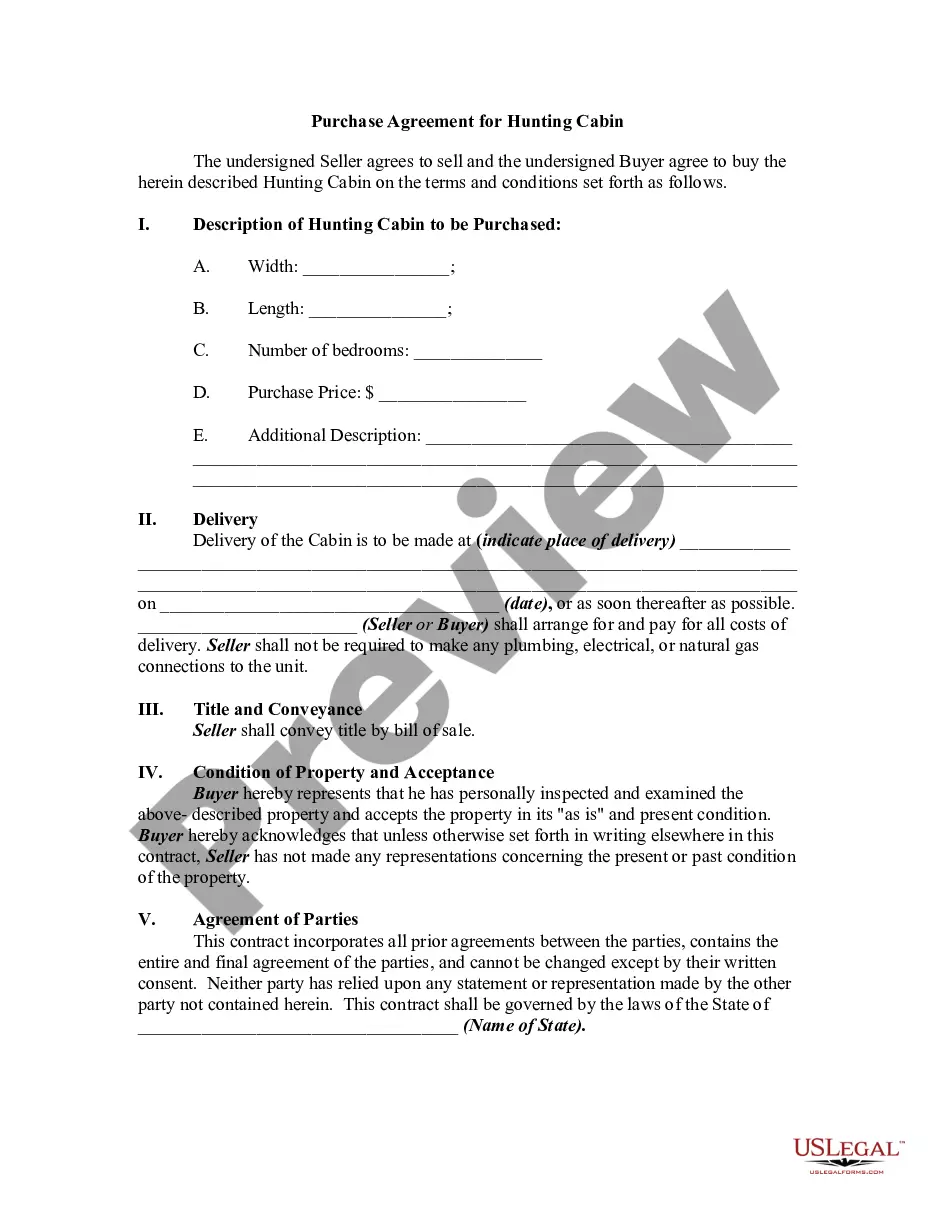

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Garden Grove California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

