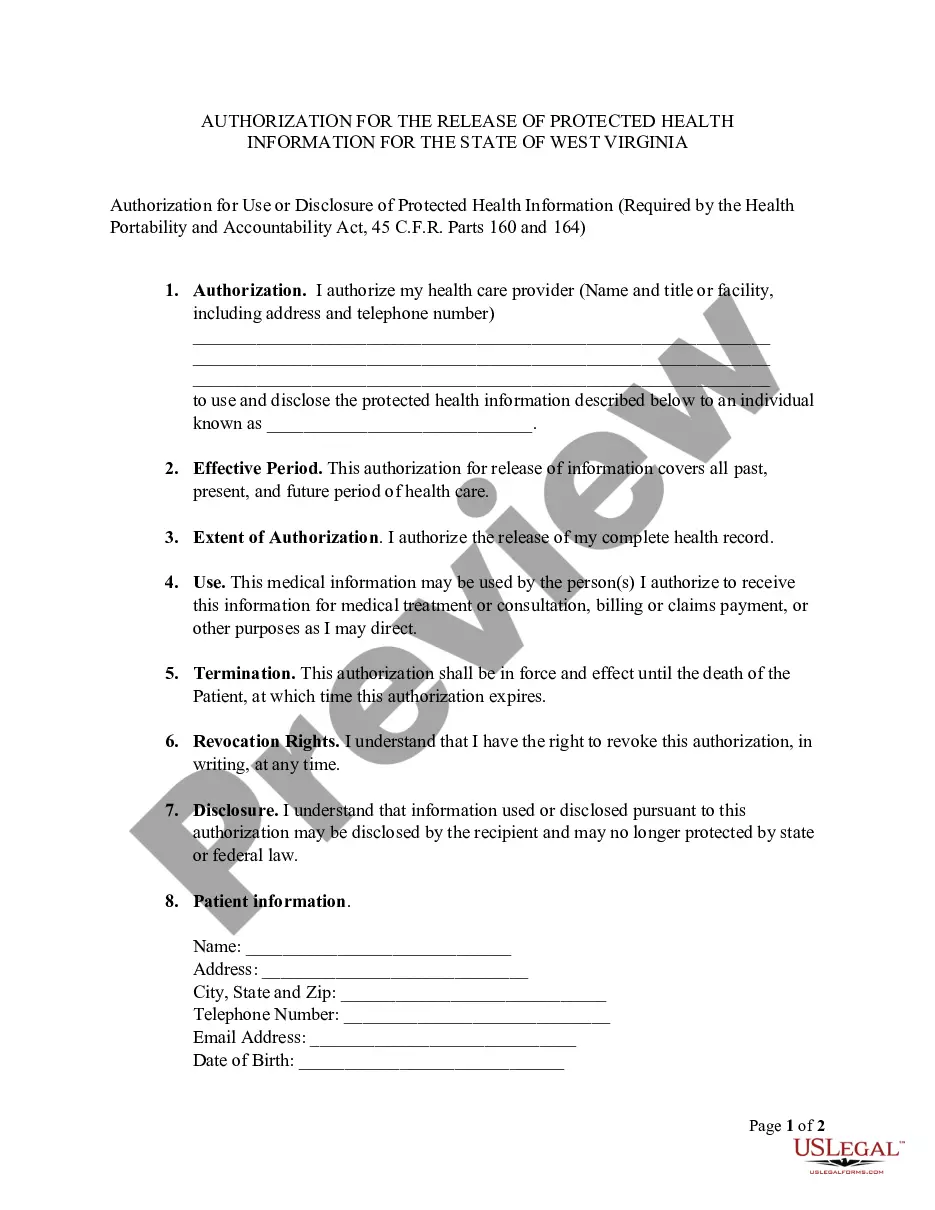

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Santa Clara California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Do you require a reliable and affordable legal forms provider to purchase the Santa Clara California Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your ideal choice.

Whether you need a simple contract to establish rules for living together with your partner or a set of documents to facilitate your separation or divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are designed in accordance with the laws of specific states and counties.

