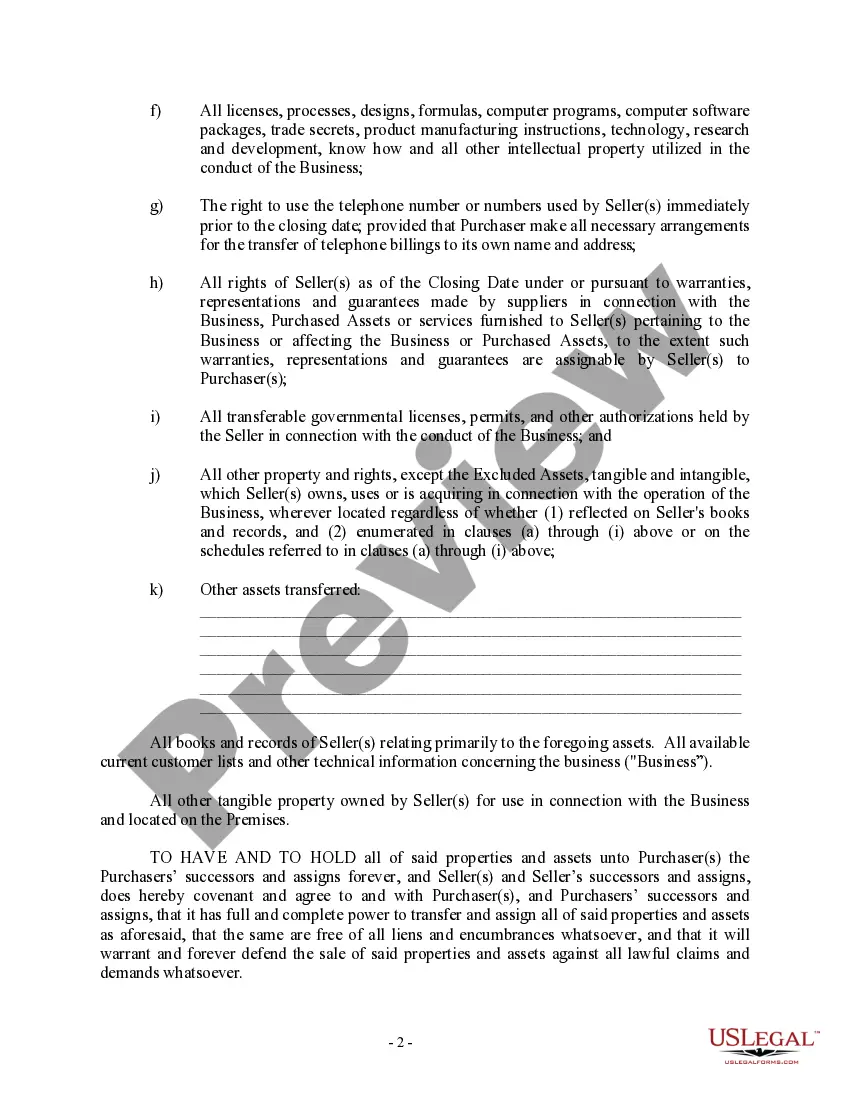

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

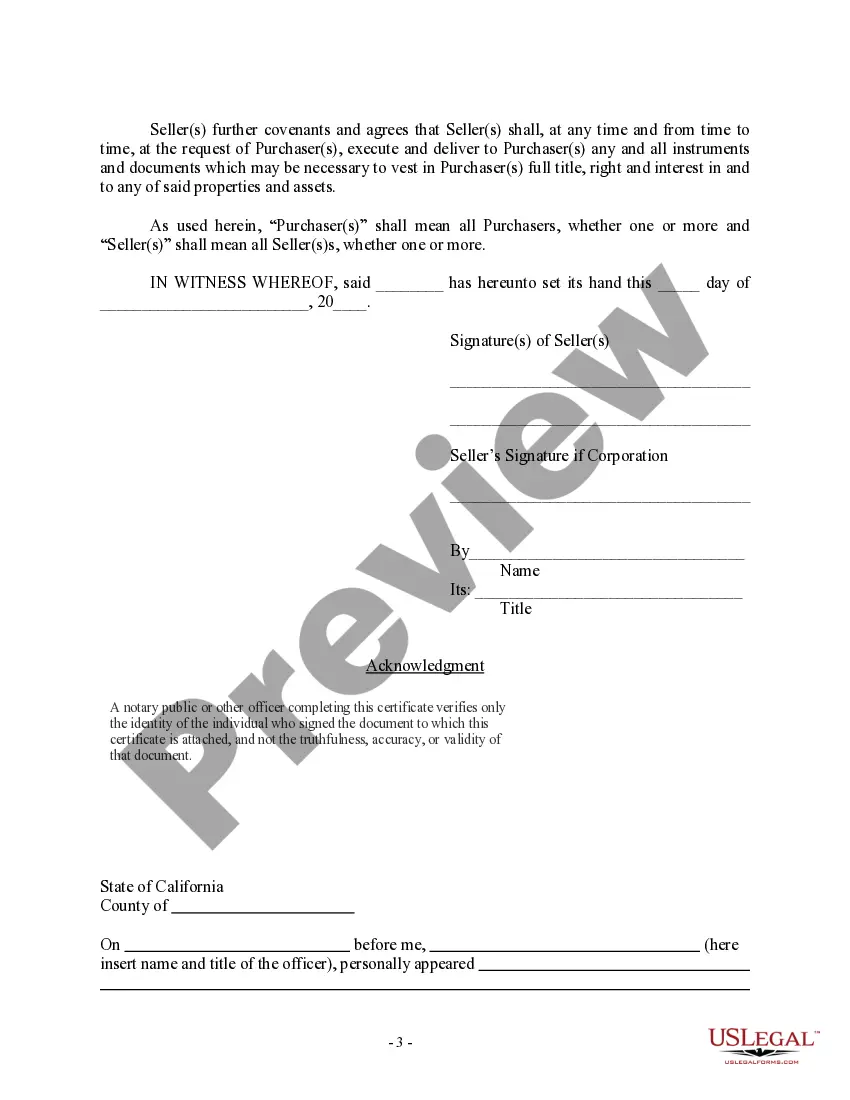

The Temecula California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that serves as proof of the transfer of ownership from the seller to the buyer. It outlines the terms and conditions of the sale, ensuring both parties are aware of their rights and obligations. Keywords: Temecula California, Bill of Sale, sale of business, individual seller, corporate seller, transfer of ownership, legal document, terms and conditions. Types of Temecula California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller: 1. Asset Purchase Agreement: This type of bill of sale focuses on the transfer of specific business assets such as equipment, inventory, property, or intellectual property rights from the seller to the buyer. It includes detailed descriptions of the assets, their condition, and any warranties or guarantees provided by the seller. 2. Stock Purchase Agreement: This bill of sale pertains to the sale of corporate shares or stock certificates from the seller to the buyer. It outlines the number and type of shares being sold, the purchase price, any restrictions on the transfer of shares, and the rights and benefits associated with the ownership of the stock. 3. Business Purchase Agreement: This comprehensive bill of sale covers the sale of an entire business, including its assets, liabilities, contracts, and goodwill. It outlines the agreed purchase price, payment terms, responsibilities of both parties during the transition, and any warranties provided by the seller regarding the business's financial condition and legal compliance. 4. Goodwill Purchase Agreement: This type of bill of sale focuses primarily on the transfer of the intangible asset known as goodwill, which refers to the established reputation, customer base, and business relationships of the seller. It details the agreed value of goodwill, the scope of the transfer, and any restrictions or conditions associated with it. 5. Intellectual Property Assignment Agreement: In cases where the business sale involves the transfer of intellectual property rights, this bill of sale outlines the specifics of the intellectual property being sold. It includes details on trademarks, patents, copyrights, trade secrets, or licensing agreements, and ensures the buyer receives full ownership rights. Regardless of the type of bill of sale used, it is crucial to consult with a lawyer or legal professional well-versed in California business laws to ensure