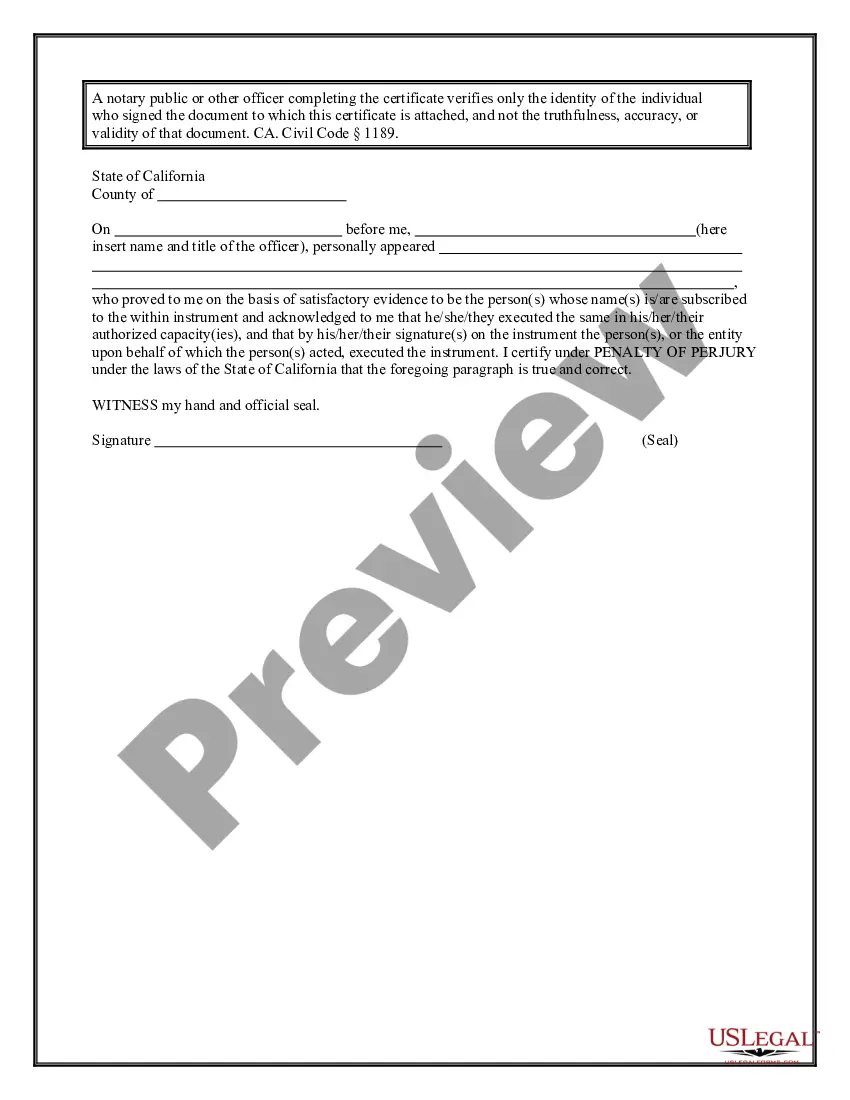

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Anaheim California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Are you seeking a reliable and economical supplier of legal forms to obtain the Anaheim California Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your prime option.

Whether you require a simple agreement to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform features more than 85,000 current legal document templates for personal and business purposes. All templates we provide are tailored and based on the regulations of specific states and counties.

To acquire the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates at any time from the My documents section.

Are you new to our platform? No problem. You can create an account with great ease; however, before proceeding, ensure you do the following.

Now you can set up your account. Then select your subscription choice and move forward with payment. Once the payment is processed, download the Anaheim California Non-Foreign Affidavit Under IRC 1445 in any offered file format. You can revisit the website at any time and redownload the document without incurring any additional charges.

Locating current legal forms has never been simpler. Try US Legal Forms now, and say goodbye to wasting your precious time understanding legal documentation online for good.

- Verify if the Anaheim California Non-Foreign Affidavit Under IRC 1445 aligns with the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the document is designed for.

- Restart your search if the template does not suit your particular situation.

Form popularity

FAQ

Section 1445(e)(1) requires withholding on certain dispositions of U.S. real property interests by a domestic partnership, domestic trust, or domestic estate. Section 1445(e)(2) requires withholding on certain distributions by foreign corporations.

One of these is IRS Notice 1445, which is a notice explaining how anyone can receive tax assistance in other languages. This is particularly useful for any taxpayer for whom English is a second language, which can make it easier for you to navigate the tax process and avoid complications or penalties.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

A foreign corporation that distributes a U.S. real property interest must withhold a tax equal to 21% of the gain it recognizes on the distribution to its shareholders.

In order to potentially avoid FIRPTA withholding, the foreign seller, the Form 8288-B and a contract for the purchase of the replacement property, must be submitted to the IRS on or before the replacement property's closing following the procedures discussed in Rev. Rroc.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

The Foreign Investment in Real Property Tax Act (FIRPTA) is a tax imposed on the amount realized from the sale of real property owned by a foreign seller. There are exceptions to this tax-withholding requirement.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

In order to apply for the withholding certificate, you will need to file Form 8288-B with the IRS prior to the date of the sale and notify the buyer that you have applied for a FIRPTA certificate.Note that filing Form 8288-B requires that an Individual Tax Identification Number (ITIN) be provided.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.