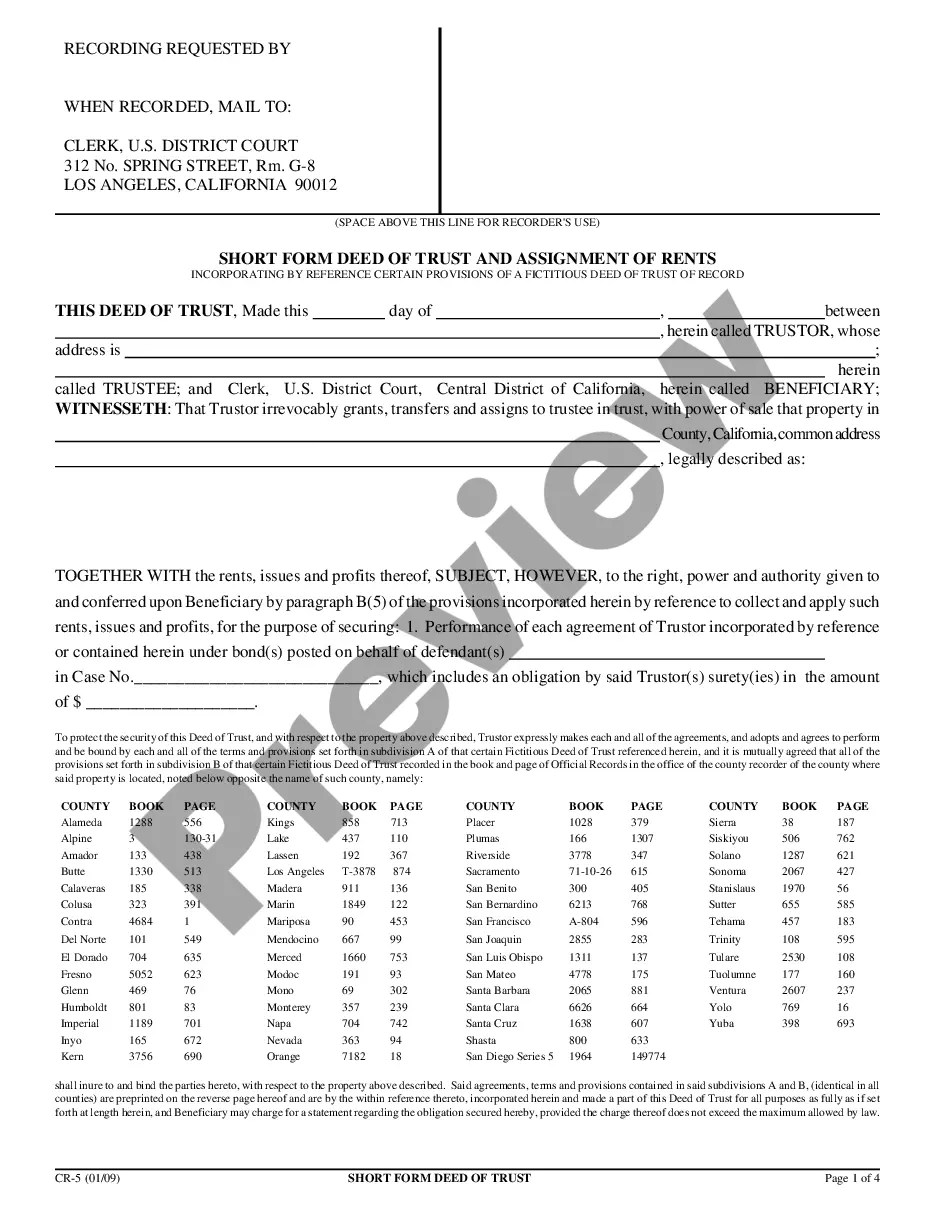

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Short Form Deed of Trust and Assignment of Rents - Los Angeles District Court Only, can be used in the transfer process or related task. Available for download now in standard format(s). USLF control no. CA-CR-005-FED

The Murrieta California Short Form Deed of Trust and Assignment of Rents is a legal document used in real estate transactions in Murrieta, California. This deed of trust serves as a security instrument that allows a lender to secure their interest in a property by placing a lien against it. The borrower, also known as the trust or, transfers their interest in the property to a trustee, who holds it as security for the lender. This document is often used in mortgage financing transactions, where the lender provides funds to the borrower to purchase or refinance a property. The short form nature of this deed of trust means that it is a simplified version, containing only the essential provisions required to serve as a valid security instrument. It typically includes important information such as the names of the parties involved, a legal description of the property, the amount of the loan, the interest rate, and the repayment terms. In addition to the deed of trust itself, the Assignment of Rents is often included in this document. It allows the lender to collect and apply any rental income generated from the property towards the loan payment in case of borrower default. This provides an additional layer of security for the lender, as they can rely on rental income to recover their investment. There are various types of Murrieta California Short Form Deed of Trust and Assignment of Rents, depending on the specific circumstances of the transaction. Some common variations include: 1. Purchase Money Deed of Trust: This type of deed of trust is used when the loan being secured is being used to purchase the property. It outlines the terms and conditions of the loan, as well as the rights and obligations of the borrower and lender. 2. Refinance Deed of Trust: This type of deed of trust is used when the loan being secured is a refinancing of an existing mortgage. It replaces the original mortgage with a new loan, and the deed of trust serves as the security instrument for the new lender. 3. Subordinate Deed of Trust: This type of deed of trust is used when there is already an existing deed of trust on the property. It allows a subsequent lender to secure their interest in the property while subordinate to the existing lien holder. In case of default, the existing lien holder is paid first before the subordinate lender. In conclusion, the Murrieta California Short Form Deed of Trust and Assignment of Rents is a crucial legal document in real estate transactions in Murrieta. It provides a simplified and efficient way for lenders to secure their interest in a property and collect rental income if necessary. The different types of this deed of trust cater to various loan scenarios, offering flexibility and protection for lenders and borrowers alike.