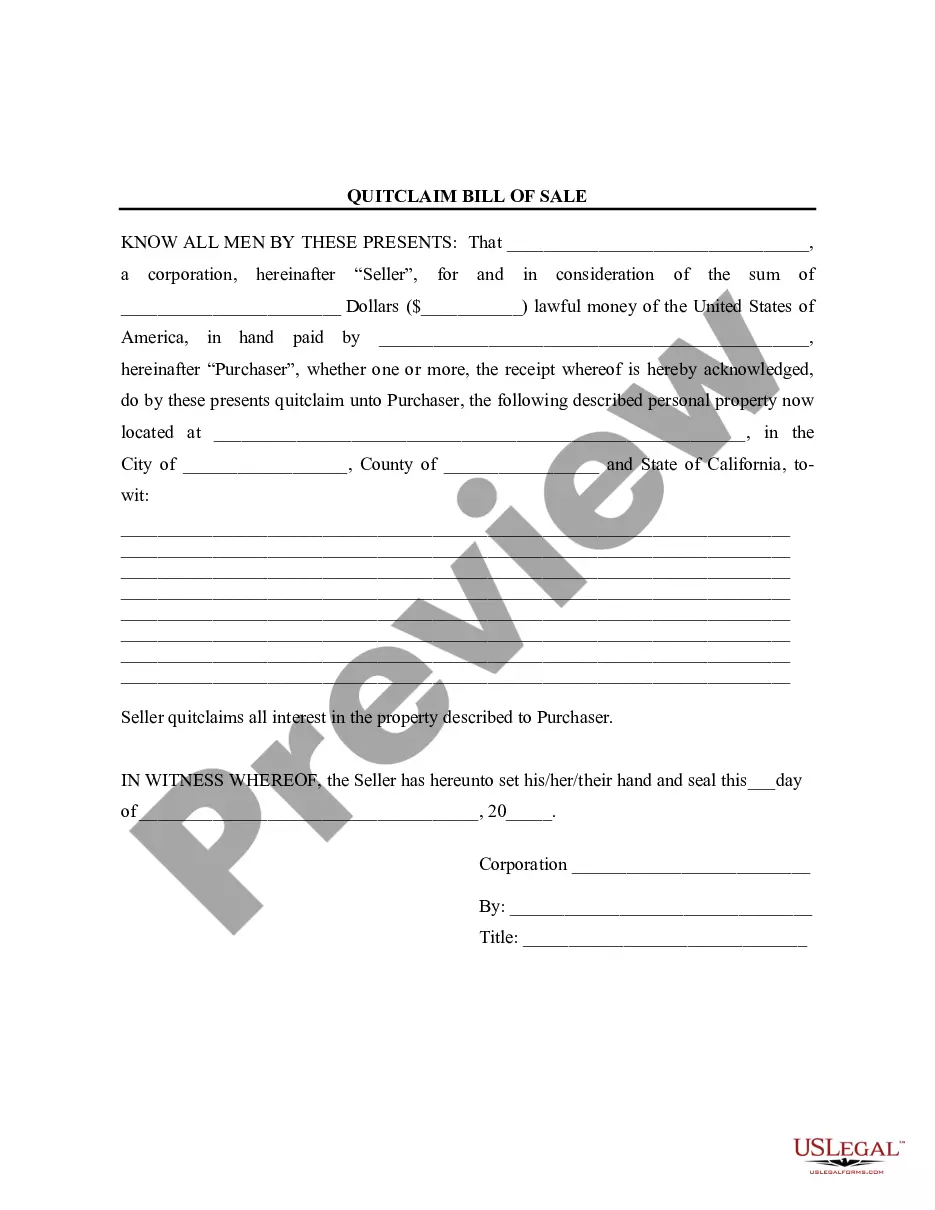

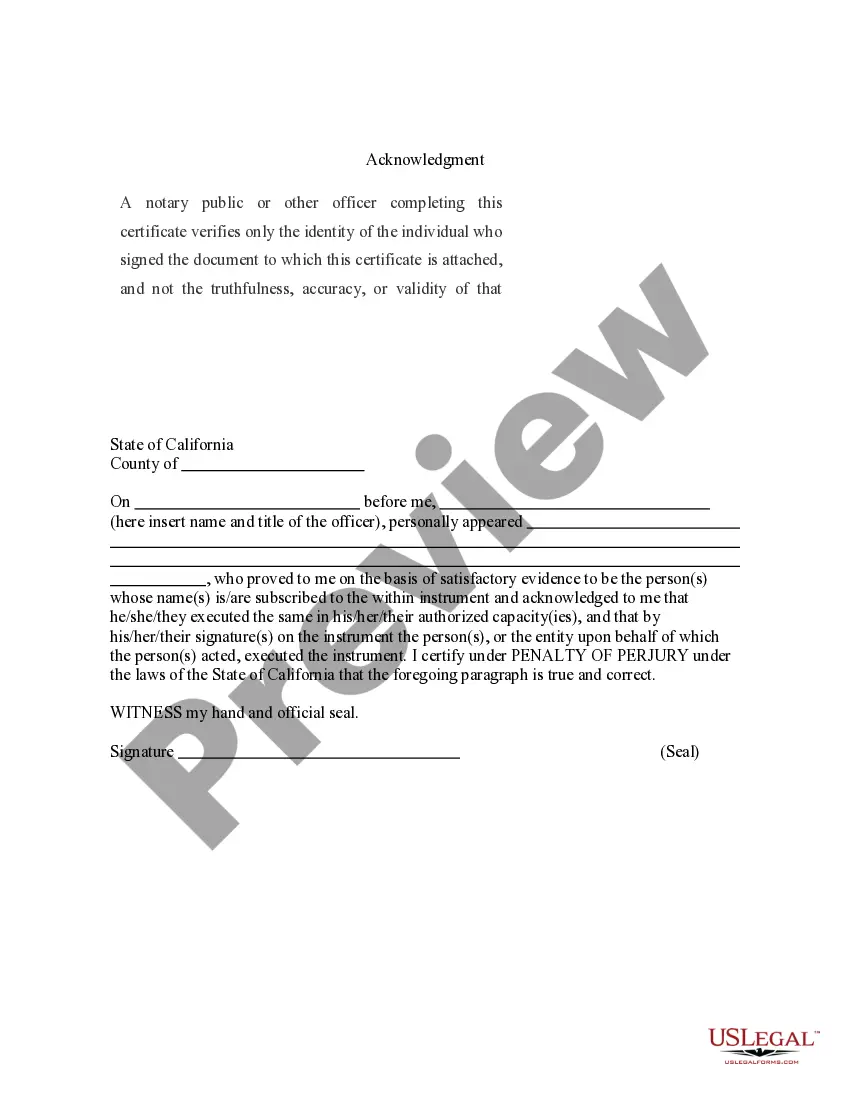

This Bill of Sale without Warranty by Corporate Seller is a Bill of Sale with an appropriate state specific Acknowledgment by corporation Seller. This is a Quitclaim Conveyance. This form complies with all applicable state statutory law.

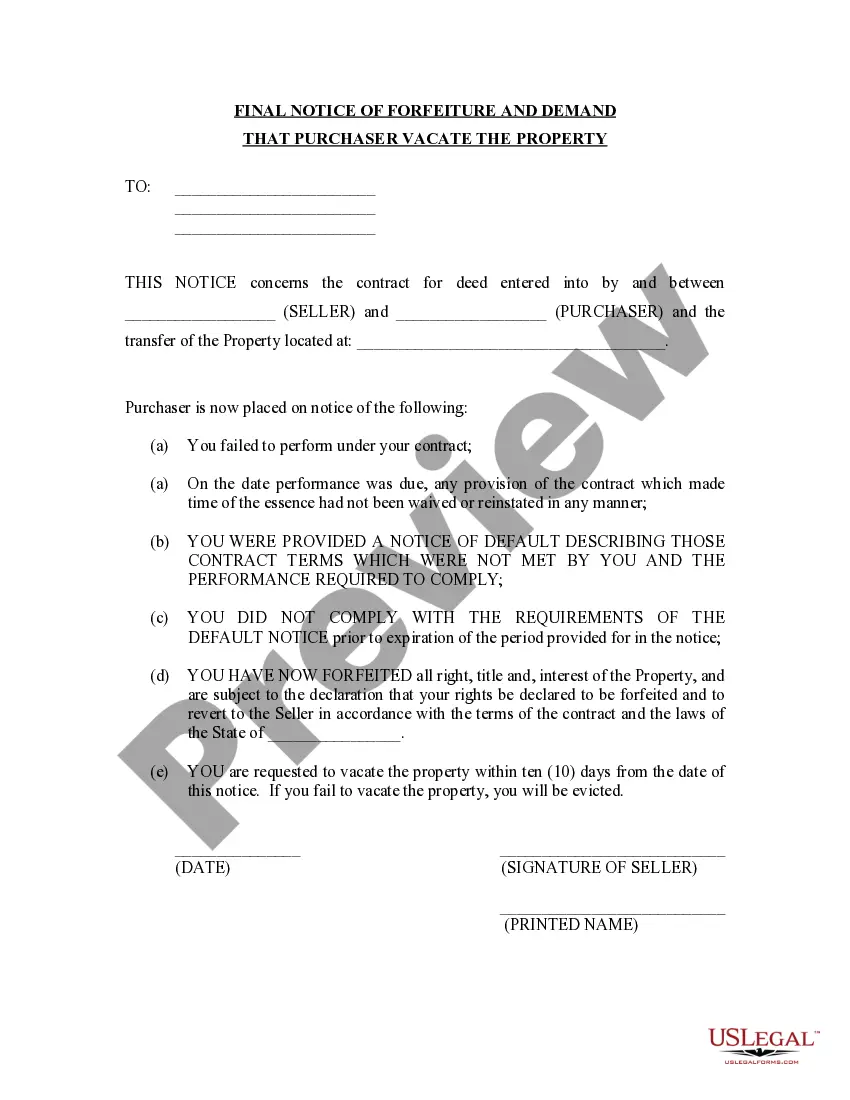

El Monte California Bill of Sale without Warranty by Corporate Seller is a legal document executed between a corporate seller and a buyer, which formalizes the transfer of ownership and assets in a transaction. This bill of sale is specifically designed for use in El Monte, California, and is commonly used in various transactions involving corporate entities. Here are some key details that are typically included in an El Monte California Bill of Sale without Warranty by Corporate Seller: 1. Parties Involved: The bill of sale clearly identifies the corporate seller and the buyer involved in the transaction. This includes their legal names, addresses, and contact information. 2. Description of Assets: The bill of sale provides a detailed description of the assets being transferred from the corporate seller to the buyer. This may include tangible assets like vehicles, equipment, real estate, or intangible assets like intellectual property or business contracts. 3. Purchase Price: The bill of sale specifies the agreed-upon purchase price for the assets being sold. It is important to note that this type of bill of sale is created without any warranty or guarantee provided by the corporate seller regarding the quality, condition, or fitness for a particular purpose of the assets being sold. 4. Payment Terms: The terms of payment, such as whether it will be made in a lump sum, installments, or through financing arrangements, are usually included in the bill of sale. The payment terms may also specify any applicable interest rates or late payment penalties. 5. Representations and Warranties: In an El Monte California Bill of Sale without Warranty by Corporate Seller, it is emphasized that the corporate seller is not providing any warranties or guarantees regarding the assets being sold. This protects the corporate seller from any future claims or disputes arising from the condition or performance of the assets. 