This is a Commercial Lease Application for a Lessor to have the proposed Lessee sign. It contains required disclosures and an authorization for release of information. A commercial lease is a detailed written agreement for the rental by a tenant of commercial property owned by the landlord. Commercial property differs from residential property in that the property's primary or only use is commercial (business oriented), rather than serving as a residence. Commercial leases are often more complex than residential leases, have longer lease terms, and may provide for the rental price to be tied to the tenant business's profitability or other factors, rather than a uniform monthly payment (though this is also quite ordinary in commercial leases).

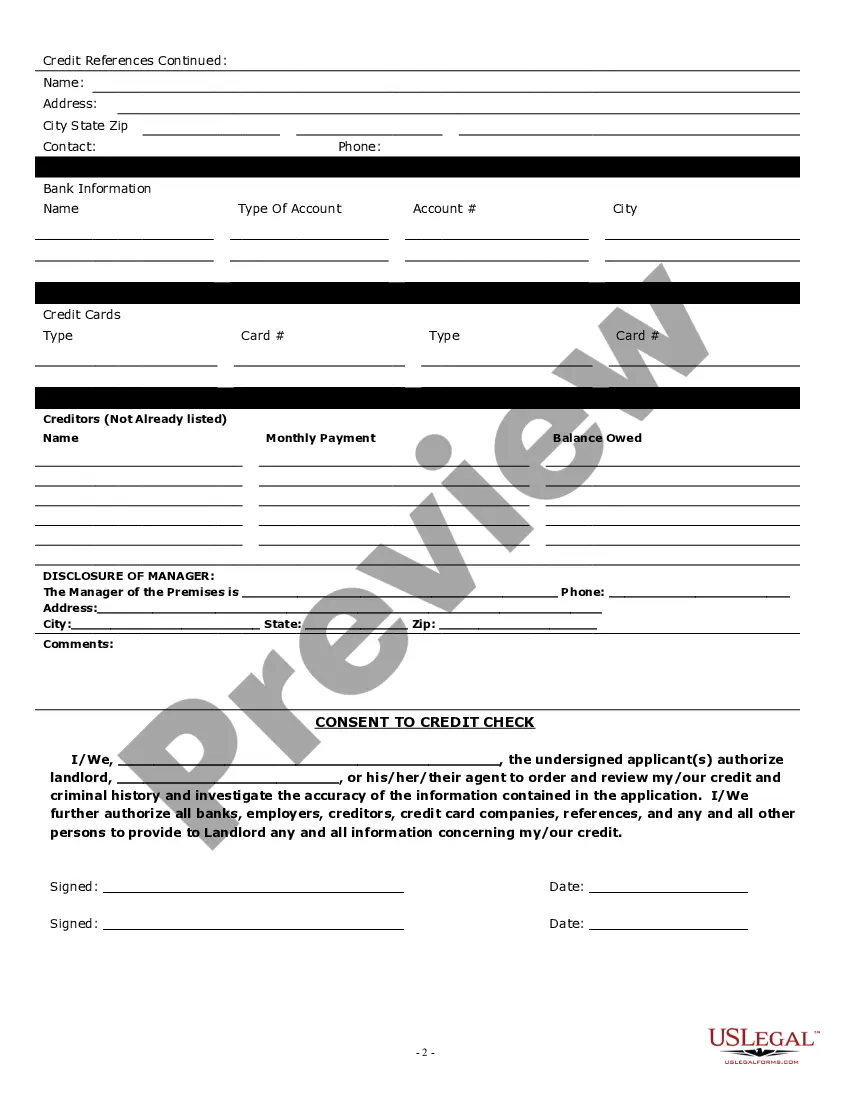

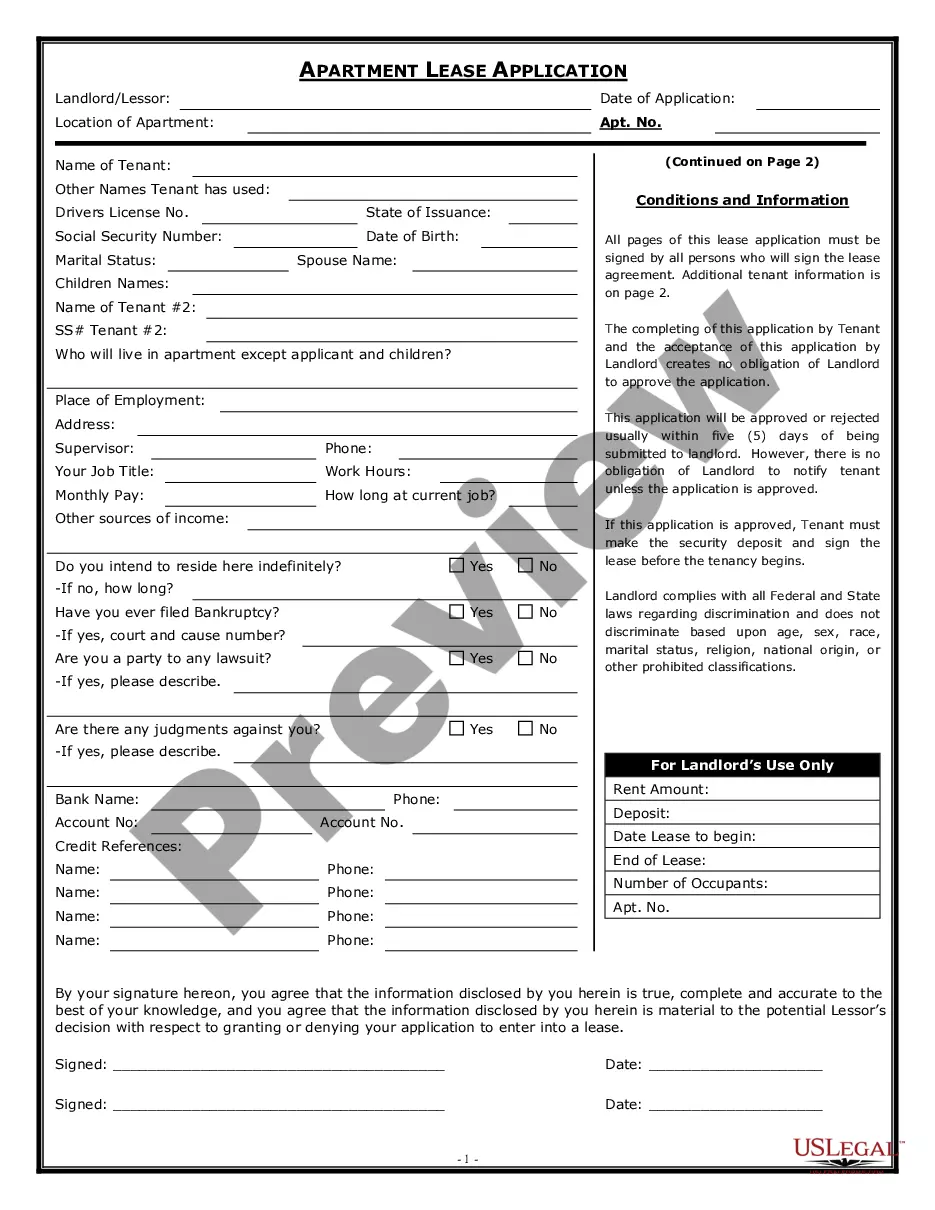

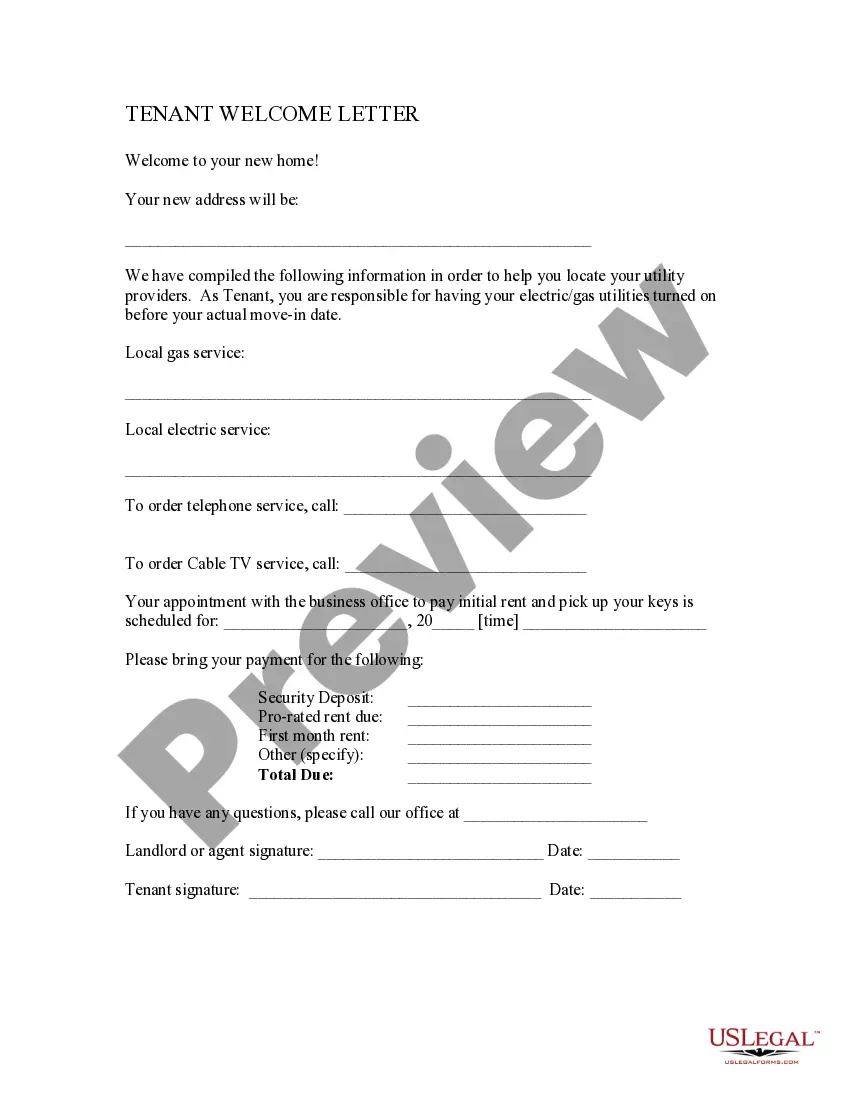

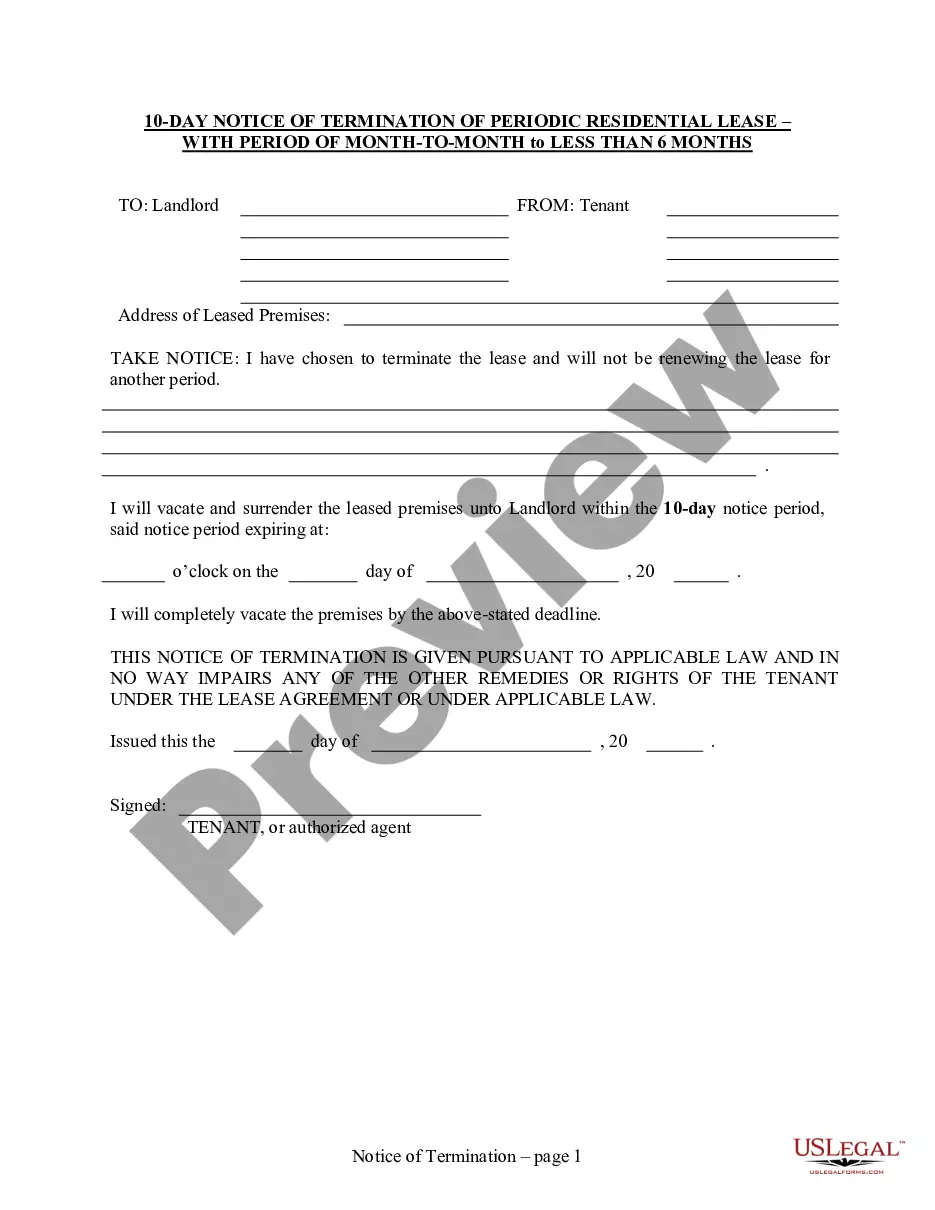

Norwalk California Commercial Rental Lease Application is a comprehensive document used by landlords or property management companies to screen potential commercial tenants before leasing their properties. This application typically asks for detailed information about the business, its financial stability, references, and other relevant details. It serves as a tool to evaluate the suitability of a tenant for a specific Norwalk, California commercial property. The Norwalk California Commercial Rental Lease Application may include the following sections: 1. Tenant Information: This section gathers basic details about the business, including the legal name, contact information, and taxpayer identification number. It may also request information about the business structure (e.g., corporation, partnership, sole proprietorship) and the number of employees. 