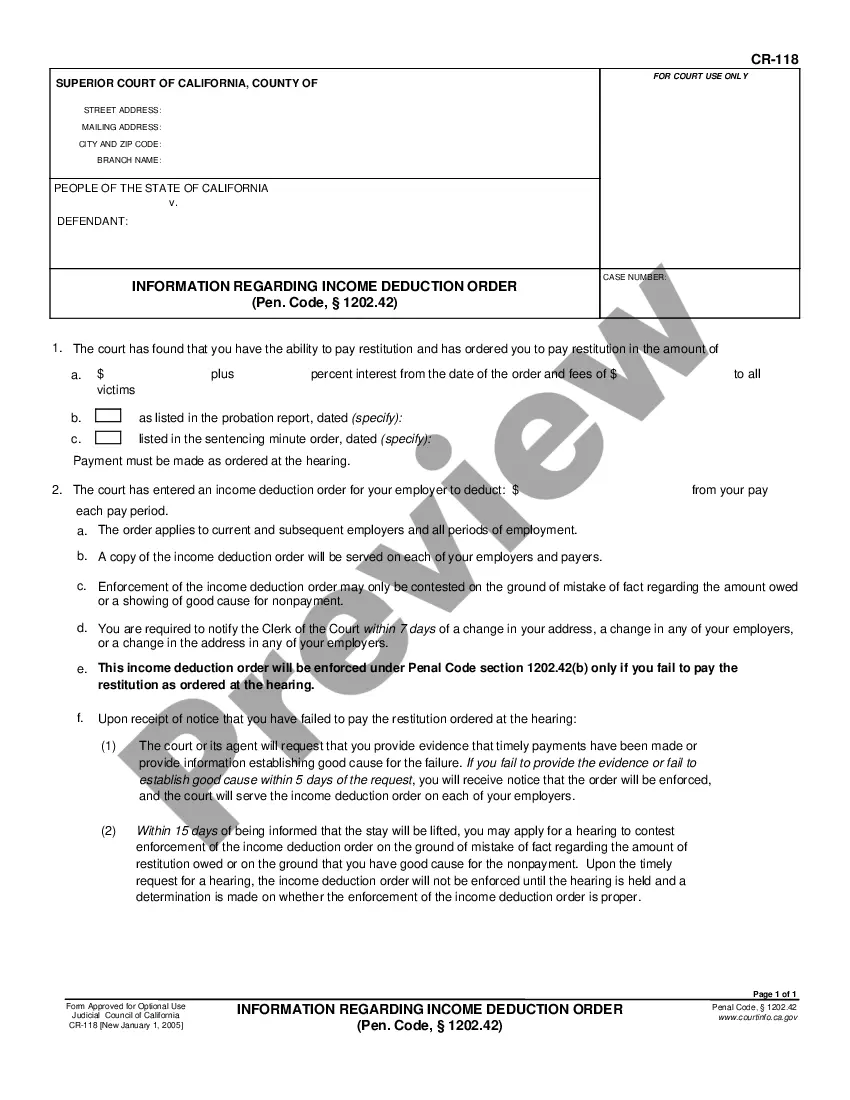

This is an order from the court to the party's employer requiring an income deduction (garnishment) be taken out of their wages as restitution.

Norwalk California Order for Income Deduction

Description

How to fill out California Order For Income Deduction?

If you have previously employed our service, sign in to your account and retrieve the Norwalk California Order for Income Deduction on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it following your billing plan.

If this is your inaugural interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and utilize the Preview option, if accessible, to verify if it fulfills your needs. If it does not suit you, use the Search tab above to locate the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and make a payment. Enter your credit card information or choose the PayPal option to finalize the purchase.

- Obtain your Norwalk California Order for Income Deduction. Select the file format for your document and store it on your device.

- Complete your form. Print it out or use online editing tools to fill it in and sign it digitally.

Form popularity

FAQ

An income deduction order, such as the Norwalk California Order for Income Deduction, directs an employer to deduct a portion of an employee's income for specific purposes, like paying off debts or supporting dependents. This order simplifies the process of meeting financial obligations, ensuring regular payments are made directly from the source of income. Understanding the implications of an income deduction order is crucial for both employees and employers. For more information and forms, visit USLegalForms.

A Norwalk California Order for Income Deduction is a legal document that instructs an employer to withhold a specific amount of an employee's earnings to satisfy a tax obligation. This order helps ensure that taxes are collected directly from wages, providing a straightforward method for the tax authorities to receive payments. It's important to comply with this order, as failing to do so can lead to penalties. You can learn more about this process and find related forms through USLegalForms.

