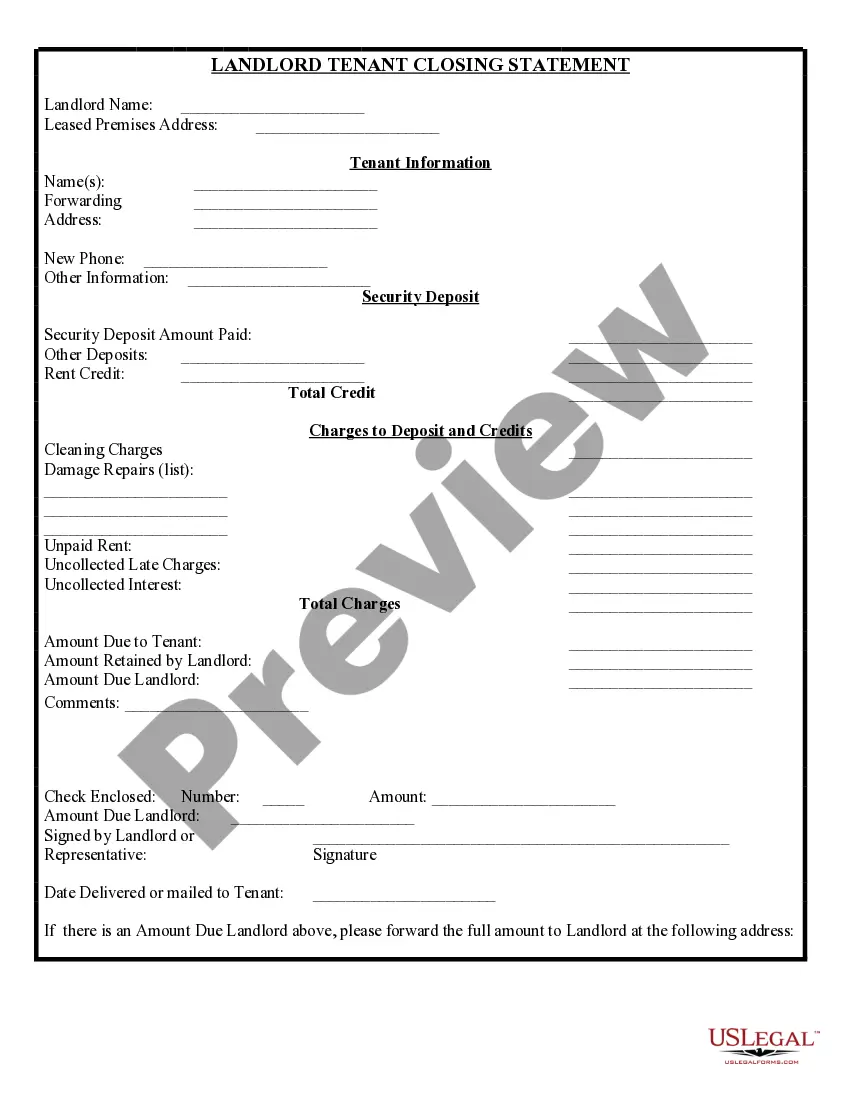

This is a Landlord Tenant Closing Statement - Reconcile Security Deposit, where the landlord records the deposits and credits, less deductions from the credits or security deposit for delivery to the tenant. It is used to document for the benefit of both parties the monies held by the landlord and due to the landlord.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

A San Diego California Landlord Tenant Closing Statement to Reconcile Security Deposit is a vital document that summarizes the financial transactions related to the security deposit at the end of a lease agreement. It serves as a record of any deductions made from the tenant's security deposit, outlines the amounts owed or refunded, and ensures transparency between the landlord and tenant. Keywords: San Diego, California, landlord, tenant, closing statement, reconcile, security deposit. There are two common types of San Diego California Landlord Tenant Closing Statements to Reconcile Security Deposit: 1. Standard Closing Statement: This type of closing statement is used when the tenant's security deposit is returned in full, without any deductions. It includes a breakdown of the original security deposit amount, any interest earned (if applicable), and the full refund to the tenant. The statement typically includes the date of the statement, the names and contact details of the landlord and tenant, the property address, and a declaration that the security deposit has been fully refunded. 2. Deduction Closing Statement: This type of closing statement is used when the landlord deducts any amounts from the tenant's security deposit to cover expenses such as unpaid rent, cleaning, repairs, or damages beyond normal wear and tear. It includes a detailed breakdown of each deduction made, including the dates, descriptions of expenses, and corresponding costs. The remaining balance after deductions is then refunded to the tenant. The statement also includes the aforementioned details, like the date, names, contact information, and property address. Regardless of the type, a San Diego California Landlord Tenant Closing Statement to Reconcile Security Deposit should adhere to the local laws and regulations regarding the return and deductions from security deposits. It should be accurate, fair, transparent, and provide a clear understanding of the financial transactions related to the security deposit.