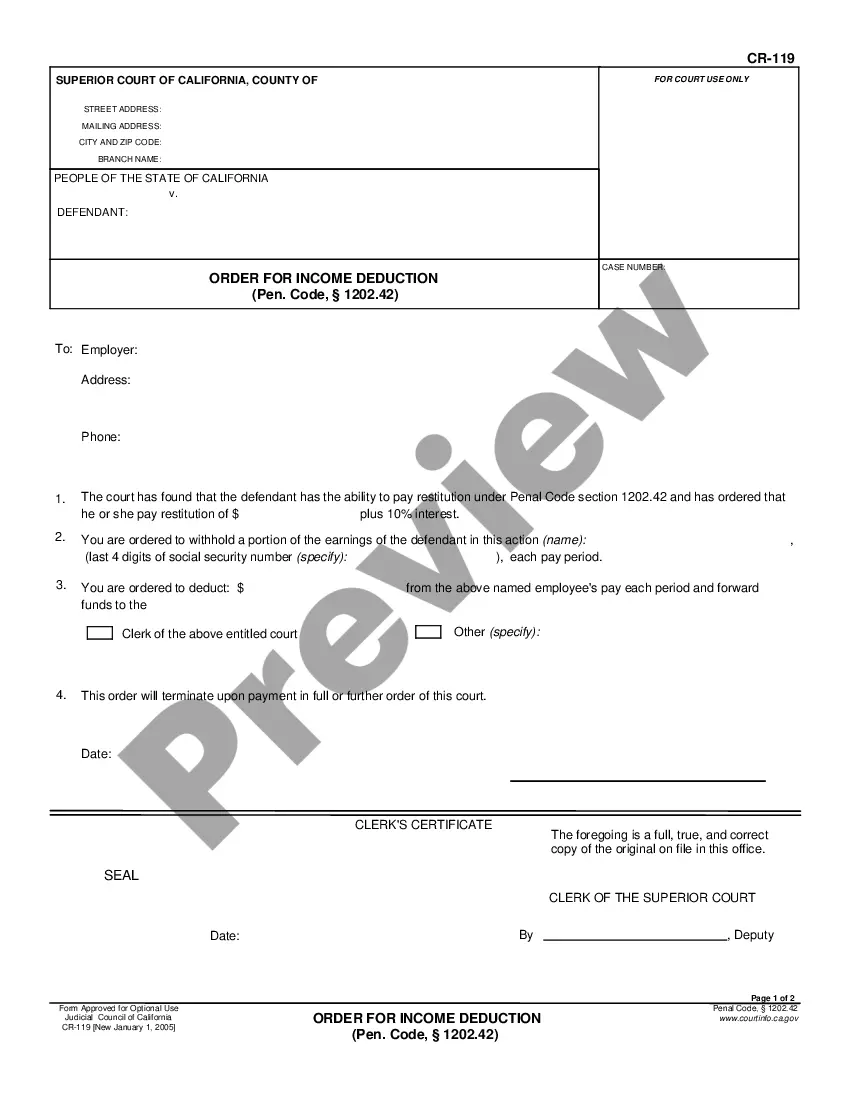

This form gives notice to a party whose income has been ordered deducted/garnished by the court as restitution.