2. Business History: This part focuses on the business's history, such as the date of establishment, previous locations, and reasons for relocation. Additionally, it may request information about the previous landlords and leases. 3. Financial Information: Landlords need to assess the financial stability of potential tenants. This section usually includes questions about the business's annual revenue, bank references, credit references, and financial statements. Proof of financial health, such as tax returns or bank statements, may also be required. 4. Lease Details: This section captures the specifics of the proposed lease agreement, including the desired lease term, rental amount, security deposit, utilities and maintenance responsibilities, and any special conditions or requirements. 5. Personal Guarantor: In some cases, landlords may request a personal guarantor to ensure rent payment in case the tenant defaults. This section gathers information about the guarantor's personal and financial background. 6. References: This section typically requires the tenant to provide references from previous landlords, suppliers, or other business contacts who can vouch for their reliability and responsibility as a tenant. 7. Legal Disclosures: Various legal disclosures and consent forms may be included as part of the application, notifying the tenant of their rights and responsibilities, such as obtaining credit reports or conducting background checks. While there may not be different types of Norwalk California Commercial Rental Lease Applications, landlords or property management companies may customize the application to fit specific property requirements or include additional clauses. It is important for potential tenants to carefully review the application, provide accurate information, and seek legal advice if needed before submitting the document.Norwalk California Commercial Rental Lease Application is a comprehensive document used by landlords or property management companies to screen potential commercial tenants before leasing their properties. This application typically asks for detailed information about the business, its financial stability, references, and other relevant details. It serves as a tool to evaluate the suitability of a tenant for a specific Norwalk, California commercial property. The Norwalk California Commercial Rental Lease Application may include the following sections: 1. Tenant Information: This section gathers basic details about the business, including the legal name, contact information, and taxpayer identification number. It may also request information about the business structure (e.g., corporation, partnership, sole proprietorship) and the number of employees. 2. Business History: This part focuses on the business's history, such as the date of establishment, previous locations, and reasons for relocation. Additionally, it may request information about the previous landlords and leases. 3. Financial Information: Landlords need to assess the financial stability of potential tenants. This section usually includes questions about the business's annual revenue, bank references, credit references, and financial statements. Proof of financial health, such as tax returns or bank statements, may also be required. 4. Lease Details: This section captures the specifics of the proposed lease agreement, including the desired lease term, rental amount, security deposit, utilities and maintenance responsibilities, and any special conditions or requirements. 5. Personal Guarantor: In some cases, landlords may request a personal guarantor to ensure rent payment in case the tenant defaults. This section gathers information about the guarantor's personal and financial background. 6. References: This section typically requires the tenant to provide references from previous landlords, suppliers, or other business contacts who can vouch for their reliability and responsibility as a tenant. 7. Legal Disclosures: Various legal disclosures and consent forms may be included as part of the application, notifying the tenant of their rights and responsibilities, such as obtaining credit reports or conducting background checks. While there may not be different types of Norwalk California Commercial Rental Lease Applications, landlords or property management companies may customize the application to fit specific property requirements or include additional clauses. It is important for potential tenants to carefully review the application, provide accurate information, and seek legal advice if needed before submitting the document.