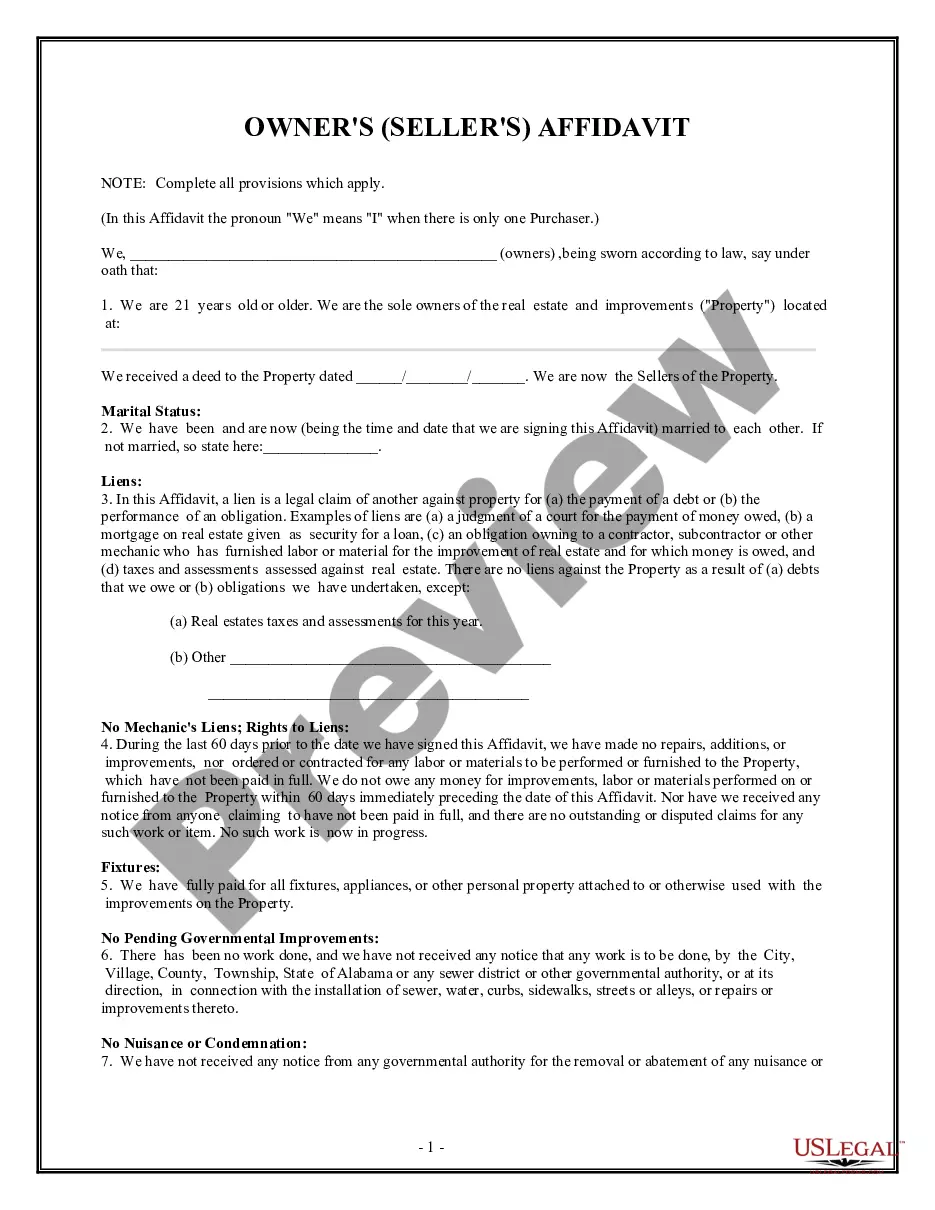

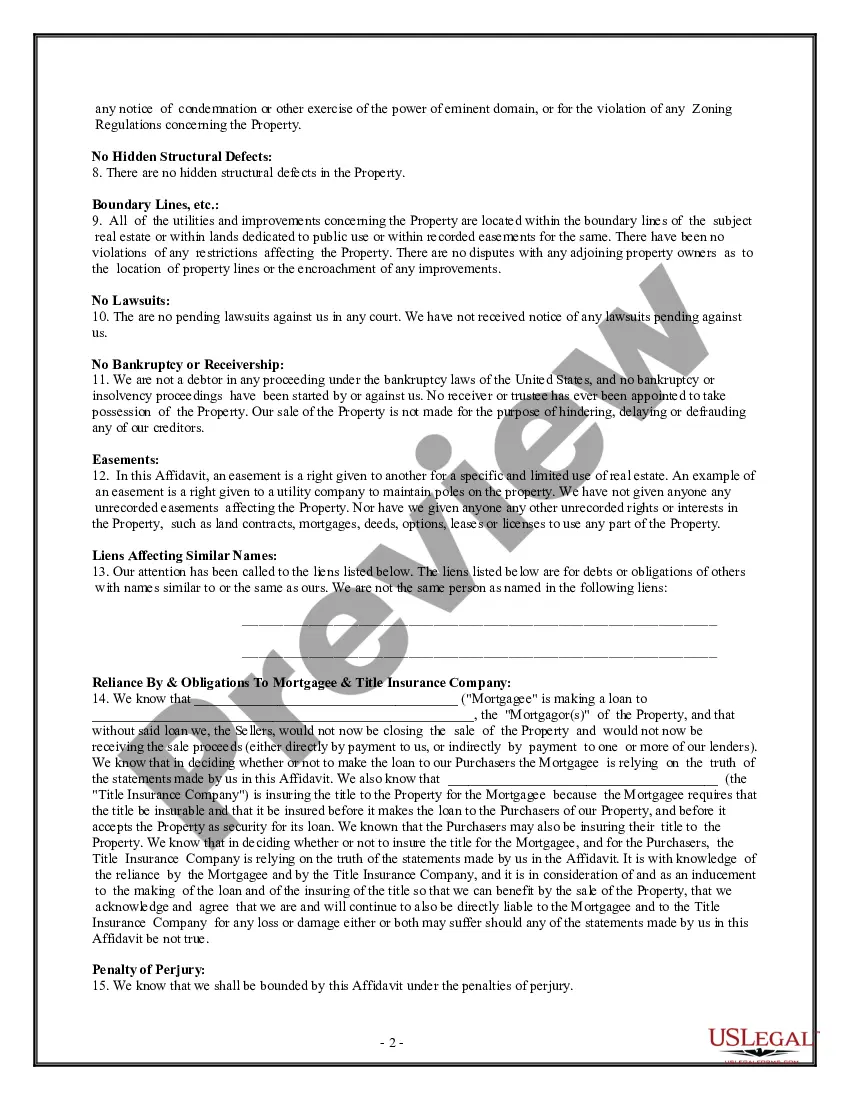

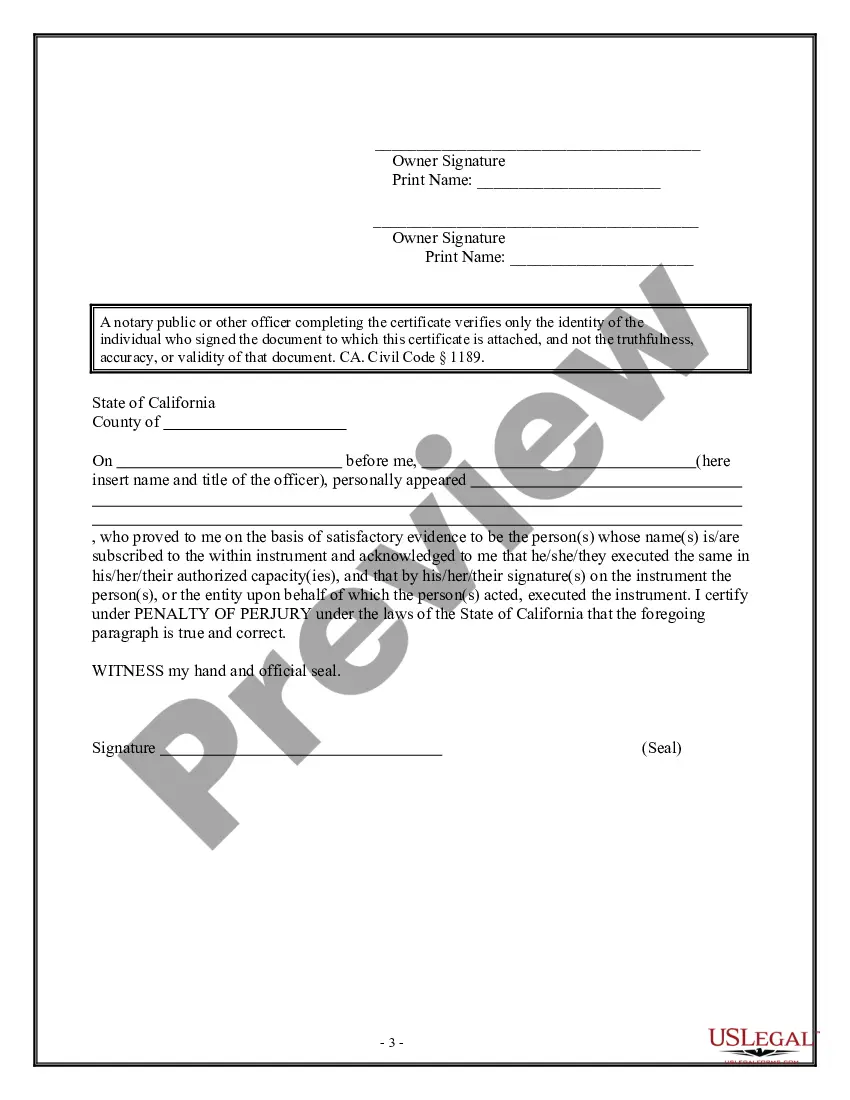

This Owner/Seller Affidavit is for seller(s) to sign at the time of closing certifying that, among other assurances, there are no liens on the property being sold, that they are the owners of the property, that there are no mechanic liens on the property and other certifications. This form must be signed and notarized.

Palmdale California Owner's or Seller's Affidavit of No Liens serves as an essential legal document in real estate transactions. This affidavit is used by property owners or sellers in Palmdale, California, to declare and confirm that there are no outstanding liens or encumbrances on the property being sold. By signing this affidavit, the owner/seller assures the buyer that they have