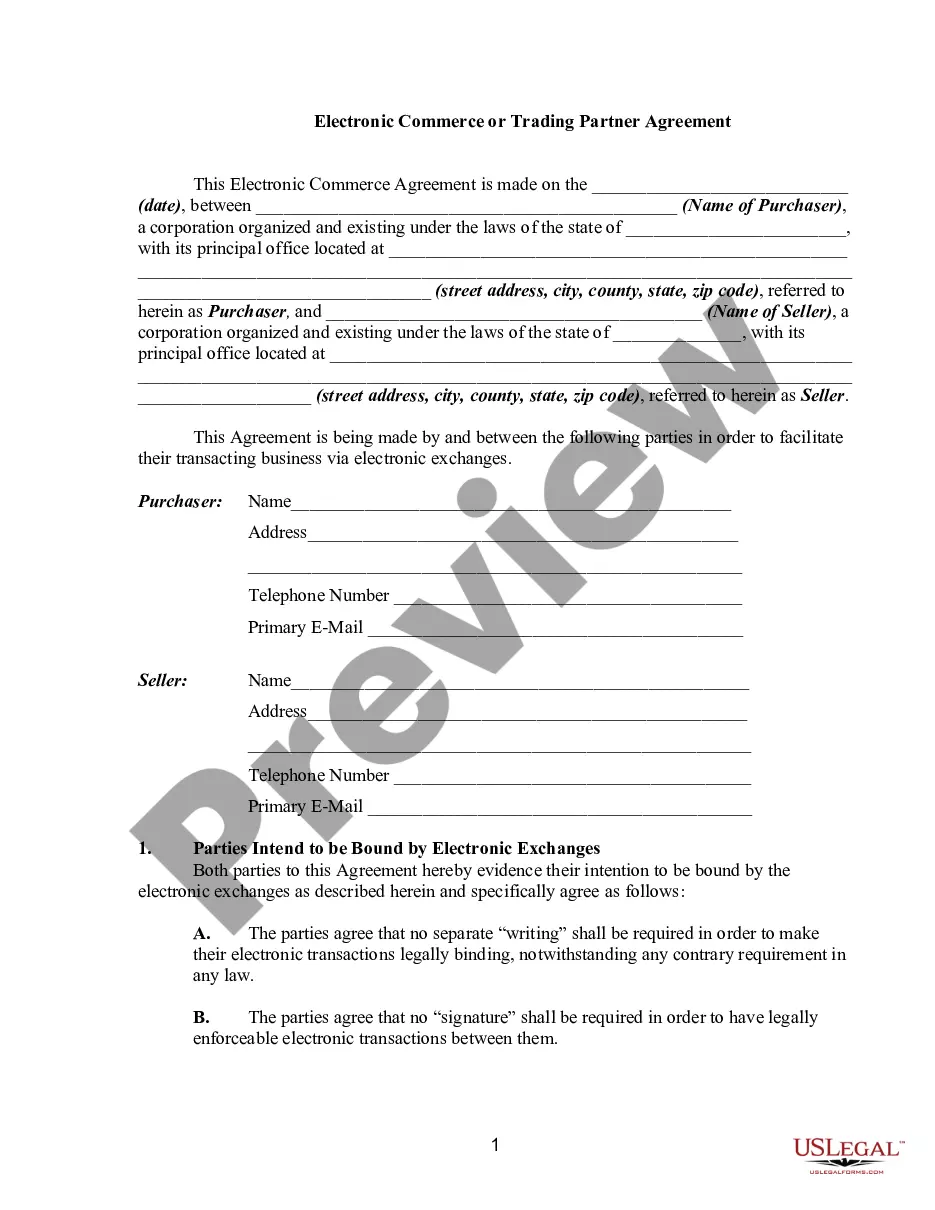

If you are in search of a legitimate form template, it’s remarkably difficult to locate a superior location than the US Legal Forms website – one of the most thorough online collections.

With this collection, you can discover thousands of document samples for organizational and personal uses by categories and areas, or keywords.

With the enhanced search functionality, finding the latest Garden Grove California Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and download it to your device.

- Additionally, the validity of each document is verified by a group of experienced attorneys who regularly assess the templates on our platform and update them based on the latest state and county regulations.

- If you are already acquainted with our system and possess a registered account, all you need to do to acquire the Garden Grove California Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just review the instructions below.

- Ensure you have accessed the sample you desire. Review its description and use the Preview option (if available) to view its content. If it doesn’t meet your needs, utilize the Search feature near the top of the screen to find the appropriate file.

- Verify your selection. Click the Buy now button. After that, select your preferred payment plan and input information to register for an account.

