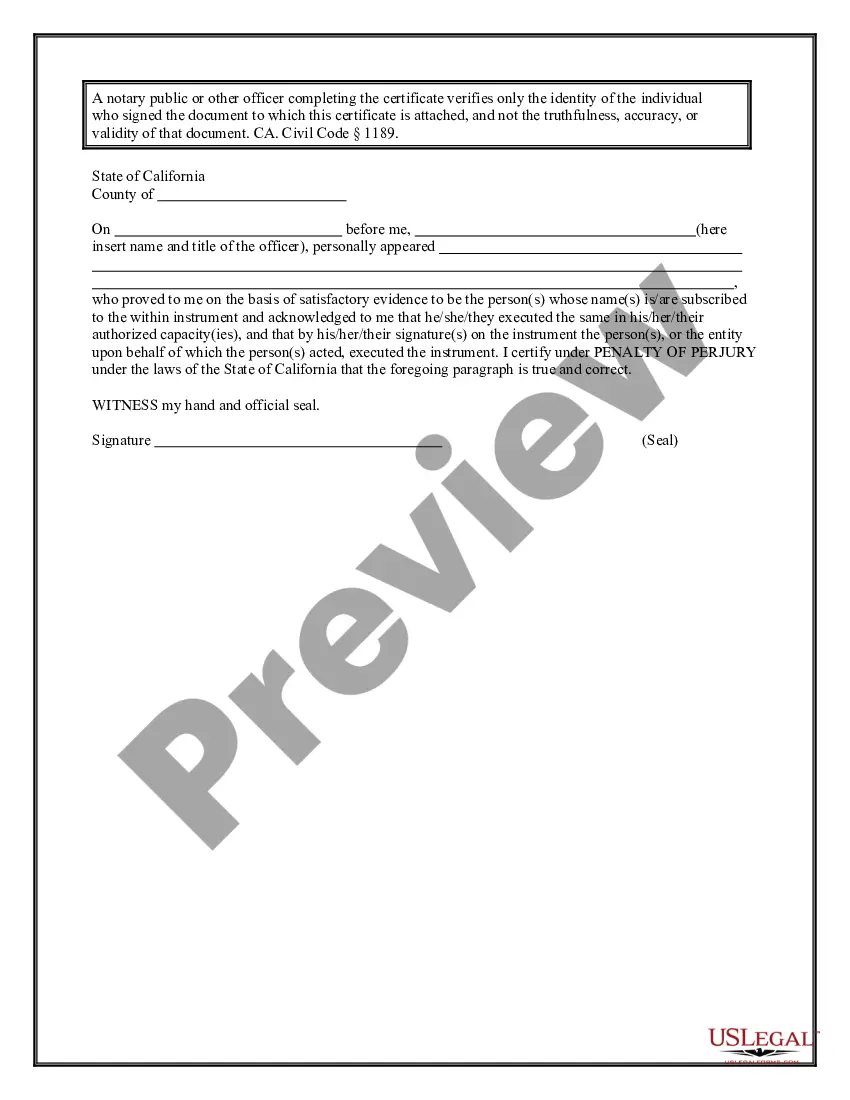

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Escondido California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Take advantage of the US Legal Forms and gain immediate access to any form template you desire.

Our efficient platform, featuring thousands of document templates, makes it easy to locate and secure nearly any document sample you require.

You can download, complete, and authenticate the Escondido California Non-Foreign Affidavit Under IRC 1445 within minutes rather than spending hours browsing the internet for the suitable template.

Utilizing our collection is a fantastic method to enhance the security of your record submissions. Our experienced attorneys routinely assess all the documents to guarantee that the templates are pertinent to a specific area and adhere to the latest laws and regulations.

US Legal Forms is likely one of the largest and most trustworthy form libraries online. We are always eager to help you with any legal proceedings, even if it’s merely downloading the Escondido California Non-Foreign Affidavit Under IRC 1445.

Feel free to take advantage of our platform and streamline your document experience as much as possible!

