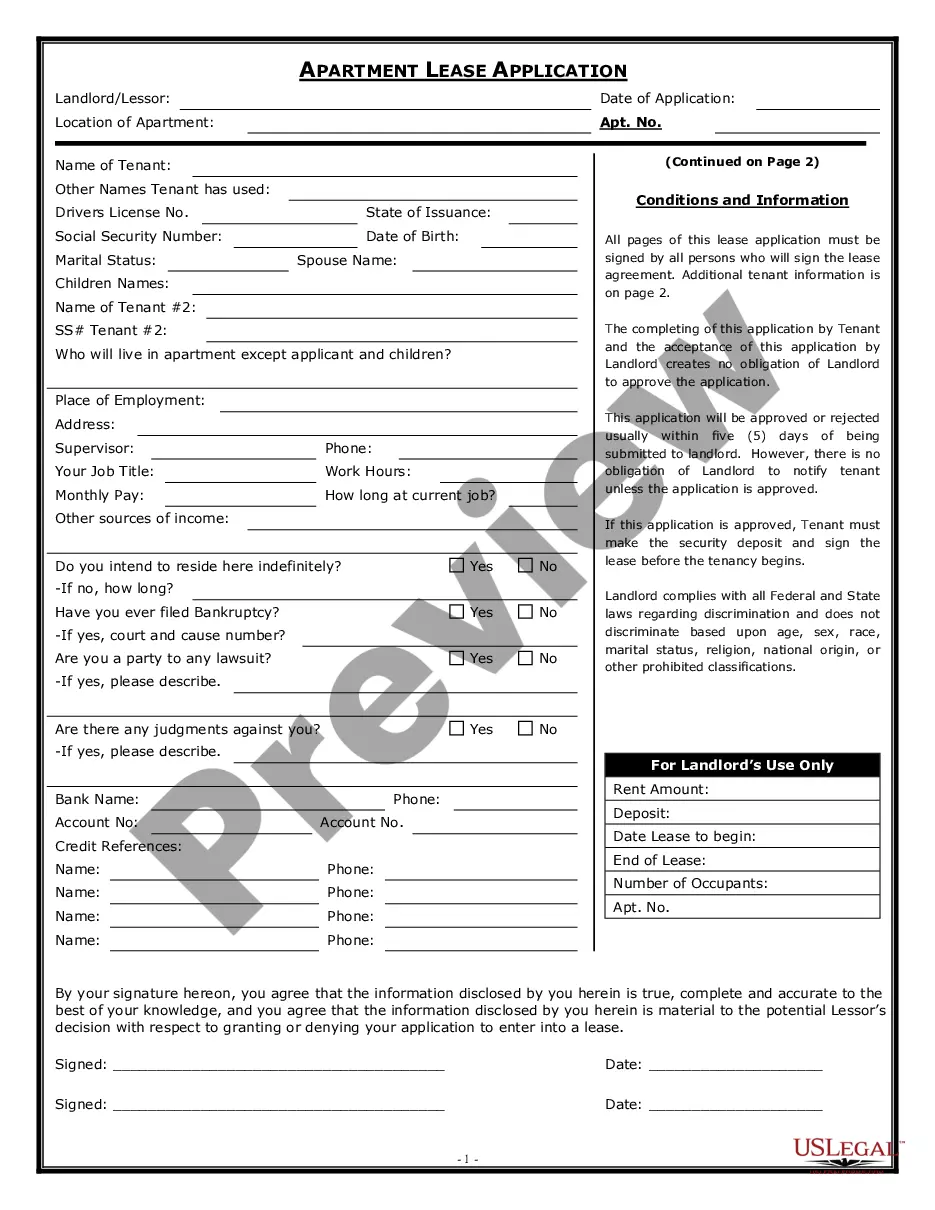

This is a Commercial Lease Application for a Lessor to have the proposed Lessee sign. It contains required disclosures and an authorization for release of information. A commercial lease is a detailed written agreement for the rental by a tenant of commercial property owned by the landlord. Commercial property differs from residential property in that the property's primary or only use is commercial (business oriented), rather than serving as a residence. Commercial leases are often more complex than residential leases, have longer lease terms, and may provide for the rental price to be tied to the tenant business's profitability or other factors, rather than a uniform monthly payment (though this is also quite ordinary in commercial leases).

