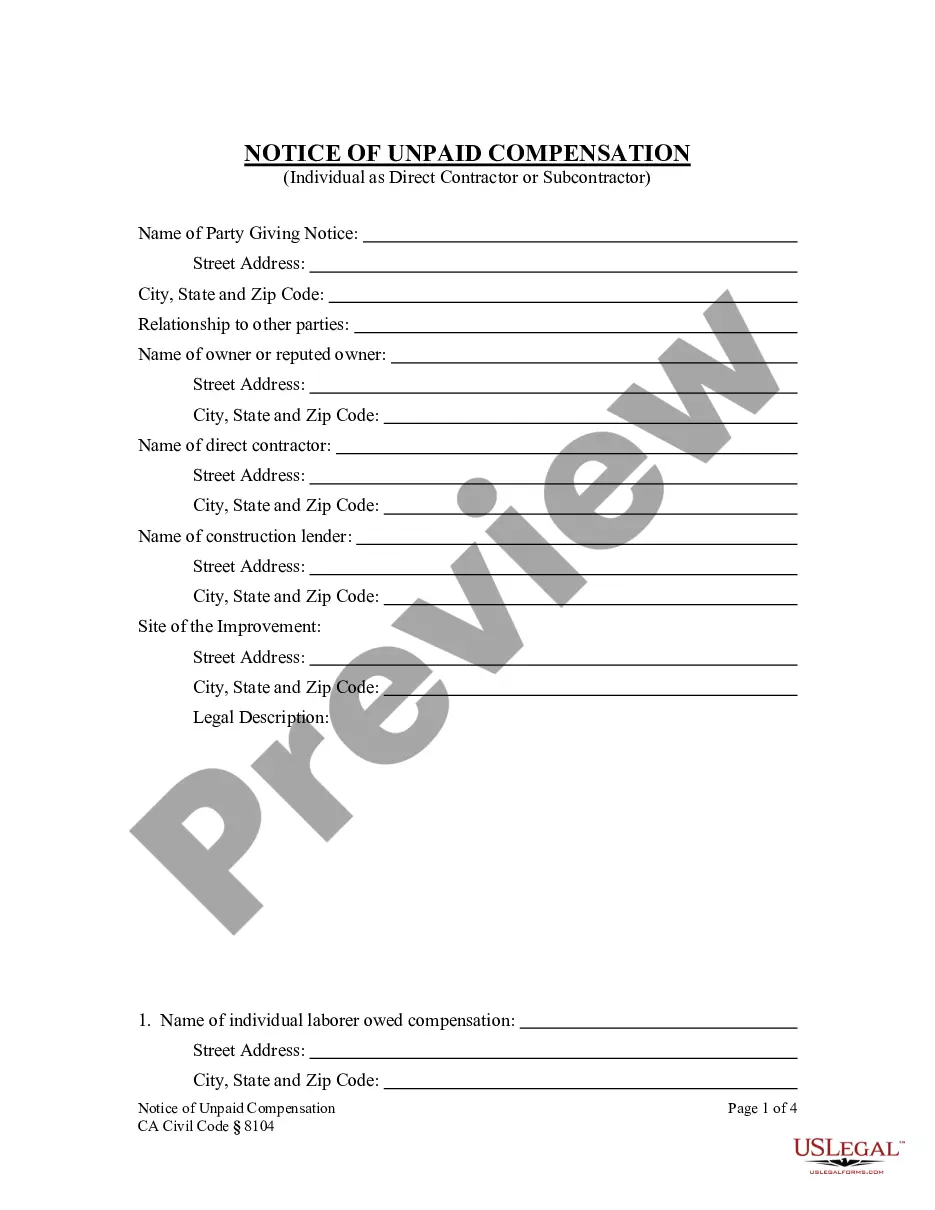

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Rialto California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional needs and various real-life situations.

All the files are systematically categorized by usage area and jurisdiction, making it as simple as pie to find the Rialto California Non-Foreign Affidavit Under IRC 1445.

