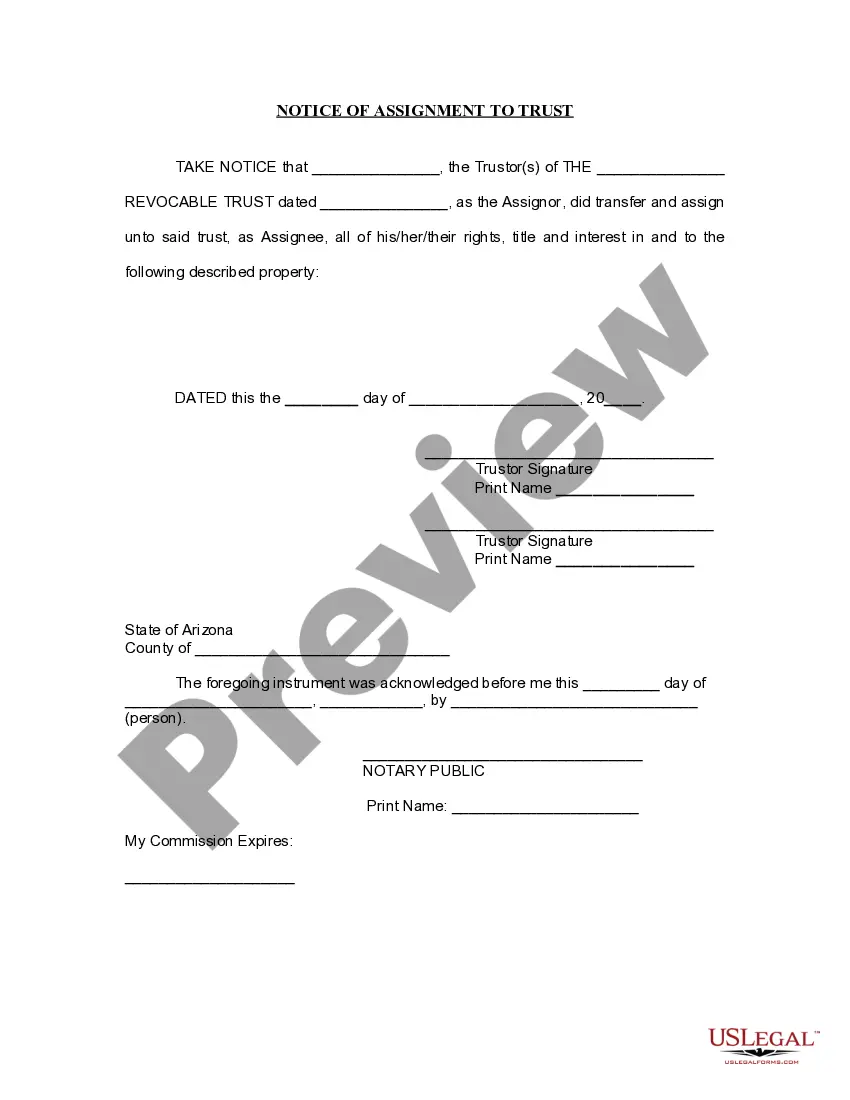

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Pomona California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Are you in search of a trustworthy and budget-friendly provider of legal documents to obtain the Pomona California Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your ideal choice.

Whether you need a simple contract to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform boasts over 85,000 current legal document samples for personal and business needs. All templates available are not generic and are tailored in line with the requirements of particular states and counties.

To retrieve the document, you must Log In to your account, find the necessary template, and hit the Download button adjacent to it. Please note that you can access your previously purchased document templates anytime from the My documents section.

Is this your first visit to our site? No problem. You can set up an account with great ease, but first, make sure to do the following.

You can now register your account. Then select the subscription choice and proceed with the payment. After the payment is processed, download the Pomona California Non-Foreign Affidavit Under IRC 1445 in any offered file format. You are welcome to revisit the website anytime and redownload the document at no extra cost.

Locating current legal documents has never been simpler. Try US Legal Forms today and stop wasting your precious time searching for legal forms online once and for all.

- Check if the Pomona California Non-Foreign Affidavit Under IRC 1445 meets the regulations of your state and locality.

- Review the document’s description (if available) to understand who it is for and its intended purpose.

- Restart the search if the template does not suit your specific circumstances.

Form popularity

FAQ

You should mail the FIRPTA certificate to the Internal Revenue Service office specified for your area. In cases involving a Pomona California Non-Foreign Affidavit Under IRC 1445, it’s important to double-check the address on the latest IRS guidelines to ensure you send it to the correct location. By mailing it to the proper address, you can avoid delays in processing. For streamlined assistance, consider using US Legal Forms to help you prepare and submit your form correctly.

To avoid FIRPTA withholding, sellers can provide proof of their non-foreign status through a Pomona California Non-Foreign Affidavit Under IRC 1445. By completing this affidavit, they affirm their eligibility, preventing unnecessary tax withholding during property sales. It's advisable to consult platforms like uslegalforms, which offer streamlined resources to create the necessary documents for this process.

IRS notice 1445 refers to guidelines regarding the Foreign Investment in Real Property Tax Act, often abbreviated as FIRPTA. This notice highlights the obligations of buyers and sellers, especially when a Pomona California Non-Foreign Affidavit Under IRC 1445 is applicable. Understanding this notice can help clarify the tax implications associated with property transactions involving foreign interests.

The FIRPTA certificate serves to verify the foreign or non-foreign status of a seller in real estate transactions. When dealing with a Pomona California Non-Foreign Affidavit Under IRC 1445, this certificate protects both parties by ensuring compliance with federal tax laws. It provides clarity about tax withholding requirements, which can be a concern for buyers of properties involving foreign sellers.

A FIRPTA statement typically includes the seller's declaration that they qualify as a non-foreign person under the regulations of the IRS. In the context of Pomona California Non-Foreign Affidavit Under IRC 1445, this statement affirms that the seller is not a foreign investor, thus simplifying the closing process for buyers. This document is crucial in avoiding withholding taxes that can apply in cases of foreign ownership.

To navigate around FIRPTA withholding requirements, a buyer can obtain a Pomona California Non-Foreign Affidavit Under IRC 1445 from the seller, confirming that they are not foreign. This affidavit can significantly reduce or eliminate withholding obligations altogether. Working with experienced professionals can provide clarity and guidance on how to prepare and present this affidavit appropriately.

FIRPTA affidavits are generally provided by the sellers of the property or their legal representatives. In Pomona, California, using a reputable real estate attorney or service can help ensure the accuracy and completeness of the Pomona California Non-Foreign Affidavit Under IRC 1445. This service can alleviate any potential issues during the sale process.

To obtain a FIRPTA withholding certificate, the seller must file Form 8288-B with the IRS. This form requests a reduction or elimination of the withholding amount for a particular transaction. In Pomona, California, it is beneficial to work with experts who can assist in preparing a Pomona California Non-Foreign Affidavit Under IRC 1445 along with the certificate application.

Yes, FIRPTA documents typically need to be notarized to ensure their authenticity. Notarization adds an extra layer of security and helps verify the identity of the person signing the Pomona California Non-Foreign Affidavit Under IRC 1445. This step is crucial for both buyers and sellers to ensure compliance with federal regulations.

A section 1445 affidavit is a legal document used under the Internal Revenue Code that certifies whether a seller is a foreign person. In California, particularly Pomona, this affidavit helps buyers avoid excess withholding by providing proof of the seller's non-foreign status. Having this documentation in place can ensure a smoother real estate transaction.