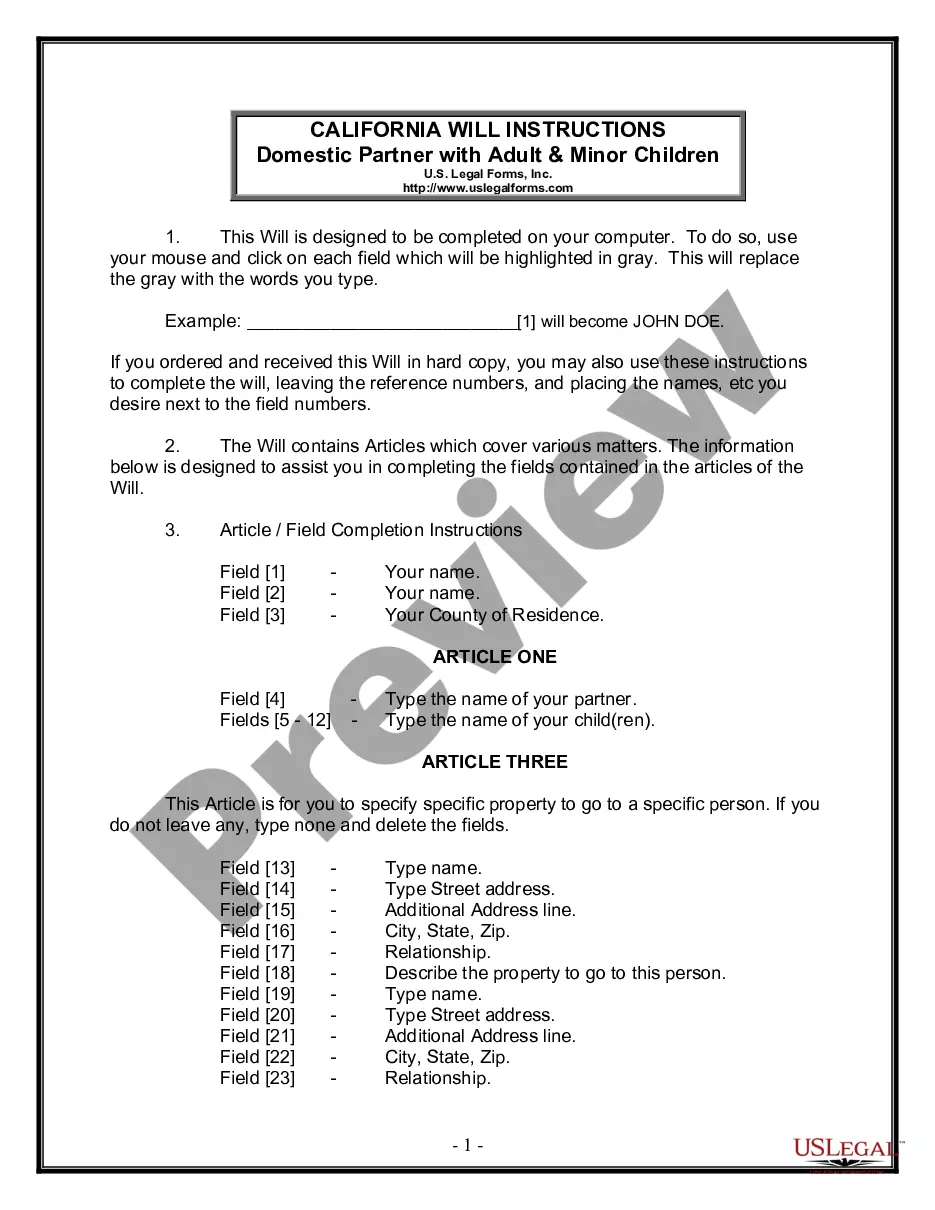

This form provides instructions for filling out form CR-115.

Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is a crucial document used in legal proceedings to assess the financial status of a defendant. This form requires defendants to provide comprehensive information about their assets, enabling the court to determine their ability to pay fines, penalties, or restitution. Here is a detailed description of this essential form: The Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is a standardized document designed to aid defendants in accurately disclosing their financial information. By completing this form, individuals involved in a legal case provide a detailed overview of their assets, liabilities, income, and expenses. To fill out the Defendant's Statement of Assets — CR-115 form correctly, follow these instructions: 1. Personal Information: Begin by providing your full legal name, home address, phone number, and email address. Include any aliases or alternate names used. 2. Case Information: Specify the court case number, name of the prosecuting agency, case type, and the name of the presiding judge. 3. Assets: List all your assets, such as real estate properties, vehicles, bank accounts, stocks, bonds, retirement accounts, and any other significant property you own. Include their current market value or the amount owed on them. If you are unsure about the value, approximate it to the best of your knowledge. 4. Debts and Liabilities: Disclose all outstanding debts, loans, mortgages, credit card balances, medical bills, tax liabilities, or any other financial obligations you have. Provide accurate details regarding the amount owed, creditor's name, and contact information. 5. Income: Detail your sources of income, including employment, self-employment, rental properties, investments, government assistance, or any other income streams. Specify the average monthly and yearly income obtained from each source. 6. Monthly Expenses: Enumerate your monthly expenses, such as living expenses (rent or mortgage, utilities, groceries), transportation, insurance, healthcare, childcare, alimony, child support, and other necessary expenditures. Try to be as precise as possible when stating the amounts. 7. Other Information: Include any additional financial details that might affect your ability to pay fines, restitution, or penalties. This could involve pending lawsuits, bankruptcy filings, or other relevant information. 8. Certification: Prior to submitting the form, review all the details provided to ensure accuracy. Sign and date the form to certify that the information is correct and complete to the best of your knowledge. Falsifying information on this form may result in legal consequences. It is important to note that while this description provides instructions for a generic Defendant's Statement of Assets — CR-115 form in Santa Maria, California, there may be variations or additional forms specific to certain cases or jurisdictions. Therefore, it is recommended to consult with an attorney or the relevant court clerk to ensure you are utilizing the correct form specific to your situation. In conclusion, the Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is an essential document that defendants must complete accurately. By providing comprehensive financial information, this form allows the court to assess the defendant's ability to pay fines, penalties, or restitution based on their assets, income, and liabilities.Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is a crucial document used in legal proceedings to assess the financial status of a defendant. This form requires defendants to provide comprehensive information about their assets, enabling the court to determine their ability to pay fines, penalties, or restitution. Here is a detailed description of this essential form: The Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is a standardized document designed to aid defendants in accurately disclosing their financial information. By completing this form, individuals involved in a legal case provide a detailed overview of their assets, liabilities, income, and expenses. To fill out the Defendant's Statement of Assets — CR-115 form correctly, follow these instructions: 1. Personal Information: Begin by providing your full legal name, home address, phone number, and email address. Include any aliases or alternate names used. 2. Case Information: Specify the court case number, name of the prosecuting agency, case type, and the name of the presiding judge. 3. Assets: List all your assets, such as real estate properties, vehicles, bank accounts, stocks, bonds, retirement accounts, and any other significant property you own. Include their current market value or the amount owed on them. If you are unsure about the value, approximate it to the best of your knowledge. 4. Debts and Liabilities: Disclose all outstanding debts, loans, mortgages, credit card balances, medical bills, tax liabilities, or any other financial obligations you have. Provide accurate details regarding the amount owed, creditor's name, and contact information. 5. Income: Detail your sources of income, including employment, self-employment, rental properties, investments, government assistance, or any other income streams. Specify the average monthly and yearly income obtained from each source. 6. Monthly Expenses: Enumerate your monthly expenses, such as living expenses (rent or mortgage, utilities, groceries), transportation, insurance, healthcare, childcare, alimony, child support, and other necessary expenditures. Try to be as precise as possible when stating the amounts. 7. Other Information: Include any additional financial details that might affect your ability to pay fines, restitution, or penalties. This could involve pending lawsuits, bankruptcy filings, or other relevant information. 8. Certification: Prior to submitting the form, review all the details provided to ensure accuracy. Sign and date the form to certify that the information is correct and complete to the best of your knowledge. Falsifying information on this form may result in legal consequences. It is important to note that while this description provides instructions for a generic Defendant's Statement of Assets — CR-115 form in Santa Maria, California, there may be variations or additional forms specific to certain cases or jurisdictions. Therefore, it is recommended to consult with an attorney or the relevant court clerk to ensure you are utilizing the correct form specific to your situation. In conclusion, the Santa Maria California Instruction form for filling out Defendant's Statement of Assets — CR-115 is an essential document that defendants must complete accurately. By providing comprehensive financial information, this form allows the court to assess the defendant's ability to pay fines, penalties, or restitution based on their assets, income, and liabilities.