San Bernardino California is a vibrant city known for its commercial opportunities and thriving business environment. If you are a commercial property owner or a prospective tenant looking to lease a commercial space in this city, understanding the San Bernardino California Commercial Rental Lease Application becomes crucial. This detailed description aims to explain the key aspects and requirements of this application, including different types of lease applications that may exist. A San Bernardino California Commercial Rental Lease Application is a legally binding document used by property owners or managers to assess the suitability of potential tenants for their commercial properties. This application assists landlords in gathering essential details about prospective tenants, including their financial situation, business history, and contact information. It serves as a significant tool in the tenant screening process and helps landlords make informed decisions about whom to lease their properties to. The application starts with basic tenant information such as the name of the business, contact information (including email address, phone number, and mailing address), and any DBA (Doing Business As) or corporation name, if applicable. Furthermore, details about the type of business, industry, and length of time in operation are typically requested. Financial background information is also a crucial part of the San Bernardino California Commercial Rental Lease Application. Applicants are required to provide their credit history, including credit scores, bankruptcy history, and outstanding debts. In some cases, supporting documents like bank statements, profit and loss statements, and tax returns may be requested to validate the financial stability of the business. Additionally, a comprehensive leasing application may also require references, both personal and professional, to give the landlord a clear idea of the applicant's character and reliability. References could include previous landlords, business partners, or other professional contacts who can vouch for the applicant's credibility and business ethics. While the core components of a San Bernardino California Commercial Rental Lease Application remain similar, there might be variations based on the type of lease being applied for. Some common types of commercial leases include: 1. Full-Service Lease: This type includes a single rental payment that covers not only the rent but also additional costs such as utilities, maintenance fees, property taxes, insurance, and more. 2. Net Lease: With a net lease, tenants are responsible for additional expenses like property taxes, insurance, and maintenance in addition to the base rent. 3. Percentage Lease: Mainly used for retail spaces, a percentage lease requires the tenant to pay a base rent along with a percentage of their gross sales. 4. Modified Gross Lease: In this type, the landlord shares expenses such as taxes, insurance, and maintenance with the tenant, while the tenant pays a flat rate for utilities. It is essential for both landlords and tenants to understand the specific lease type being applied for and tailor the San Bernardino California Commercial Rental Lease Application accordingly. In conclusion, the San Bernardino California Commercial Rental Lease Application serves as a vital tool for property owners to evaluate prospective tenants and make informed decisions. By collecting comprehensive information about the tenant's financial background, business history, and references, this application helps landlords ensure they select a reliable and responsible tenant to occupy their commercial property. It is important to recognize the different types of commercial leases and customize the application accordingly to cater to specific lease requirements.San Bernardino California is a vibrant city known for its commercial opportunities and thriving business environment. If you are a commercial property owner or a prospective tenant looking to lease a commercial space in this city, understanding the San Bernardino California Commercial Rental Lease Application becomes crucial. This detailed description aims to explain the key aspects and requirements of this application, including different types of lease applications that may exist. A San Bernardino California Commercial Rental Lease Application is a legally binding document used by property owners or managers to assess the suitability of potential tenants for their commercial properties. This application assists landlords in gathering essential details about prospective tenants, including their financial situation, business history, and contact information. It serves as a significant tool in the tenant screening process and helps landlords make informed decisions about whom to lease their properties to. The application starts with basic tenant information such as the name of the business, contact information (including email address, phone number, and mailing address), and any DBA (Doing Business As) or corporation name, if applicable. Furthermore, details about the type of business, industry, and length of time in operation are typically requested. Financial background information is also a crucial part of the San Bernardino California Commercial Rental Lease Application. Applicants are required to provide their credit history, including credit scores, bankruptcy history, and outstanding debts. In some cases, supporting documents like bank statements, profit and loss statements, and tax returns may be requested to validate the financial stability of the business. Additionally, a comprehensive leasing application may also require references, both personal and professional, to give the landlord a clear idea of the applicant's character and reliability. References could include previous landlords, business partners, or other professional contacts who can vouch for the applicant's credibility and business ethics. While the core components of a San Bernardino California Commercial Rental Lease Application remain similar, there might be variations based on the type of lease being applied for. Some common types of commercial leases include: 1. Full-Service Lease: This type includes a single rental payment that covers not only the rent but also additional costs such as utilities, maintenance fees, property taxes, insurance, and more. 2. Net Lease: With a net lease, tenants are responsible for additional expenses like property taxes, insurance, and maintenance in addition to the base rent. 3. Percentage Lease: Mainly used for retail spaces, a percentage lease requires the tenant to pay a base rent along with a percentage of their gross sales. 4. Modified Gross Lease: In this type, the landlord shares expenses such as taxes, insurance, and maintenance with the tenant, while the tenant pays a flat rate for utilities. It is essential for both landlords and tenants to understand the specific lease type being applied for and tailor the San Bernardino California Commercial Rental Lease Application accordingly. In conclusion, the San Bernardino California Commercial Rental Lease Application serves as a vital tool for property owners to evaluate prospective tenants and make informed decisions. By collecting comprehensive information about the tenant's financial background, business history, and references, this application helps landlords ensure they select a reliable and responsible tenant to occupy their commercial property. It is important to recognize the different types of commercial leases and customize the application accordingly to cater to specific lease requirements.