Organizing documents neatly and adhering to legal stipulations is crucial. Leverage the US Legal Forms library to have vital document templates readily available for all your needs!

- Verify the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns with your local jurisdiction requirements.

- Seek out an alternative template, if necessary.

- If you spot any discrepancy, use the Search tab above to find the appropriate one.

- Once satisfied, proceed to the next step.

Form popularity

FAQ

The seller of the property typically provides the FIRPTA affidavit during the sale process. They complete the Rialto California Non-Foreign Affidavit Under IRC 1445 to declare their non-foreign status. This important documentation not only aids in legal compliance but also helps streamline the sale for both parties involved. Ensure that your seller is prepared with this affidavit to facilitate a smooth transaction.

A foreign person affidavit protects purchasers from unexpected tax liabilities related to FIRPTA. When a buyer obtains this affidavit, they receive assurance that there will be no withholding taxes applied to the sale. This is particularly important in real estate transactions, as it can significantly impact the financial outcome. Utilizing the Rialto California Non-Foreign Affidavit Under IRC 1445 is an excellent way to secure this critical information upfront.

foreign affidavit is a formal legal document that confirms the seller is not a foreign entity as defined by the IRS. This affidavit asserts that the transaction does not fall under FIRPTA withholding requirements. By utilizing the Rialto California NonForeign Affidavit Under IRC 1445, buyers can avoid unnecessary tax complications. Ensuring this documentation is correctly prepared is crucial for a smooth transaction.

affidavit is a different type of declaration that does not require notarization or witness verification. Unlike an affidavit, which is a legally binding document, a nonaffidavit serves as a simple statement of facts. In the realm of real estate, a nonaffidavit may not suffice when addressing FIRPTA requirements. Therefore, using the Rialto California NonForeign Affidavit Under IRC 1445 is advisable to meet legal standards.

Typically, the seller of the property signs the FIRPTA certificate. This document confirms their status as a foreign or non-foreign person under IRC Section 1445. If you are engaging in a real estate transaction, having the seller provide a Rialto California Non-Foreign Affidavit Under IRC 1445 can simplify the process for all parties involved. Proper execution of this certificate is crucial to avoid unnecessary withholding tax.

An international affidavit is a written statement confirmed by an oath before a notary public or authorized official, used in various legal contexts across borders. This document assists in validating identities and intentions in international transactions, including real estate. In the context of the Rialto California Non-Foreign Affidavit Under IRC 1445, it verifies the residency status of the seller. It is vital for ensuring compliance with tax obligations.

A 1445 certificate is a document issued under IRC 1445 that proves a seller is not a foreign person. This certificate is essential in real estate transactions to prevent tax withholding on the sale proceeds. For buyers and sellers in Rialto, California, understanding this certificate can streamline the process and ensure compliance with federal tax regulations. At US Legal Forms, we provide reliable resources to help you easily complete your Rialto California Non-Foreign Affidavit Under IRC 1445.

A certificate confirming that a seller is not a foreign person is a crucial document in real estate transactions. It asserts that the seller meets the criteria set out under the Internal Revenue Code, specifically IRC 1445. This certificate is vital for buyers, as it helps them avoid withholding taxes associated with foreign entities. For those in Rialto, California, using our services on US Legal Forms can simplify obtaining a Rialto California Non-Foreign Affidavit Under IRC 1445.

A FIRPTA affidavit must include the seller's declaration of their residency status and details about the property transaction. It needs to be signed, dated, and typically notarized to ensure validity. Incorporating a Rialto California Non-Foreign Affidavit Under IRC 1445 can greatly facilitate this process by clearly outlining the seller’s non-foreign status, which legally relieves buyers from withholding requirements.

Reporting FIRPTA withholding requires submitting Form 8288-A to the IRS with the buyer's tax identification information. The buyer must also include the withholding amount and seller details. If you utilize the Rialto California Non-Foreign Affidavit Under IRC 1445, you can streamline this process, ensuring you report accurately and avoid complications with the IRS.