Santa Ana California Information Regarding Income Deduction Order: A Comprehensive Guide Santa Ana, located in Orange County, California, has specific regulations and provisions in place concerning Income Deduction Orders (Idol). An Income Deduction Order is a legal document issued by a court that requires an employer to withhold a portion of an employee's income for the purpose of repaying debts or fulfilling financial obligations. Santa Ana provides important information regarding Idol to ensure compliance and understanding for employers, employees, and debtors alike. Types of Santa Ana California Information Regarding Income Deduction Orders: 1. General Overview: — Definition: An overview of what an Income Deduction Order entails, its purpose, and how it is utilized in Santa Ana, California. — Eligibility: Information on who can request an DO and the requirements that must be met for its implementation. — Debt Types: Explanation of the specific types of debts that can qualify for an DO, including child support, spousal support, and other financial obligations. 2. Application Process: — Filing Procedure: Step-by-step instructions on how to file for an DO in Santa Ana, including necessary documentation and forms that need to be completed. — Court Hearing: Details regarding the court hearing process, including how to prepare and what to expect during the proceedings. — Notice and Service: Information regarding the notice requirements for all parties involved in the DO, ensuring proper communication and transparency. 3. Employer Obligations: — Withholding Duties: Explanation of an employer's responsibilities upon receiving an DO, including accurately deducting and remitting the specified amounts. — Reporting Requirements: Details on the reporting obligations that employers have in regard to Idol, such as providing periodic statements to the issuing agency or recipient. 4. Employee Rights and Protections: — Notification: Information on how employees are notified about the DO, their rights to contest or request modifications, and what to do if they believe a mistake has been made. — Confidentiality: Understanding the confidentiality rights of employees with respect to their financial information and the consequences of breaching such confidentiality. 5. Termination and Modification: — TerminatiododoDO: Explanation of the circumstances under which an DO may be terminated, such as debt repayment completion or change in circumstances. — Modification Requests: Details on the process of seeking modification to an existing DO due to significant changes in income, financial situation, or other relevant factors. 6. Penalties and Non-Compliance: — Consequences of Non-Compliance: Information on penalties that employers may face for failing to comply with Idol, including fines, legal action, or other disciplinary measures. — Legal Recourse: Explanation of the steps employees can take to enforce compliance by their employers and seek appropriate legal action if necessary. By understanding the Santa Ana California Information Regarding Income Deduction Order, both employers and employees can navigate the process effectively. Adhering to the established guidelines and ensuring compliance with Idol helps maintain financial stability and fulfill obligations in Santa Ana, California.Santa Ana California Information Regarding Income Deduction Order: A Comprehensive Guide Santa Ana, located in Orange County, California, has specific regulations and provisions in place concerning Income Deduction Orders (Idol). An Income Deduction Order is a legal document issued by a court that requires an employer to withhold a portion of an employee's income for the purpose of repaying debts or fulfilling financial obligations. Santa Ana provides important information regarding Idol to ensure compliance and understanding for employers, employees, and debtors alike. Types of Santa Ana California Information Regarding Income Deduction Orders: 1. General Overview: — Definition: An overview of what an Income Deduction Order entails, its purpose, and how it is utilized in Santa Ana, California. — Eligibility: Information on who can request an DO and the requirements that must be met for its implementation. — Debt Types: Explanation of the specific types of debts that can qualify for an DO, including child support, spousal support, and other financial obligations. 2. Application Process: — Filing Procedure: Step-by-step instructions on how to file for an DO in Santa Ana, including necessary documentation and forms that need to be completed. — Court Hearing: Details regarding the court hearing process, including how to prepare and what to expect during the proceedings. — Notice and Service: Information regarding the notice requirements for all parties involved in the DO, ensuring proper communication and transparency. 3. Employer Obligations: — Withholding Duties: Explanation of an employer's responsibilities upon receiving an DO, including accurately deducting and remitting the specified amounts. — Reporting Requirements: Details on the reporting obligations that employers have in regard to Idol, such as providing periodic statements to the issuing agency or recipient. 4. Employee Rights and Protections: — Notification: Information on how employees are notified about the DO, their rights to contest or request modifications, and what to do if they believe a mistake has been made. — Confidentiality: Understanding the confidentiality rights of employees with respect to their financial information and the consequences of breaching such confidentiality. 5. Termination and Modification: — TerminatiododoDO: Explanation of the circumstances under which an DO may be terminated, such as debt repayment completion or change in circumstances. — Modification Requests: Details on the process of seeking modification to an existing DO due to significant changes in income, financial situation, or other relevant factors. 6. Penalties and Non-Compliance: — Consequences of Non-Compliance: Information on penalties that employers may face for failing to comply with Idol, including fines, legal action, or other disciplinary measures. — Legal Recourse: Explanation of the steps employees can take to enforce compliance by their employers and seek appropriate legal action if necessary. By understanding the Santa Ana California Information Regarding Income Deduction Order, both employers and employees can navigate the process effectively. Adhering to the established guidelines and ensuring compliance with Idol helps maintain financial stability and fulfill obligations in Santa Ana, California.