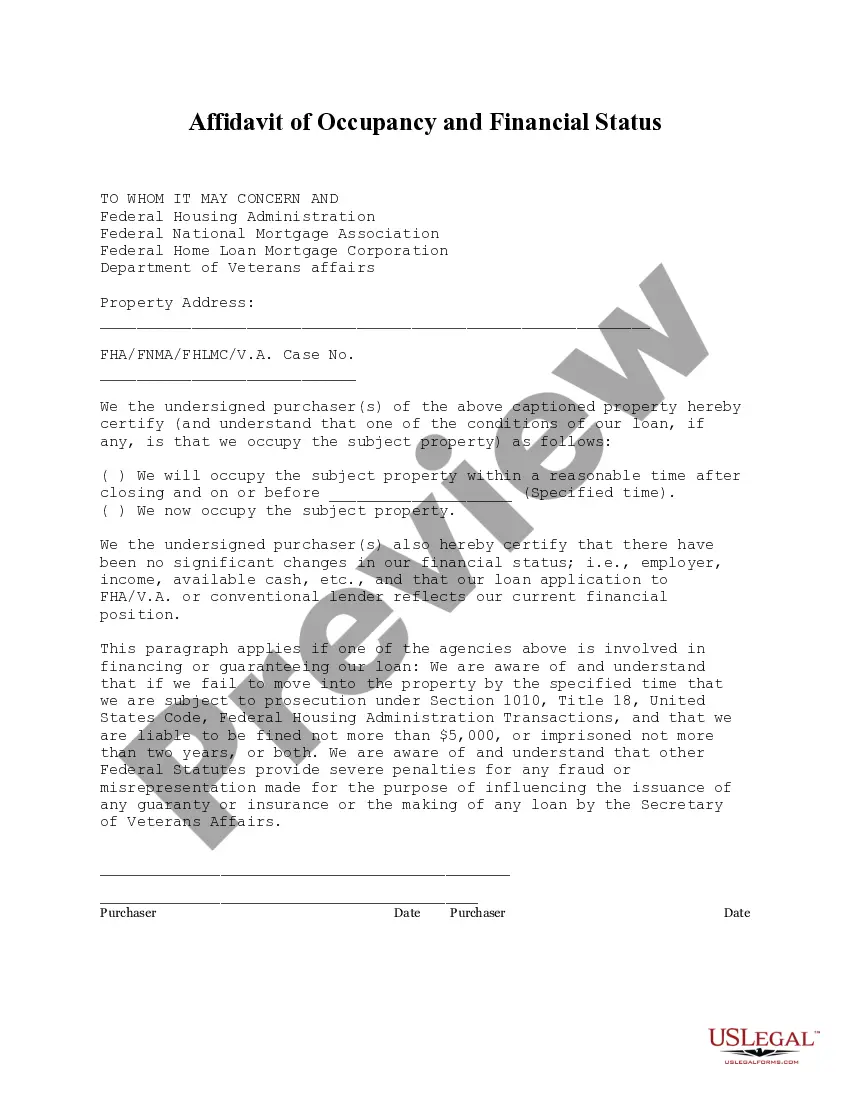

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

Long Beach California Affidavit of Occupancy and Financial Status

Description

How to fill out California Affidavit Of Occupancy And Financial Status?

We consistently aim to lessen or evade legal complications when navigating intricate legal or financial matters.

To achieve this, we enroll in legal services that are generally very expensive.

However, not every legal matter is similarly intricate. The majority of them can be addressed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it in the My documents section. The process is equally simple if you’re new to the platform! You can set up your account within a few minutes. Ensure that the Long Beach California Affidavit of Occupancy and Financial Status adheres to the laws and regulations of your state and locality. Additionally, it’s important to review the form’s description (if available), and if you notice any inconsistencies with what you initially sought, look for an alternative template. Once you’ve confirmed that the Long Beach California Affidavit of Occupancy and Financial Status meets your needs, you can select the subscription option and move forward to payment. Then you can download the document in any convenient file format. For over 24 years, we’ve assisted millions of individuals by providing ready-to-customize and current legal forms. Make the best use of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your matters independently without relying on legal assistance.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Benefit from US Legal Forms whenever you need to obtain and download the Long Beach California Affidavit of Occupancy and Financial Status or any other document securely and easily.

Form popularity

FAQ

In Long Beach, ADUs are allowed on any property within residential, mixed-use and planned development zoning districts, as well as areas with specific plans allowing residential uses, and may range in size from 150 to 800 square feet.

According to the National Building Code of the Philippines, an Occupancy Permit, also known as Certificate of Occupancy, shall be issued and approved first by the respective Office of the Building Official before using the structure.

Planning And Development Fees / Permit Fees Services ProvidedSingle- and Multi-Family UnitsSite Plan Review: Conceptual$5,137.10/ application plus $1.64 / 100 sq. ft.Committee (staff) Approval$6,558.00/ application plus $3.28 / 100 sq. ft.Planning Commission Approval$10,930.00/ application plus $3.28 / 100 sq.12 more rows ?

A Certificate of Occupancy (C of O) is a document issued by Building & Safety which certifies that a commercial space or newly constructed residential building has been inspected for compliance with the California Building Standards Code and local ordinances which govern construction and occupancy.

A. A Certificate of Occupancy is issued upon final approval of all inspections for work authorized under a building and associated permits. The City of San Diego issues Certificates of Occupancy for the following: 1. New non-residential buildings; 2.

On average, the overall processing times may take 2 to 4 months for most construction projects.

I want to build an ADU in Los Angeles. How much do the permits cost? ADU permits typically costs between $1,800 and $8,000 in Los Angeles. This cost will very project by project and is determined by the estimated value of the construction being performed, and the number of square feet your project adds to the property.

Please allow 1 business day for processing. The NOC must be recorded at Palm Beach County Recording Department located at 205 North Dixie Highway (4th Floor), West Palm Beach, FL 33401 (561-355-2991).

Permitting Your ADU Depending on your location, you may need both zoning and building permits. Zoning permits can range from $25 to $4,000 and building permits can run from $450 to $15,000.

However, the projected cost to build an 800-square-foot ADU, the largest allowed in Long Beach, could cost about $220,000 based on 2022 construction prices.