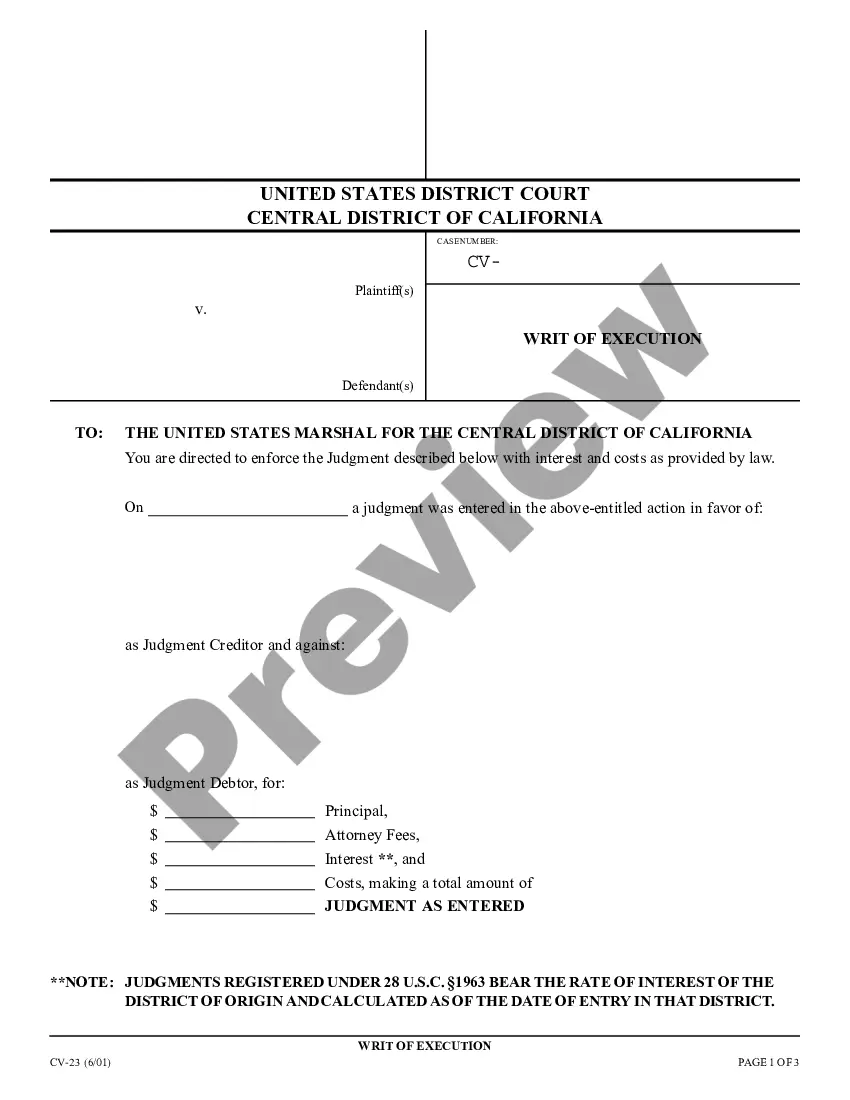

This is an order from the court to the party's employer requiring an income deduction (garnishment) be taken out of their wages as restitution.

Hayward California Order for Income Deduction is a legal process by which a portion of an individual's income is withheld and redirected towards the payment of certain financial obligations. This order is typically issued by the Hayward California court system and can apply to various types of financial obligations, including child support, spousal support, and other court-ordered payments. The purpose of the Hayward California Order for Income Deduction is to ensure timely and consistent payments towards the designated obligations. By deducting these amounts directly from the individual's income, it aims to streamline the payment process and enforce financial responsibility. There are different types of Hayward California Order for Income Deduction, each pertaining to specific obligations. Some commonly encountered types include: 1. Child Support Order for Income Deduction: This order is issued in cases where an individual is required to pay child support. It authorizes the withholding of a specific percentage or amount from their income to cover the support payments. 2. Spousal Support Order for Income Deduction: In situations where spousal support is awarded, this order facilitates the automatic deduction of the specified support amount from the obligated individual's income. 3. Court-Ordered Debt Repayments Order for Income Deduction: This type of order is applicable when an individual has been ordered by the court to repay a certain debt, such as restitution, fines, or other financial obligations resulting from legal proceedings. It allows for the withholding of a portion of the individual's income to satisfy these debts. 4. Tax Garnishment Order for Income Deduction: In some cases, the Hayward California Order for Income Deduction may be issued to collect unpaid taxes. This order authorizes the withholding of a portion of the individual's income to cover their outstanding tax liabilities. It is important to note that the specific terms and conditions of the Hayward California Order for Income Deduction can vary depending on the nature of the financial obligation and the individual circumstances. Compliance with this order is legally binding, and failure to adhere to the terms may result in penalties, legal consequences, or further enforcement actions.Hayward California Order for Income Deduction is a legal process by which a portion of an individual's income is withheld and redirected towards the payment of certain financial obligations. This order is typically issued by the Hayward California court system and can apply to various types of financial obligations, including child support, spousal support, and other court-ordered payments. The purpose of the Hayward California Order for Income Deduction is to ensure timely and consistent payments towards the designated obligations. By deducting these amounts directly from the individual's income, it aims to streamline the payment process and enforce financial responsibility. There are different types of Hayward California Order for Income Deduction, each pertaining to specific obligations. Some commonly encountered types include: 1. Child Support Order for Income Deduction: This order is issued in cases where an individual is required to pay child support. It authorizes the withholding of a specific percentage or amount from their income to cover the support payments. 2. Spousal Support Order for Income Deduction: In situations where spousal support is awarded, this order facilitates the automatic deduction of the specified support amount from the obligated individual's income. 3. Court-Ordered Debt Repayments Order for Income Deduction: This type of order is applicable when an individual has been ordered by the court to repay a certain debt, such as restitution, fines, or other financial obligations resulting from legal proceedings. It allows for the withholding of a portion of the individual's income to satisfy these debts. 4. Tax Garnishment Order for Income Deduction: In some cases, the Hayward California Order for Income Deduction may be issued to collect unpaid taxes. This order authorizes the withholding of a portion of the individual's income to cover their outstanding tax liabilities. It is important to note that the specific terms and conditions of the Hayward California Order for Income Deduction can vary depending on the nature of the financial obligation and the individual circumstances. Compliance with this order is legally binding, and failure to adhere to the terms may result in penalties, legal consequences, or further enforcement actions.