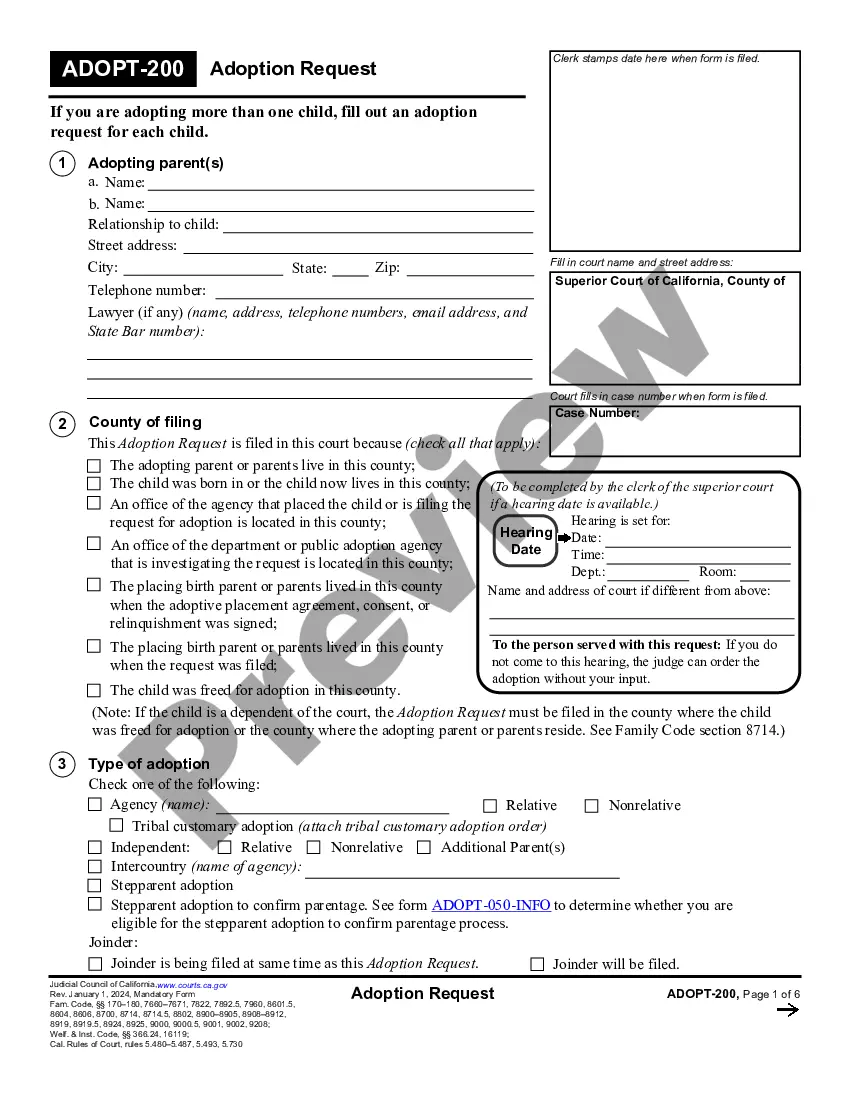

Accounting Report-Adoptions: This report lists all of the expenses incurred from adopting your child. This form is not necessary if one is adopting as a step-parent and/or domestic partner.

Thousand Oaks California Adoption Expenses

Description

How to fill out California Adoption Expenses?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial matters.

To achieve this, we seek attorney services that are typically quite expensive.

Nevertheless, not all legal issues are equally intricate.

The majority can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Thousand Oaks California Adoption Expenses or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to manage your affairs on your own without the need for legal counsel.

- We offer access to legal form templates that are not always easily accessible.

- Our templates are specifically tailored to states and regions, which greatly eases the search process.

Form popularity

FAQ

Adopting in California involves navigating various legal requirements, which can seem daunting at first. However, many families find the process manageable with proper resources and support. The complexity can arise from the need for thorough background checks and home studies. Utilizing platforms like USLegalForms can help simplify your understanding of Thousand Oaks California Adoption Expenses and streamline your journey to adoption.

The time it takes to adopt a baby in California can vary widely based on several factors. On average, the process may take anywhere from six months to two years. This timeline often includes background checks, interviews, and the final placement of the child. It’s essential to consider Thousand Oaks California Adoption Expenses as you anticipate additional costs during this process.

In California, adoption assistance typically is not subject to income tax. Therefore, if you receive assistance as part of your adoption journey in Thousand Oaks, you can use those funds to support your family without fearing tax implications. This policy is designed to provide families with more financial freedom.

Adoption assistance usually is not considered taxable income under IRS regulations. For residents of Thousand Oaks, California, this means that assistance you receive for adoption-related costs can be utilized without the worry of tax consequences. This can make adoption more financially feasible for many families.

Yes, you can write off qualified adoption expenses on your tax return. In Thousand Oaks, California, expenses such as agency fees, court costs, and travel expenses related to adoption may be eligible. This deduction helps reduce your overall tax burden and supports families through the adoption process.

Generally, adoption income is not taxable according to IRS guidelines. This means that subsidies and reimbursements you receive for adoption-related expenses in Thousand Oaks, California, will not count as taxable income. This allows adoptive parents to manage their financial responsibilities more comfortably.

On your IRS Form 1040, the adoption credit is reported on line 18 of Schedule 3. For folks in Thousand Oaks, California, ensuring you complete this correctly is important for receiving potential tax benefits. Accurate reporting helps facilitate tax refunds related to adoption expenses.

You can report your adoption expenses on your federal tax return using IRS Form 8839. In Thousand Oaks, California, it is essential to follow the guidelines for claiming the adoption tax credit and ensure all expenses are documented accurately. This allows you to maximize your benefits related to your adoption journey.

The adoption tax credit is not a direct refund; instead, it reduces your tax liability. In Thousand Oaks, California, if your tax liability is less than the credit amount, you may receive a refund for the remaining amount. This means that the adoption tax credit serves to benefit your overall tax situation.

When applying for a mortgage in Thousand Oaks, California, adoption subsidies are typically not considered as part of your income. Lenders focus more on your steady income sources such as employment. Thus, this benefit can alleviate some financial strain without affecting your mortgage qualifications.