- Determine the form you need.

- Ensure it is the template you were looking for: check its title and description, and utilize the Preview feature when available. Alternatively, use the Search bar to find the required one.

- Initiate the downloading process.

- Click Buy Now and select the pricing plan that best fits you. Then, create an account and complete your order using a credit card or PayPal.

- Download the file.

- Choose the format for the Escondido California Non-Foreign Affidavit Under IRC 1445 and edit and complete, or sign it according to your requirements.

Form popularity

FAQ

An example of a FIRPTA statement includes a declaration that the seller is not a foreign person for tax purposes and is exempt from withholding under the regulation. This statement supports compliance with tax laws and helps facilitate a smoother transaction. If you need assistance crafting a proper FIRPTA statement for your property sale, UsLegalForms offers resources and templates tailored for your needs in Escondido, California.

To complete a FIRPTA affidavit, you must provide specific information about the property transaction and the seller's residency status. Important details include the seller's name, tax identification number, and a declaration of non-foreign status. Using platforms like UsLegalForms can simplify this process, ensuring you gather the necessary information correctly and efficiently for your Escondido, California Non-Foreign Affidavit Under IRC 1445.

The purpose of a FIRPTA certificate is to establish the tax status of a property seller in a transaction. When you are buying property in Escondido, California, this certificate confirms whether the seller qualifies as a foreign entity under the Foreign Investment in Real Property Tax Act. Obtaining this document is crucial as it protects you from potential tax liabilities that could arise from the sale.

A FIRPTA certificate, typically associated with Form 8288-B, should be mailed to the appropriate IRS address based on your property location. If dealing with the Escondido California Non-Foreign Affidavit Under IRC 1445, ensure your certificate is complete to prevent any delays. Always keep a copy of your submission for your records. Utilizing services like US Legal Forms can help streamline this mailing process by providing helpful instructions.

You must mail Form 8822, which is used for changing your address, to the address specified in the form's instructions. For individuals processing an Escondido California Non-Foreign Affidavit Under IRC 1445, it is crucial to keep the IRS updated on your residence. Check that your mailing address corresponds with the most recent IRS information. If you need assistance with address changes or IRS forms, consider using US Legal Forms for guidance.

Filing FIRPTA withholding requires you to provide the IRS with Form 8288 and possibly Form 8288-B, depending on your circumstances. For those involved in the Escondido California Non-Foreign Affidavit Under IRC 1445, confirm your resident status to determine if withholding applies. Ensure timely submission to avoid penalties. You can find helpful templates and guidelines on platforms such as US Legal Forms to assist you during this process.

Form 8869, used for making an election under section 761, should be mailed to the address indicated in the form's instructions. If your filing relates to an Escondido California Non-Foreign Affidavit Under IRC 1445, confirm the correct submission address applicable for your situation. It's important to keep track of mailings and confirmations. Using an online platform like US Legal Forms can ensure that you have the correct information before you send your form.

You should mail Form 8288-B to the address specified in the instructions accompanying the form. For the Escondido California Non-Foreign Affidavit Under IRC 1445, ensure you send it to the appropriate IRS center based on the state of the transaction. Double-check that all necessary documents are included to avoid processing delays. If you need assistance, consider using resources from US Legal Forms to streamline your mailing process.

To file a FIRPTA certificate in relation to the Escondido California Non-Foreign Affidavit Under IRC 1445, you will need to complete the IRS Form 8288-B. Be sure to include all required information regarding the sale of real property. Once you've filled it out, submit your certificate to the IRS for processing. Always consider using platforms like US Legal Forms, which can guide you through this process efficiently.

To create a FIRPTA affidavit for real estate, the seller must provide proof of their non-foreign status. This is typically achieved with the Escondido California Non-Foreign Affidavit Under IRC 1445, which requires information such as the seller's name, tax identification number, and a declaration of citizenship status. Accurate completion of this affidavit is essential for ensuring the buyer does not face withholding taxes. Always consult with a tax professional or real estate attorney to ensure compliance.