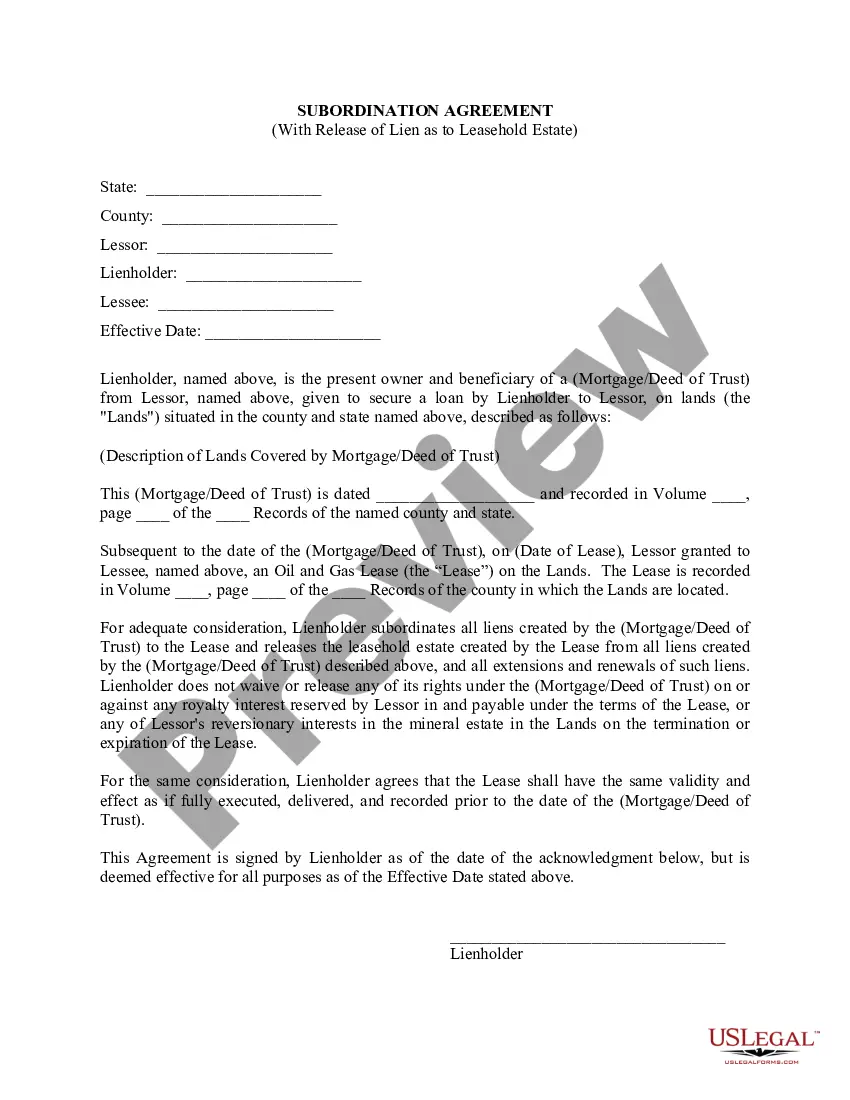

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

A Jurupa Valley California Lease Subordination Agreement is a legally binding document used to establish the priorities of various liens on a leased property. It is commonly utilized in real estate transactions, particularly when a tenant wishes to secure financing secured by the property. This agreement outlines the relationship between the landlord, tenant, and lender, and specifies the conditions under which the tenant's leasehold interest will be subordinated to the lender's lien. The purpose of a Jurupa Valley California Lease Subordination Agreement is to ensure that the lender's lien takes priority over the tenant's leasehold interest in the event of default or foreclosure. By subordinating their lease, the tenant acknowledges that the lender's rights and interests in the property supersede their own. This arrangement is often required by lenders to minimize the risk associated with the secondary interests on the property. There are different types of Jurupa Valley California Lease Subordination Agreements, each serving specific purposes. The most common types include: 1. Commercial Lease Subordination Agreement: This type of agreement applies to commercial properties and allows tenants to continue leasing the property while ensuring their lease is subordinate to the lender's lien. 2. Residential Lease Subordination Agreement: Used primarily for residential properties, this agreement permits tenants to maintain their lease arrangement while recognizing the priority of the lender's lien in case of default or foreclosure. 3. Stand-Alone Leasehold Subordination Agreement: This agreement is typically used when a lease already exists, and a tenant is seeking financing against their leasehold interest. It establishes the priority of the lender's lien and subordinates the tenant's lease accordingly. 4. Master Lease Subordination Agreement: In situations where there is a master lease, this agreement establishes the priority of the lender's lien over all subordinate leases under the master lease structure. 5. Estoppel and Subordination Agreement: This agreement is a combination of an estoppel certificate, which confirms the lease terms, and a subordination agreement, which outlines the lease's priority to the lender's lien. It provides a comprehensive understanding of the lease arrangement and its relationship with the financing. Overall, a Jurupa Valley California Lease Subordination Agreement is a crucial document in real estate transactions that helps protect the interests of both landlords and lenders. It clarifies the priority of liens on leased properties and ensures the smooth execution of financing arrangements while maintaining the leasehold interest of tenants.A Jurupa Valley California Lease Subordination Agreement is a legally binding document used to establish the priorities of various liens on a leased property. It is commonly utilized in real estate transactions, particularly when a tenant wishes to secure financing secured by the property. This agreement outlines the relationship between the landlord, tenant, and lender, and specifies the conditions under which the tenant's leasehold interest will be subordinated to the lender's lien. The purpose of a Jurupa Valley California Lease Subordination Agreement is to ensure that the lender's lien takes priority over the tenant's leasehold interest in the event of default or foreclosure. By subordinating their lease, the tenant acknowledges that the lender's rights and interests in the property supersede their own. This arrangement is often required by lenders to minimize the risk associated with the secondary interests on the property. There are different types of Jurupa Valley California Lease Subordination Agreements, each serving specific purposes. The most common types include: 1. Commercial Lease Subordination Agreement: This type of agreement applies to commercial properties and allows tenants to continue leasing the property while ensuring their lease is subordinate to the lender's lien. 2. Residential Lease Subordination Agreement: Used primarily for residential properties, this agreement permits tenants to maintain their lease arrangement while recognizing the priority of the lender's lien in case of default or foreclosure. 3. Stand-Alone Leasehold Subordination Agreement: This agreement is typically used when a lease already exists, and a tenant is seeking financing against their leasehold interest. It establishes the priority of the lender's lien and subordinates the tenant's lease accordingly. 4. Master Lease Subordination Agreement: In situations where there is a master lease, this agreement establishes the priority of the lender's lien over all subordinate leases under the master lease structure. 5. Estoppel and Subordination Agreement: This agreement is a combination of an estoppel certificate, which confirms the lease terms, and a subordination agreement, which outlines the lease's priority to the lender's lien. It provides a comprehensive understanding of the lease arrangement and its relationship with the financing. Overall, a Jurupa Valley California Lease Subordination Agreement is a crucial document in real estate transactions that helps protect the interests of both landlords and lenders. It clarifies the priority of liens on leased properties and ensures the smooth execution of financing arrangements while maintaining the leasehold interest of tenants.