Form popularity

FAQ

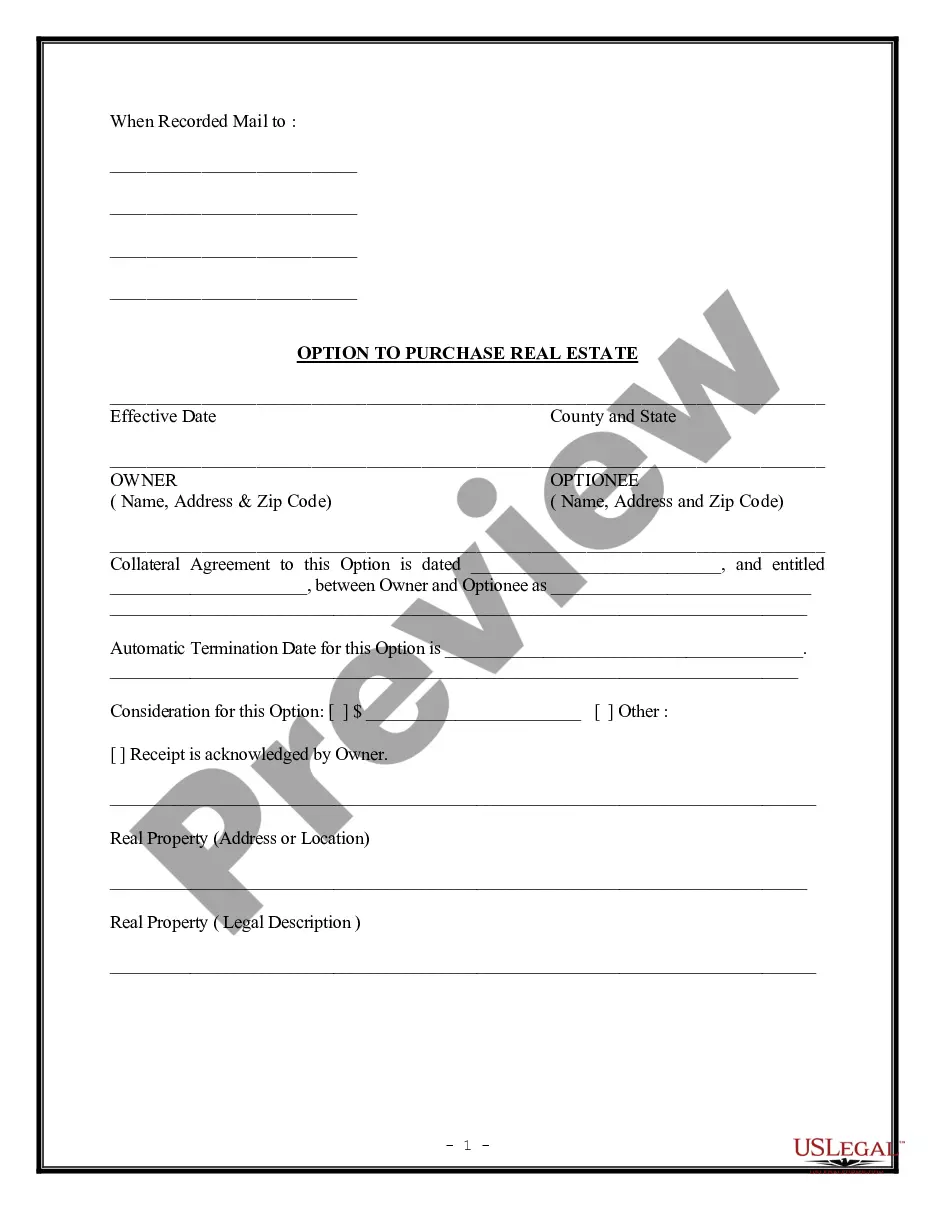

The seller's Affidavit of non-foreign status is a crucial document that certifies the seller's identity as a non-foreign individual or entity. This affidavit serves to prevent the IRS from withholding funds during the sale of real estate, particularly under IRC 1445. By utilizing the Garden Grove California Non-Foreign Affidavit Under IRC 1445, sellers can streamline their transactions and have peace of mind regarding tax implications.

