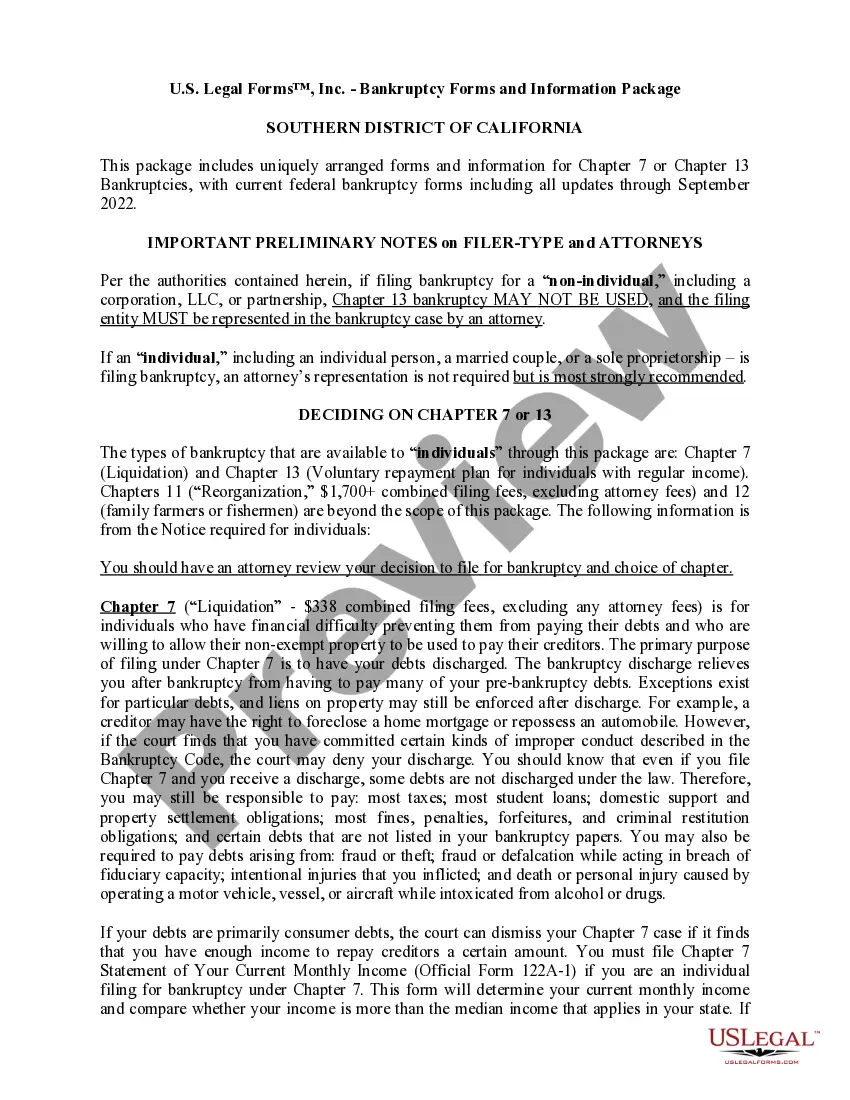

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

If you are considering filing for bankruptcy in the Irvine, California Central District, it is essential to understand the intricacies and requirements of the process. To help individuals navigate through Chapter 7 or Chapter 13 bankruptcy proceedings, various Irvine California Central District Bankruptcy Guide and Forms Packages are available. These comprehensive packages provide individuals with the necessary resources and documentation to successfully navigate bankruptcy proceedings. The Irvine California Central District Bankruptcy Guide and Forms Package for Chapter 7 is designed specifically for individuals seeking relief through liquidation bankruptcy. With this package, you will receive a detailed guide on the Chapter 7 process, including eligibility requirements, asset exemptions, and necessary forms. It ensures that you have access to all the necessary forms required to file your bankruptcy petition accurately. On the other hand, the Irvine California Central District Bankruptcy Guide and Forms Package for Chapter 13 caters to individuals who wish to reorganize their debts and establish a repayment plan. This package includes a comprehensive guide on Chapter 13 bankruptcy, explaining eligibility criteria, debt limits, and the repayment plan process. It also provides all the essential forms needed to file a Chapter 13 bankruptcy petition. Both packages offer detailed instructions and step-by-step guidance to simplify the bankruptcy process for individuals residing in the Irvine, California Central District. They cover aspects such as financial documentation requirements, credit counseling requirements, and the different stages of the bankruptcy process. By utilizing these packages, individuals can take control of their financial situation and make informed decisions about their bankruptcy options. Whether you opt for Chapter 7 or Chapter 13 bankruptcy, having a comprehensive guide and the necessary forms will ensure that you comply with all legal requirements and maximize the chances of a successful outcome. In conclusion, the Irvine California Central District Bankruptcy Guide and Forms Packages for Chapters 7 or 13 are invaluable resources for individuals considering bankruptcy. By providing comprehensive guides and necessary documentation, these packages assist individuals in navigating the intricate bankruptcy process successfully. Whether you are seeking liquidation or reorganization, these packages help you meet all the requirements and ensure a smoother journey towards financial relief.