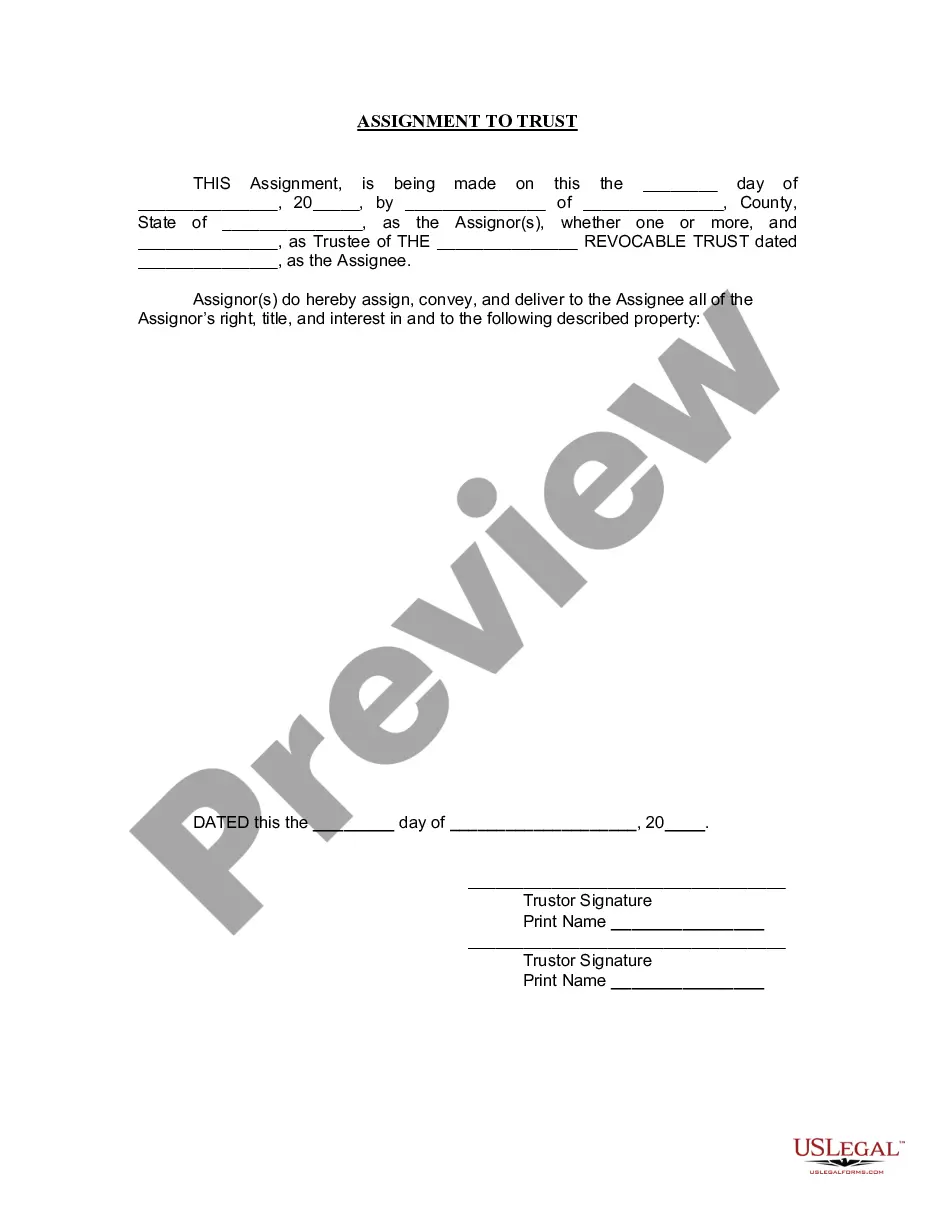

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Stockton California Closing Statement

Description

How to fill out California Closing Statement?

Are you seeking a dependable and economical supplier of legal forms to obtain the Stockton California Closing Statement? US Legal Forms is your prime selection.

Whether you need a basic contract to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the court system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business usage. All the templates we provide are tailored and structured based on the requirements of specific states and counties.

To obtain the document, you must Log In to your account, locate the needed form, and click the Download button adjacent to it. Please remember that you can access your previously bought document templates anytime in the My documents section.

Are you unfamiliar with our site? No problem. You can set up an account with ease, but first, ensure that you do the following.

Now you can create your account. Then select the subscription plan and move on to payment. Once the payment is completed, download the Stockton California Closing Statement in any available format. You can revisit the website at any moment and redownload the document at no extra cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting hours on understanding legal paperwork online once and for all.

- Verify if the Stockton California Closing Statement aligns with the laws of your state and locality.

- Review the form’s description (if accessible) to understand who and what the document is meant for.

- Initiate the search again if the form does not meet your specific needs.

Form popularity

FAQ

You can contact the City of Stockton through their official website, where you will find phone numbers and email addresses for various departments. They also provide an online form for submitting inquiries or concerns directly. Connecting with city officials can be beneficial, especially when you need clarity on documents related to your Stockton California Closing Statement.

Stockton's city number refers to its unique identifier used in governmental and postal services. This number is essential for residents and businesses for legal and administrative purposes. If you are engaging in real estate transactions, having this information handy could help clarify details related to your Stockton California Closing Statement.

The term 'Mudville' originates from a poem by Ernest Lawrence Thayer, which portrays a fictional town that resonates with Stockton's early struggles, particularly during the rainy season. This nickname reflects the city's challenging past with flooding and drainage issues. Understanding this history can provide context when reviewing local property dealings, including the Stockton California Closing Statement.

Stockton has a mixed reputation. It is known for its challenges with crime and economic indicators but also boasts a strong sense of community and resilience. Many residents appreciate the city's diversity and the efforts to revitalize the local economy. If you are purchasing property in this city, it's wise to stay informed about these factors, especially when it comes to the Stockton California Closing Statement.

To file a complaint with the City of Stockton, visit their official website and navigate to the contact section for various departments. You can also call their customer service line for direct assistance. Don't forget to document your concerns clearly, which may help in resolving issues related to your real estate transactions, including understanding your Stockton California Closing Statement.

As of 2023, the new mayor of Stockton is Kevin Lincoln. He aims to address community needs and enhance local services effectively. His leadership brings fresh perspectives essential for the growth of Stockton. If you're involved in property transactions, familiarize yourself with how local governance, including the mayor's policies, can influence the Stockton California Closing Statement.

Stockton, California, is known for its rich history and cultural diversity. The city boasts numerous attractions, including the Haggin Museum, which showcases local art and history. Additionally, Stockton is significant for its vibrant agricultural scene, contributing to the state's economy. If you're navigating real estate in this dynamic area, understanding the Stockton California Closing Statement is essential.

Understanding an escrow statement can seem challenging at first, but it becomes easier with a bit of guidance. Focus on key sections, such as amount due, fees, and credits, which are clearly outlined in the Stockton California Closing Statement. By breaking down each part, you can better grasp your financial responsibilities and any disbursements. Platforms like US Legal Forms can assist you in interpreting these documents clearly.

Yes, a closing statement and a settlement statement generally refer to the same document. Both contain vital information about the final costs and credits associated with a property transaction. In the context of a Stockton California Closing Statement, this document provides a detailed breakdown of all financial obligations for buyers and sellers. Understanding this document is essential for a smooth closing process.

The last step in escrow closing involves the finalization of documents, including the Stockton California Closing Statement. This crucial document outlines all financial transactions related to the property. Once all parties review and agree, signatures are provided, completing the escrow process. This ensures that everyone involved is clear about the financial details before finalizing the sale.