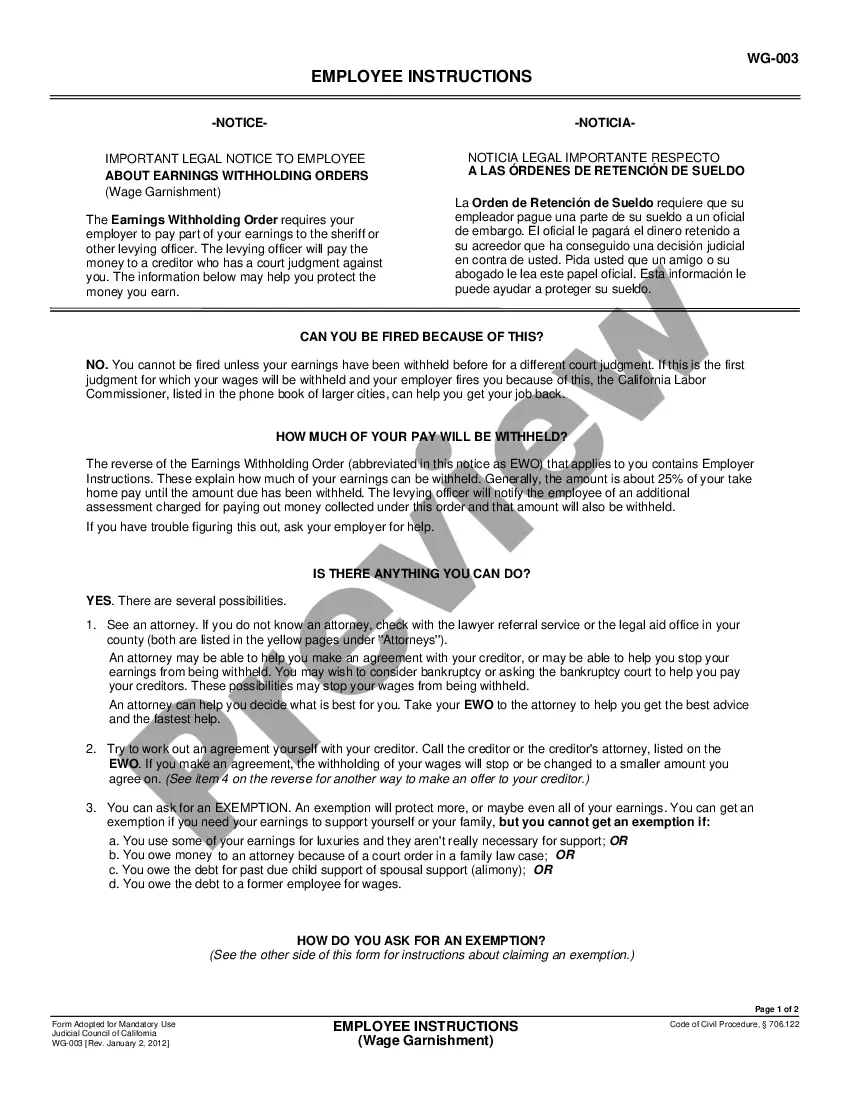

An income withholding order in California is a legal request requiring employers to withhold a certain amount from an employee's paycheck. This order often facilitates child support or alimony payments directly from wages, improving the reliability of payments. In Norwalk, adhering to such orders is necessary to comply with court rulings. If you need more information, platforms like US Legal Forms can assist you in understanding your obligations.

A wage withholding order in California is designed to direct an employer to deduct a specified amount from an employee's wages. This order often comes into play for child support or spousal support payments, ensuring that financial obligations are met consistently. In Norwalk, this order ensures that payments are made directly from your paycheck. Understanding how this order works can help in planning your finances effectively.

An income withholding order is a legal instruction that requires your employer to withhold a portion of your salary to satisfy debts like child support. In Norwalk, California, this process is often used to ensure timely payments and protect the interests of dependents. The order simplifies payment processes, making it easier for all parties involved. If you receive such an order, consider exploring platforms like US Legal Forms for guidance.

You may receive an earnings withholding order in Norwalk as a result of unpaid debts, typically related to child support or spousal support. This order indicates that a court has determined you need to fulfill a financial obligation, allowing your employer to withhold a portion of your paycheck. It's important to review the order carefully and understand your rights. Seeking legal assistance can help you navigate the situation.

The process for a Norwalk California Order for Income Deduction can take various timelines depending on the specifics of your case. Generally, once the order is issued, your employer must comply within a specified time frame, usually within a few weeks. However, delays may occur if there are complications, such as disputes over the order. Staying informed and working with a legal professional can help streamline the process.

In Florida, an income withholding order operates similarly to the Norwalk California Order for Income Deduction. The court issues the order, which mandates employers to withhold a specific portion of an employee's earnings for child support or other financial obligations. The employer then sends these amounts directly to the appropriate agency. Understanding this process is crucial for ensuring compliance and timely payments.

The time it takes for income withholding to start can vary. Generally, after a Norwalk California Order for Income Deduction is issued, employers are usually required to begin withholding wages within 10 days. This means that once you submit the order, you can expect to see the first deduction soon after. If you have questions about timing, consulting with uLegalForms can provide you with clarity.