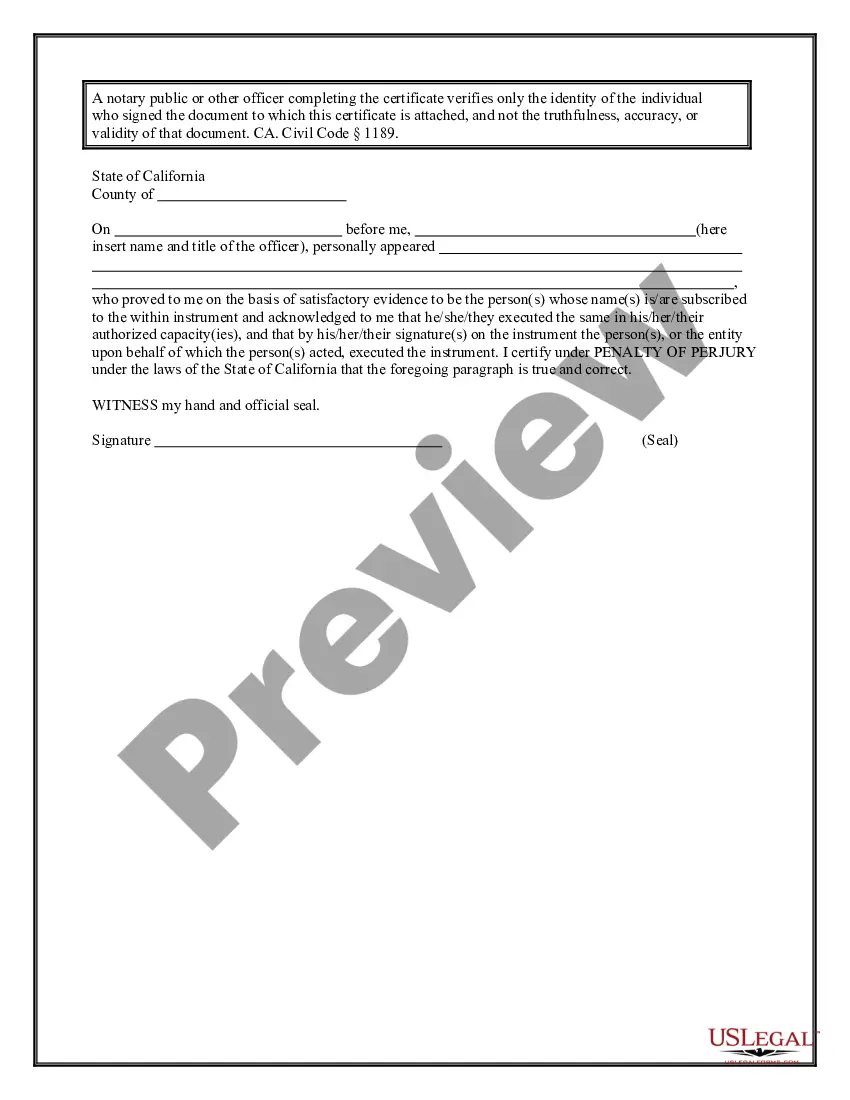

Yes, a FIRPTA Affidavit should be notarized to ensure its authenticity and legal validity. In Garden Grove, California, having your affidavit notarized reinforces your status as a non-foreign person, which can help avoid IRS withholding during property sales. Without proper notarization, potential errors or challenges may arise, complicating your real estate transaction.

A United States real property holding corporation, also known as a USRP corporation, is a business entity that primarily holds US real estate assets. The significance of this designation lies in tax obligations, especially regarding FIRPTA compliance. For those involved in Garden Grove California real estate, understanding your corporation's status can be essential for accurate tax reporting and transactions.

Under section 1445, a foreign person is defined as anyone who is not a U.S. citizen or a resident alien. This includes individual sellers, corporations, and partnerships that operate outside the United States. Clarifying your status with a Garden Grove California Non-Foreign Affidavit Under IRC 1445 can help sellers avoid unnecessary withholding by the IRS during property transactions.

A Section 1445 Affidavit is a document necessary for confirming a seller's status as a non-foreign person when selling real estate in the US. By submitting this affidavit, you can prevent the IRS from withholding a portion of the sale proceeds, thereby ensuring a smoother transaction. Specifically, in Garden Grove, California, this affidavit demonstrates compliance with the Internal Revenue Code and eliminates unnecessary complications during property sales.

A seller is classified as a foreign person when they are not a U.S. citizen or resident alien for tax purposes. This classification is significant because it triggers specific tax withholding requirements under Section 1445 of the IRC. If you are handling a real estate transaction in Garden Grove, understanding this classification is vital to determine if a Non-Foreign Affidavit Under IRC 1445 is necessary to facilitate a smooth and compliant sale.

The amount a transferor realizes on the transfer of a U.S. real property interest is zero when the transferor receives no monetary or property exchange during the transaction. This situation may arise in certain gifting scenarios or transfers between related parties. Even in such cases, the Garden Grove California Non-Foreign Affidavit Under IRC 1445 may still be necessary to clarify tax implications and ensure compliance with federal regulations.

Section 1221 of the Internal Revenue Code pertains to the definition of capital assets. It outlines the types of property that qualify as capital assets, which influences how gains and losses are taxed. For those involved in transactions related to the Garden Grove California Non-Foreign Affidavit Under IRC 1445, knowing about capital assets can affect the tax implications when selling real estate.

The Internal Revenue Code (IRC) is a comprehensive set of tax laws in the United States. It consists of various sections that cover different aspects of taxation, including income tax, estate tax, and more. Specifically, when discussing the Garden Grove California Non-Foreign Affidavit Under IRC 1445, you are referring to Section 1445, which deals with withholding tax on foreign persons transferring U.S. real property interests.