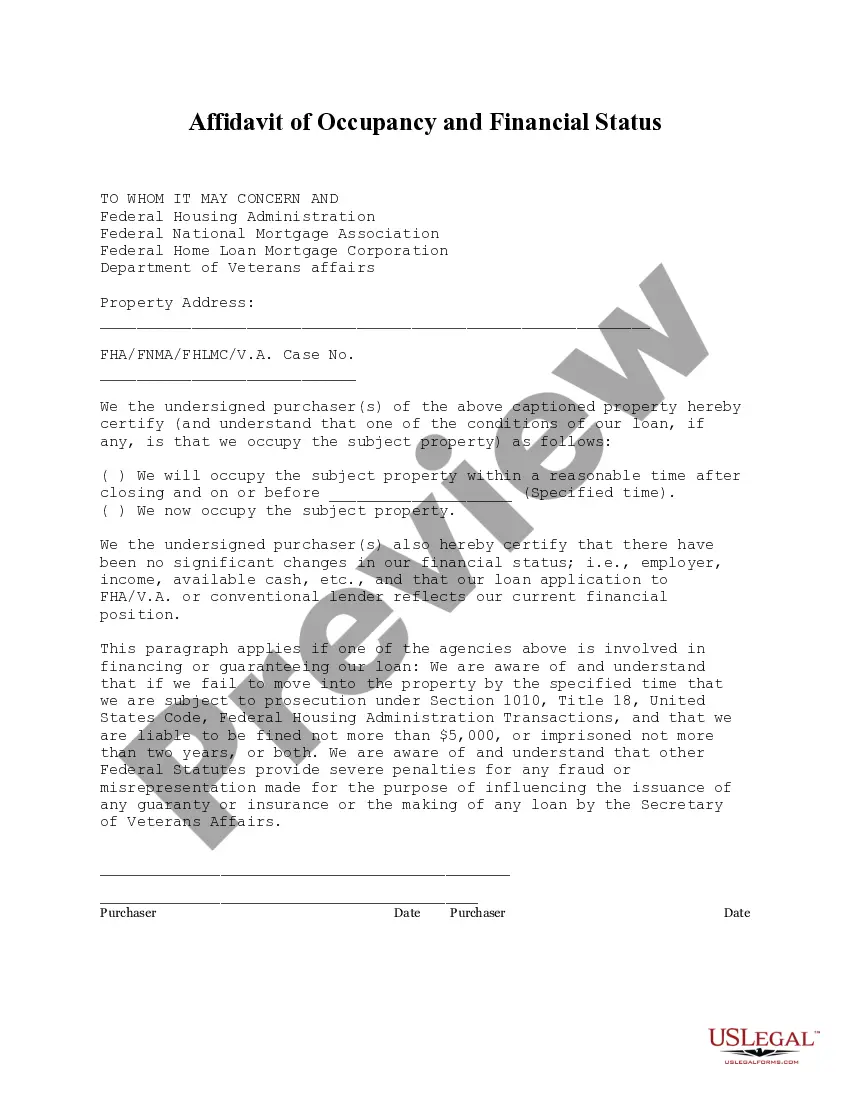

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

The Santa Clara California Affidavit of Occupancy and Financial Status is a crucial document used in the real estate industry to gather comprehensive information about a property owner's occupation status and financial stability. This affidavit serves as a legal declaration by the property owner regarding their residency and financial standing. The Santa Clara County government requires this affidavit for various purposes, such as property tax assessments, mortgage applications, rental agreements, and government assistance programs. It ensures that accurate data is recorded to aid in determining tax liabilities and eligibility for financial aid. The affidavit typically includes essential information such as the property owner's name, contact details, and social security number or taxpayer identification number. Additionally, it requires the owner to specify their occupancy status, indicating whether the property serves as their primary residence, a second home, or an investment property. Furthermore, the affidavit prompts the property owner to disclose their financial status, including sources of income, assets, liabilities, and debt obligations. This information assists in evaluating an individual's ability to fulfill their financial commitments and eligibility for specific assistance programs. To enhance accuracy and prevent fraud, the Santa Clara California Affidavit of Occupancy and Financial Status may require supporting documentation such as tax returns, bank statements, property deeds, and rental agreements, depending on the purpose and nature of the application. Different types of Santa Clara California Affidavits of Occupancy and Financial Status may exist based on specific circumstances or requirements. For instance: 1. Residential Affidavit of Occupancy and Financial Status: This document is used for primary residential properties, indicating that the property owner lives in the property as their main dwelling. 2. Second Home Affidavit of Occupancy and Financial Status: This affidavit is necessary when the property owner has a secondary residence in Santa Clara County, typically used as a vacation home or occasional dwelling. 3. Investment Property Affidavit of Occupancy and Financial Status: This type of affidavit applies when the property owner rents out the property or holds it for investment purposes, rather than utilizing it as their primary or secondary residency. In conclusion, the Santa Clara California Affidavit of Occupancy and Financial Status is a critical document used to gather accurate information about a property owner's residency and financial stability. It aids in property tax assessments, mortgage applications, rental agreements, and government assistance programs. The affidavit ensures transparency and adherence to legal requirements while supporting fair determination of tax liabilities and eligibility criteria.The Santa Clara California Affidavit of Occupancy and Financial Status is a crucial document used in the real estate industry to gather comprehensive information about a property owner's occupation status and financial stability. This affidavit serves as a legal declaration by the property owner regarding their residency and financial standing. The Santa Clara County government requires this affidavit for various purposes, such as property tax assessments, mortgage applications, rental agreements, and government assistance programs. It ensures that accurate data is recorded to aid in determining tax liabilities and eligibility for financial aid. The affidavit typically includes essential information such as the property owner's name, contact details, and social security number or taxpayer identification number. Additionally, it requires the owner to specify their occupancy status, indicating whether the property serves as their primary residence, a second home, or an investment property. Furthermore, the affidavit prompts the property owner to disclose their financial status, including sources of income, assets, liabilities, and debt obligations. This information assists in evaluating an individual's ability to fulfill their financial commitments and eligibility for specific assistance programs. To enhance accuracy and prevent fraud, the Santa Clara California Affidavit of Occupancy and Financial Status may require supporting documentation such as tax returns, bank statements, property deeds, and rental agreements, depending on the purpose and nature of the application. Different types of Santa Clara California Affidavits of Occupancy and Financial Status may exist based on specific circumstances or requirements. For instance: 1. Residential Affidavit of Occupancy and Financial Status: This document is used for primary residential properties, indicating that the property owner lives in the property as their main dwelling. 2. Second Home Affidavit of Occupancy and Financial Status: This affidavit is necessary when the property owner has a secondary residence in Santa Clara County, typically used as a vacation home or occasional dwelling. 3. Investment Property Affidavit of Occupancy and Financial Status: This type of affidavit applies when the property owner rents out the property or holds it for investment purposes, rather than utilizing it as their primary or secondary residency. In conclusion, the Santa Clara California Affidavit of Occupancy and Financial Status is a critical document used to gather accurate information about a property owner's residency and financial stability. It aids in property tax assessments, mortgage applications, rental agreements, and government assistance programs. The affidavit ensures transparency and adherence to legal requirements while supporting fair determination of tax liabilities and eligibility criteria.