6. Indemnification and Liability: This section outlines the agreement between the parties regarding indemnification, which means that the buyer assumes all liabilities related to the assets after the completion of the sale. It is important for the buyer to assess the assets thoroughly before signing the bill of sale to avoid any potential future issues or liabilities. Different types of El Monte California Bill of Sale without Warranty by Corporate Seller may exist based on the specific nature of the transaction. For example, there may be separate forms for the sale of vehicles, real estate, or intellectual property by corporate sellers in El Monte, California. Each type of bill of sale will have its specific provisions and requirements tailored to the unique assets being transferred. In conclusion, an El Monte California Bill of Sale without Warranty by Corporate Seller is a legally binding document that facilitates the transfer of assets from a corporate seller to a buyer. It is essential to consult with a legal professional to ensure compliance with applicable laws and regulations while drafting or executing such a bill of sale.El Monte California Bill of Sale without Warranty by Corporate Seller is a legal document executed between a corporate seller and a buyer, which formalizes the transfer of ownership and assets in a transaction. This bill of sale is specifically designed for use in El Monte, California, and is commonly used in various transactions involving corporate entities. Here are some key details that are typically included in an El Monte California Bill of Sale without Warranty by Corporate Seller: 1. Parties Involved: The bill of sale clearly identifies the corporate seller and the buyer involved in the transaction. This includes their legal names, addresses, and contact information. 2. Description of Assets: The bill of sale provides a detailed description of the assets being transferred from the corporate seller to the buyer. This may include tangible assets like vehicles, equipment, real estate, or intangible assets like intellectual property or business contracts. 