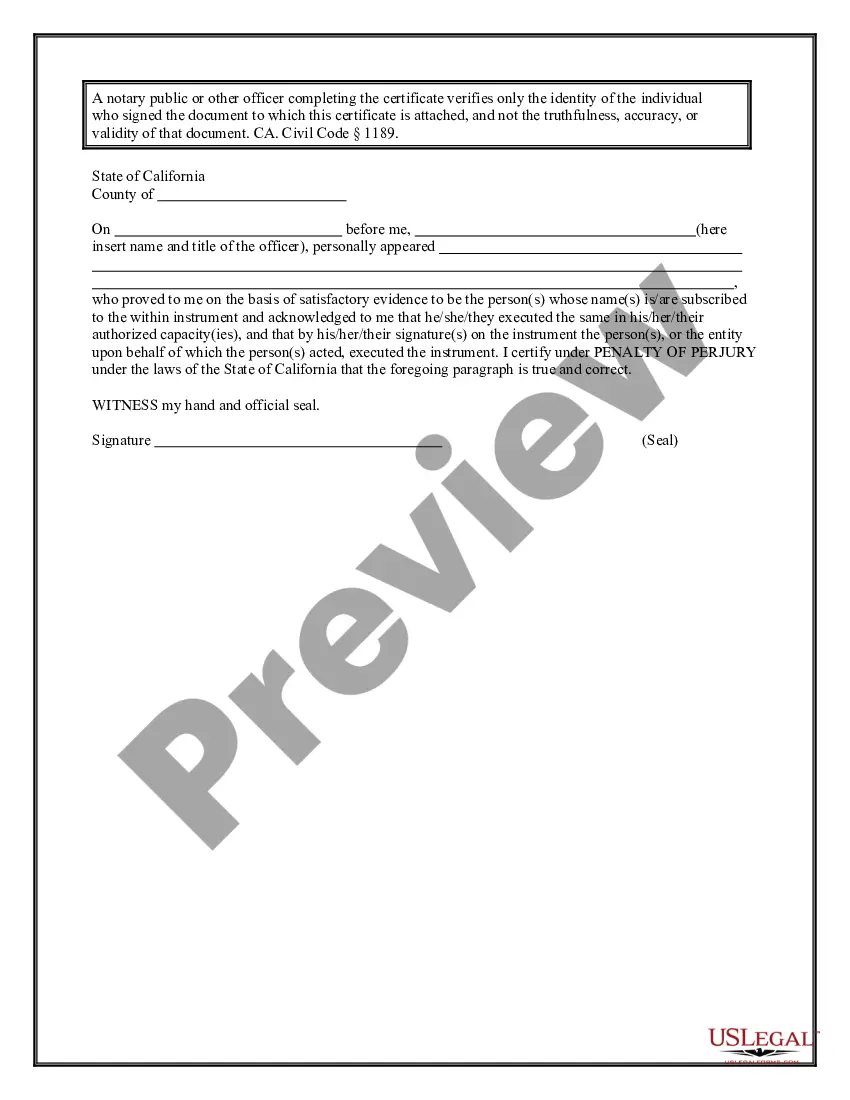

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Los Angeles California Non-Foreign Affidavit Under IRC 1445 is a legal document pertaining to the sale or disposition of property by a non-foreign individual in the city of Los Angeles, California. This affidavit is required by the Internal Revenue Code (IRC) Section 1445, which deals with the withholding tax on dispositions of the United States real property interests by foreign individuals. The purpose of the Los Angeles California Non-Foreign Affidavit Under IRC 1445 is to certify that the seller or transferor of the property is not a foreign person, thus exempting them from the mandatory tax withholding requirements under IRC Section 1445. There are various types of Los Angeles California Non-Foreign Affidavits Under IRC 1445, which may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual sells or disposes of a property located in Los Angeles, California, and declares their non-foreign status. 2. Corporate Non-Foreign Affidavit: This affidavit is applicable when a corporate entity, such as a business or a company, transfers or sells a property in Los Angeles and asserts its non-foreign status. 3. Trust Non-Foreign Affidavit: In case a trust is involved in the transfer or sale of a property in Los Angeles, this type of affidavit is used to verify the non-foreign status of the trust. 4. Partnership/LLC Non-Foreign Affidavit: If a partnership or limited liability company (LLC) is the seller or transferor of the property, this affidavit is utilized to confirm the non-foreign status of the entity. Submitting a duly completed Los Angeles California Non-Foreign Affidavit Under IRC 1445 is crucial in order to release the buyer from any obligation to withhold a certain percentage of the purchase price as tax, which would otherwise be remitted to the IRS. It is important to note that the specific requirements and procedures for filing a Los Angeles California Non-Foreign Affidavit Under IRC 1445 may vary, and it is advisable to consult with a qualified legal professional or tax advisor to ensure compliance with all applicable regulations. Failure to file the affidavit or provide accurate information may lead to legal consequences or delays in the property transaction process.Los Angeles California Non-Foreign Affidavit Under IRC 1445 is a legal document pertaining to the sale or disposition of property by a non-foreign individual in the city of Los Angeles, California. This affidavit is required by the Internal Revenue Code (IRC) Section 1445, which deals with the withholding tax on dispositions of the United States real property interests by foreign individuals. The purpose of the Los Angeles California Non-Foreign Affidavit Under IRC 1445 is to certify that the seller or transferor of the property is not a foreign person, thus exempting them from the mandatory tax withholding requirements under IRC Section 1445. There are various types of Los Angeles California Non-Foreign Affidavits Under IRC 1445, which may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual sells or disposes of a property located in Los Angeles, California, and declares their non-foreign status. 2. Corporate Non-Foreign Affidavit: This affidavit is applicable when a corporate entity, such as a business or a company, transfers or sells a property in Los Angeles and asserts its non-foreign status. 3. Trust Non-Foreign Affidavit: In case a trust is involved in the transfer or sale of a property in Los Angeles, this type of affidavit is used to verify the non-foreign status of the trust. 4. Partnership/LLC Non-Foreign Affidavit: If a partnership or limited liability company (LLC) is the seller or transferor of the property, this affidavit is utilized to confirm the non-foreign status of the entity. Submitting a duly completed Los Angeles California Non-Foreign Affidavit Under IRC 1445 is crucial in order to release the buyer from any obligation to withhold a certain percentage of the purchase price as tax, which would otherwise be remitted to the IRS. It is important to note that the specific requirements and procedures for filing a Los Angeles California Non-Foreign Affidavit Under IRC 1445 may vary, and it is advisable to consult with a qualified legal professional or tax advisor to ensure compliance with all applicable regulations. Failure to file the affidavit or provide accurate information may lead to legal consequences or delays in the property transaction process.