compliance and protect the interests of both the buyer and the seller.The Temecula California Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that serves as proof of the transfer of ownership from the seller to the buyer. It outlines the terms and conditions of the sale, ensuring both parties are aware of their rights and obligations. Keywords: Temecula California, Bill of Sale, sale of business, individual seller, corporate seller, transfer of ownership, legal document, terms and conditions. Types of Temecula California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller: 1. Asset Purchase Agreement: This type of bill of sale focuses on the transfer of specific business assets such as equipment, inventory, property, or intellectual property rights from the seller to the buyer. It includes detailed descriptions of the assets, their condition, and any warranties or guarantees provided by the seller. 2. Stock Purchase Agreement: This bill of sale pertains to the sale of corporate shares or stock certificates from the seller to the buyer. It outlines the number and type of shares being sold, the purchase price, any restrictions on the transfer of shares, and the rights and benefits associated with the ownership of the stock. 3. Business Purchase Agreement: This comprehensive bill of sale covers the sale of an entire business, including its assets, liabilities, contracts, and goodwill. It outlines the agreed purchase price, payment terms, responsibilities of both parties during the transition, and any warranties provided by the seller regarding the business's financial condition and legal compliance. 4. Goodwill Purchase Agreement: This type of bill of sale focuses primarily on the transfer of the intangible asset known as goodwill, which refers to the established reputation, customer base, and business relationships of the seller. It details the agreed value of goodwill, the scope of the transfer, and any restrictions or conditions associated with it. 5. Intellectual Property Assignment Agreement: In cases where the business sale involves the transfer of intellectual property rights, this bill of sale outlines the specifics of the intellectual property being sold. It includes details on trademarks, patents, copyrights, trade secrets, or licensing agreements, and ensures the buyer receives full ownership rights. Regardless of the type of bill of sale used, it is crucial to consult with a lawyer or legal professional well-versed in California business laws to ensure compliance and protect the interests of both the buyer and the seller.