3. Purchase Price: The bill of sale specifies the agreed-upon purchase price for the assets being sold. It is important to note that this type of bill of sale is created without any warranty or guarantee provided by the corporate seller regarding the quality, condition, or fitness for a particular purpose of the assets being sold. 4. Payment Terms: The terms of payment, such as whether it will be made in a lump sum, installments, or through financing arrangements, are usually included in the bill of sale. The payment terms may also specify any applicable interest rates or late payment penalties. 5. Representations and Warranties: In an El Monte California Bill of Sale without Warranty by Corporate Seller, it is emphasized that the corporate seller is not providing any warranties or guarantees regarding the assets being sold. This protects the corporate seller from any future claims or disputes arising from the condition or performance of the assets. 6. Indemnification and Liability: This section outlines the agreement between the parties regarding indemnification, which means that the buyer assumes all liabilities related to the assets after the completion of the sale. It is important for the buyer to assess the assets thoroughly before signing the bill of sale to avoid any potential future issues or liabilities. Different types of El Monte California Bill of Sale without Warranty by Corporate Seller may exist based on the specific nature of the transaction. For example, there may be separate forms for the sale of vehicles, real estate, or intellectual property by corporate sellers in El Monte, California. Each type of bill of sale will have its specific provisions and requirements tailored to the unique assets being transferred. In conclusion, an El Monte California Bill of Sale without Warranty by Corporate Seller is a legally binding document that facilitates the transfer of assets from a corporate seller to a buyer. It is essential to consult with a legal professional to ensure compliance with applicable laws and regulations while drafting or executing such a bill of sale.