To obtain the form, you must Log In to your account, find the required form, and click the Download button next to it. Please remember that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first visit to our platform? No problem. You can create an account in just a few minutes, but first, make sure to do the following.

Now you can create your account. Then select the subscription plan and proceed with the payment. Once the payment is completed, download the Santa Clara California Non-Foreign Affidavit Under IRC 1445 in any available format. You can come back to the site whenever needed and re-download the form at no additional cost.

Acquiring current legal forms has never been easier. Try US Legal Forms now and say goodbye to wasting hours searching for legal documents online once and for all.

- Check if the Santa Clara California Non-Foreign Affidavit Under IRC 1445 complies with your state and local laws.

- Review the form’s information (if available) to understand who and what the form is intended for.

- Restart your search if the form is not suitable for your legal circumstances.

Form popularity

FAQ

FIRPTA is triggered when the sale involves real property in the United States sold by a foreign seller. Buyers must be aware of the seller's foreign status to determine their withholding responsibilities accurately. Engaging with platforms like uslegalforms can provide essential guidance on navigating FIRPTA requirements, ensuring you are well-prepared for the transaction.

FIRPTA applies in situations where a foreign person sells U.S. real estate, including residential properties and commercial real estate. It is crucial for buyers to recognize when a seller is foreign to determine if withholding requirements apply. Understanding these situations ensures that buyers in Santa Clara, California meet their tax obligations without misunderstandings, especially when utilizing the Non-Foreign Affidavit.

You should mail your completed FIRPTA certificate to the IRS at the address specified on the form. Ensure you send it to the correct location to avoid delays in processing. Checking the IRS website or contacting them directly can provide the most current mailing address and additional instructions tailored to your specific situation.

In many cases, sellers who are not foreign persons may need a FIRPTA certificate to prove their exempt status under the law. If you, as a seller, meet the criteria defined by the IRS, obtaining this certificate helps facilitate smoother transactions. Utilizing the Santa Clara, California Non-Foreign Affidavit Under IRC 1445 simplifies this process and enhances your credibility as a seller.

Buyers of real estate in Santa Clara, California, may need to file for FIRPTA if they are purchasing property from a foreign seller. Specifically, if withholding is required, buyers must complete the necessary IRS forms to report and remit the withheld amount. This process helps safeguard both the buyer and seller, ensuring correct tax handling during property transactions.

A FIRPTA statement typically includes a declaration that the seller is not a foreign person, confirming their residency status under U.S. tax laws. An example would be a statement that says, 'I declare under penalties of perjury that I am not a foreign person, as defined in IRC 1445.' When preparing a Santa Clara California Non-Foreign Affidavit Under IRC 1445, ensure to include this statement to prevent unnecessary withholding during a real estate transaction. Consider using US Legal Forms for customizable templates that meet these requirements.

To file FIRPTA withholding in Santa Clara, California, you need to complete Form 8288 and submit it along with your tax payment to the IRS. This form is crucial for reporting the sale of real estate by a foreign person. Additionally, providing a Santa Clara California Non-Foreign Affidavit Under IRC 1445 can help demonstrate that the seller is not a foreign person, potentially reducing your withholding obligations. Using services like US Legal Forms can simplify the process by offering you ready-made forms and guidance.

A Section 1445 affidavit is a document that attests to the seller's non-foreign status, thereby exempting the transaction from FIRPTA withholding requirements. When properly executed, it provides assurance to the buyer regarding tax obligations. For real estate transactions in Santa Clara, California, utilizing a Section 1445 affidavit can streamline the buying process.

IRS Notice 1445 is an important communication that outlines the requirements for agents, buyers, and transferees involved in real estate transactions subject to FIRPTA. It provides information regarding tax withholding obligations and procedures. If you're navigating the complexities of real estate in Santa Clara, California, understanding Notice 1445 is essential.

A foreign person under FIRPTA generally includes any non-U.S. citizen or non-resident alien, as well as foreign corporations, partnerships, or trusts. This status affects how taxes are withheld on real estate transactions. If you’re involved in a property transaction in Santa Clara, California, knowing who qualifies as a foreign person can help clarify what steps to take.