the legal right to transfer the property without any potential limitations caused by third-party claims. Different types of Palmdale California Owner's or Seller's Affidavit of No Liens may include: 1. General Palmdale California Owner's or Seller's Affidavit of No Liens: This is the standard affidavit that most property owners or sellers in Palmdale use during real estate transactions. It states that the property being sold is free from any liens, judgments, or other encumbrances, except as explicitly mentioned in the agreement. 2. Conditional Palmdale California Owner's or Seller's Affidavit of No Liens: In some cases, when there are known potential issues or pending legal matters regarding the property, a conditional affidavit might be required. This type of affidavit specifies certain conditions or limitations regarding the liens or encumbrances and declares that the property will be free from such claims upon fulfilling those conditions. 3. Specific Palmdale California Owner's or Seller's Affidavit of No Liens: This type of affidavit is used when there are specific liens or encumbrances that the owner or seller is aware of and wants to disclose. It lists these known liens or encumbrances, assuring the buyer that these are the only existing claims on the property. The Palmdale California Owner's or Seller's Affidavit of No Liens serves as an important protection for buyers, as it minimizes the risk of post-sale disputes and unexpected financial liabilities. Before signing this affidavit, property owners or sellers should conduct a thorough title search or consult with a real estate attorney to ensure the accuracy of the information provided.