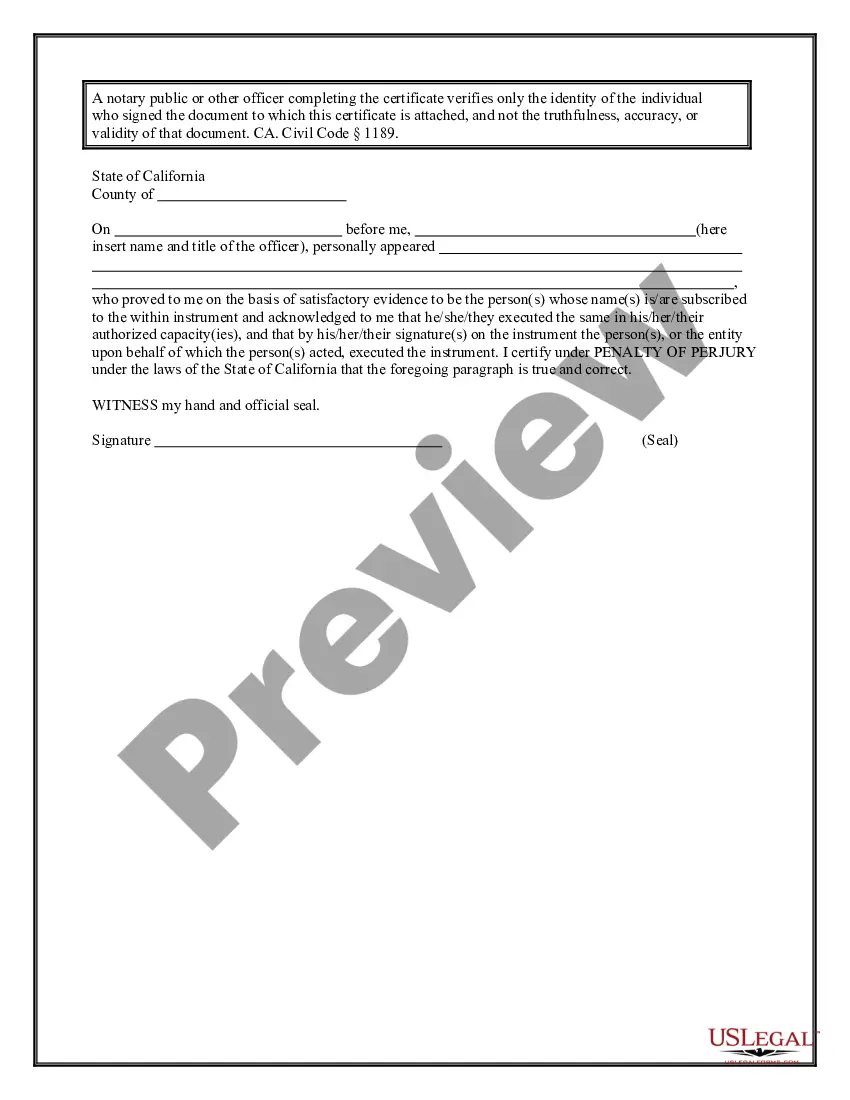

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Burbank California Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: The Burbank California Non-Foreign Affidavit under IRC 1445 is a legal document required by the Internal Revenue Service (IRS) for certain real estate transactions involving foreign sellers and buyers in Burbank, California. This affidavit ensures compliance with the regulations outlined in section 1445 of the Internal Revenue Code (IRC) to prevent tax evasion and ensure proper tax reporting. Let's dive into this topic and understand its intricacies. Understanding IRC 1445: IRC 1445 refers to the section of the Internal Revenue Code that governs withholding procedures and tax obligations related to the disposition of U.S. real property interests by foreign persons. The law mandates that the buyer (transferee) of a U.S. real property interest must withhold a percentage of the total sales price as a deposit towards the seller's potential capital gain tax liability. Purpose of the Non-Foreign Affidavit: A Burbank California Non-Foreign Affidavit Under IRC 1445 provides critical information to the IRS, ensuring that the buyer communicates the seller's foreign status accurately. By completing this affidavit, the buyer certifies that the seller is not a foreign person or entity, thereby exempting them from withholding taxes under IRC 1445. Types of Burbank California Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when the seller is an individual and not a foreign person or entity as defined by the IRS. The individual provides personal information, including their name, address, taxpayer identification number, and certification of non-foreign status. 2. Entity Non-Foreign Affidavit: When the seller is an entity, such as a corporation, partnership, trust, or LLC, this affidavit is used. The entity discloses its legal structure, taxpayer identification number, and certifies its non-foreign status. 3. Combined Non-Foreign Affidavit: In some cases, if the transaction involves both the sale of real estate and personal property, a combined affidavit must be completed. This includes information about the seller's non-foreign status for both real and personal property components of the transaction. Completing the Affidavit: To complete the Burbank California Non-Foreign Affidavit Under IRC 1445, the buyer must verify the seller's identity and non-foreign status. This usually involves obtaining the seller's tax identification number, reviewing identification documents, and ensuring the information provided is accurate and up to date. Consequences of Non-Compliance: Failure to correctly submit a Burbank California Non-Foreign Affidavit Under IRC 1445 or withholding the appropriate amount, if required, can lead to severe penalties and liabilities for the buyer. The IRS may impose substantial fines, interest, and even additional taxes to the buyer if they fail to comply with the regulations. Conclusion: The Burbank California Non-Foreign Affidavit Under IRC 1445 plays a crucial role in real estate transactions involving foreign sellers and buyers, ensuring tax compliance and reporting requirements set forth by the IRS. Understanding the various types of affidavits and their significance is vital to avoid potential penalties. It is recommended to consult with a qualified tax professional or attorney to navigate through the complexities of IRC 1445 and complete the required affidavits accurately.